ETHUSDH2026 trade ideas

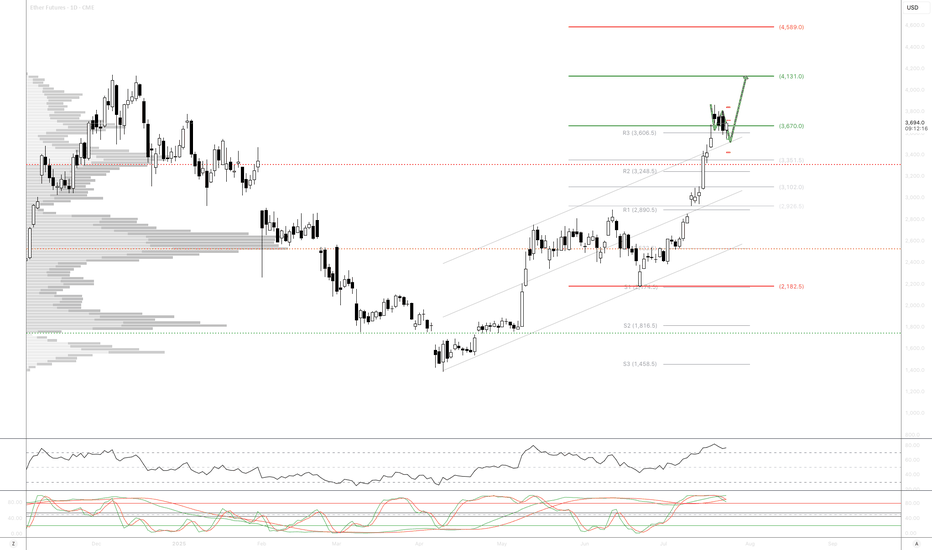

Ether futures: Quarterly signal and new ATH...GN gents,

As you know, I've been bullish ETH for a while now, although I had hedged partially in the last few days ahead of the correction we had, but now started deploying cash I raised again. Ether futures chart from CME shows more conservative targets than stop given that it has more limited data, but it is interesting to be aware of what tradfi whales see when operating in this market.

With some luck, macro data doesn't derail the train here, and things move steadily higher for the rest of the year and into early to half 2026 at least, before significant corrections or "bear markets" unfold.

Best of luck!

Cheers,

Ivan Labrie.

From Strength to Weakness: ETH Validates a Key Bearish PatternIntroduction (Market Context)

Ether Futures (ETH) and Micro Ether Futures (MET) have been at the center of market attention since April 2025, when prices staged a remarkable rally of more than +250%. This surge was not just a technical phenomenon—it came in the wake of major macro events such as Liberation Day and the reemergence of U.S. tariff policies under Donald Trump’s administration. Those developments sparked speculative flows into digital assets, with Ether acting as one of the prime beneficiaries of capital rotation.

Yet markets rarely move in one direction forever. After such a sharp rise, technical exhaustion often follows, and signs of that exhaustion are beginning to surface on ETH’s daily chart. Traders who enjoyed the rally now face a critical juncture: whether to protect gains or to consider new opportunities in the opposite direction. The key lies in a pattern that has appeared many times in history, often marking important reversals—the Rising Wedge.

What is a Rising Wedge?

A Rising Wedge is one of the most recognizable bearish reversal formations in technical analysis. It typically develops after a strong uptrend, where price continues to push higher but does so with diminishing momentum. On the chart, the highs and lows still point upward, but the slope of the highs is shallower than the slope of the lows, creating a narrowing upward channel.

The psychology behind the wedge is critical: buyers are still in control, but they are running out of strength with every push higher. Sellers begin to absorb demand more aggressively, and eventually, price breaks through the lower boundary of the wedge. This breakdown often accelerates as trapped buyers unwind positions.

From a measurement perspective, technicians project the maximum width of the wedge at its start, and then apply that distance downward from the point of breakdown. This projection offers a technical target for where price may gravitate in the following weeks. In the case of Ether Futures, that target points toward the 3,200 area, a level of strong technical interest and a logical area for traders to watch closely.

RSI and Bearish Divergence

Alongside the wedge, momentum indicators add further weight to the bearish case. The Relative Strength Index (RSI) is a widely used oscillator that measures momentum on a scale of 0 to 100. Values above 70 are generally interpreted as “overbought,” while values below 30 suggest “oversold.”

The most powerful signals often emerge not when RSI is at an extreme, but when it diverges from price action. A bearish divergence occurs when price sets higher highs while RSI forms lower highs. This is an indication that upward momentum is weakening even as price appears to climb.

Ether Futures have displayed this phenomenon clearly over the past few weeks. The daily chart shows four successive higher highs in price, yet RSI failed to confirm these moves, instead tracing a series of lower peaks. Notably, RSI pierced the overbought zone above 70 twice during this period, but momentum faded quickly after each attempt. This divergence is a classic early warning sign that a bullish run is running out of steam.

