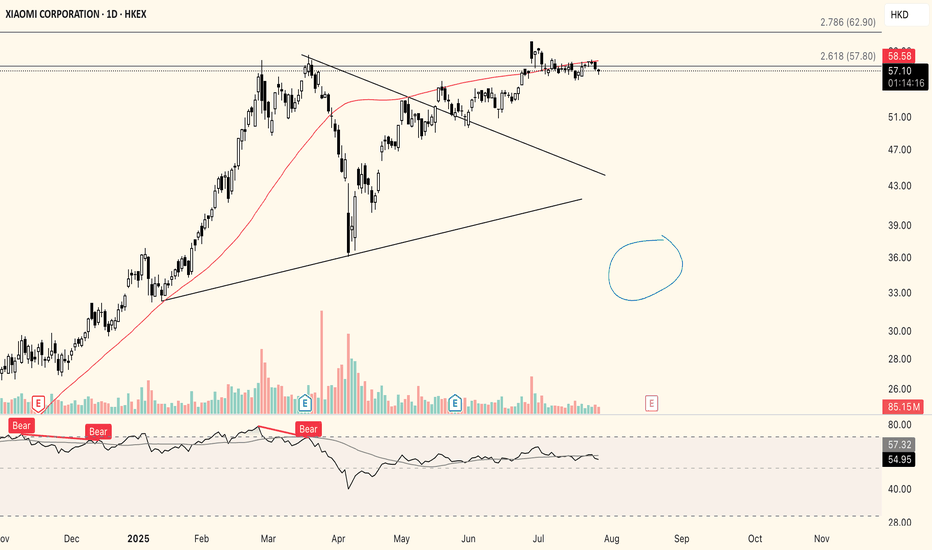

Xiaomi becomes an opportunity hereXiaomi had a steep retrace, something I've been eying for some time already as show here:

Right now Xiaomi might be starting to create a local bottom. This is very early days though, and further patience is required. As said in my initial thread with bearish views, this could go to 29HKD for sur

Xiaomi Corporation Class B

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.20 EUR

3.19 B EUR

49.31 B EUR

17.22 B

About Xiaomi Corporation Class B

Sector

Industry

CEO

Jun Lei

Website

Headquarters

Beijing

Founded

2010

IPO date

Jul 9, 2018

Identifiers

3

ISIN KYG9830T1067

Xiaomi Corp. engages in the design, manufacture and sale of smartphone, hardware and software products. Its business covers power bank, audio, camera and lifestyle. Xiaomi doing business through three business segments-Hardware, E-commerce & New Retail and Internet services. Its products include power bank pro, headphones, in-ear headphones pro, bluetooth headset basic with dock, bluetooth speaker, sphere camera, home security camera, action camera, robot builder, electric scooter, bedside lamp, and body composition scale. The company was founded by Jun Lei, Bin Lin, Wan Qiang Li, Feng Hong, De Liu, Chuan Wang, and Jiang Ji Huang on March 3, 2010 and is headquartered in Beijing, China.

Related stocks

Xiaomi is offering its loyal investors an opportunityLooking at the weekly chart, I think there might be some more room for the price to fall despite the recent shares buyback by the Company. This is also the highest peak the prices went in Dec 2020 before suffering a huge fall to below 10 dollars over the next few years..........

Had you went in dur

DO NOT turn your head away XiaomiHKEX:1810 (Xiaomi) represents an exceptional long-term opportunity when acquired at the right price. The majority of analysts maintain a Buy rating on the stock, with an average price target in the HK$56–58 range. Fundamentally, Xiaomi continues to gain global smartphone market share, often growing

Xiaomi is going to get a fresh haircutAs you can tell by looking at the chart, there seems to be a distribution at play here. After hitting a HTF 2.618 extension, there was quite a steep retracement that resulted in what looked like a bull flag. With recent sweep of that same high at the 2.618 extension, it now looks like Xiaomi will br

Xiaomi is offering a discount soon, are you ready ?I was talking to my wife who does not quite like this company for basically copying what the western brands are doing. Haha, a different perception from me.

