LTC/USD – Testing Resistance at 200-SMA📉 Bias: SHORT (facing overhead rejection)

Litecoin trades at $93.12, approaching the 200-SMA ($93.96) after a modest intraday rebound. RSI sits around 52, reflecting equilibrium after earlier volatility, but bulls are meeting resistance near $94.

If price rejects this zone, we could see a pullback toward $91.73–$91.00. A confirmed close above $94.00 would neutralize the bearish setup and open a path to $95.50.

📊 Key Levels:

Resistance: $93.96 / $94.50 / $95.80

Trade ideas

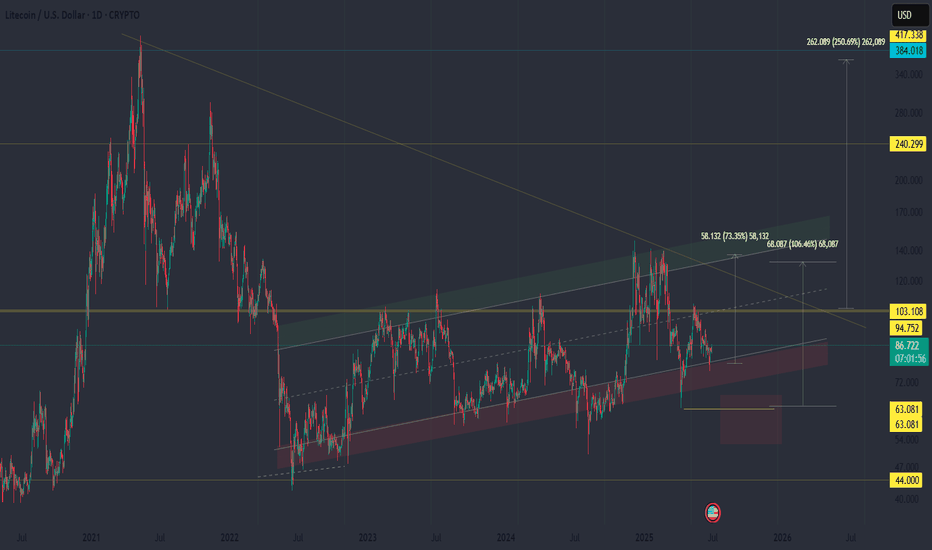

This 3,000-Day Pattern Is About to EndLitecoin has been coiling for almost 3,000 days. The same structure that built up before the 2017 run has formed again, just stretched across a longer timeline. Every fakeout, every rejection, every drop that looked like the end was really the market gathering liquidity and shaking out the weak hands.

This is the same three phase rhythm that played out last cycle.

Accumulation – long quiet ranges where people lose interest.

Expansion – that sudden vertical breakout when liquidity rotates out of Bitcoin and Ethereum.

Liquidation – the wipeout that reloads the spring before the next leg.

Litecoin tends to lag while Bitcoin and Ethereum take off, then it wakes up when everyone least expects it. That’s its pattern. The same fractal that once sent it from $4 to $400 is here again, just bigger and tighter.

If the fractal logic holds, the next expansion could reach between 15x and 25x, putting Litecoin somewhere between $1,400 and $2,300. It’s been years of pressure building in silence, and when that spring finally releases, it will be violent.

Don't forget your roots // Litecoin // $100 to $15k //1. Structural Undervaluation Relative to Bitcoin

Litecoin is 99% code-compatible with Bitcoin, sharing its security model, capped supply (84 M), halving schedule, and UTXO architecture.

Yet it trades at <0.5% of Bitcoin’s market cap despite similar functional utility as a medium of exchange and testbed for Bitcoin upgrades (SegWit and Lightning Network were both activated first on LTC).

This asymmetry represents a valuation gap between near-identical monetary assets — one of which (LTC) is still operational, deflationary, and liquid.

2. Proven Network Longevity and Zero Downtime

In 12+ years of operation, Litecoin has maintained zero downtime, placing it among the most technically resilient blockchains ever launched.

This reliability, combined with predictable issuance and miner decentralization, supports a trust premium that is rarely priced into its market value.

3. Hard-Capped, Deflationary, and Transparent

Litecoin’s supply mechanics mirror Bitcoin’s scarcity: 84 M hard cap and quadrennial halving.

With the most recent halving (August 2023), inflation fell below 1.2%, lower than many fiat currencies — yet LTC remains priced as if it were an inflationary altcoin.

Over time, declining emission and strong liquidity across exchanges (including full regulatory clearance in the U.S.) create structural upward pressure.

4. Regulatory Cleanliness and Institutional Readiness

Unlike many altcoins, Litecoin has never been labeled a security by the SEC or any major regulator.

It is approved for U.S. institutions (e.g., Fidelity, Grayscale, EDX Markets, PayPal), offering a compliant exposure to sound money without legal baggage.

This regulatory clarity positions LTC for institutional rediscovery once risk capital rotates back into compliant proof-of-work assets post-ETF era.

