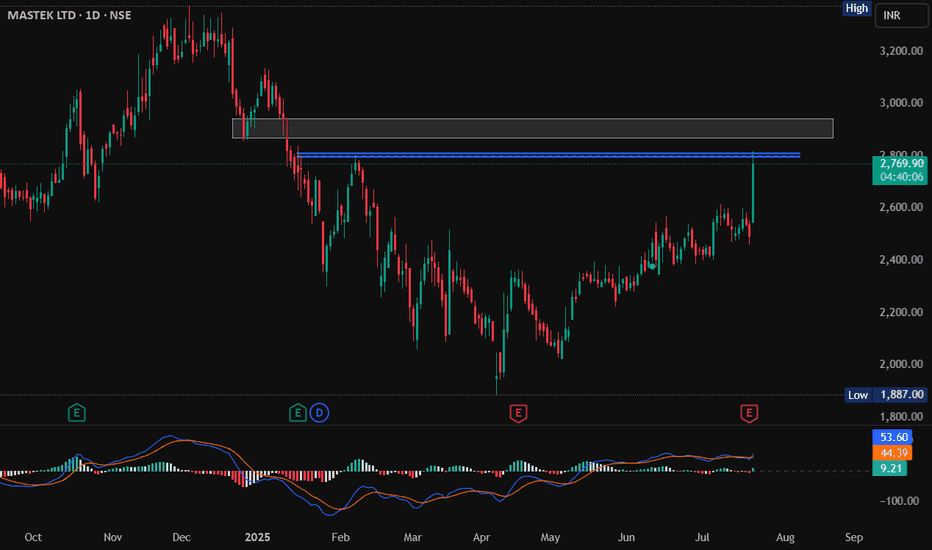

Mastek, Resistance, 1D LongMastek has crossed 2800 and made high of 2818, however it was unable to sustain it. If it crosses the level of 2800 with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami then we can see

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

118.15 INR

3.76 B INR

34.55 B INR

14.02 M

About Mastek Limited

Sector

Industry

CEO

Umang Nahata

Website

Headquarters

Mumbai

Founded

1982

ISIN

INE759A01021

FIGI

BBG000BHX6K7

Mastek Ltd. is an enterprise digital and cloud transformation partner, which engages in the provision of digital experience and engineering, cloud implementations, data, automation and artificial intelligence (AI), and cloud managed services. The firm caters customers in industries such as healthcare and life sciences, retail and consumer, manufacturing, financial services, and public sector across countries including the United Kingdom, United States of America, Europe, the Middle East, and Asia Pacific. It operates through the following geographical segments: UK and Europe Operations, North America Operations, Middle East, and Others. The company was founded by Ashank Datta Desai, Ketan Bansilal Mehta, Radhakrishnan Sundar, and Venkatraman Ram Sudhakar on May 14, 1982 and is headquartered in Mumbai, India.

Related stocks

MASTEK SWING ANALYSISThanks for stopping by.

All analysis here is done strictly from an investor’s perspective — focusing on risk, return, valuation, and potential upside.

The notes cover key details. I’ve backed every thesis with my own analysis — no fluff, just what matters to investors.