Imo, this is a smart move instead of reinventing the wheel. It has already proven it works and people like it so tweaking the products from sm

Xiaomi 1810 HK LongXiaomi reports revenue of RMB 111.3 billion in Q1 2025, up 47% YoY

Adjusted net profit up 64% YoY to RMB 10.7 billion

Operating profit margin and net margin improved to 11.8% and 9.6%, respectively

Xiaomi became the leader in China's smartphone market in Q1 2025 with an 18.8% share (up 4.7 p.p. Y

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

USY77108AF8

Xiaomi Best Time International Ltd. 4.1% 14-JUL-2051Yield to maturity

5.55%

Maturity date

Jul 14, 2051

USY77108AD3

Xiaomi Best Time International Ltd. 2.875% 14-JUL-2031Yield to maturity

4.40%

Maturity date

Jul 14, 2031

XIAO4979273

Xiaomi Best Time International Ltd. 3.375% 29-APR-2030Yield to maturity

4.33%

Maturity date

Apr 29, 2030

XIAO5092059

Xiaomi Best Time International Ltd. 0.0% 17-DEC-2027Yield to maturity

—

Maturity date

Dec 17, 2027

See all 3CP bonds

159792

Wells Fargo China Securities Hong Kong Stock Connect Internet ETFWeight

15.27%

Market value

1.04 B

USD

Explore more ETFs

Frequently Asked Questions

The current price of 3CP is 3.98 EUR — it has increased by 0.52% in the past 24 hours. Watch Xiaomi Corporation Class B stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange Xiaomi Corporation Class B stocks are traded under the ticker 3CP.

3CP stock has risen by 4.52% compared to the previous week, the month change is a −4.58% fall, over the last year Xiaomi Corporation Class B has showed a −25.01% decrease.

We've gathered analysts' opinions on Xiaomi Corporation Class B future price: according to them, 3CP price has a max estimate of 7.79 EUR and a min estimate of 3.36 EUR. Watch 3CP chart and read a more detailed Xiaomi Corporation Class B stock forecast: see what analysts think of Xiaomi Corporation Class B and suggest that you do with its stocks.

3CP stock is 1.89% volatile and has beta coefficient of 1.22. Track Xiaomi Corporation Class B stock price on the chart and check out the list of the most volatile stocks — is Xiaomi Corporation Class B there?

Today Xiaomi Corporation Class B has the market capitalization of 103.78 B, it has increased by 0.87% over the last week.

Yes, you can track Xiaomi Corporation Class B financials in yearly and quarterly reports right on TradingView.

Xiaomi Corporation Class B is going to release the next earnings report on Mar 24, 2026. Keep track of upcoming events with our Earnings Calendar.

3CP earnings for the last quarter are 0.06 EUR per share, whereas the estimation was 0.04 EUR resulting in a 26.17% surprise. The estimated earnings for the next quarter are 0.04 EUR per share. See more details about Xiaomi Corporation Class B earnings.

Xiaomi Corporation Class B revenue for the last quarter amounts to 13.54 B EUR, despite the estimated figure of 13.75 B EUR. In the next quarter, revenue is expected to reach 15.19 B EUR.

3CP net income for the last quarter is 1.47 B EUR, while the quarter before that showed 1.39 B EUR of net income which accounts for 5.70% change. Track more Xiaomi Corporation Class B financial stats to get the full picture.

No, 3CP doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 15, 2026, the company has 43.69 K employees. See our rating of the largest employees — is Xiaomi Corporation Class B on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Xiaomi Corporation Class B EBITDA is 4.64 B EUR, and current EBITDA margin is 7.61%. See more stats in Xiaomi Corporation Class B financial statements.

Like other stocks, 3CP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Xiaomi Corporation Class B stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Xiaomi Corporation Class B technincal analysis shows the neutral today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Xiaomi Corporation Class B stock shows the neutral signal. See more of Xiaomi Corporation Class B technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.