5. Neglected Narrative Amid Speculative Rotations

Capital has flowed to “narrative tokens” (AI, memecoins, RWAs), leaving LTC deeply discounted versus peers in terms of network throughput, liquidity depth, and exchange presence.

As Bitcoin ETF adoption matures and investors seek cheaper BTC proxies, LTC stands out as the only decade-old, decentralized, commodity-class PoW asset with a clean track record.

6. Re-Rating Catalyst

The Litecoin ETF narrative or its inclusion in proof-of-work indexes could trigger a mean-reversion trade.

Even a modest re-pricing to 1–2% of BTC’s market cap implies a 3–6× upside from current levels without requiring speculative new narratives — just recognition of fundamental parity.

Thesis Summary

Litecoin is a pure monetary layer asset: decentralized, deflationary, regulatory-clean, and technologically aligned with Bitcoin — yet priced like a forgotten altcoin.

Its valuation dislocation is not due to weakness, but due to narrative neglect — creating one of the clearest fundamental mispricings in the digital asset market.

No Bullish Setup for Litecoin YetFenzoFx—Litecoin is trading sideways near $98.3 after Friday’s sharp selloff. The 1-hour chart shows price respect at $92.40 minor support, but declining cumulative volume delta signals weakening buyer interest.

The overall trend remains bearish, with resistance at $102.4. LTC may tap into buyside liquidity above $102.9, but failure to hold could extend the downtrend toward $85.5 and $78.6. There’s no bullish setup at the time of writing. Traders should remain cautious, as the market is volatile and prone to erratic swings. Happy trading, everyone.

LTCUSD H4 | Could We See a Bullish Reversal?Litecoin has bounced off the buy entry which is a pullback support and could rise from this level to the upside.

Buy entry is at 97.36, which i a pullback support.

Stop loss is at 90.92, which is an overlap support that aligns with the 127.2% Fibonacci extension.

Take profit is at 111.13, which is a pullback resistance that lines up with the 38.2% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

LTC/USDT — Accumulation Before Breakout?📊 Technical Overview:

Litecoin is forming a potential reversal structure near a key long-term support zone. Historically, this area acted as an accumulation range before significant upward moves.

The price is still holding within a broad ascending channel, and current consolidation may represent the final stage before a breakout.

🔻 Below lies a potential liquidity trap zone — a fakeout could occur, triggering weak hands before continuation. For us, that’s a spot to add, not to exit.

📈 Trade Plan:

-Partial entry is already possible at the current zone

-Additional entries planned if price drops lower

-No stop-loss — risk is managed strictly via position sizing

-Take-profits aligned with major resistance zones where selling pressure occurred in the past

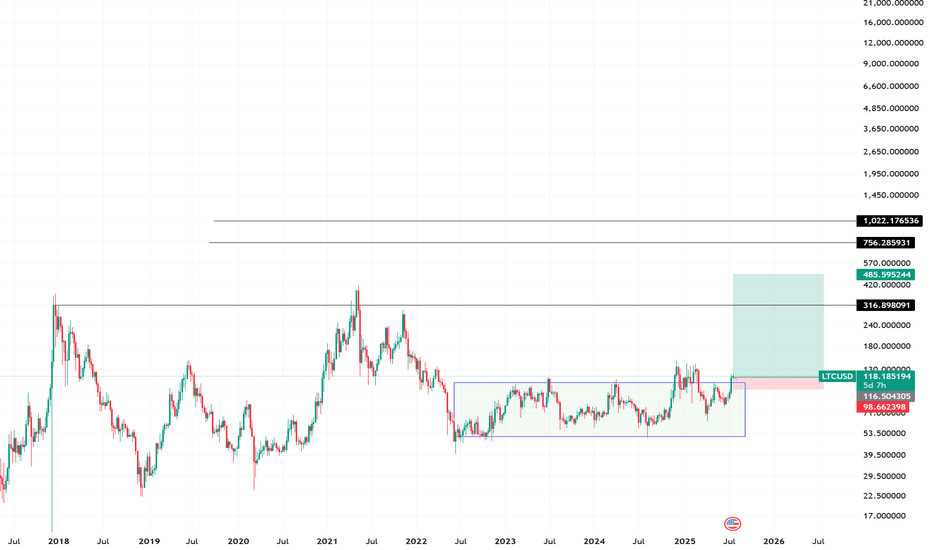

Triangle formation/ cup on the horizonNow price is below 0.236 fib level. It's in a 9 year consolidation range eventually something has to break.

Just like they always done a analogy of Tony Hawke by btc, question is - is ltcusd about to do the same and travel to the moon a bit later than btcusd and ethusd

The fib levels go into the 1000 and once btc and ethereum gain their smaller sibling will be boosted by that alone and as a use of transactional back up and use as more people will exchange cryptos especially if it stays as a payment meaning it's being slowly introduced as a form of payment or money distribution.

This pair still has to make a name for itself.

