Job Growth Takes Off but Traders Stay Put. What’s Happening?Are these jobs in the room with us right now?

📊 A Blockbuster Headline

The delayed January jobs report arrived Wednesday. Nonfarm payrolls ECONOMICS:USNFP showed 130,000 new hires , more than double the 55,000 estimate. On paper, that looked like a strong start to the year.

Wall Street’s re

Roadmaps for $20000 Gold and $800 Silver.Roadmaps for $20000 Gold and $800 Silver.

HUGE reaction on that possible 45 year breakdown line for stocks vs silver.

If we get a bounce in Q2, it will OFFICIALLY morph into existence, making it a CRITICAL & VALID line.

BIG moves for Gold, Silver, Oil and friends below that.

DOW JONES 9-month Channel Up is still holding.Dow Jones (DJI) has been trading within a 9-month Channel Up and is currently on its latest Bullish Leg following a 1D MA50 (blue trend-line) bounce. The last two Bullish Legs peaked just below the -0.382 Fibonacci extension. The strongest Sell Signal was given however by the 1D RSI when it hit its

US30 Consolidation Growth momentumUS30 trading within a well-defined ascending channel, confirming a medium-term bullish trend. Price has consistently respected both the upper resistance and lower support boundaries of the channel, indicating strong trend structure and controlled momentum.

Recently, price produced a strong impulsiv

Potential Massive Fibonacci Time Cycle TurnToday 02/09/26 the Dow Jones Industrial Average (DJI) made a new all-time high unconfirmed by the Dow Transportation Average, S&P 500, and Nasdaq Composite.

This high comes at the end point of a massive Fibonacci time cycles covering 97 – years.

