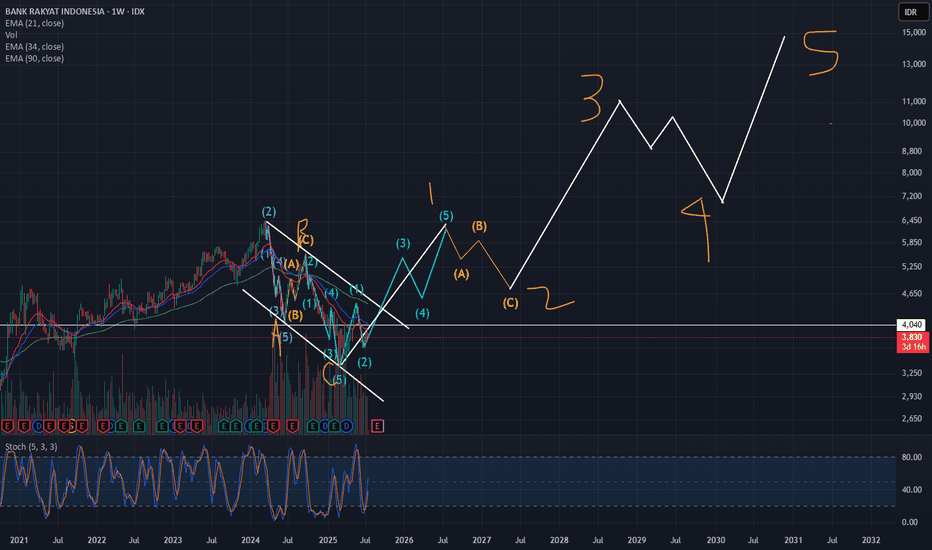

Needs ConfirmationJust to the point... The structure still looks bad but there is no invalid confirmation that it will continue to fall.

Weekly closed nya juga jelek

The action?

1. Speculation, buy now with averaging strategy There was demand in the previous candles. Invalid if the price drops below support

2. Waiti

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.02 EUR

3.60 B EUR

15.25 B EUR

66.36 B

About PT Bank Rakyat Indonesia (Persero) Tbk Class B

Sector

Industry

CEO

Sunarso

Website

Headquarters

Jakarta

Founded

1895

ISIN

ID1000118201

FIGI

BBG00FGWYBJ6

PT Bank Rakyat Indonesia (Persero) Tbk is a holding company, which engages in the provision of financial services. It operates through the following segments: Micro Business, Retail Business, Corporate Business, and Subsidiary Business. The Micro Business segment offers banking products and services to individual and micro entrepreneurs. The Retail Business segment provides consumer and commercial banking products and services to small and medium-sized enterprises. The Corporate Business segment caters large corporations and institutions with international banking services, treasury services, and capital market support services. The Subsidiary Business segment includes conventional banking, financing services, remittance services, life insurance, general insurance, venture capital, and securities. The company was founded by Aria Wiriatmaja on December 16, 1895 and is headquartered in Jakarta, Indonesia.

Related stocks

BBRI Weekly Outlook – Testing a Multi-Decade TrendlineTicker: BBRI (IDX)

Timeframe: Weekly

Status: High-Priority Technical Watchlist

🔹 Long-Term Structure

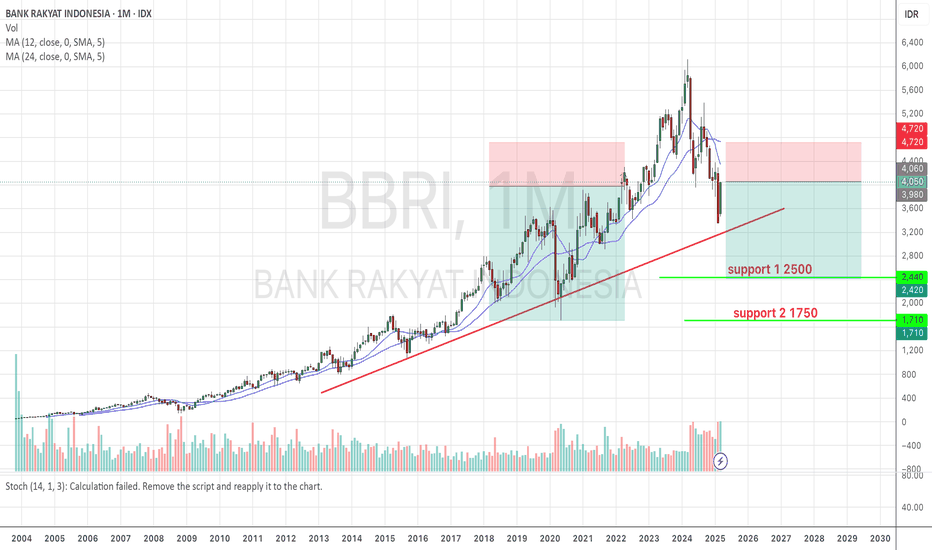

BBRI is currently testing a major ascending trendline that has been in play since 2008. This zone has historically served as a reliable long-term inflection point, having been tested multiple times

