LTCBTC Monthly – Multi-Year Downtrend Nearing Exhaustion?RSI Structure Suggests a Major Reversal Brewing

Timeframe: 1M (Monthly)

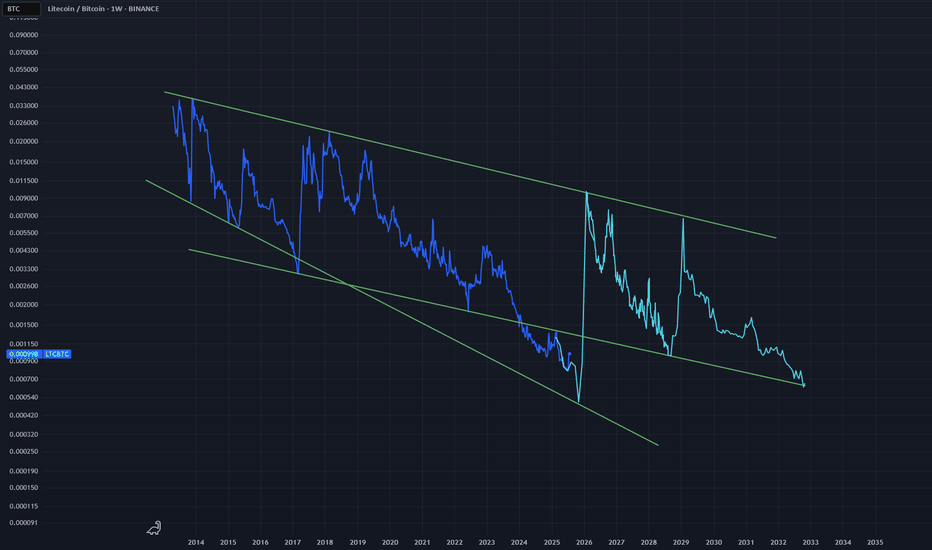

LTCBTC has spent almost a decade grinding lower inside a clearly defined multi-channel descending structure. Every major rally has formed a lower high, respecting long-term trendlines dating back to 2014–2015.

Price is now compressing at the bottom of the macro falling wedge/channel, with volatility at historic lows and volume drying up—a structure that often precedes a major trend change.

📐 Price Structure

1. Macro Downtrend Channels

Red support line marks the absolute long-term floor, tested several times since 2023–2025.

Price is currently sitting right on that red long-term support, with early signs of demand returning.

2. Volume Profile

Volume has been steadily decreasing for years.

This type of volatility + volume contraction at major support has historically preceded large expansions (both bullish or bearish, but combined with RSI, the bullish case is stronger).

📊 RSI Momentum Analysis

This is the strongest part of the chart.

1. Long-Term RSI Downtrend (Orange)

RSI has been respecting a 10-year descending trendline, creating lower highs since 2017.

Price is approaching this trendline again from below.

A monthly breakout above this RSI resistance would be the first macro bullish confirmation in nearly a decade.

2. RSI Higher Lows (Red)

Despite price making flat or lower lows, RSI is making higher lows, creating:

A long-term bullish divergence

A tightening momentum structure, signaling diminishing seller strength

This is the exact structure seen before previous LTCBTC macro reversals.

📈 Bullish Case

If LTCBTC holds the red support and RSI continues upward:

Key bullish triggers:

🔵 Monthly RSI breakout above the orange resistance line

🟢 Monthly close above the orange descending price channel

🟩 Volume expansion returning after multi-year compression

Targets on breakout (from conservative to aggressive):

0.0022 (bottom of mid-green channel)

0.0040 (mid of macro channel)

0.0060–0.0080 (top of the long-term green channel)

📉 Bearish Case

If LTCBTC loses the red macro support:

Structure invalidation

Retest of historical lows

Continuation of multi-year bleed

This would require RSI also rejecting at the orange line and rolling over.

📌 Conclusion

LTCBTC is sitting on a once-per-cycle support zone while RSI prints a multi-year bullish divergence and approaches a key breakout trendline.

This is one of the most interesting long-term setups on the chart in 2025.

Price compression + RSI compression + long-term support often leads to explosive moves.

Not financial advice — just a chart-based idea.

Trade ideas

Is Litecoin finally ready to pop for real this time? 1600% gainAs many of you have been, I'm watching crypto prices closely since the BTC jump to $123k, waiting for the next move. Well, today we see that move and the entire market is blood red, except for...

Litecoin.

The patiently waiting little brother of the "big 3", waiting for his time to grow up and shine. Well today I'm impressed, mr. Litecoin is the only green coin in my entire Watchlist.