Forward-Looking Trade Idea

With the Rising Wedge breakdown and RSI divergence in place, a structured trade plan emerges. Futures traders can express this view through either the standard Ether Futures contract (ETH) or its smaller counterpart, the Micro Ether Futures contract (MET).

Contract Specs & Margins

Ether Futures (ETH): Notional = 50 Ether, Tick size = 0.50, Tick value = $25.00, Initial margin ≈ $68,800 (subject to CME updates).

Micro Ether Futures (MET): Notional = 0.1 Ether, Tick size = 0.50, Tick value = $0.05, Initial margin ≈ $140 (subject to CME updates).

Trade Plan (Bearish Setup)

Direction: Short

Entry: 4,360

Target: 3,200

Stop Loss: 4,702 (coinciding with a minor resistance level)

Reward-to-Risk Ratio: ≈ 3.39 : 1

The projected wedge target around 3,200 is not only a measured move from the pattern but also sits close to a previously established UFO support zone. While anecdotal, this confluence reinforces the credibility of the level as a potential magnet for price.

Risk Management

Regardless of how compelling a technical setup may appear, the most decisive factor in trading remains risk management. Defining risk in advance ensures that losses are limited if the market behaves unexpectedly. In this case, placing the stop at 4,702 not only keeps risk under control but also aligns with a minor resistance level, making the trade plan technically coherent.

Position sizing also plays a crucial role. The availability of Micro Ether Futures (MET) allows traders to participate with significantly reduced capital requirements compared to the full-sized ETH contract. This flexibility makes it easier to fine-tune exposure and manage account risk more precisely.

Equally important is the discipline of adhering to precise entries and exits. Chasing a trade or ignoring pre-defined stop levels can erode the edge provided by technical analysis. Markets often deliver multiple opportunities, but without sound risk management, traders may not survive long enough to benefit from them. Ultimately, capital preservation is the foundation on which consistent performance is built.

Closing

Ether’s spectacular rally since April 2025 is a reminder of the asset’s ability to deliver explosive moves under the right conditions. Yet history shows that parabolic advances rarely continue uninterrupted. The combination of a Rising Wedge breakdown and a confirmed RSI divergence provides strong evidence that the current uptrend is losing momentum, and the market may be entering a corrective phase.

For traders, this is less about predicting the future and more about recognizing when probabilities align in favor of a defined setup. With clear entry, target, and stop levels, the ETH and MET contracts offer a structured opportunity for those willing to take a bearish stance while managing their risk appropriately.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

minor pullback with deceptive volitility brings high RR for=SELL1->3 : we make lower lows , number 2 is confirmed as the current dominant power in this micro structure,

3->4 : we push back upto number 2 with a large burst of volitility, these large bursts can be decieving, manytimes they don't have sustaining power and can be thought of a sprinters 'final push' , not the start of somehting signiciant.

* What do I think will happen ?

* after we reach number 2 , there is no significant volitile movement, this leads me to believe that the large wick from 3->4 is not super significant in our analysis, if it was we should be seeing more of that buyer activity, yet we see a controlled selloff with not much resistance

* looking at the Chaos Theory indicatior, we can see that over the past 2,500 bars , if price closes below a zone, we have a 65% chance of it reaching the next low, with this in mind we can see that we have indeed had the bar close but not reach , so an entry just below the border of the zone with an expected follow through, and a stop loss at the proven buyers number 2 seems like a logical trade that would work more often than not

* we have hidden bearish for RSI, MFI and ACC/Dist which is helpful for a sell

ETH1!How I see it playing out (it will seem so obvious in hindsight):

4,070 holds as ETH bottom

Tom Lee's quant praised praised for accurately forecasting ETH bottom using *checks notes* elliott waves and ichimoku (they were probably gunning for the CME gap at 4087.50, now filled)

CME ETH "record" shorts used as fuel; their unwind sends ETH through ATH

ETHUSD - Expect a bounce ... now? lets go above ATHLong time no see !

I was in vacations with the cult of the CME Gap that I joined

Soooo, Eth took some logic profits, it was a quasi straight line from 2400 to 4800 (not mentionning that its coming before from under 1500), a 10% correction is totally ok

we are actually in the middle of the last CME GAP, its filling daddy

Dec 2024 high

100 MA 4H

0.5 fib resistance from last low

0.236 is 4K so we still have room to be in denial if it dips more

as you can see thats a lot of convergences, not even talking about BTC, BTC.D, USDT.D, GOLD and all the other tickers aligning perfectly for the big ritual of the big last leg of the big bull run (B.R.B.L.L.B.B.R.) (I know how to make it since those vacations)

Sooo SL is slightly under first bullish Order Block that u can see in this chart @ around 3440, yes sry I can't mess with the levs even with this perfect entry opportunity

TP1 : 7000

TP2 : 9000

TP3 : 11000 (0.618 fib extension)

Will update the TPs if momentum changes

XX

not advise

BTC, ETH CME Gaps Could Fill Before Bullish Continuation!Ethereum CME futures currently show a visible gap around $4,100 . Price is approaching this level, and based on historical behavior, CME gaps often act as magnets, drawing price in to fill them before a continuation in trend.

