CAD/CHF

No trades

About CAD/CHF

The Canadian Dollar vs. Swiss Franc pair is often recognized as a carry trade vehicle because of the relationship between a low yielding, safety geared currency (CHF) and a higher yielding, growth related one (CAD). The CHF is considered to be safety geared and low yielding because of its reputation as a safe harbor and haven for foreigners depositing their wealth in a foreign private banking system. The CAD is considered to be a commodity currency because of its exporting of natural resources which makes it sensitive to investors' outlooks on global economic growth.

Related currencies

CAD/CHF – H1 Technical AnalysisCAD/CHF – H1 Technical Analysis

🔹 The pair is moving within a well‑defined descending channel, reflecting strong bearish control over the overall trend.

🔹 The price recently failed to break above the upper boundary of the channel and subsequently broke through minor support levels, reinforcing the l

Bearish momentum to continue?CAD/CHF has rejected off the pivot and could drop to the 1st support.

Pivot: 0.57101

1st Support: 0.56044

1st Resistance: 0.57579

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investm

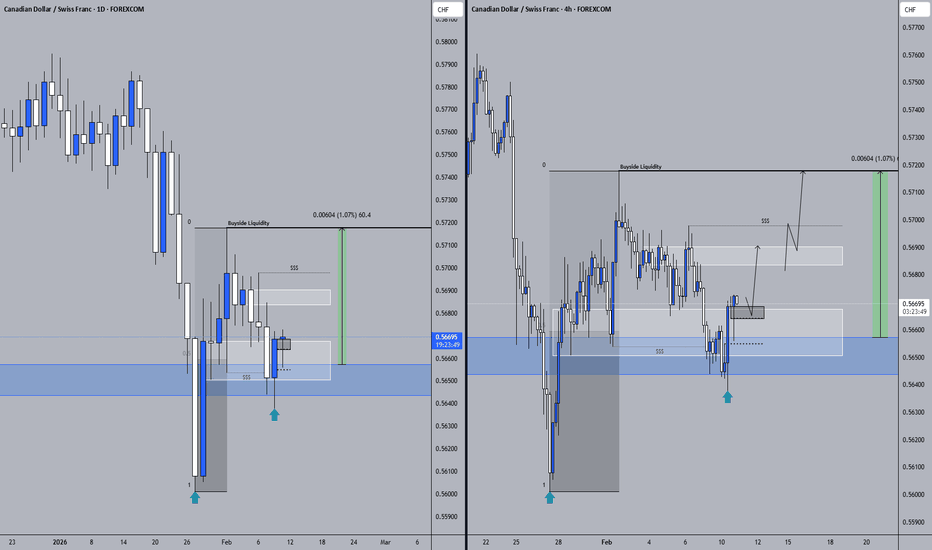

CADCHF: When Can It Resume The Bullish TrendCADCHF: When Can It Resume The Bullish Trend

CADCHF is suffering from a prolonged downtrend due to issues that I will not explain in much detail.

CADCHF reached a historical low of 0.5600. This area has been tested three times so far and has bounced back up, indicating that we have strong interes

CAD/CHF BEST PLACE TO BUY FROM|LONG

CAD/CHF SIGNAL

Trade Direction: long

Entry Level: 0.568

Target Level: 0.570

Stop Loss: 0.567

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

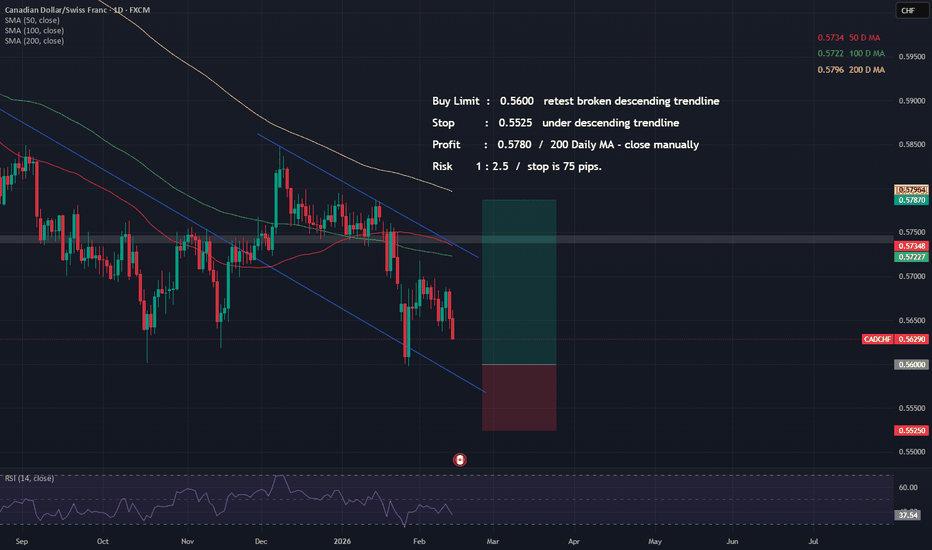

Buy CAD/CHF on retest of broken Daily trendline (sweep lows)Last year in November price action broke a descending Daily trendline which I believe was the first signs of a structure change. 2-3 weeks ago price action retested this trendline and was rejected. Now we are back here again for the 3rd attempt and possible the last after a sweep of the lows. The SN

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of CADCHF is 0.56377 CHF — it has decreased by −0.29% in the past 24 hours. See more of CADCHF rate dynamics on the detailed chart.

The value of the CADCHF pair is quoted as 1 CAD per x CHF. For example, if the pair is trading at 1.50, it means it takes 1.5 CHF to buy 1 CAD.

The term volatility describes the risk related to the changes in an asset's value. CADCHF has the volatility rating of 0.48%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The CADCHF showed a −0.67% fall over the past week, the month change is a −2.13% fall, and over the last year it has decreased by −11.40%. Track live rate changes on the CADCHF chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

CADCHF is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade CADCHF right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with CADCHF technical analysis. The technical rating for the pair is strong sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the CADCHF shows the strong sell signal, and 1 month rating is sell. See more of CADCHF technicals for a more comprehensive analysis.