Zooming in on the chart: there’s a clean, rounded cup and a crisp handle forming, and that handle looks like it’s already breaking out. If Bitcoin can hold the $112K level, I think this could be the start of some serious moves from LTC.

The perfect bull flag that's formed on the chart has good volume too.

That blue line coming down is a long term trendline, and price is consolidating above it.

Still thinking about that "1600%"?

If you zoom out, there's a massive descending wedge forming since 2014 (11 years!!!). If Litecoin finally breaks out of it, the first fib level (.236) is at .01275BTC, that's 1600% up from here.

We'll see.

LTCBTC Secular Low launching into the Golden Ratio.One of the biggest sleepers in the cryptoverse. Watch it launch into the Golden Ratio as BTC calms down into the 161.8 grand mark.

Not too sure where the bottom is for LTCBTC, but who cares? The final trajectory here looks to be around 0.01, which puts LTCUSD around $1618 per piece.

This is in fact the silver bullet that will kill the upcoming altseason - be forewarned.

Litecoin vs Bitcoin —The Institutional Wave? Consider the ETFsStarting November 2022 LTCBTC (Litecoin vs Bitcoin) went on a major downtrend, until November 2024. After November 2024 this downtrend is no more.

There was a bounce late last year and this event changed the chart. The latest low last month, June 2025, ended up as a technical double-bottom. Less than 5% below the November 2024 low and this low happened after 217 days. This means that in seven months sellers became exhausted and they couldn't produce a new major low. This reveals that the bearish trend is over. Once the downtrend ends, we get a change of trend, a change of trend implies an uptrend, an uptrend implies long-term growth. We are looking at a long-term bottom and... From the bottom we grow.

This is not an opportunity that presents itself often. The BTC trading pairs are hard to trade. These are for experts only. A new opportunity is developing that can lead to exponential growth. It is amazing how this section of the market works. LTCBTC will grow as Bitcoin and the rest of the market grows. This tends to produce a multiplier effect that is hard to explain. You will understand when you see it in action.

LTCBTC is hitting bottom. The bottom is already established, several weeks old. The candles low is flat, we can expect massive growth; excitement and institutional adoption on Litecoin thanks to the ETFs, it will be the first time this pair grows in years and the type of chart it will produce it is hard to tell.

We are entering uncharted territory. The bullish phase can be mild just as it can be ultra-strong. There is no limit to the upside. It can grow for years or for 4 to 8 months. Both scenarios look good.

The best part is to catch the bottom; an early wave. Prices are low now, easy to buy and hold. Focus on the long-term.

Litecoin has good potential for this incoming 2025 bull market.

Thank you for reading.

Namaste.

The LTC Bullish case to $10k and why it can happen this Bull RunEveryone is ignoring LTC, Digital Silver.

If we are to look at the network hash for Litecoin and where it was during the previous seasons peak, Jan 2018 and May 2021, we can see the network has was at 100TH and ~210TH in 2021..

We are currently at 2.3 - 2.5 PH, that is 12-25x previous values during the Price top in the last 2 bull runs.

Looking at the NVM (Network Value Model) for Litecoin, we can notice the network has constantly grown while the price is now pretty much unchanged and at the same level as 4 or 7 years ago.

Lastly if we are to look at the BTCLTC and LTCBTC chart, both are displaying a clear picture, it's Litecoin's time to shine and show why it is called Digital Silver and Bitcoin Digital Gold..

Litecoin is valued at 0.1 of BTC based on previous charts and ATH, that easily puts Litecoin at the 5 digits range, tehnically Litecoin can surge to 430 - 700x, time will tell if we go to $20-30k or more, it also depends where Bitcoin will meet it's peak this run. Will it be $150-190k or $250-490k??

This will dicated Alts top and of course Litecoins too.

Let's not forget that ETH was $70-90 in 2017-2018, it did not stop it going to EUROTLX:4K and it will not stop it from moving now into 5 digits, Litecoin can and will do the same.

It's a solid network, there are a ton of miners, tehnically it's in a 5 year Triangle and breaking out, we are going to see ETF listings for LTC soon, news will start to pile and retail will want to buy the cheaper Bitcoin, the one with real and actual Payment Utility!

Let's see where we are in 3 months and end of this Year.

I am predicting we teleport to $300-500 sooner rather than later!

