HOMEUSDT Forming Bullish WaveHOMEUSDT is currently displaying a bullish wave pattern, signaling strong momentum and potential for an extended upward move. The wave structure indicates that the market is progressing through impulsive and corrective phases, with the next leg likely to push prices significantly higher. With volume supporting this trend, the setup strengthens the bullish case and highlights the possibility of a strong breakout in the coming sessions.

Based on the pattern projection, the expected gain for HOMEUSDT is in the range of 70% to 80%+, making it an attractive opportunity for swing traders and investors. Bullish wave patterns often lead to sharp rallies once momentum builds, especially when accompanied by steady buying activity. This setup shows that market participants are becoming more confident, which could fuel the next wave higher.

Investor interest in HOMEUSDT has also been increasing, which adds further credibility to the ongoing trend. The combination of technical strength, rising demand, and solid market participation creates a favorable environment for a potential extended rally. If the bullish wave continues as projected, HOMEUSDT could deliver substantial returns in the near term.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

HOMEUSDT.3S trade ideas

HOMEUSDT UPDATE#HOME

UPDATE

HOME Technical Setup

Pattern : Bullish Support Bounce

Current Price: $0.03928

Target Price: $0.056

Target % Gain: 45.82%

Technical Analysis: HOME has bounced strongly from the key demand zone on the 1D chart, confirming support with a bullish candle. Breakout momentum suggests continuation toward $0.056 with healthy upside potential.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

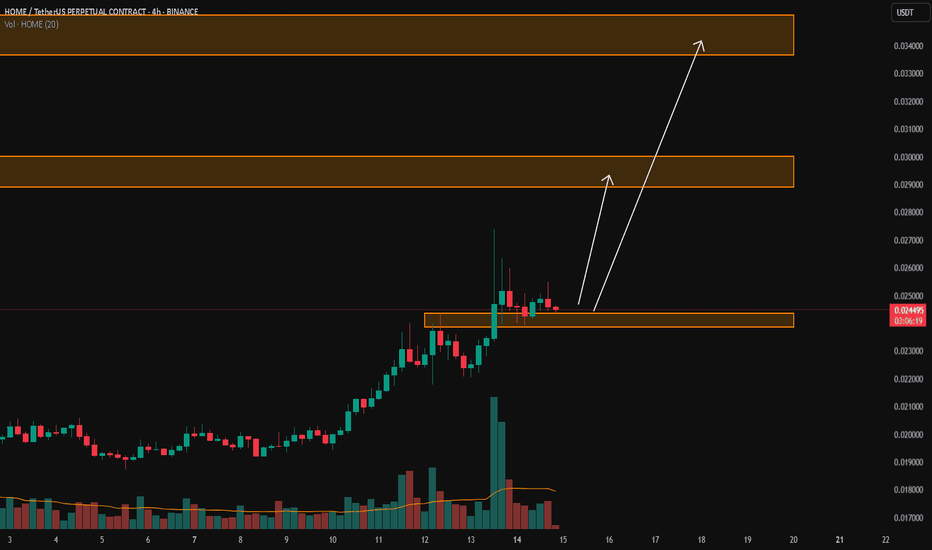

HOMEUSDT Forming Bullish BreakoutHOMEUSDT is currently presenting a bullish breakout pattern that has started to attract the attention of traders and investors. With strong technical signals aligning, the pair has broken above key resistance levels, signaling that market sentiment is shifting in favor of the bulls. Breakout structures like this are often followed by sharp rallies as liquidity builds and momentum accelerates.

The trading volume on HOMEUSDT is showing positive signs, confirming that this move is backed by solid participation rather than weak price action. When volume supports a breakout, it usually indicates strength and sustainability in the trend. Based on the current technical outlook, expectations point toward a potential gain of 40% to 50%+, making it an appealing setup for short- to mid-term traders.

Investor interest in this project is increasing as the breakout confirms strength in its underlying demand. Market participants are positioning themselves to capture the upcoming move, which could continue to push price levels higher. As long as support holds and momentum remains intact, this breakout could evolve into a more extended bullish wave.

Overall, HOMEUSDT is standing out with a clean bullish breakout structure, healthy volume, and rising investor confidence. If momentum continues to build, the projected targets are well within reach, offering a favorable opportunity for market participants keeping an eye on breakout-driven plays.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

HOME Bearish DivergenceBINANCE:HOMEUSDT

Trade Setup:

Target 1: 0.03657(0.786 Fibonnaci Golden Zone).

Target 2: 0.03257 (0.618 Fibonnaci Golden Zone).

Target 3: 0.02957 (0.5 Fibonnaci Golden Zone).

Target 4: 0.01784 (0 Fibonnaci).

DCA : 0.04489 (1.135 Fibonacci)

Stop Loss: 0.04815 (1.272 Fibonacci).

RSI Analysis: The RSI is showing a bearish divergence, suggesting potential bearish momentum. The current RSI is around 77.15, approaching oversold territory, so caution is advised.