Bitcoin CME futures also have a gap sitting near $117,400. The recent rally has brought BTC close to this zone, increasing the probability of a short-term retracement to fill the gap before any significant breakout attempts.

Both gaps are key areas to watch, as a clean fill followed by strong buying pressure could set the stage for the next bullish wave in BTC and ETH.

Cheers

Hexa

3 possible ETH level for a bounce. I am currently long on ETH from $4200.

These are the 3 level I'm looking for a bounce.

I rather long a sweep of the lows at $4500.

If ETH loses this volume profile I will be simply looking at the next volume profile IMO. Im bullish on eth IMO I don't think it will pull back to hard.

Nasdaq Hits New All Time HighThe big news of the session today was the CPI report, which rose by a less than expected amount in July. Initially, equity markets jumped off of the report and were able to close the day higher after some back and forth price action. THe Russell was the leader which traded up near 3% on the day while the S&P and Nasdaq traded to their all time high prices. While the Nasdaq was at an all time high, the Russell is looking to cross a critical level that traders have not seen since February of this year.

Outside of the equities, the significant jump in the Crypto markets continued today which was led by Ether futures and Solana futures which both traded up about 8% on the day. Ether futures have been on an incredible stretch to the upside and have now reached a level not seen since December of 2021, showing strong continued momentum. Bitcoin has also continued to slowly climb higher and will be looking to re-test its all time high price which is right near $123,615.

If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

*CME Group futures are not suitable for all investors and involve the risk of loss. Copyright © 2023 CME Group Inc.

**All examples in this report are hypothetical interpretations of situations and are used for explanation purposes only. The views in this report reflect solely those of the author and not necessarily those of CME Group or its affiliated institutions. This report and the information herein should not be considered investment advice or the results of actual market experience.

Quantum Solutions BTC Rises Amid Yen Weakness Strategic BITDPSAs Japan’s yen continues to slide against the U.S. dollar, Quantum Solutions, a Japanese technology firm, is doubling down on Bitcoin exposure — a move that reflects a broader trend among Asian firms seeking digital assets as a hedge. For companies like BITDPS, these market shifts present a unique opportunity to profit from both macro and crypto volatility.

Yen Weakness and Bitcoin Exposure

The Japanese yen has depreciated over 10% year-to-date, hitting multi-decade lows. With the Bank of Japan maintaining ultra-low interest rates while the U.S. continues its hawkish stance, the yen’s weakness seems far from over.

Quantum Solutions' decision to increase its Bitcoin holdings reflects:

Hedging against currency devaluation

Diversification of balance sheet assets

Speculative positioning on crypto upside

Their latest filings show millions allocated to Bitcoin, signaling increasing institutional acceptance of crypto in Japan — a market historically cautious about digital assets.

Why It Matters for Global Markets

Quantum Solutions is not alone. Across Asia, especially in inflation-sensitive economies, corporations are reassessing fiat stability and exploring crypto for capital preservation and yield.

This emerging demand can push Bitcoin’s price upward in regional cycles, increase demand for crypto infrastructure, and elevate trading volume — all creating an environment ripe for arbitrage, hedging, and structured crypto-financial products.

How BITDPS Capitalizes on This Trend

BITDPS is uniquely positioned to profit from macro-driven crypto moves thanks to its:

Cross-border trading infrastructure — enabling arbitrage between Asian and Western exchanges

Currency-volatility hedging systems — profiting from forex-crypto interdependencies

Dynamic algorithmic trading models — adjusting exposure as macro signals shift

As institutional players like Quantum Solutions increase their Bitcoin holdings, price reactions across spot, futures, and derivatives markets become predictable and exploitable — with the right tools.

At BITDPS, we monitor macro shifts like yen devaluation in real-time, plug that data into our crypto-trading systems, and execute precision trades that extract value from currency-crypto correlations. We profit when price inefficiencies appear — regardless of direction.

Conclusion

The growing institutional Bitcoin interest in Japan, driven by yen weakness, marks a new era of macro-crypto integration. For Quantum Solutions, it’s a hedge. For BITDPS, it’s a profit machine. As volatility persists, we stand ready — using smart AI systems and global liquidity access — to turn every macro ripple into actionable alpha.

