NOKIA Nokia and Nvidia have recently announced a strategic partnership centered on pioneering AI-powered telecommunications networks, particularly targeting the transition from 5G to 6G. Key points of the collaboration include:

Nvidia’s $1 billion investment in Nokia, acquiring a 2.9% stake at roughly $6.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.164 EUR

1.25 B EUR

19.22 B EUR

5.03 B

About Nokia Oyj

Sector

Industry

CEO

Justin Hotard

Website

Headquarters

Espoo

Founded

1865

ISIN

FI0009000681

FIGI

BBG000R2GP02

Nokia Oyj engages in the provision of network infrastructure, technology, and software services. It operates through the following segments: Mobile Networks, Network Infrastructure, Cloud and Network Services, and Nokia Technologies. The Mobile Networks segment offers technologies for Radio Access Networks (RAN) as well as Microwave Radio Links (MWR) for transport networks. The Network Infrastructure serves communication service providers, enterprises, webscales and public sector customers. The Cloud and Network Services segment builds around software and the cloud and is focused on driving leadership in cloud-native software and as-a-service delivery models, as demand for critical networks accelerates; and with strong market positions in communications software, private wireless networks, and cognitive (or intelligent) services. The Nokia Technologies segment, building on decades of innovation and R&D leadership in technologies used in virtually all mobile devices used today, is expanding the Nokia patent licensing business, reintroducing the Nokia brand to smartphones through brand licensing, and establishing a technology licensing business. The company was founded by Fredrik Idestam in 1865 and is headquartered in Espoo, Finland.

Related stocks

NOKIA - Long-Term"Long" Term does not imply "going Long" mind you .. just means .. eh .. like much time ..

Made a nice "Fib", they seem to be important to 'Traders' and 'Anal-ysts®' (not to me, sorry),

I just draw that humbug in here because all my other IDEA's usually have pretty empty charts (see some lines fur

NOK Nokia Options Ahead of EarningsAnalyzing the options chain and the chart patterns of NOK Nokia prior to the earnings report this week,

I would consider purchasing the 5.50usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $0.34.

If these options prove to be profitable prior to the earning

Nokia ($NOK): The Most Underestimated Comeback Story in Tech Inf6G Leadership & Strategic Relevance

Nokia is already positioning itself as a major player in 6G development, with research partnerships across the EU, U.S., and Japan.

2 Strong Core Business

Despite macro headwinds, Nokia’s Network Infrastructure and Cloud & Network Services divisions continue to g

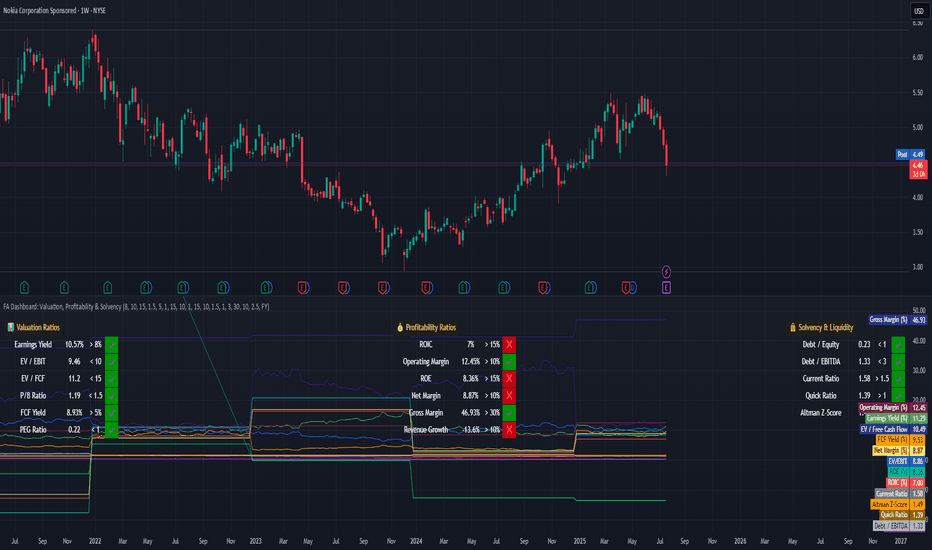

How to Evaluate Companies with a Fundamental Dashboard**Tutorial: How to Evaluate Companies with a Fundamental Dashboard (Example: Nokia)**

This tutorial explains how to use a custom-built dashboard in TradingView to evaluate companies based on key financial dimensions: **Valuation**, **Profitability**, and **Solvency & Liquidity**.

