#202535 - priceactiontds - weekly update - dax futuresGood Day and I hope you are well.

comment: Neutral. We can drop a little more until we hit the bull trend line and weekly 20ema around 23800 but we don’t have to. I don’t think you can short down here and hope for more downside after last week. Market is barely moving and on the monthly chart we ha

Related futures

a return to solid structure in an uptrend creates a =BUYers wrld1->3 : we create higher highs ,

number 2 originating buyers create number 3 surpassing number 1 , this makes number 2 buyers a solid major low, as they have proven themselves stronger than the most recent major sellers

3->4 : we return to the major solid buyers in the market

what do I think will

#202534 - priceactiontds - weekly update - dax futures Good Day and I hope you are well.

comment: Neutral. I do think this could become a giant bull trap but confirmation is only below 24200. For now it’s best to be neutral since we are in the middle of the triangle. Not much more to read into this so don’t try looking at this for hours and make stuff

#202532 - priceactiontds - weekly update - fdaxGood Evening and I hope you are well.

comment: Multiple ways to draw triangles on this daily chart and I will continue to bet on a contracting range. So for me shorts above 24200 are mighty fine with stop 24750. Mid-point of the most obvious triangle is 24090 which is my line in the sand for both s

DAX Futures FDAX1!) Imbalance Fill Before Bullish Continuation?Analysis Summary:

1. Current pullback after a strong impulse move suggests a short-term retracement.

2. The imbalance zone (highlighted in red) around 23,970–24,010 may act as a magnet.

3. Alternatively, price may continue lower to tap into 4H demand / liquidity zone before reversing upward.

📌 Ed

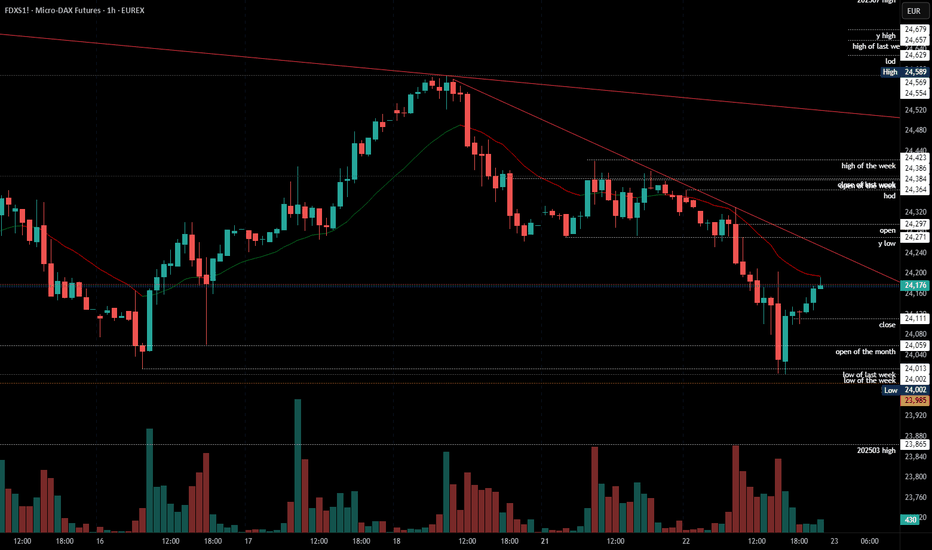

2025-07-22 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Bears had two legs down and the reversal from 24000 was strong enough to doubt this can go below 24000. I do expect some form of re-test of 24000 but the buying since then was insane again. Not a single 1h bar dropped below the prior one.