MEV Bot Exploit by MIT-Educated Brothers Leads to $25M CryptoIn the dynamic world of crypto trading, where cutting-edge innovation meets finance, abuses are inevitable. One of the most prominent cases of the year involves brothers Anton and James Peraire-Bueno, MIT graduates accused of exploiting Maximal Extractable Value (MEV) strategies to siphon off $25 million from the Ethereum ecosystem within seconds. The case may set a precedent for how automated behavior in decentralized systems is judged under traditional legal frameworks.

What Happened?

According to the prosecution, the brothers deployed several Ethereum validators and used specialized algorithms to reorder transactions within blocks. This allowed them to front-run other MEV bots and redirect transaction flows in their favor—a textbook mempool attack. In just 12 seconds, they allegedly drained $25 million in ETH and other digital assets.

Why Is This Case Unique?

First major MEV case involving such significant financial losses

Criminal charges despite actions operating within protocol rules

Academic background of the defendants adds to the public intrigue

This case raises a key legal question: Can actions that are technically “legal” under protocol rules still constitute fraud if they are knowingly harmful to other participants?

Implications for the Crypto Industry

The trial could redefine ethical and legal standards in the DeFi and automated trading sectors. If convicted, this could trigger a broader review of front-running bots, sandwich attacks, and other MEV strategies that, until now, have existed in a legal gray area.

As the regulatory landscape evolves, this trial may become a cornerstone in shaping how future MEV tactics are governed—and how automated trading fits into the legal definition of financial manipulation.

Pi Network Faces Scrutiny as Market Cap Hits $3.4BPi Network, the mobile-first crypto project that attracted millions of users with its "mine-on-your-phone" concept, is facing growing scrutiny as its market capitalization has surged to $3.4 billion, despite lingering concerns over its actual utility and use cases. As hype continues to propel its valuation, the community and broader crypto market are demanding answers: What can Pi really do?

Background and Growth

Launched in 2019 by a team of Stanford graduates, Pi Network aimed to democratize cryptocurrency mining by enabling users to earn tokens on their smartphones without expensive hardware. Through aggressive referral-based marketing and a user-friendly interface, it reportedly attracted over 50 million users globally.

However, after years in beta and a still-limited mainnet release, the Pi token is not yet fully tradable on major exchanges, and its price remains speculative. Despite that, Pi's market cap is estimated at $3.4 billion based on limited OTC (over-the-counter) trading and projected supply metrics.

Utility Concerns Intensify

With a large user base and growing token valuation, the pressure is on for Pi Network to deliver tangible value. Key concerns include:

Lack of utility – Most users cannot use Pi to pay for goods or services in real-world scenarios.

No open mainnet – While a “closed mainnet” has launched, the network still lacks full public blockchain access, hampering transparency and developer participation.

Centralization – Pi’s governance and decision-making remain opaque, raising questions about decentralization and long-term sustainability.

No listings on major exchanges – Without real-time market discovery, token valuation remains speculative and potentially misleading.

Community Reaction

Many early adopters continue to support Pi, viewing it as a long-term project that needs time to mature. Some local communities even organize Pi-based bartering systems. However, critics argue that without real-world use cases, Pi remains a glorified points system rather than a functional cryptocurrency.

The disconnect between market cap and utility has fueled concerns of a speculative bubble. In fact, some compare Pi to past projects like BitConnect, which promised much but delivered little.

The Road Ahead

To maintain its momentum and justify its valuation, Pi Network must:

Open its mainnet to public interaction and developer contributions.

Secure listings on reputable exchanges to enable transparent price discovery.

Establish real-world utility, such as integration with e-commerce, payments, or DeFi applications.

Improve transparency around tokenomics, governance, and long-term roadmap.

Failure to address these areas could result in an erosion of community trust and capital flight to more proven projects.

Conclusion

Pi Network’s $3.4 billion market cap is both impressive and problematic. It highlights the power of community-driven growth but also underscores the risks of hype-driven valuations. As the crypto market matures, utility—not just marketing—is what will determine long-term success. For Pi, the clock is ticking to move from potential to performance.

ETH Risk 15% Correction After Fall Below $2,000 What’s Next?Ethereum (ETH), the second-largest cryptocurrency by market cap, has recently fallen below the key $2,000 support level, both technically and psychologically important. This move has fueled bearish sentiment and triggered forecasts of a possible further decline to the $1,700 zone—representing a potential 15% correction from current levels.

Technical Overview

Following the breakdown of the $2,000 support, Ethereum has come under increasing selling pressure. Several technical indicators are pointing toward further downside:

RSI (Relative Strength Index) has dipped into oversold territory, reflecting strong bearish momentum.

MACD has turned negative, suggesting further downward movement.

