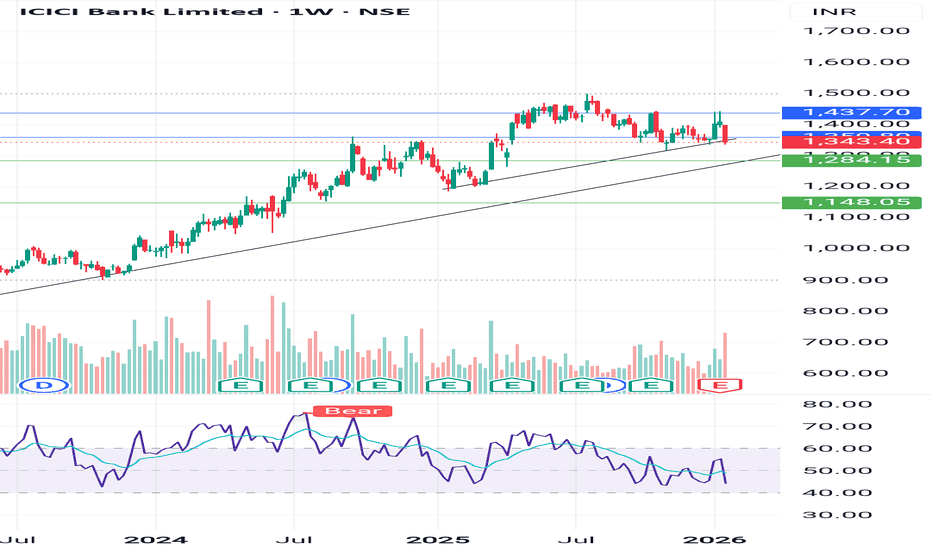

NSE – NIFTY 750 | ICICI Bank | 05 Feb 2026Intro:

Monthly structure overview of ICICI Bank as part of the NIFTY 750 Structure Census.

Structure:

Long-term impulse structure intact

Rising structural support held across major cycles

Current phase: higher-level consolidation near trend highs

Disclaimer:

This is a structural update

ICICI Bank Limited Sponsored ADR

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.71 USD

6.04 B USD

34.66 B USD

3.57 B

About ICICI Bank Limited

Sector

Industry

CEO

Sandeep Bakhshi

Website

Headquarters

Mumbai

Founded

1955

IPO date

Sep 24, 1997

Identifiers

3

ISIN US45104G1040

ICICI Bank Ltd. engages in the provision of banking and financial services, which includes retail banking, corporate banking, and treasury operations. It operates through the following segments: Retail Banking, Wholesale Banking, Treasury, Other Banking, Life Insurance, and Others. The Retail Banking segment includes exposures of the bank, which satisfy the four qualifying criteria of regulatory retail portfolio as stipulated by the Reserve Bank of India guidelines on the Basel III framework. The Wholesale Banking segment deals with all advances to trusts, partnership firms, companies, and statutory bodies, by the Bank which are not included in the Retail Banking segment. The Treasury segment handles the entire investment portfolio of the bank. The Other Banking segment comprises leasing operations and other items not attributable to any particular business segment of the bank. The Life Insurance segment represents results of ICICI Prudential Life Insurance Company Limited. The Others segment include ICICI Home Finance Company Limited, ICICI Venture, ICICI International Limited, ICICI Securities Primary Dealership Limited, ICICI Securities Limited, ICICI Securities Holdings Inc., ICICI Securities Inc., ICICI Prudential Asset Management Company Limited, ICICI Prudential Trust Limited, ICICI Investment Management Company Limited, ICICI Trusteeship Services Limited, and ICICI Prudential Pension Funds Management Company Limited. The company was founded in 1955 and is headquartered in Mumbai, India.

Related stocks

ICICI Bank - Support at Trendline & EMA Junction"While ICICI Bank remains in a long-term uptrend, several factors suggest caution in the short to medium term. The price is currently testing a major multi-month rising trendline, but the negative RSI divergence on the weekly timeframe is a significant red flag, indicating weakening bullish momentum

ICICI Bank | Gann Square of 9 Intraday Case Study | 06 Apr 2023This chart presents a classical WD Gann Square of 9 intraday setup, where price completed its normal capacity early in time, leading to a high-probability reversal.

On 06 April 2023, ICICI Bank started gaining upside momentum from the third 15-minute candle.

The intraday low at ₹875 was selected

ICICI Bank Ltd | Downtrend Breakout with Fibonacci SupportICICI Bank Ltd | Downtrend Breakout with Fibonacci Support

ICICI Bank Ltd has broken out of its prevailing downtrend, with price decisively crossing and sustaining above the descending trendline. The stock is also holding well above the 0.5 Fibonacci retracement level, which strengthens the bullish

ICICIBANK "W" Pattern Reversal at Multi-Week Support | Bullish SICICIBANK "W" Pattern Reversal at Multi-Week Support | Bullish Reversal Setup

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 TECHNICAL SETUP

Current Price: 1,343.90 (+0.44%)

Timeframe: Weekly (1W)

Symbol: ICICIBANK (ICICI Bank Limited)

Exchange: NSE

Category: Stock / Banking Sector

━━━━━━━━━━━━━━━━━━

ICICI BANKICICI Bank Ltd., incorporated in the year 1994, is a banking company (having a market cap of Rs 9,93,046.55 Crore).

ICICI Bank Ltd. key Products/Revenue Segments include Interest & Discount on Advances & Bills, Income From Investment, Interest On Balances with RBI and Other Inter-Bank Funds and Inte

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

I

75IHFCL30

ICICI Home Finance Co. Ltd. 7.5% 08-NOV-2030Yield to maturity

8.45%

Maturity date

Nov 8, 2030

I

802IHFCL30

ICICI Home Finance Co. Ltd. 8.02% 10-JUN-2030Yield to maturity

8.00%

Maturity date

Jun 10, 2030

I

725ICICI31

ICICI Home Finance Co. Ltd. 7.25% 12-AUG-2031Yield to maturity

7.34%

Maturity date

Aug 12, 2031

I

807IHFCL27

ICICI Home Finance Co. Ltd. 8.07% 01-OCT-2027Yield to maturity

6.35%

Maturity date

Oct 1, 2027

I

781IHFCL28

ICICI Home Finance Co. Ltd. 7.81% 12-APR-2028Yield to maturity

5.67%

Maturity date

Apr 12, 2028

I

802IHFC29

ICICI Home Finance Co. Ltd. 8.02% 19-APR-2029Yield to maturity

5.60%

Maturity date

Apr 19, 2029

I

US45112FAJ57

ICICI Bank Ltd. (Dubai Branch) 4.0% 18-MAR-2026Yield to maturity

4.36%

Maturity date

Mar 18, 2026

I

US45112FAM86

ICICI Bank Ltd. (Dubai Branch) 3.8% 14-DEC-2027Yield to maturity

4.32%

Maturity date

Dec 14, 2027

I

734IHFCL28

ICICI Home Finance Co. Ltd. 7.3388% 24-JUL-2028Yield to maturity

—

Maturity date

Jul 24, 2028

See all IBN bonds