current mar

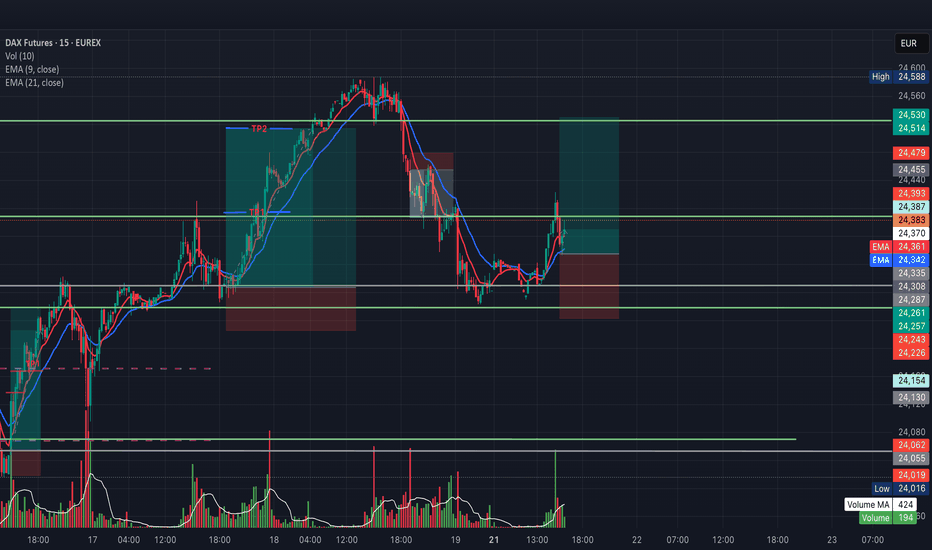

DAX Futures (FDAX1!) – Intraday Long Setup from SupportInstrument: FDAX1! (DAX Futures – EUREX)

Chart: 15 mins

Type: Intraday / Day Trade

DAX Futures is holding support near 24,259 after a recent pullback. Watching for a potential bounce if price remains above this level, with a move toward intraday highs as a possible target.

This setup is valid only

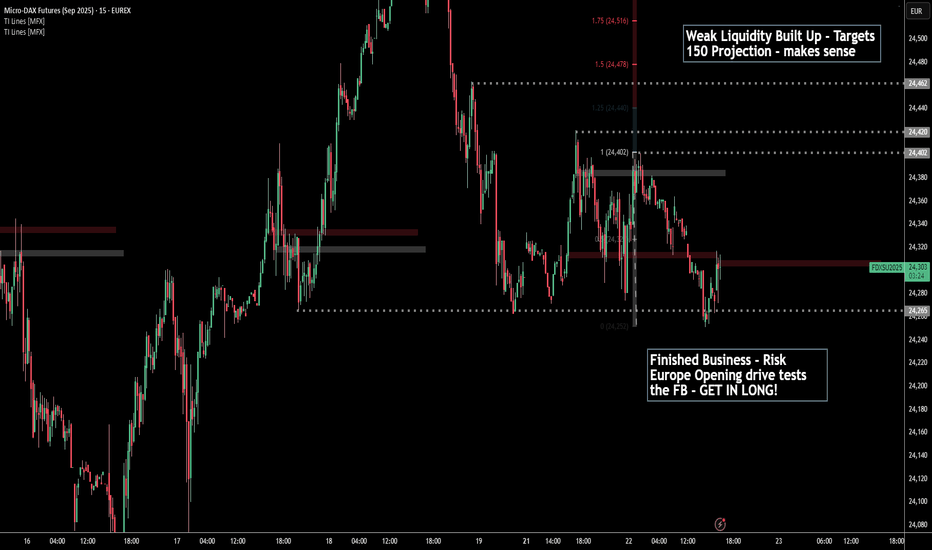

Finished Business TEST - LONGEurope Opening Drive shows a test of Finished Business

Above we have Multiple liquidity levels for Instos to take profits of their LONGS.

Also 150 projection (next distributions POC) marries up where the weak liquidity is.

GET IN and ride risk behind the demand auctions all the way.

FDAX Today 1. Wave (3) likely near completion:

Price hit the 1.618 extension of Wave 1, which is textbook for a Wave 3 target.

There’s also confluence with the 23.6% retracement from the previous swing high (24,703), and we're near a Bearish FVG + Order Block zone.

High-probability zone for a short-term reje

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The nearest expiration date for Mini-DAX Futures is Jun 18, 2021.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Mini-DAX Futures before Jun 18, 2021.