The 50-day and 200-day moving averages are approaching a potential death cross, which may confirm a medium-term bearish trend.

Fundamental Headwinds

Declining network activity – Transaction volume, DeFi engagement, and NFT usage on Ethereum are all decreasing, affecting demand for ETH.

Increased liquidity from staking withdrawals – Recent protocol upgrades have led to a rise in ETH available for sale.

Rising competition from L2 and alternative chains (e.g., Solana, Avalanche) – This is drawing capital and attention away from Ethereum.

Where Is the Next Support?

Key support zones lie near $1,850 and then at $1,700. If these levels fail, ETH could potentially drop to the March lows around $1,500. That said, such a move would likely require a major macroeconomic shock or a significant negative crypto-specific event.

Is a Reversal Possible?

Despite the bearish signals, ETH still holds strong long-term fundamentals as one of the most widely used blockchain platforms. Potential catalysts for a recovery include:

Renewed interest in staking and on-chain activity.

Positive news regarding spot or futures-based ETH ETFs.

Rising developer and institutional engagement, especially around innovations like EigenLayer and L2 adoption.

Conclusion

Ethereum’s breakdown below $2,000 puts it in a technically vulnerable position, with the possibility of further short-term downside. While bearish momentum dominates for now, ETH remains a core asset in the crypto space. Investors should brace for more volatility but also stay alert for signs of recovery as the broader ecosystem continues to evolve.

XRP Whales Move $759 Million in Tokens Paribas Group AnalysisAn extraordinary on-chain event has captured traders' attention: wallets holding significant XRP balances—commonly referred to as “whales”—have transferred a total of $759 million worth of XRP in recent blocks. Paribas Group investigates the motives, potential market impact, and strategic context behind this movement.

Transaction Breakdown

According to ledger analytics, multiple transfers in excess of 100 million XRP per transaction occurred across different days. Some tokens were moved to self-hosted wallets, others to lesser-known exchanges. Only a small portion appears earmarked for active trading.

Potential Whale Objectives

Custodial reshuffling: Whales may be migrating tokens between private addresses or custodial services to streamline portfolio structure, not necessarily to sell.

Institutional repositioning: Redistribution to regulated entities could indicate upcoming trading or staking activity.

Whale accumulation or profit taking: Transfers to exchanges may signal an intention to sell, while self-transfers could denote accumulation.

Market Context

XRP has remained range-bound amid fluctuating sentiment surrounding Ripple’s legal settlement and anticipated widespread bank adoption. The recent whale movements coincide with rumors of banking clients integrating XRP into payment rails, indicating whales could be preemptively positioning for institutional demand.

Paribas Trading Insight

Track exchange shifts: Continuous tracking of XRP inflows into centralized exchanges may signal imminent sell pressure.

Observe liquidity depth: After such large transfers, watch out for spread tightening and order book fluctuations.

Strategic entries and exits: Paribas encourages deploying limit orders at key support/resistance levels to benefit from short-term volatility triggered by whale activity.

Conclusion

The $759 million XRP whale transfer is potentially strategic repositioning ahead of an anticipated institutional adoption news cycle. Paribas Group awaits further exchange activity for confirmation. In the interim, prudent investors are advised to monitor wallet behavior, scale positions based on liquidity dynamics, and remain alert to sudden shifts in XRP market structure.

Building a Future for RWAs and Multichain DeFi: A Strategic OutlThe intersection of real-world assets (RWAs) and decentralized finance (DeFi) has become one of the most transformative trends in the blockchain space. As traditional financial institutions explore blockchain integration, and DeFi continues to mature, tokenized RWAs—like real estate, bonds, and commodities—are poised to redefine the global financial landscape. Combined with multichain interoperability, this evolution promises greater efficiency, transparency, and accessibility.

The Rise of Real-World Assets on Blockchain

Tokenization is the process of converting rights to an asset into a digital token on a blockchain. For RWAs, this means that tangible assets—such as property, equities, or art—can be fractionalized and traded globally in real-time. This unlocks liquidity in previously illiquid markets, enables 24/7 trading, and reduces administrative overhead.

Use cases are rapidly emerging: real estate funds issuing tokenized shares; commodities like gold being represented on-chain; and even government bonds available on DeFi platforms. These developments democratize access to assets once limited to high-net-worth individuals and institutions.

However, integrating RWAs into DeFi isn't just a technical feat. It requires robust legal frameworks, clear custodianship, and standardized processes for valuation and dispute resolution. Without proper infrastructure, tokenized RWAs risk becoming speculative rather than transformative.

The Role of Multichain Ecosystems

No single blockchain can accommodate the entire spectrum of financial use cases. Multichain architecture—where assets and applications span multiple blockchains—is essential to scale RWA integration effectively.

