Why the Yen Remains Weak Despite Hawkish BoJ SignalsAt its 23/Jan policy meeting, the BoJ held rates steady but adopted a more hawkish tone, emphasizing that further hikes remain possible and flagging currency depreciation and bond yield volatility as near-term risks. Despite this shift, the yen weakened, falling to a two-week low near 159.

In the

Related futures

A Supply-and-Demand View of the Japanese YenPattern recognition and technical analysis are the foundations of price action in forex trading. Supply and demand dictate that for markets to be in equilibrium, demand must equal supply. Excessive supply without compensatory demand causes prices to crater, vice versa is true.

Post Covid, the Japane

Yen February view

- Where is price?

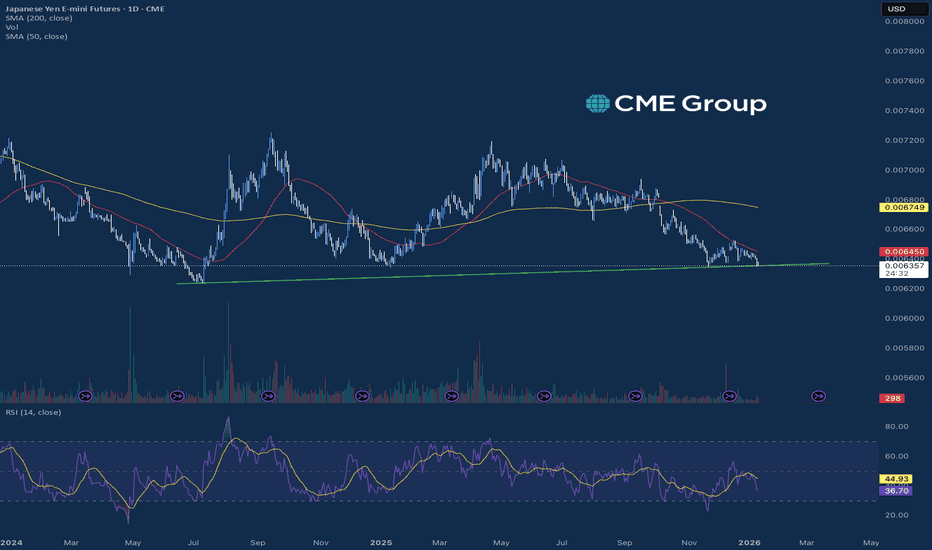

Price is in Area3 on the quarterly and area 4 on the monthly timeframe. February candle will open in area 4, making it a congestion entrance candle. Direction is turning up, slopes also up on the monthly, the qyarterly has still three months for the candle to form

- What is it

FX Trends with Lower DollarThe FX markets have entered 2026 defined by a structural shift in the U.S. dollar’s dominance and a resurgence of technical volatility. After a turbulent 2025 marked by "Liberation Day" tariffs and significant greenback depreciation, the first weeks of 2026 have seen FX futures traders pivot toward

JPY Futures – Swing Long IdeaCommercials (Smart Money) are clearly positioned bullish, indicating underlying accumulation.

At the same time, price is trading at relatively cheap levels versus the US Dollar from a short-term valuation perspective.

We are now approaching a well-defined demand zone, visible on both the weekly and

Japanese Yen Near Recent LowsRecent selling pressure in Japanese yen futures has intensified as 2026 begins, driven primarily by a widening "policy divergence" between the Bank of Japan and other major central banks. Despite a slight move toward normalization late last year, the BoJ has maintained a cautious stance, with market

Forget the Textbook: A 30-Year Reality CheckA Big Policy Moment

A central bank (BOJ) just pushed interest rates to levels not seen in 30 years.

That’s not a routine tweak — that’s a regime shift.

Textbooks might suggest a clean, logical market response.

Reality? Markets got emotional. Fast.

Selling Got Loud

Instead of an orderly adjust

3-Decade Rate Milestone: How Markets Digest Policy ShocksA Central Bank Decision Decades in the Making

When a central bank moves interest rates to levels not seen in three decades, markets rarely respond in a linear or orderly fashion. Such decisions are not interpreted as isolated adjustments, but as structural signals that force participants to reasse

Smart Money Made a Weird Move in JPY..Here’s What It Means for UJPY Futures: A Rare & Complex "Condor" in Play

On the JPY futures chart, just above current price, lies a wing of a "Condor" option structure that formed last week.

This isn’t a small play — the size suggests a serious participant.

Historically, in 4 out of 5 cases, price has reacted to the wings

(JPY) futures: The Risk and Rate DifferentialThe Yen chart highlights global risk appetite and the impact of interest rate divergence.Pattern: The price is in a long-term decline, consolidating in a descending wedge/triangle above major support approx 0.0063$.

Signal: The Yen's weakness is fundamentally caused by the massive interest rate diff

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.