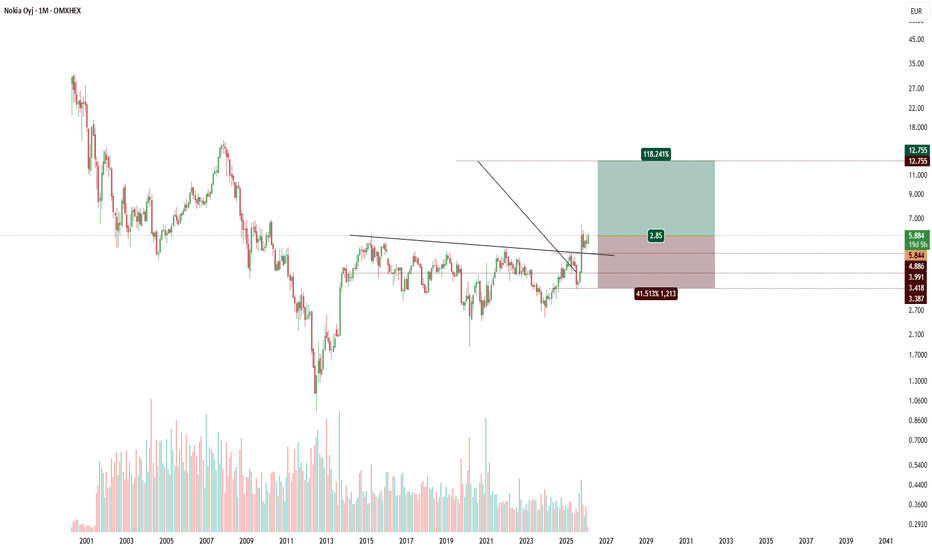

NOKiA: $7.18 | Redemption in the Ai Generation produced half of the world mobile phones

went with msoft

missed out developers

apple overtook

tried to head on with lumia

no devs no users dead in the water abandoned phone

went in telecom

now NVIDiA partnered

as ai data play for the next gen

coould be a take over

or something wondefrful

N

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.114 EUR

629.00 M EUR

19.89 B EUR

4.95 B

About Nokia Oyj

Sector

Industry

CEO

Justin Hotard

Website

Headquarters

Espoo

Founded

1865

IPO date

Mar 29, 1905

Identifiers

2

ISIN FI0009000681

Nokia Oyj engages in the provision of network infrastructure, technology, and software services. It operates through the following segments: Mobile Networks, Network Infrastructure, Cloud and Network Services, and Nokia Technologies. The Mobile Networks segment offers technologies for Radio Access Networks (RAN) as well as Microwave Radio Links (MWR) for transport networks. The Network Infrastructure serves communication service providers, enterprises, webscales and public sector customers. The Cloud and Network Services segment builds around software and the cloud and is focused on driving leadership in cloud-native software and as-a-service delivery models, as demand for critical networks accelerates; and with strong market positions in communications software, private wireless networks, and cognitive (or intelligent) services. The Nokia Technologies segment, building on decades of innovation and R&D leadership in technologies used in virtually all mobile devices used today, is expanding the Nokia patent licensing business, reintroducing the Nokia brand to smartphones through brand licensing, and establishing a technology licensing business. The company was founded by Fredrik Idestam in 1865 and is headquartered in Espoo, Finland.

Related stocks

NOKBF — Swing Trade Analysis**NOKBF — Swing Trade Analysis**

**1. Overview**

* **Price:** 5.93

* **Trend Filter:** Above 200 SMA (5.16). This indicates a long-term bullish bias.

