Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.63 INR

1.14 B INR

29.77 B INR

84.86 M

About Laxmi Organic Industries Ltd.

Sector

Industry

CEO

Rajan Venkatesh

Website

Headquarters

Mumbai

Founded

1989

ISIN

INE576O01020

FIGI

BBG00ZKVSHH5

Laxmi Organic Industries Ltd. engages in the manufacture of acetyl and specialty intermediates. It offers ethyl acetate, acetic acid, and diketene derivative products (DDP). The company was founded on May 15, 1989 and is headquartered in Mumbai, India.

Related stocks

Expecting Good resultsIf possible take a break Till US Elections.

Jubilant Ingrevia results are good. Expecting Laxmi Organics results to be good as they operate in the similar segment.

Observe Market conditions then decide on the trade.

They will release the results after market. So BTST or intraday makes sense if mar

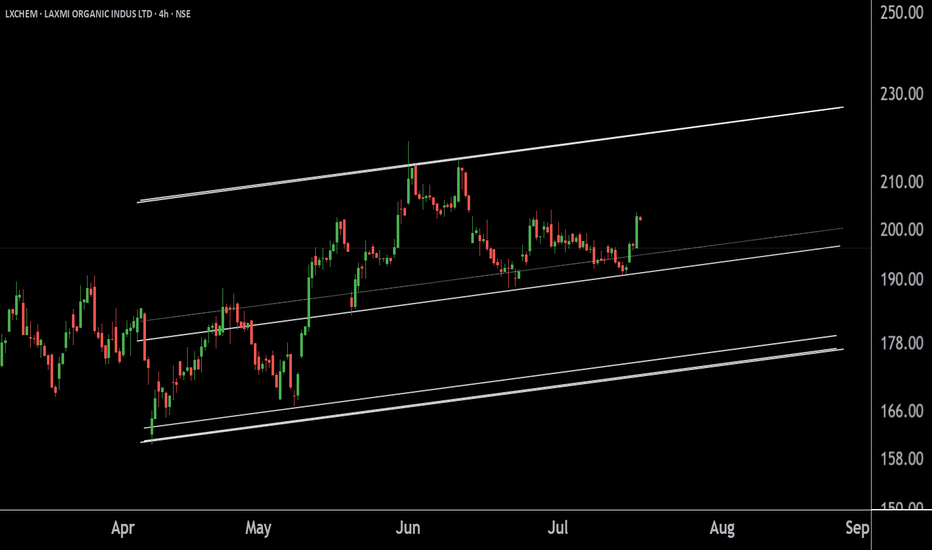

Laxmi Organic The stock is currently near its support level of 310-315, which could act as a strong base for further upward movement. Above that we can see upside potential of 350-400+.

The next major resistance is at 480-490 INR. Breaking this level could lead to significant upside potential.

Laxmi Organic Indu

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of LXCHEM is 211.11 INR — it has increased by 2.78% in the past 24 hours. Watch Laxmi Organic Industries Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Laxmi Organic Industries Ltd. stocks are traded under the ticker LXCHEM.

LXCHEM stock has fallen by −1.56% compared to the previous week, the month change is a 2.55% rise, over the last year Laxmi Organic Industries Ltd. has showed a −26.44% decrease.

We've gathered analysts' opinions on Laxmi Organic Industries Ltd. future price: according to them, LXCHEM price has a max estimate of 236.00 INR and a min estimate of 179.00 INR. Watch LXCHEM chart and read a more detailed Laxmi Organic Industries Ltd. stock forecast: see what analysts think of Laxmi Organic Industries Ltd. and suggest that you do with its stocks.

LXCHEM reached its all-time high on Sep 16, 2021 with the price of 628.00 INR, and its all-time low was 143.25 INR and was reached on Mar 25, 2021. View more price dynamics on LXCHEM chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LXCHEM stock is 1.81% volatile and has beta coefficient of 1.70. Track Laxmi Organic Industries Ltd. stock price on the chart and check out the list of the most volatile stocks — is Laxmi Organic Industries Ltd. there?

Today Laxmi Organic Industries Ltd. has the market capitalization of 59.52 B, it has decreased by −2.11% over the last week.

Yes, you can track Laxmi Organic Industries Ltd. financials in yearly and quarterly reports right on TradingView.

Laxmi Organic Industries Ltd. is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

LXCHEM net income for the last quarter is 213.91 M INR, while the quarter before that showed 217.59 M INR of net income which accounts for −1.69% change. Track more Laxmi Organic Industries Ltd. financial stats to get the full picture.

Yes, LXCHEM dividends are paid annually. The last dividend per share was 0.50 INR. As of today, Dividend Yield (TTM)% is 0.23%. Tracking Laxmi Organic Industries Ltd. dividends might help you take more informed decisions.

Laxmi Organic Industries Ltd. dividend yield was 0.29% in 2024, and payout ratio reached 12.19%. The year before the numbers were 0.25% and 13.45% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 6, 2025, the company has 2.05 K employees. See our rating of the largest employees — is Laxmi Organic Industries Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Laxmi Organic Industries Ltd. EBITDA is 2.39 B INR, and current EBITDA margin is 9.82%. See more stats in Laxmi Organic Industries Ltd. financial statements.

Like other stocks, LXCHEM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Laxmi Organic Industries Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Laxmi Organic Industries Ltd. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Laxmi Organic Industries Ltd. stock shows the sell signal. See more of Laxmi Organic Industries Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.