The starting point is the DJI mania peak made in 19

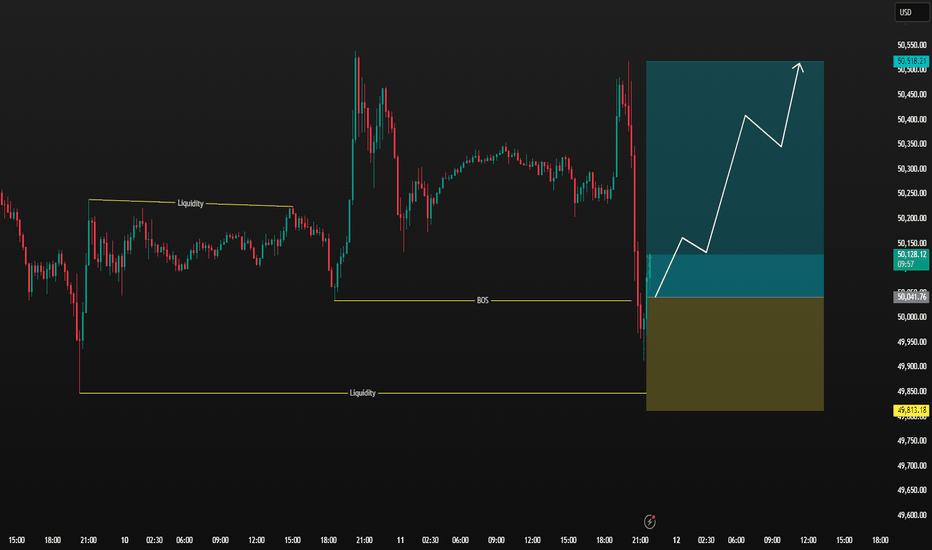

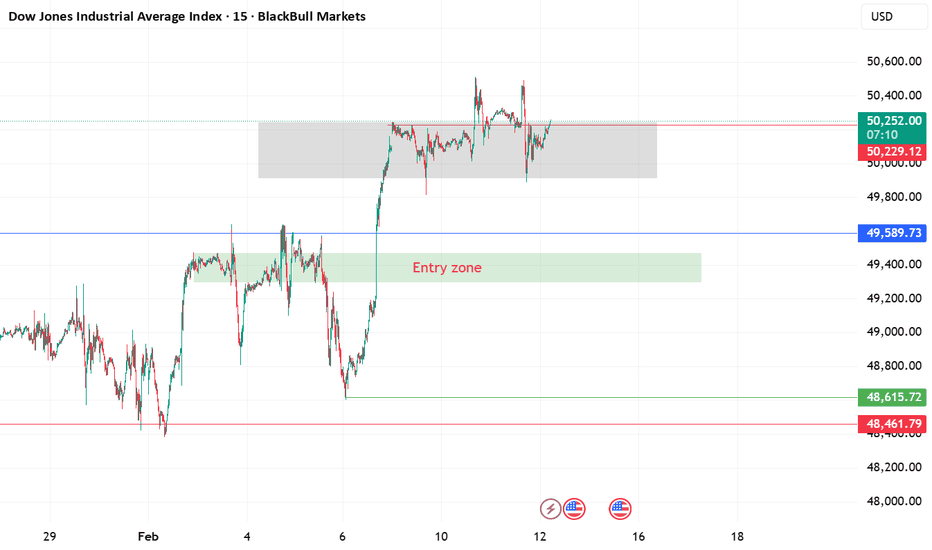

Expected retracement US30Looking at the chart, the Dow Jones is currently sitting right inside a consolidation zone around 50,247, where price is hesitating between buyers and sellers. This grey box i drew marks resistance, showing the market is undecided at this level. My expectation seems to be that price won’t immediatel

1h TF - Long on Dow Jones Industrial Average Index (Ticker DJI)TVC:DJI

Technicals:

Having the price consolidated between 48800 and 49600 during January, trade picture strongly depend on market sentiment and event occurence.

- Short-term Long scenario:

In case price decides to move above 49600 a descent amount of stop-losses will be collected, pushing

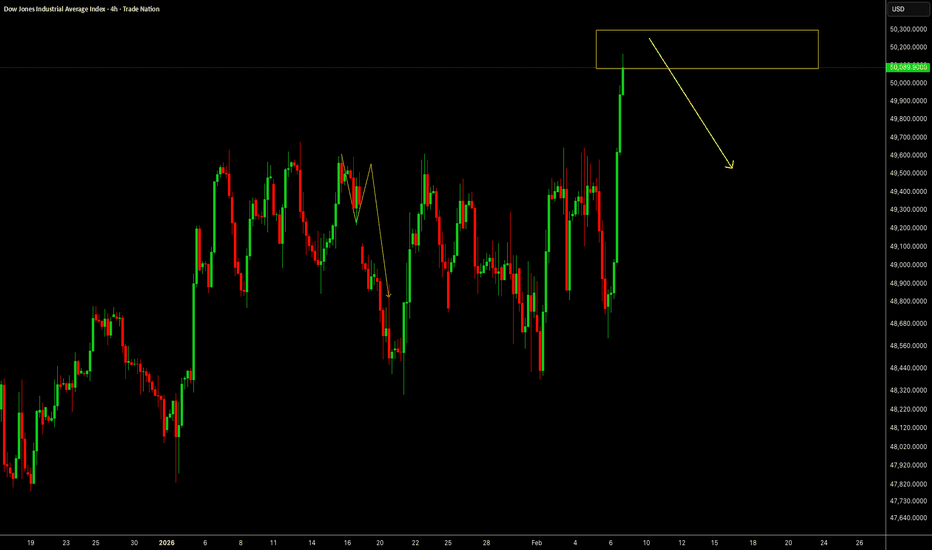

US30 Momentum Still StrongUS30 has extended higher with strong bullish participation, printing a decisive impulsive candle on the 4H timeframe and closing near the highs. This move confirms continuation intent rather than exhaustion, with buyers maintaining control after the recent consolidation phase.

Price is respecting t

See all ideas

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

Dow Jones Industrial Average Index reached its highest quote on Jan 13, 2026 — 49,683.5 USD. See more data on the Dow Jones Industrial Average Index chart.

The lowest ever quote of Dow Jones Industrial Average Index is 9,614.3 USD. It was reached on Jul 2, 2010. See more data on the Dow Jones Industrial Average Index chart.

Dow Jones Industrial Average Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Dow Jones Industrial Average Index futures or funds or invest in its components.