Cocoa Futures

No trades

Related commodities

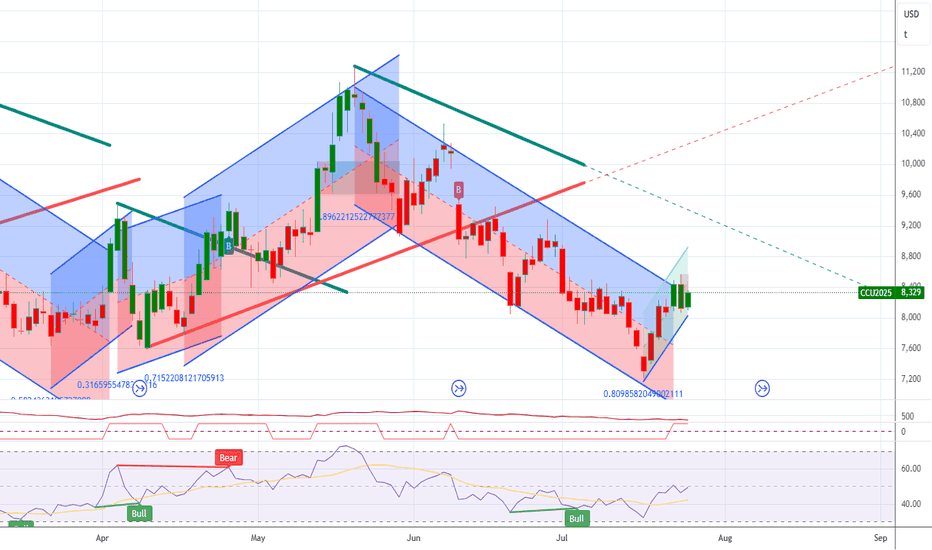

COCOA FUTURES |Long Setup | El Niño Aftershock | Nov 7, 2025COCOA FUTURES (CC1!) | Long Setup | Seasonal Tightness, El Niño Aftershock, Channel Base Retest | Nov 7, 2025

🔹 Thesis Summary

Cocoa sits at the lower rail of a multi-year rising channel while global stocks remain tight after 2024–25 weather shocks. Seasonality turns constructive into Q4–Q1, and th

Cocoa Crash: From $12,000 to $6,000 — Over 50% Drop in 2025After hitting record highs above $12,000 per ton in April 2024, cocoa futures ( NYSE:CC ) have plunged more than 53%, now trading near $6,000.

The selloff comes as supply pressures ease in West Africa, speculative longs unwind, and better weather improves harvest outlooks.

Still, chocolate prices

23.10.25 Cocoa Weekly buyWeekly

Cocoa reacted from a previous demand zone (Rally-Base-Rally, wider version) and it looks like it may be forming a Drop-Base-Rally pattern. This will be confirmed or invalidated with the close of this week.

At the moment, there is no clear trend, as there is still no confirmation according t

Cocoa Futures (CC1!)Cocoa prices in New York are down over -50% from their all-time high in 2024 (Blue Line); but London prices have declined -58% from their April 2024 peak (Green Line), to $4,262, the lowest in 20 months. New York prices are still above the 20-year average of ~$2,700 per ton. What's driving the Londo

Cocoa ICEUS - Support (5,950-6,250) | Multi-Confluence AnalysisCocoa Seasonal Confluence Zone – Q4 Outlook

This is a multi-confluence analysis of cocoa futures, combining seasonal patterns, structural levels and institutional positioning zones .

All key levels and insights are annotated directly on the charts for clarity and quick visual reference.

Sea

Cocoa Futures (ICE) – Long Trade Setup🍫 Cocoa Futures (ICE) – Long Trade Setup

Direction: Long Bias

Contract: Cocoa (NY / ICE)

Current Price: ~7,437

🔍 Technical Setup

Price has been consolidating after the sharp run-up and has now pulled back into a key long-term trendline (yellow support).

A downtrend channel breakout is forming –

Long Chocolate📌 Cocoa Futures: Seasonality, Trading Strategies & Market Drivers

Cocoa is more than just the foundation of chocolate; it’s a soft commodity with centuries of economic significance. Once used as currency by ancient civilizations in Central and South America, cocoa became a global commodity after th

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Cocoa Futures is 5,880 USD / TNE — it has risen 0.74% in the past 24 hours. Watch Cocoa Futures price in more detail on the chart.

The volume of Cocoa Futures is 10.56 K. Track more important stats on the Cocoa Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Cocoa Futures this number is 60.43 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Cocoa Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Cocoa Futures. Today its technical rating is neutral, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Cocoa Futures technicals for a more comprehensive analysis.