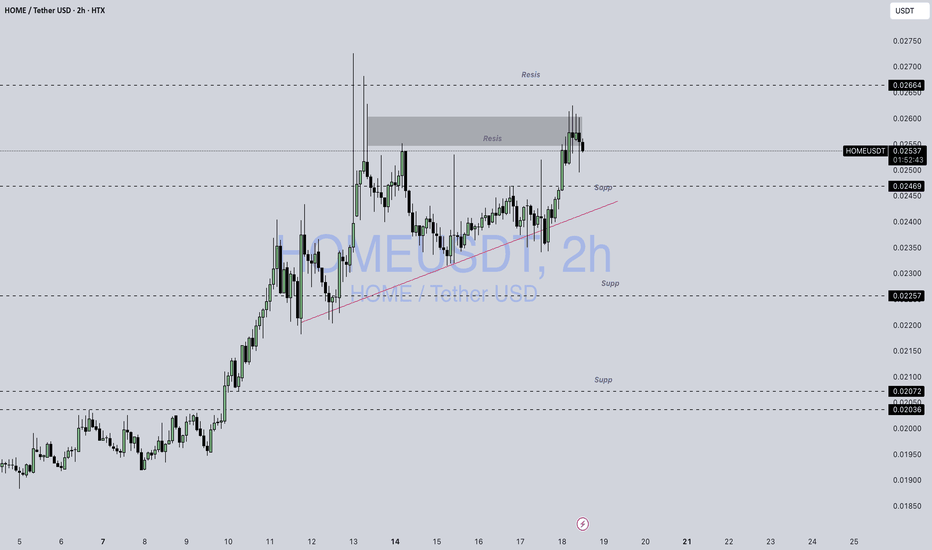

Home / UsdtHTX:HOMEUSDT

### 🧠 **Technical Breakdown of HOME/USDT (2h chart)**

#### 🔲 **Supply Zone (Resistance)**

* **Price Range:** 0.02550 – 0.02633

* This gray zone has previously caused multiple rejections.

* Several upper wicks indicate sellers are active here, absorbing buying pressure.

#### 📍 **Current Price Position**

* Price is **hovering at the edge of the supply zone** (\~0.02549).

* Candle bodies are struggling to close strongly above this region.

#### 🕳️ **Liquidity Wicks**

* A spike near **0.02664** signals liquidity hunts or stop-loss triggers.

* Repeated failures to close above this area suggest **supply dominance** for now.

#### 🔻 **Support Levels**

* **0.02469** – Weak intraday support

* **0.02257** – Strong structure support (tested and held)

* **0.02072 & 0.02036** – Deep support area; significant bounce occurred here previously

---

### 📌 Summary:

* The asset is **testing a known resistance** after recovering from lower levels.

* Behavior in the 0.02550–0.02633 zone is **critical**: either price gets absorbed and reverses, or buyers overpower and break higher.

* Support levels below are clearly defined in case of a retracement.

HOME/USDTKey Level Zone: 0.023850 - 0.024350

LMT v2.0 detected.

The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align.

Introducing LMT (Levels & Momentum Trading)

- Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL.

- While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones.

- That insight led to the evolution of HMT into LMT – Levels & Momentum Trading.

Why the Change? (From HMT to LMT)

Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by:

- Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork.

- Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup.

- Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively.

- Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets.

Whenever I share a signal, it’s because:

- A high‐probability key level has been identified on a higher timeframe.

- Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent.

- The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry.

***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note: The Role of Key Levels

- Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer.

- Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance.

My Trading Rules (Unchanged)

Risk Management

- Maximum risk per trade: 2.5%

- Leverage: 5x

Exit Strategy / Profit Taking

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically sell 50% during a high‐volume spike.

- Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R.

- Exit at breakeven if momentum fades or divergence appears.

The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

From HMT to LMT: A Brief Version History

HM Signal :

Date: 17/08/2023

- Early concept identifying high momentum pullbacks within strong uptrends

- Triggered after a prior wave up with rising volume and momentum

- Focused on healthy retracements into support for optimal reward-to-risk setups

HMT v1.0:

Date: 18/10/2024

- Initial release of the High Momentum Trading framework

- Combined multi-timeframe trend, volume, and momentum analysis.

- Focused on identifying strong trending moves high momentum

HMT v2.0:

Date: 17/12/2024

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

Date: 23/12/2024

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

Date: 31/12/2024

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

Date: 05/01/2025

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

Date: 06/01/2025

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

HMT v8.1 :

Date : 18/04/2025

- Refined Take Profit (TP) logic to be more conservative for improved win consistency

LMT v1.0 :

Date : 06/06/2025

- Rebranded to emphasize key levels + momentum as the core framework

LMT v2.0

Date: 11/06/2025

- Fully restructured lower timeframe (LTF) momentum logic

- Enhanced entry timing for better precision and alignment with key levels

HOME | Two Possible PathsThe HOME 4-hour chart shows price consolidating near the 0.01974 support level with two distinct scenarios emerging:

Bullish Path (Green Arrow):

Price breaks above resistance zones around 0.02200-0.02800

Target: 0.03632 resistance level

Supported by recent bounce from support

Bearish Path (Red Arrow):

Price breaks below current support at 0.01974

Target: 0.01400-0.01500 area

Confirmed by potential lower high formation

Key Levels:

Critical Support: 0.01974 (current price)

Resistance Zones: 0.02200, 0.02800 (pink boxes)

Breakout Target: 0.03632

Risk Assessment:

The RSI shows neutral momentum around 50, indicating indecision. A decisive break above 0.02000 favors the bullish scenario, while a close below 0.01900 supports the bearish outlook. This appears to be a critical inflection point requiring patience for confirmation.