Cross-chain interoperability enables users to leverage different blockchains for what they do best. Ethereum offers deep liquidity and composability. Algorand and Avalanche deliver scalability and low fees. Polkadot and Cosmos focus on seamless interoperability. Bridging these ecosystems creates a holistic, resilient financial infrastructure.

Protocols like Wormhole, LayerZero, and Chainlink’s CCIP are leading the charge in enabling these connections. By ensuring assets can move securely and efficiently across chains, they support a unified liquidity layer that benefits both RWA issuers and investors.

Challenges and Opportunities

Despite the promise, several hurdles remain. Regulatory compliance is fragmented across jurisdictions, making it difficult for global RWA platforms to operate consistently. Many DeFi protocols are not yet equipped to handle the complexities of asset custody, identity verification, or investor rights enforcement.

Moreover, education is a significant barrier. Institutional investors and retail users alike must understand the risks and mechanisms of DeFi to participate confidently. Projects that prioritize transparency, usability, and regulatory alignment are more likely to gain mainstream adoption.

The opportunity, however, is vast. RWAs could unlock trillions in idle capital, while multichain frameworks reduce friction in global capital markets. Combined, they offer a future where financial products are borderless, inclusive, and programmable.

Conclusion

The convergence of RWAs and multichain DeFi represents a critical shift in finance—from centralized gatekeeping to decentralized participation. It has the potential to create a more accessible and efficient global financial system. While challenges persist, technological advances and increasing institutional interest suggest that this transformation is not only possible, but inevitable. The next few years will be pivotal in shaping the architecture, governance, and standards of this emerging ecosystem.

Aave proposal tolaunch centralized lending on Kraken’s Ink movesAave’s community overwhelmingly approved a proposal to license a centralized version of its lending protocol for deployment on Kraken’s Ink blockchain.

A proposal for the decentralized finance (DeFi) lending protocol Aave to launch a centralized version of its service on the crypto exchange Kraken’s Ink blockchain has received widespread approval among the community.

An Aave request for comment (ARFC) for the deployment of a whitelabel version of Aave v3 for the Ink Foundation, the organization behind the Ink blockchain, was approved with 99.8% of the votes cast in favor.

An ARFC acts as a preliminary offchain vote before proceeding with a full decentralized autonomous organization (DAO) vote. The next phase involves drafting an Aave improvement proposal (AIP) that will be voted onchain.

The ARFC states that “by granting a license to deploy a centralized version of the Aave (AAVE) codebase, Aave can expand its technology adoption while creating new revenue streams.”

Aave had not responded to a request for comment by publication time.

Kraken unveiled its Ink blockchain in late 2024, following an October announcement. The chain aims to serve as a compliant layer-2 platform for tokenized assets and institutional DeFi.

Aave eyes institutional lending market

The proposal states that the partnership could be “an opportunity for Aave to expand its influence in the institutional lending space,” creating additional revenue streams for the protocol.

The Aave DAO would receive a share “greater than or equal to the equivalent of a Reserve Factor of 5% based on borrow volume in all pools.” The Ink Foundation also committed funds to the development of the new protocol

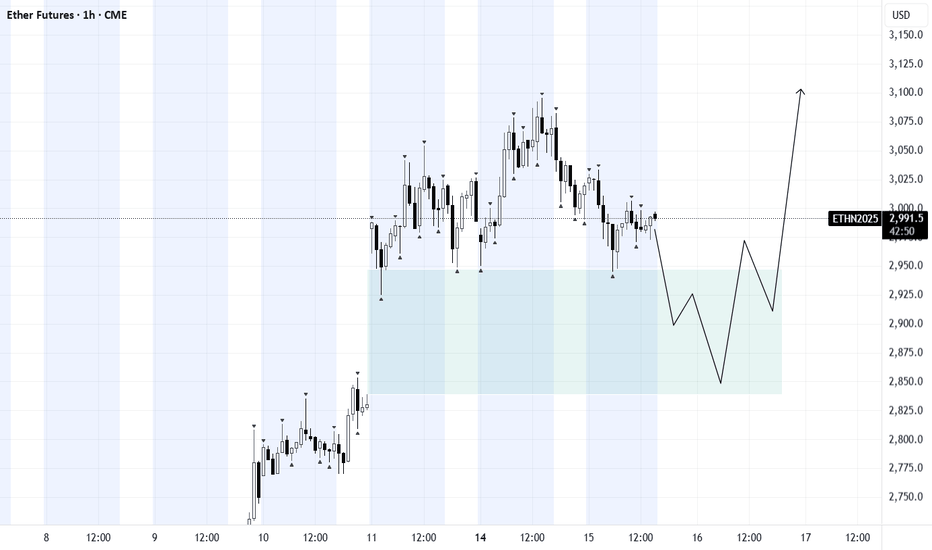

ETH/USD Breaking Higher, Can Fill The Gap? Hey traders,

Some of the altcoins are recovering very nicely today, with Ethereum being no exception. In fact, we’ve seen a pretty nice consolidation on ETH over the last three weeks, and it looks like it’s breaking to the upside right now. I wouldn’t be surprised to see more gains unfolding into wave five of a five-wave advance away from the April lows.

