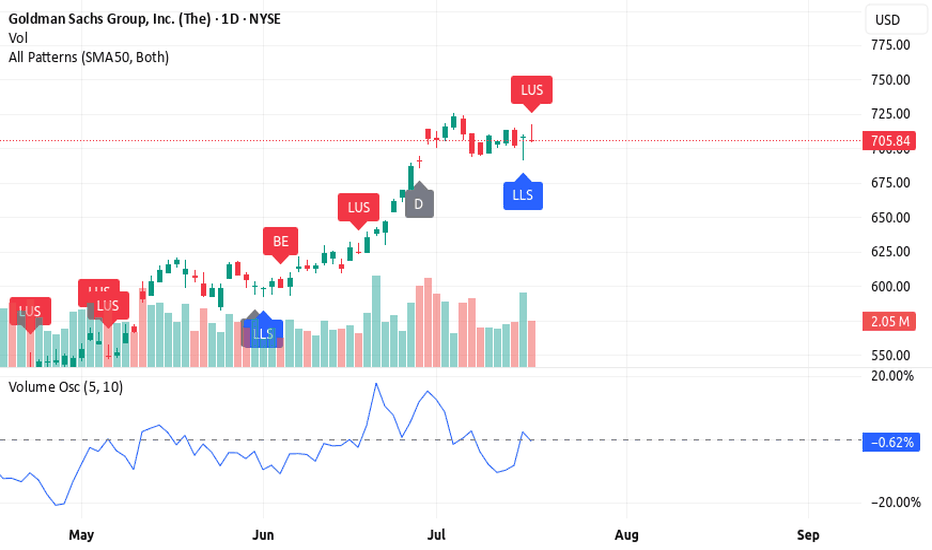

Goldman is a classic in more ways than one - long at 716.00 The 716.00 was a pre-market trade, btw. Goldman benefits whenever the rich benefit, and if there's one thing I'm sure of in the next several years, it's that the rich in America will outperform everyone else financially. But this isn't just a play on macro, government related, targeted largesse. I

Key facts today

A U.S. judge dismissed an antitrust lawsuit against Goldman Sachs and nine banks, alleging price manipulation in corporate bond trading due to insufficient evidence of a conspiracy.

Goldman Sachs is the lead underwriter for Legence's upcoming U.S. initial public offering, targeting a valuation of up to $2.95 billion.

On September 2, 2025, Goldman Sachs International reported transactions by an exempt trader, including purchases, sales, and derivatives related to key securities.

64.51 CAD

19.56 B CAD

173.75 B CAD

About Goldman Sachs Group, Inc. (The)

Sector

Industry

CEO

David Michael Solomon

Website

Headquarters

New York

Founded

1869

ISIN

CA38150F1045

FIGI

BBG014T46XQ3

The Goldman Sachs Group, Inc. engages in the provision of financial services. It operates through the following business segments: Global Banking and Markets, Asset and Wealth Management, and Platform Solutions. The Global Banking and Markets segment includes investment banking, global investments, and equity and debt investments. The Asset and Wealth Management segment relates to the direct-to-consumer banking business which includes lending, deposit-taking, and investing. The Platform Solutions segment includes consumer platforms such as partnerships offering credit cards and point-of-sale financing, and transaction banking. The company was founded by Marcus Goldman in 1869 and is headquartered in New York, NY.

Related stocks

Goldman Sachs Group Inc. (NYSE) (W)Breakout Confirmation: Price has successfully broken above the $700–$740 resistance zone with sustained weekly closes, confirming a strong breakout.

Current Price Action: Closed at $741.89 (+1.53%), consolidating just above the breakout level – a healthy sign of strength.

Key Levels:

Support

Rocket Booster Setup is Igniting Above the 50 & 200 EMAGoldman Sachs: Rocket Booster Setup is Igniting 🚀

Goldman Sachs NYSE:GS (GS) is showing signs of a potential upside move according to the Rocket Booster Strategy and supporting technical indicators.

Key Bullish Signals

Above the 50 & 200 EMA (Rocket Booster Strategy)

The price is ho

3 Reasons Why Goldman Sachs (GS) Still Looks Bullish🚀 3 Reasons Why Goldman Sachs (GS) Still Looks Bullish (Despite a Bearish Candle)

Goldman Sachs is in a bullish trend, but the latest candlestick is flashing a warning. Here's why GS still looks strong — and what to watch for next 📈

1️⃣ Candlestick pattern – long upper shadow

The long upper shado

The Return Of The 3 Step Rocket Booster StrategyOne thing you can know about me is i desire to learn how to

drive a car.I still dont know how to drive car.

Sometimes i feel safe being driven

on public roads.

But the freedom that comes from owning your own car,

i still dont know how that feels like.

Whats better to do it yourself, or have other

Goldman Sachs (GS): Long Position Opportunity Amid Stabilizing V

-Key Insights: Goldman Sachs (GS) stands to benefit from stabilizing market

volatility, as reflected by the declining VIX. While macroeconomic uncertainties

and earnings season pressures persist, GS has room for recovery with strong

potential upside driven by resilience in financial services and li

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where GS is featured.