---

🛠 **How to U

Nokia:Inverted Head and Shoulders Structure + Retest of BreakoutOn the weekly chart of Nokia, a classic Inverted Head and Shoulders reversal pattern has formed. The breakout above the neckline occurred with increased volume, confirming the strength of the move. Currently, the price is undergoing a standard technical retest of the neckline from above — a typical

Halftime Update: NOK - Nokia CorporationNokia brought out of it's current channel, tapping $5.14 before pulling back which we expect it to come back to the $4.53 for another potential entry before it's stronger continuation to the upside within this channel, ultimately heading back to the $6.50 Price Levels.

FINANCIAL NEWS:

Nokia Oyj (NY

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

L

NOK3697111

Lucent Technologies Inc. 6.45% 15-MAR-2029Yield to maturity

5.72%

Maturity date

Mar 15, 2029

See all 0HAF bonds

SLG_OMXH25

Seligson & Co OMX Helsinki 25 Exchange Traded Fund UnitsWeight

9.86%

Market value

68.87 M

USD

MIVB

Amundi MSCI Europe SRI Climate Paris Aligned UCITS ETF DR C CapitalisationWeight

2.45%

Market value

58.82 M

USD

ACU7

Amundi MSCI Europe SRI Climate Paris Aligned UCITS ETF DR (D)Weight

2.45%

Market value

58.82 M

USD

Explore more ETFs

Curated watchlists where 0HAF is featured.

Frequently Asked Questions

The current price of 0HAF is 5.886 EUR — it has decreased by −0.70% in the past 24 hours. Watch Nokia Oyj stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSIN exchange Nokia Oyj stocks are traded under the ticker 0HAF.

0HAF stock has fallen by −2.75% compared to the previous week, the month change is a 36.69% rise, over the last year Nokia Oyj has showed a 38.04% increase.

We've gathered analysts' opinions on Nokia Oyj future price: according to them, 0HAF price has a max estimate of 7.31 EUR and a min estimate of 3.30 EUR. Watch 0HAF chart and read a more detailed Nokia Oyj stock forecast: see what analysts think of Nokia Oyj and suggest that you do with its stocks.

0HAF reached its all-time high on Jun 13, 2022 with the price of 4,455.000 EUR, and its all-time low was 1.000 EUR and was reached on Sep 21, 2018. View more price dynamics on 0HAF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0HAF stock is 2.36% volatile and has beta coefficient of 0.96. Track Nokia Oyj stock price on the chart and check out the list of the most volatile stocks — is Nokia Oyj there?

Today Nokia Oyj has the market capitalization of 32.90 B, it has increased by 1.53% over the last week.

Yes, you can track Nokia Oyj financials in yearly and quarterly reports right on TradingView.

Nokia Oyj is going to release the next earnings report on Jan 29, 2026. Keep track of upcoming events with our Earnings Calendar.

0HAF earnings for the last quarter are 0.06 EUR per share, whereas the estimation was 0.05 EUR resulting in a 22.36% surprise. The estimated earnings for the next quarter are 0.15 EUR per share. See more details about Nokia Oyj earnings.

Nokia Oyj revenue for the last quarter amounts to 4.83 B EUR, despite the estimated figure of 4.64 B EUR. In the next quarter, revenue is expected to reach 6.11 B EUR.

0HAF net income for the last quarter is 78.00 M EUR, while the quarter before that showed 77.00 M EUR of net income which accounts for 1.30% change. Track more Nokia Oyj financial stats to get the full picture.

Yes, 0HAF dividends are paid quarterly. The last dividend per share was 0.03 EUR. As of today, Dividend Yield (TTM)% is 2.35%. Tracking Nokia Oyj dividends might help you take more informed decisions.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Nokia Oyj EBITDA is 2.72 B EUR, and current EBITDA margin is 17.73%. See more stats in Nokia Oyj financial statements.

Like other stocks, 0HAF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Nokia Oyj stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Nokia Oyj technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Nokia Oyj stock shows the strong buy signal. See more of Nokia Oyj technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.