Targets around 3000 and even 3300 could be quite interesting, especially if we consider the big gap that dates back to February.

GH

Solana and BNB Chain Lead Blockchain Growth: Weekly HighlightsRecord Activity: 342 Million Transactions in Just 7 Days

July 2025 marks a historic milestone for the crypto industry: in a single week, public blockchains processed more than 342 million transactions — the highest figure in the history of decentralized networks. Two platforms stood out the most: Solana and BNB Chain, ranking at the top in network activity and showcasing both technological maturity and growing user demand.

Solana — The Engine of Hyperactive Web3

Solana continues to prove its reputation as one of the most high-performance blockchains. Over the past week, the network processed over 200 million transactions, accounting for more than 58% of total activity. This achievement is driven by Solana’s high throughput and ultra-low fees, making it highly attractive for mass adoption and retail developers.

One of the main growth drivers has been the surge in meme coins and simple tokens created on Solana through platforms like Pump.fun. While these assets are often speculative, they generate massive traffic — tens of millions of transactions daily from thousands of users. This in turn boosts TVL and DEX activity.

But Solana is no longer just about gamified tokens. Increasingly, serious projects in DeFi, infrastructure, and Web3 gaming are launching on the network. New NFT platforms, liquid staking services, and retail investment apps are transforming Solana into a hub for both speculators and long-term participants.

BNB Chain — Stability, Infrastructure, and Maturity

While Solana grabs attention with viral growth and hype, BNB Chain demonstrates the steady strength of a mature ecosystem. The network handled approximately 65 million transactions, securing second place in the weekly rankings. User and developer activity remains consistently high, while tools for building DApps and DeFi products continue to expand.

Recent upgrades, including faster block finality and support for new standardized smart contracts, have enhanced user experience and transaction speed. In 2025, BNB Chain is targeting throughput of up to 20,000 transactions per second, aiming for scalability on par with centralized exchanges.

BNB Chain also plays a strong role in GameFi, logistics solutions, stablecoins, and cross-chain interoperability, positioning itself as a foundation for integrating traditional business models into the crypto ecosystem.

Why This Growth Matters

This record-breaking week signals that crypto has moved far beyond speculative trading. Blockchains are becoming operational environments where millions of value-driven transactions occur daily.

The surge in activity on Solana and BNB Chain underscores a key trend: platforms that combine high traffic capacity with usability and cost efficiency are taking center stage.

Risks and Challenges

Despite the positive outlook, vulnerabilities remain:

Solana could overheat. Activity driven by meme coins is volatile — if hype fades, engagement could plummet.

BNB faces competition from Ethereum L2. Fast, low-cost L2 solutions like Arbitrum and Optimism could lure users away.

Regulatory threats. Any sanctions or restrictions, especially in the U.S., could negatively impact both networks.

Conclusion

Solana and BNB Chain represent two distinct strategies for success:

Solana: speed, scale, and viral engagement.

BNB Chain: stability, ecosystem depth, and infrastructural strength.

Their dominance during the biggest week in blockchain history proves they are among the key architects of the new digital economy. Which one will maintain leadership in the second half of the year remains to be seen — but one thing is clear: the fight for the heart of Web3 is on.

Thumzup Bets Big on XRP How $250 Million Could Be a Game-ChangerA New Crypto Strategy: Beyond Bitcoin

In 2025, one thing is clear: publicly traded companies are no longer limiting themselves to Bitcoin-only investments. A prime example is Thumzup Media Corporation, a Nasdaq-listed firm that recently approved a plan to allocate up to $250 million into crypto assets. Unlike past strategies, which were heavily BTC-focused, Thumzup is diversifying — prioritizing XRP, ETH, SOL, DOGE, USDC, and LTC. Among these, XRP stands out as one of the company’s largest bets.

Why XRP?

XRP is a token with a complex history and massive potential. Despite years of legal battles with the SEC, by 2025, XRP has solidified its position as a reliable asset for fast international transactions. Its widespread use among banks and financial institutions makes it unique compared to other altcoins.

Thumzup highlighted several reasons for putting XRP at the forefront:

High Liquidity: XRP trades on most major exchanges with significant volume.

Low Fees: The network enables quick, low-cost transfers of large sums.

Regulatory Progress: After Ripple’s partial victory over the SEC, XRP gained legal clarity in the U.S., making it far more attractive for public companies.

Adding to the momentum, XRP reached a new all-time high above $3.60 when Thumzup announced its strategic move — further boosting investor confidence.