LTC Trendline bounceI haven't held my favorite coin in awhile, glad to finally be able to buy some. I know BTC is going to go back to at least GETTEX:87K sometime soon, and if LTC is gonna do better than btc it looks like a safe buy to me. Not sure how high it'll go but we'll see, hope it pumps before ETH reaches my buy zone

Litecoin Could Triple Against Bitcoin (LTC/BTC)As much as crypto annoys me these days, I can't help but still pay attention to this wild market.

There are some red flags - a lot of uncertainty and major paradigm shifts apparently looming on the horizon. Bitcoin has really slowed down, when it comes to price increases and volatility. It's also now associated with political polarization, as it has been predictably co-opted by wealthy interests, aimed at centralizing financial control and surveillance. Nevertheless, cryptocurrencies chug along.

I'll admit, I've always liked Litecoin. Maybe it's because it was the first cryptocurrency I bought where I realized, hey, Bitcoin isn't the best at what it's supposed to do. It was a lot faster and cheaper, and remains a preferred medium of exchange for crypto transfers. This is evidenced by its growing number of active addresses, when compared with Bitcoin's stagnation.

bitinfocharts.com

bitinfocharts.com

Bitcoin's growth has stagnated, when it comes to its use as a transfer of value, whereas Litecoin continues to grow slowly. Litecoin's active addresses are also only about 50% less when compared with Bitcoin, making its "adoption" not all too far behind.

Of course, there are probably many flaws with Litecoin, as there are with cryptocurrencies as a payment method in general, but when you look at the current crypto market cap and how much Litecoin is actually used, it seems to be undervalued when compared to all the other fluff out there.

It just works. Its max supply is also only 4x that of Bitcoin. It's unlikely to ever achieve a market cap similar, but even if it it goes 4x from here in USD terms (taking it just above its past ATH), its market cap would be the same as Dogecoin, around $37B. That's honestly pretty funny to me.

The only thing I like about crypto is that it's marginally better than a lotto ticket. Maybe if things get even more dystopian, owning some crypto isn't a terrible idea. Things are absurd as it is. I don't like it, but that's how things have been going.

For some quick technicals. Litecoin is on its strongest tear against ETH since 2018:

Litecoin also broke down from a major uptrend against the USD a while ago, but if it gets back in (currently above $170ish), it could fuel a pretty explosive rally.

Based on the above LTC/BTC chart, there is room for a pretty large upside correction.

HOWEVER, it's important to keep in mind that markets are fragile overall right now. If Bitcoin makes a sizeable correction, back down to $70-80k or deeper, Litecoin may drop down to some lows not seen in some time. It's also important to remember that serious upside for Litecoin has previously occurred near market tops.

This is not meant as financial advice! This represents my opinion and feelings about the markets, which are always evolving.

-Victor Cobra

LTC is gearing up for a massive 250% surge! Hello Traders 🐺

In this idea, I want to introduce a promising coin that has the potential to deliver massive gains—at least a 250% pump in the upcoming altcoin season!

This is a long-term perspective, so make sure to consider this chart as a mid to long-term hold for maximum gains!

🐺 Stay sharp, trade smart! – KIU_COIN 🐺

Ltcbtc maybe chickens can fly?This has taken longer than I ever thought to develop but... It's the pure catch-up play for the masses who want sound money and missed the BTC run. Fairly launched, not constrained by the politics of BTC Devs, it has integrated privacy for those who want it. On ramps are well developed across the industry. It'll get an etf. Could go to range high as an occasional oscillator vs..btc or could break out of the existing long term range like doge did last cycle. Ltcusdt birthed doge and it's merge mined together so there's more than meets the eye between them. Head and shoulders reversal playing out vs. Eth possibly? Time as always will tell.

LITECOIN BITCOIN (BEST-CASE)Like Bitcoin, CRYPTOCAP:LTC is first and foremost a digital currency that can be exchanged peer-to-peer, untrusted and securely, very quickly and at minimal cost.

The modifications made to the Bitcoin blockchain to give rise to Litecoin’s blockchain required only minor efforts in terms of IT development, as most of the innovation came from Bitcoin.

Nevertheless, Litecoin’s strength lies in the fact that these changes are few but significant:

A ”proof of work” that uses the Scrypt hash function rather than SHA-256 for Bitcoin

Block creation four times faster, with an average interval of 2.5 minutes instead of 10 minutes

Total number of units four times greater, with 84 million instead of 21 million

Mining difficulty changes every two and a half days instead of every two weeks

On the other hand, as with Bitcoin, the issuance of new litecoins is halved every 4 years (halving): since August 2019, miners have received 12.5 litecoins as a reward for each block validated.