Spotify appears to be searching for a floor around the $95 area.Spotify appears to be searching for a floor around the $95 area.

After the recent sharp breakdown from the upper trendline, price has accelerated to the downside with strong momentum, suggesting a shift from distribution to corrective pressure. The $95 zone stands out as a potential technical suppo

Shopify, Inc. Class A

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.80 EUR

1.07 B EUR

10.01 B EUR

1.22 B

About Shopify Inc.

Sector

CEO

Tobias Albin Lütke

Website

Headquarters

Ottawa

Founded

2004

IPO date

May 21, 2015

Identifiers

3

ISIN CA82509L1076

Shopify, Inc. is a global commerce company that provides essential internet infrastructure for commerce, offering trusted tools to start, scale, market, and run a retail business of any size. The Company's software enables merchants to run their business across all of their sales channels, including web and mobile storefronts, physical retail locations, social media storefronts and marketplaces. The Shopify platform provides merchants with a single view of their business across all of their sales channels and enables them to manage products and inventory, process orders and payments, fulfill and ship orders, build customer relationships, source products, leverage analytics and reporting and access financing, all from one integrated back office. The company was founded on September 28, 2004 and is headquartered in Ottawa, Canada.

Related stocks

A Comprehensive Bull Thesis on Shopify Inc.A Comprehensive Bull Thesis on Shopify Inc.: Scaling the Ecosystem with Discipline

As of January 28th, Shopify Inc. (SHOP) was trading at $138.92 per share. While its valuation metrics—a trailing P/E of 102.15 and a forward P/E of 72.99, according to Yahoo Finance—command a premium, a growing cohort

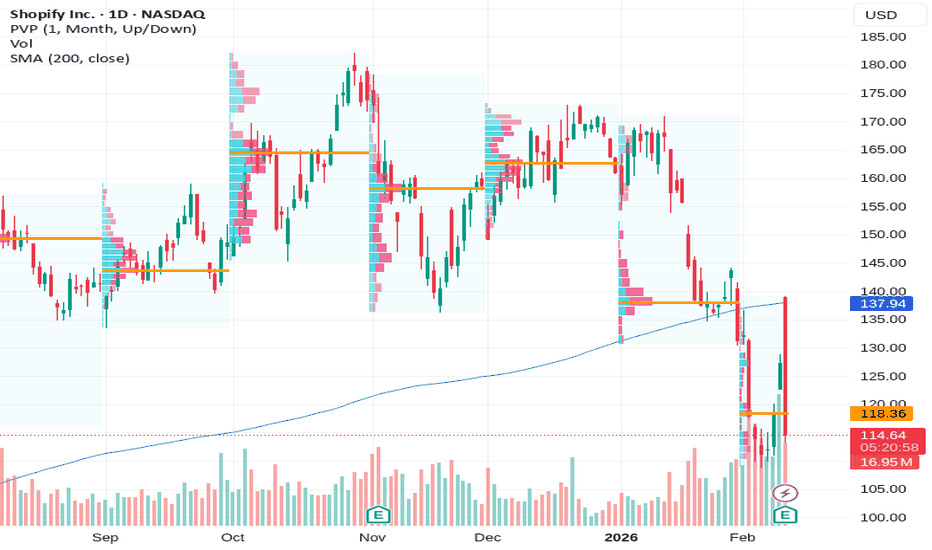

Shopify at Key Support Ahead of Earnings – Bounce Setup in PlayCurrent Price: 112.05 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 58%(Professional traders see a potential earnings-related bounce from support, and X sentiment leans bullish, but mixed views and known volatility keep confidence moderate.)

Targets

Target 1: 118.00

Breakdown in Shopify?Shopify failed to hold a record high in late October, and now some traders may think a breakdown is starting.

The first pattern on today’s chart is the drop on November 4 after quarterly results. The e-commerce company subsequently remained below that session’s range, making lower highs in December

Shopify: Bearish EffortsShopify has recently continued its bearish efforts but only managed to establish a slightly lower low. In our primary scenario, we ascribe more downside potential to the regular turquoise wave B, which should, however, culminate above the support at $88.16. In the subsequent wave C, we anticipate ri

Shopify IncNASDAQ:SHOP

If the 21 MA catches up with price and the 0.886 holds, a bullish continuation is most likely.

I added a solid trend-change indicator. Institutions do not gamble. While retail tries to catch falling knives, institutions wait for a clean trend shift and then accumulate. Do whatever sui

Shopify setting up for a short-term rebound above $160Current Price: $157.2

Direction: LONG

Confidence Level: 45% (Signals are limited and volumes are light, but with mixed information and price holding above recent support, I’m defaulting to a bullish bias with tight risk controls.)

Targets:

- T1 = $162.0

- T2 = $166.0

Stop Levels:

- S1 = $152.0

-

SHOP Technical Outlook: SMA Pullback and Bullish Structure📈 SHOPIFY, INC. (SHOP) — Swing Trade Profit Playbook

Exchange: NASDAQ

Market Type: US Stocks

Trade Style: Swing Trade

Bias: Bullish Continuation

🧠 Market Thesis (Clean & Professional)

SHOP is showing bullish momentum confirmation after a Simple Moving Average (SMA) pullback, signaling renewed buye

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 307 is 94.68 EUR — it has increased by 1.75% in the past 24 hours. Watch Shopify, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange Shopify, Inc. Class A stocks are traded under the ticker 307.

307 stock has risen by 0.46% compared to the previous week, the month change is a −33.92% fall, over the last year Shopify, Inc. Class A has showed a −18.46% decrease.

We've gathered analysts' opinions on Shopify, Inc. Class A future price: according to them, 307 price has a max estimate of 184.51 EUR and a min estimate of 92.52 EUR. Watch 307 chart and read a more detailed Shopify, Inc. Class A stock forecast: see what analysts think of Shopify, Inc. Class A and suggest that you do with its stocks.

307 stock is 5.24% volatile and has beta coefficient of 3.42. Track Shopify, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is Shopify, Inc. Class A there?

Today Shopify, Inc. Class A has the market capitalization of 124.12 B, it has decreased by −1.74% over the last week.

Yes, you can track Shopify, Inc. Class A financials in yearly and quarterly reports right on TradingView.

Shopify, Inc. Class A is going to release the next earnings report on Apr 30, 2026. Keep track of upcoming events with our Earnings Calendar.

307 earnings for the last quarter are 0.40 EUR per share, whereas the estimation was 0.43 EUR resulting in a −6.06% surprise. The estimated earnings for the next quarter are 0.28 EUR per share. See more details about Shopify, Inc. Class A earnings.

Shopify, Inc. Class A revenue for the last quarter amounts to 3.10 B EUR, despite the estimated figure of 3.07 B EUR. In the next quarter, revenue is expected to reach 2.59 B EUR.

307 net income for the last quarter is 642.33 M EUR, while the quarter before that showed 222.45 M EUR of net income which accounts for 188.75% change. Track more Shopify, Inc. Class A financial stats to get the full picture.

No, 307 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 17, 2026, the company has 7.6 K employees. See our rating of the largest employees — is Shopify, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Shopify, Inc. Class A EBITDA is 1.66 B EUR, and current EBITDA margin is 16.63%. See more stats in Shopify, Inc. Class A financial statements.

Like other stocks, 307 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Shopify, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Shopify, Inc. Class A technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Shopify, Inc. Class A stock shows the sell signal. See more of Shopify, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.