If you find the idea useful

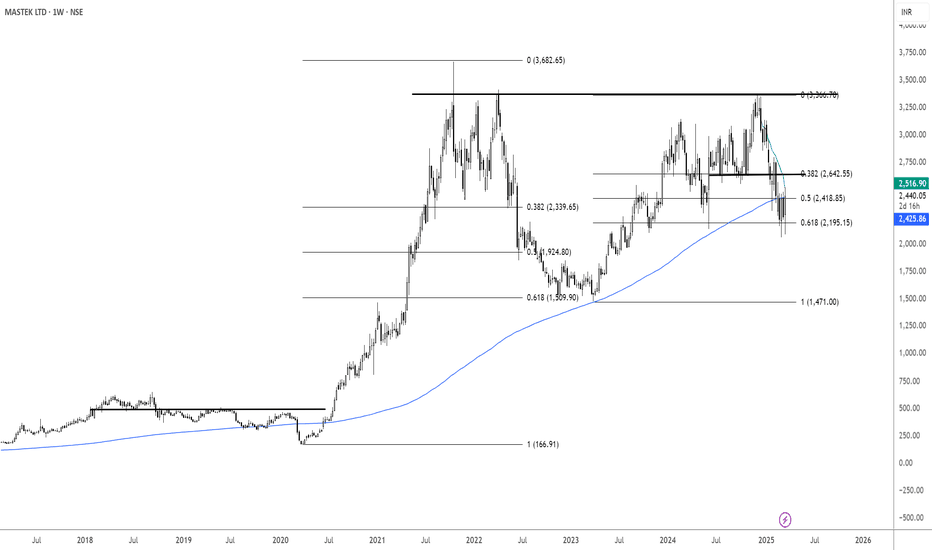

MASTEK MID-TERM ANALYSISMASTEK is looking positive on charts , and once it crosses and sustains above 2691, then it can go up to 3475-3661. And on the downside, if it slips further, then the important support range on the downside would be 2315-2128. And levels for short covering on the downside to look for would be 1924.

Mastek: Monthly Rounding Bottom Breakout Opportunity!🚀 Mastek: Monthly Rounding Bottom Breakout Opportunity! 🚀

Current Market Price: 3257

Stop Loss: 2480

Target: 5160

Mastek is nearing a major monthly rounding bottom breakout above the 3320 closing level. A confirmed monthly close above this level could signal a strong upward trend, offering a promi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SMALLCAP

Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF Units Exchange Traded FundWeight

0.22%

Market value

178.75 K

USD

HESC

HSBC ETFs PLC - HSBC MSCI Emerging Markets Small Cap Screened UCITS ETFWeight

0.04%

Market value

16.83 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of MASTEK is 2,170.40 INR — it has decreased by −0.17% in the past 24 hours. Watch Mastek Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Mastek Limited stocks are traded under the ticker MASTEK.

MASTEK stock has fallen by −3.18% compared to the previous week, the month change is a −0.37% fall, over the last year Mastek Limited has showed a −33.44% decrease.

We've gathered analysts' opinions on Mastek Limited future price: according to them, MASTEK price has a max estimate of 3,320.00 INR and a min estimate of 2,490.00 INR. Watch MASTEK chart and read a more detailed Mastek Limited stock forecast: see what analysts think of Mastek Limited and suggest that you do with its stocks.

MASTEK reached its all-time high on Oct 19, 2021 with the price of 3,669.00 INR, and its all-time low was 8.90 INR and was reached on Oct 11, 2001. View more price dynamics on MASTEK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MASTEK stock is 1.15% volatile and has beta coefficient of 1.39. Track Mastek Limited stock price on the chart and check out the list of the most volatile stocks — is Mastek Limited there?

Today Mastek Limited has the market capitalization of 68.28 B, it has decreased by −1.55% over the last week.

Yes, you can track Mastek Limited financials in yearly and quarterly reports right on TradingView.

Mastek Limited is going to release the next earnings report on Jan 15, 2026. Keep track of upcoming events with our Earnings Calendar.

MASTEK net income for the last quarter is 974.50 M INR, while the quarter before that showed 920.50 M INR of net income which accounts for 5.87% change. Track more Mastek Limited financial stats to get the full picture.

Mastek Limited dividend yield was 1.05% in 2024, and payout ratio reached 18.89%. The year before the numbers were 0.75% and 19.39% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 4, 2025, the company has 5.12 K employees. See our rating of the largest employees — is Mastek Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Mastek Limited EBITDA is 5.05 B INR, and current EBITDA margin is 14.41%. See more stats in Mastek Limited financial statements.

Like other stocks, MASTEK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Mastek Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Mastek Limited technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Mastek Limited stock shows the sell signal. See more of Mastek Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.