HKG33 H4 | Falling Towards Key SupportBased on the H4 chart analysis, we could see the price fall to our buy entry level of 26,218.97, which is an overlap support.

Our stop loss is set at 25,891.89, which is a pullback support that aligns with the 127.2% Fibonacci extension and the 78.6% Fibonacci projection.

Our take profit is set at

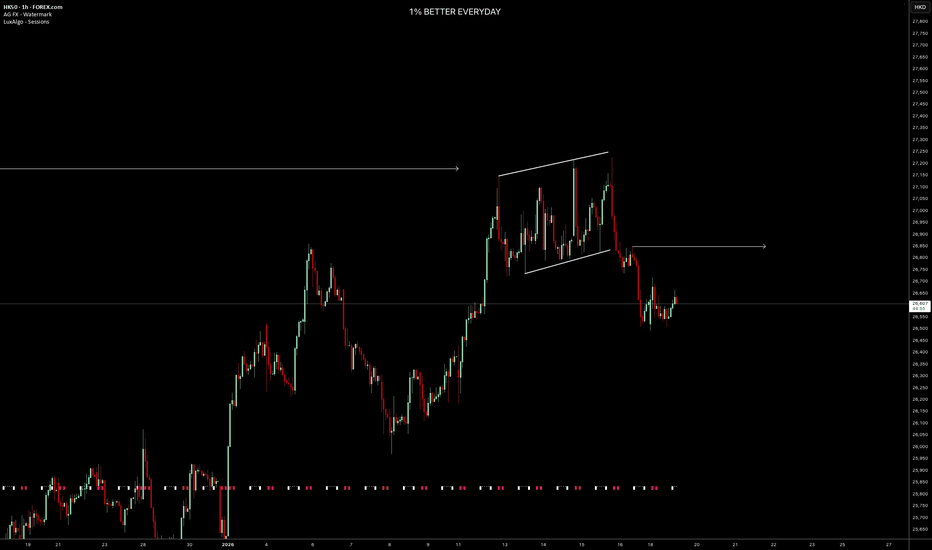

HKG33 | Bullish Momentum BuildingBased on the H4 chart analysis, we could see the price fall towards our buy entry level at 27,022.65, which is a pullback support that is slightly above the 38.2% Fibonacci retracement.

Our stop loss is set at 26,646.39, which is a pullback support that is slightly below the 61.8% Fibonacci retrace

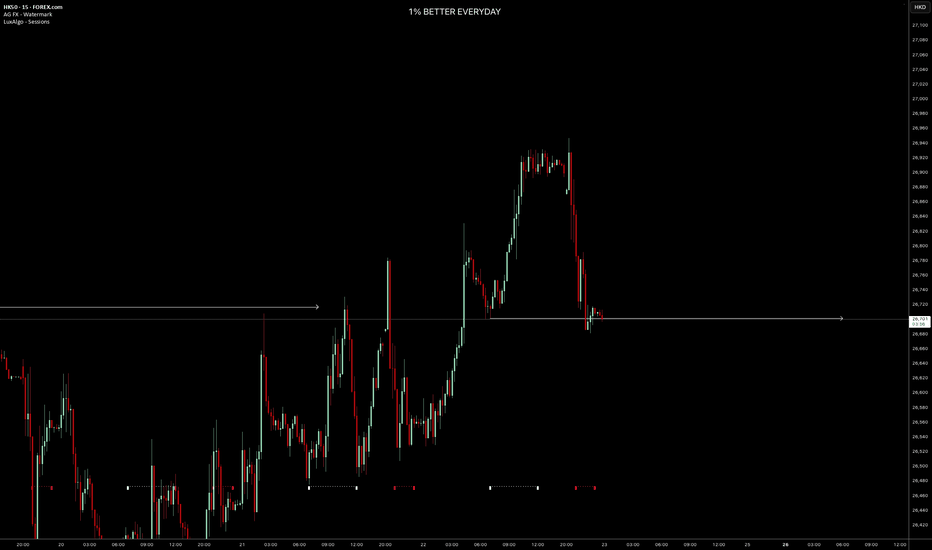

HK50 – Pullback Into HTF Order Block | Bullish Continuation SetuHK50 is showing a strong bullish expansion after breaking higher-timeframe structure. Price is now pulling back into a key higher-timeframe order block zone, which could offer a continuation long opportunity.

Key Levels

• Higher-timeframe OB zone: 26,600 – 26,950

• Current price area: around 27,170

HSI is on fire? tapping on fire horse? Happy New Year everyone!

May the joy continues spreading from the festive season for this year.

HSI had closed the year with a +27.77% ; ~5500+pts this has outperformed:-

S&P500 (i.e +16.39%; +963.87)

Nasdaq (i.e +20.17%; +4,237.67)

HSI kick-started the year with a rally with +700pts on the first

See all ideas

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

Hong Kong 50 CFD reached its highest quote on Jan 29, 2018 — 33,530 HKD. See more data on the Hong Kong 50 CFD chart.

The lowest ever quote of Hong Kong 50 CFD is 10,558 HKD. It was reached on Oct 27, 2008. See more data on the Hong Kong 50 CFD chart.

Hong Kong 50 CFD is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Hong Kong 50 CFD futures or funds or invest in its components.