* **Setup Type:** **Mean Reversion / Oversold Bounce (Long Setup)**. The extremely low RSI(2) (1.19) and the price being significantly below sh

Nokia:Inverted Head and Shoulders Structure + Retest of BreakoutOn the weekly chart of Nokia, a classic Inverted Head and Shoulders reversal pattern has formed. The breakout above the neckline occurred with increased volume, confirming the strength of the move. Currently, the price is undergoing a standard technical retest of the neckline from above — a typical

NOKIA Nokia and Nvidia have recently announced a strategic partnership centered on pioneering AI-powered telecommunications networks, particularly targeting the transition from 5G to 6G. Key points of the collaboration include:

Nvidia’s $1 billion investment in Nokia, acquiring a 2.9% stake at roughly $6.

NOKIA - Long-Term"Long" Term does not imply "going Long" mind you .. just means .. eh .. like much time ..

Made a nice "Fib", they seem to be important to 'Traders' and 'Anal-ysts®' (not to me, sorry),

I just draw that humbug in here because all my other IDEA's usually have pretty empty charts (see some lines fur

NOK Nokia Options Ahead of EarningsAnalyzing the options chain and the chart patterns of NOK Nokia prior to the earnings report this week,

I would consider purchasing the 5.50usd strike price Calls with

an expiration date of 2025-11-21,

for a premium of approximately $0.34.

If these options prove to be profitable prior to the earning

Nokia ($NOK): The Most Underestimated Comeback Story in Tech Inf6G Leadership & Strategic Relevance

Nokia is already positioning itself as a major player in 6G development, with research partnerships across the EU, U.S., and Japan.

2 Strong Core Business

Despite macro headwinds, Nokia’s Network Infrastructure and Cloud & Network Services divisions continue to g

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SLG_OMXH25

Seligson & Co OMX Helsinki 25 Exchange Traded Fund UnitsWeight

10.08%

Market value

77.02 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of NOKIA is 5.868 EUR — it has increased by 0.62% in the past 24 hours. Watch Nokia Oyj stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OMXHEX exchange Nokia Oyj stocks are traded under the ticker NOKIA.

NOKIA stock has risen by 1.17% compared to the previous week, the month change is a 5.43% rise, over the last year Nokia Oyj has showed a 23.02% increase.

We've gathered analysts' opinions on Nokia Oyj future price: according to them, NOKIA price has a max estimate of 7.20 EUR and a min estimate of 3.50 EUR. Watch NOKIA chart and read a more detailed Nokia Oyj stock forecast: see what analysts think of Nokia Oyj and suggest that you do with its stocks.

NOKIA reached its all-time high on Jun 20, 2000 with the price of 65.000 EUR, and its all-time low was 1.330 EUR and was reached on Jul 18, 2012. View more price dynamics on NOKIA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

NOKIA stock is 1.93% volatile and has beta coefficient of 1.23. Track Nokia Oyj stock price on the chart and check out the list of the most volatile stocks — is Nokia Oyj there?

Today Nokia Oyj has the market capitalization of 32.76 B, it has increased by 6.23% over the last week.

Yes, you can track Nokia Oyj financials in yearly and quarterly reports right on TradingView.

Nokia Oyj is going to release the next earnings report on Apr 23, 2026. Keep track of upcoming events with our Earnings Calendar.

NOKIA earnings for the last quarter are 0.16 EUR per share, whereas the estimation was 0.15 EUR resulting in a 9.26% surprise. The estimated earnings for the next quarter are 0.04 EUR per share. See more details about Nokia Oyj earnings.

Nokia Oyj revenue for the last quarter amounts to 6.13 B EUR, despite the estimated figure of 6.11 B EUR. In the next quarter, revenue is expected to reach 4.54 B EUR.

NOKIA net income for the last quarter is 532.00 M EUR, while the quarter before that showed 78.00 M EUR of net income which accounts for 582.05% change. Track more Nokia Oyj financial stats to get the full picture.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Nokia Oyj EBITDA is 2.59 B EUR, and current EBITDA margin is 13.90%. See more stats in Nokia Oyj financial statements.

Like other stocks, NOKIA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Nokia Oyj stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Nokia Oyj technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Nokia Oyj stock shows the buy signal. See more of Nokia Oyj technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.