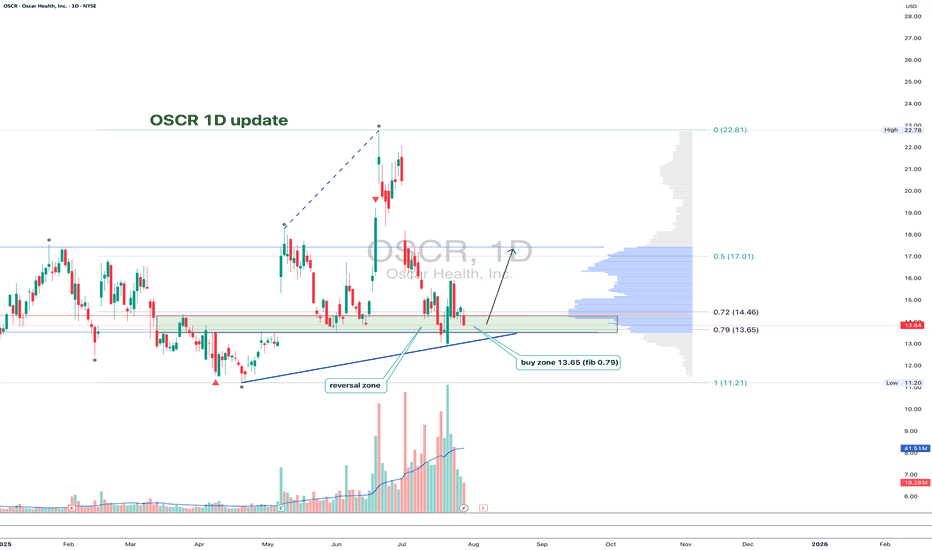

Oscar Health (OSCR) – Risk/Reward Setup Worth WatchingI’m tracking a long setup on NYSE:OSCR after a strong recovery trend that has been quietly building since the summer. It’s carving out a technical structure that offers a clean risk/reward.

Company Context

Oscar Health is a tech-driven health insurance company that’s been rebuilding its story i

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.54 EUR

24.57 M EUR

8.87 B EUR

189.35 M

About Oscar Health, Inc.

Sector

Industry

CEO

Mark T. Bertolini

Website

Headquarters

New York

Founded

2012

ISIN

US6877931096

Oscar Health, Inc. is a health insurance company, which serves its customers through a technology platform. It offers individual and family, small group and medicare advantage plans, and technology platform to others within the provider and payor space. The company was founded by Mario Tobias Schlosser, Kevin Nazemi, and Joshua Kushner on October 25, 2012 and is headquartered in New York, NY.

Related stocks

OSCR - Cyclical Expansion and Algorithmic ConfluenceOscar Health moves in cycles. It's possible to observe algorithmic confluence with the 3rd extension at 1.618 (~$60). The price reacted to the algorithmic expansion channel as expected and retraced to the equilibrium of the weekly bullish breaker. Therefore, the price behavior I anticipate is an agg

OSCR gap and refillOSCR pumped way past target one and pushed into the weekly supply. The gap was filled to the upside, but we will likely retrace this move. Most of this is already completed, we will likely wick below 17.5$.

My plan:

Possibly shares and cash secured puts around 17$, I have a large LEAP call spread

OSCR gap closureOSCR has filled the daily gap and quickly met our nearly two price targets. I have taken lots of profits and converted my exposure to purely LEAP call spreads to preserve capital. I still believe we will see 22$ soon, and UNH pumping might also drag us up. A golden fib extension is around 25$, but m

OSCR: back to support and now it’s decision timeAfter the recent impulse move, OSCR has pulled back to a key support zone around 13.65. That area aligns with the 0.79 Fib retracement, a horizontal level from spring, and a rising trendline that has already triggered reversals in the past. The structure is still intact, and buyers are testing the

Oscar Health has great linesI have 20 call options for NYSE:OSCR just to be transparent. The strike price is $15, exp March 2026. This one has some really good simple chart structure and solid fundamentals. I'll be watching this to break the $18.13 in the next few days. It could quickly sweep up into the $20's and then r

Trade Setup Description – OSCR (Oscar Health)!📝

Ticker: OSCR

Timeframe: 30m chart (short-term view)

Current Price: $16.81 (+19.77%)

🔍 Technical Breakdown

Chart Pattern: Price recently bounced from support around $16.00 and broke above a short-term trendline (ascending triangle setup).

Key Levels:

Support: $16.00 (white line – prior demand

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 9VY is featured.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange Oscar Health, Inc. Class A stocks are traded under the ticker 9VY.

We've gathered analysts' opinions on Oscar Health, Inc. Class A future price: according to them, 9VY price has a max estimate of 15.38 EUR and a min estimate of 6.84 EUR. Watch 9VY chart and read a more detailed Oscar Health, Inc. Class A stock forecast: see what analysts think of Oscar Health, Inc. Class A and suggest that you do with its stocks.

9VY stock is 6.13% volatile and has beta coefficient of −0.06. Track Oscar Health, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is Oscar Health, Inc. Class A there?

Yes, you can track Oscar Health, Inc. Class A financials in yearly and quarterly reports right on TradingView.

Oscar Health, Inc. Class A is going to release the next earnings report on Nov 11, 2025. Keep track of upcoming events with our Earnings Calendar.

9VY earnings for the last quarter are −0.76 EUR per share, whereas the estimation was −0.69 EUR resulting in a −9.98% surprise. The estimated earnings for the next quarter are −0.47 EUR per share. See more details about Oscar Health, Inc. Class A earnings.

Oscar Health, Inc. Class A revenue for the last quarter amounts to 2.43 B EUR, despite the estimated figure of 2.48 B EUR. In the next quarter, revenue is expected to reach 2.62 B EUR.

9VY net income for the last quarter is −193.86 M EUR, while the quarter before that showed 254.44 M EUR of net income which accounts for −176.19% change. Track more Oscar Health, Inc. Class A financial stats to get the full picture.

No, 9VY doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 29, 2025, the company has 2.4 K employees. See our rating of the largest employees — is Oscar Health, Inc. Class A on this list?

Like other stocks, 9VY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Oscar Health, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.