BBRIBbri

Wait and see first

For long investors,bbri is still bullish but for trader or beginner investors,do not enter first

Because for the weekly the price has breaked thru MA200,we will monitor whether the support of 3.350 will break through or not i fit breaks through

We will monitor the price of 2

BBRI BUY NOW 3350! Support level at 3050-3150BBRI is now probably trade in the end of its deep correction, as on the technical view, by the Elliot Waves count, it is now completing the WAVE 5 of C (it confirmed by the Bullish Divergence on MACD).

The price could be be a little lower on the next 1-5 trading days to the 3050-3150, which is the

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BYRA is 0.19 EUR — it has increased by 11.58% in the past 24 hours. Watch PT Bank Rakyat Indonesia (Persero) Tbk Class B stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange PT Bank Rakyat Indonesia (Persero) Tbk Class B stocks are traded under the ticker BYRA.

BYRA stock has risen by 6.53% compared to the previous week, the month change is a 17.78% rise, over the last year PT Bank Rakyat Indonesia (Persero) Tbk Class B has showed a −32.14% decrease.

We've gathered analysts' opinions on PT Bank Rakyat Indonesia (Persero) Tbk Class B future price: according to them, BYRA price has a max estimate of 0.28 EUR and a min estimate of 0.18 EUR. Watch BYRA chart and read a more detailed PT Bank Rakyat Indonesia (Persero) Tbk Class B stock forecast: see what analysts think of PT Bank Rakyat Indonesia (Persero) Tbk Class B and suggest that you do with its stocks.

BYRA reached its all-time high on Nov 9, 2017 with the price of 1.03 EUR, and its all-time low was 0.07 EUR and was reached on Jan 21, 2011. View more price dynamics on BYRA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BYRA stock is 11.58% volatile and has beta coefficient of 1.42. Track PT Bank Rakyat Indonesia (Persero) Tbk Class B stock price on the chart and check out the list of the most volatile stocks — is PT Bank Rakyat Indonesia (Persero) Tbk Class B there?

Today PT Bank Rakyat Indonesia (Persero) Tbk Class B has the market capitalization of 31.75 B, it has decreased by −4.33% over the last week.

Yes, you can track PT Bank Rakyat Indonesia (Persero) Tbk Class B financials in yearly and quarterly reports right on TradingView.

PT Bank Rakyat Indonesia (Persero) Tbk Class B is going to release the next earnings report on Nov 12, 2025. Keep track of upcoming events with our Earnings Calendar.

BYRA earnings for the last quarter are 0.00 EUR per share, whereas the estimation was 0.00 EUR resulting in a −1.28% surprise. The estimated earnings for the next quarter are 0.01 EUR per share. See more details about PT Bank Rakyat Indonesia (Persero) Tbk Class B earnings.

PT Bank Rakyat Indonesia (Persero) Tbk Class B revenue for the last quarter amounts to 2.63 B EUR, despite the estimated figure of 2.75 B EUR. In the next quarter, revenue is expected to reach 2.55 B EUR.

BYRA net income for the last quarter is 663.35 M EUR, while the quarter before that showed 758.33 M EUR of net income which accounts for −12.53% change. Track more PT Bank Rakyat Indonesia (Persero) Tbk Class B financial stats to get the full picture.

PT Bank Rakyat Indonesia (Persero) Tbk Class B dividend yield was 8.42% in 2024, and payout ratio reached 86.05%. The year before the numbers were 5.57% and 80.09% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 4, 2025, the company has 81.17 K employees. See our rating of the largest employees — is PT Bank Rakyat Indonesia (Persero) Tbk Class B on this list?

Like other stocks, BYRA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PT Bank Rakyat Indonesia (Persero) Tbk Class B stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PT Bank Rakyat Indonesia (Persero) Tbk Class B technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PT Bank Rakyat Indonesia (Persero) Tbk Class B stock shows the sell signal. See more of PT Bank Rakyat Indonesia (Persero) Tbk Class B technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.