$250 Million — The Source and the Strategy

In 2025, Thumzup’s board approved a major expansion of crypto holdings on its balance sheet. This investment is financed through a mix of free capital, new stock issuance, and partial bonds. The goal is not just to build an investment portfolio but to create an infrastructure-like crypto fund, similar to MicroStrategy’s approach — but with a broader basket of assets.

The company’s ambition goes beyond simply holding assets for price appreciation. Thumzup plans to integrate cryptocurrency into its advertising platform, where users get paid for posting content. XRP and other assets could serve as internal payment tools within this ecosystem.

Media Impact and Brand Boost

The move sparked massive media attention and market buzz. The excitement grew further when Donald Trump Jr. acquired company shares and joined as an advisor, creating a PR storm. As a result, Thumzup’s stock surged over 80% in a single month.

Such attention from political figures and traditional investors reinforces the notion that XRP — and other crypto assets — are evolving from “digital assets” to integral components of operational business models.

Risks to Consider

High Volatility: Significant crypto exposure could harm the company’s balance sheet in a bear market.

Regulatory Shifts: Despite progress, Ripple’s legal situation isn’t fully resolved.

Reputation Risk: Failure in crypto ventures could damage shareholder confidence.

Bottom Line

Thumzup Media has taken a bold step, positioning cryptocurrency — especially XRP — as a strategic growth tool rather than just a hedge. This move signals a paradigm shift: from “Bitcoin as a reserve” to multi-token integration into business models. If successful, this strategy could encourage other public companies to follow suit, marking the dawn of multi-asset corporate crypto treasuries.

SEI vs Ethereum: Why Investors Are Betting on Accelerated GrowthBlockchain Market Enters a Phase of Differentiation

Following the overall recovery of the crypto market in Q2 2025, certain Layer 1 projects are attracting increased attention. One such emerging player suddenly in the spotlight is the SEI blockchain, which positions itself as a high-performance solution for trading, DeFi, and Web3 applications. While Ethereum continues to struggle with scalability issues and competition from its own Layer 2 solutions, SEI bulls claim:

“This is the project that can outpace ETH in growth rate as early as Q3.”

What Makes SEI Technologically Different?

Investor optimism around SEI is rooted not just in marketing, but in specific technological advantages. Unlike Ethereum, which prioritizes maximum decentralization even at the expense of speed, SEI leverages a parallelized transaction processing engine, achieving finality in under 500ms. This not only accelerates transaction processing but also scales the performance of order books and marketplaces.

Additionally, SEI has implemented an order-based DEX model, bringing decentralized exchanges closer to the user experience of centralized platforms like Binance. This is a key differentiator: unlike Ethereum, which requires additional protocols to implement limit orders, SEI has them built into its architecture.

Ecosystem and Activity

Since the beginning of the year, more than 80 applications have launched on SEI, ranging from NFT marketplaces to derivatives platforms. According to DeFiLlama, TVL (total value locked) has surpassed $1.2 billion, more than 5x its level at the start of the year. Major exchanges like Binance, KuCoin, and Bybit have confirmed support for the blockchain, while the project team actively expands into Asia and Latin America.

Investor Dynamics and Price Expectations

SEI entered Q3 2025 trading around $0.34, and analysts see growth potential up to $0.70–$0.80 if the positive trend continues. This represents over 100% upside from current levels, whereas Ethereum, according to most forecasts, is expected to post only 15–20% gains during the same period.

Some institutional reports already classify SEI as a high-growth potential asset, alongside Solana and Aptos. This signals a possible market shift in the coming months.

Risks: Realism Over Hype

However, key risks remain:

Competition from Ethereum L2: Solutions like Arbitrum and Base deliver high speed while maintaining ETH compatibility.

Hype Cyclicality: Surges in interest for new Layer 1s can be short-lived.

Dependence on DeFi: SEI is currently attractive for developers and traders but still lacks everyday applications.

Conclusion

SEI indeed has technological advantages that enable rapid scaling. Its architecture makes it especially promising in the context of growing DEX and Web3 adoption. While Ethereum remains the leader in terms of infrastructure and trust, SEI could outpace ETH in growth rate during Q3 2025, particularly if it sustains its expansion and avoids technical or market setbacks.

Ethereum Approaches $2,908 as Bullish Momentum FadesEthereum remains bullish, trading near $2,796 and approaching monthly resistance at $2,908. Stochastic shows an overbought reading of 81.0, suggesting short-term buying exhaustion.

Bearish Scenario : A pullback toward $2,651 is likely if $2,908 holds. Extended selling pressure could lead to a test of the anchored VWAP near $2,500.

Bullish scenario : A confirmed breakout above $2,908 would likely extend the rally toward $3,260.