90 is a level we see as entry and support

Daily we have a large indecision candle. M and above TF has wicks only that's why I believe on the bigger timeframe it will buy but you will be adding money every month to keep the idea alive. I don't see it going to 0 or negatives because that would bring a crash to crypto which for some have moved on from when they started or made waves on percent of gains.

1000 to 10000 is reasonable like ETHUSD

. Call me crazy like a family member of the Simpsons.

Things a done deliberatly in the markets.

People never thought gold would be here but I did know it would pass 3000 eventually today we at 4000, btcusd when I traded it was at 5k

When it make that break to dip to much to the 15k-20k lvl I knew it will see 60 to 100k. So just like ETHUSD I tried entering 2500 but it kept rejecting. Today it's at 3000-4000k.

All I'm saying is when they don't believe it's a delusion conclusion but once it reaches there they start believing to late and want to jump ship like everyone else when the news broadcasts speaks like sheep being herd.

I share this for myself and the gain of the smart

LTC - Top is in, this MUSK be the ENDCharting for dummies'. The market has mostly good news, a pro US government and the FED appears doomed. Obviously all indicators were for a rug pull by greedy market makers. This is why decentralization is the only way. Has to go to ZERO AMEX:USD before that can happen.

Offline we Go

LTC: Sell Volume Is Being Absorbed, Bullish Run in FocusFenzoFx—LTC sits in the upper quadrant of the bullish fair value gap, aligned with anchored VWAP. Selling volume is rising, but price remains stable—suggesting absorption by large buyers.

Litecoin is currently at a premium, making it less ideal for new entries. We recommend monitoring the $109.3 support zone, backed by a low volume node, for a better entry.

If this level holds, LTC may rally toward $128.60 and $134.10. A break below $109.3 would invalidate the bullish outlook.

Of course. Here is a technical analysis of Litecoin (LTC): LiteOf course. Here is a technical analysis of Litecoin (LTC):

Litecoin (LTC) is currently exhibiting a cautious and range-bound technical structure, largely mirroring the broader market's indecision. The price action on the daily chart shows LTC trapped between a key support zone around $70 - $72 and a significant resistance level near $82 - $85.

The moving average configuration presents a challenge for bulls. The 50-day EMA (around $78) is acting as a dynamic resistance level, while the 200-day EMA (further below) highlights the overall neutral-to-bearish longer-term trend. The price has struggled to sustain momentum above the 50-day EMA, indicating a lack of buyer conviction. The MACD is hovering around its zero line, displaying weak momentum and a series of failed crossover attempts. The RSI is neutral, typically ranging between 40 and 60, which confirms the absence of strong directional bias.

The $70** level is the critical support to watch; a decisive break and close below this could trigger a steeper decline towards the **$65 level. Conversely, for a bullish scenario to gain credibility, LTC must convincingly reclaim the $85** resistance. Such a move would likely target the next psychological hurdle at **$90.

Volume has been consistently low, reflecting a lack of interest and participation. Until either the $70** support or the **$85 resistance is broken with significant volume, LTC is likely to continue its sideways consolidation. Patience for a confirmed breakout is key.

LTC/USD May Tap $110.5 Before DropFenzoFx—Litecoin is trading sideways. We expect LTC/USD to tick higher toward $110.5 before resuming its downtrend. If this scenario unfolds, the next bearish target is the $88.00 support area.

Please note, the bearish outlook remains valid unless price closes and stabilizes above the fair value gap near $114.00.

LTCUSD Is Breaking Out3Month Chart on this one

The RSI clearly shows a pivot upwards at this middle line

Price is also within a large triangle which could be considered a bullflag in my mind

I think price will break out of this triangle spectacularly.

Green circles are very similar price formations.

Very Good Long Choice as an altcoin.

Litecoin Ready to Explode After 3 Years of SleepIn recent years, with the flood of new crypto projects, Litecoin has quietly faded into the background.

Since the local low in May 2022, the price action has been rather lethargic, contained within a well-defined range between 60 and 130 USD.

However, since April 2025, something interesting has been happening — Litecoin seems to be waking up, quietly and almost secretly, as if not to attract too much attention.

From that point onward, LTC/USD has been steadily printing higher lows, and if we zoom out to the longer-term chart, the structure looks remarkably clean — almost textbook — for a potential breakout setup.

Even recently, after another touch of the resistance zone, the correction that followed took the form of a bullish flag, and last week’s strong engulfing candle practically erased an entire month of pullback, now pressing once again against the key resistance level.

In my opinion, it’s time for this cryptocurrency to wake up.

A clear break above 130 would be a strong technical confirmation of that view.

While Litecoin might not deliver the “10x hype” potential that newer tokens promise, it has consistently proven to be one of the most stable and resilient assets in the crypto space.

After three years of accumulation, a breakout could easily trigger an explosive move to the upside.

📈 I’m personally buying Litecoin, with a target around 300 USD in the medium term.

Sometimes, the coins everyone forgets about are the ones that surprise the most. 🚀