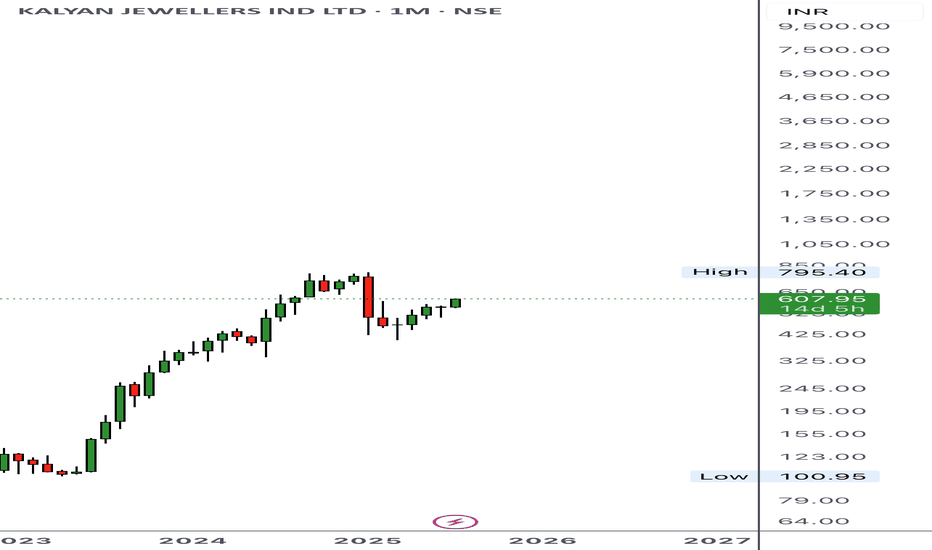

Diwali Dhamaka Starts HereTechnical View Expected Upmove

1)Supply Sufficient ;

2)Cyclic DB Found ;

3)BB And Rsi Confirmed The UpMove ;

4)Gold Rate Also Booms Already ;

5)Risk is Low 475 Max SL. Reward Minimum upto 720 In shorterm.

Fundamental Understanding In My View

1)Company is expected to give good quarter;

2)Company

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.75 INR

7.15 B INR

250.45 B INR

359.00 M

About Kalyan Jewellers India Ltd.

Sector

Industry

CEO

Sanjay Raghuraman

Website

Headquarters

Thrissur

Founded

1993

ISIN

INE303R01014

FIGI

BBG00WXX2GC9

Kalyan Jewellers India Ltd. owns and operates jewellery stores. The firm offers gold, diamond, platinum, and silver jewelleries. Its brands include Mudhra, Nimah, Anokhi, Rang, Tejasvi, Ziah, Laya, Glo, Candere, Vedha, Apoorva, and Hera. The company was founded by TS Kalyanaraman in 1993 and is headquartered in Thrissur, India.

Related stocks

Kalyan Jewellers (Swing):Kalyan Jewellers (Swing):

Kalyan is getting ready to break the past crucial supply zone.

Signs of remarkable consolidation and a strong base formation is quite convincing.

Trade offers a RR of more than 1:3.

Check out my earlier views for a better understanding.

Note: Do your own due diligence

KALYAN JEWLLERS IND LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (re

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of KALYANKJIL is 455.80 INR — it has decreased by −1.62% in the past 24 hours. Watch Kalyan Jewellers India Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Kalyan Jewellers India Ltd. stocks are traded under the ticker KALYANKJIL.

KALYANKJIL stock has fallen by −11.64% compared to the previous week, the month change is a −10.63% fall, over the last year Kalyan Jewellers India Ltd. has showed a −40.26% decrease.

We've gathered analysts' opinions on Kalyan Jewellers India Ltd. future price: according to them, KALYANKJIL price has a max estimate of 770.00 INR and a min estimate of 500.00 INR. Watch KALYANKJIL chart and read a more detailed Kalyan Jewellers India Ltd. stock forecast: see what analysts think of Kalyan Jewellers India Ltd. and suggest that you do with its stocks.

KALYANKJIL reached its all-time high on Jan 2, 2025 with the price of 795.40 INR, and its all-time low was 55.05 INR and was reached on Jun 20, 2022. View more price dynamics on KALYANKJIL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

KALYANKJIL stock is 4.06% volatile and has beta coefficient of 1.45. Track Kalyan Jewellers India Ltd. stock price on the chart and check out the list of the most volatile stocks — is Kalyan Jewellers India Ltd. there?

Today Kalyan Jewellers India Ltd. has the market capitalization of 477.61 B, it has increased by 3.40% over the last week.

Yes, you can track Kalyan Jewellers India Ltd. financials in yearly and quarterly reports right on TradingView.

Kalyan Jewellers India Ltd. is going to release the next earnings report on Nov 6, 2025. Keep track of upcoming events with our Earnings Calendar.

Kalyan Jewellers India Ltd. revenue for the last quarter amounts to 72.69 B INR, despite the estimated figure of 71.16 B INR. In the next quarter, revenue is expected to reach 74.28 B INR.

KALYANKJIL net income for the last quarter is 2.64 B INR, while the quarter before that showed 1.88 B INR of net income which accounts for 40.77% change. Track more Kalyan Jewellers India Ltd. financial stats to get the full picture.

Yes, KALYANKJIL dividends are paid annually. The last dividend per share was 1.50 INR. As of today, Dividend Yield (TTM)% is 0.26%. Tracking Kalyan Jewellers India Ltd. dividends might help you take more informed decisions.

Kalyan Jewellers India Ltd. dividend yield was 0.32% in 2024, and payout ratio reached 21.64%. The year before the numbers were 0.28% and 20.69% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 26, 2025, the company has 12.53 K employees. See our rating of the largest employees — is Kalyan Jewellers India Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Kalyan Jewellers India Ltd. EBITDA is 16.73 B INR, and current EBITDA margin is 6.51%. See more stats in Kalyan Jewellers India Ltd. financial statements.

Like other stocks, KALYANKJIL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Kalyan Jewellers India Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Kalyan Jewellers India Ltd. technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Kalyan Jewellers India Ltd. stock shows the sell signal. See more of Kalyan Jewellers India Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.