AccHi,

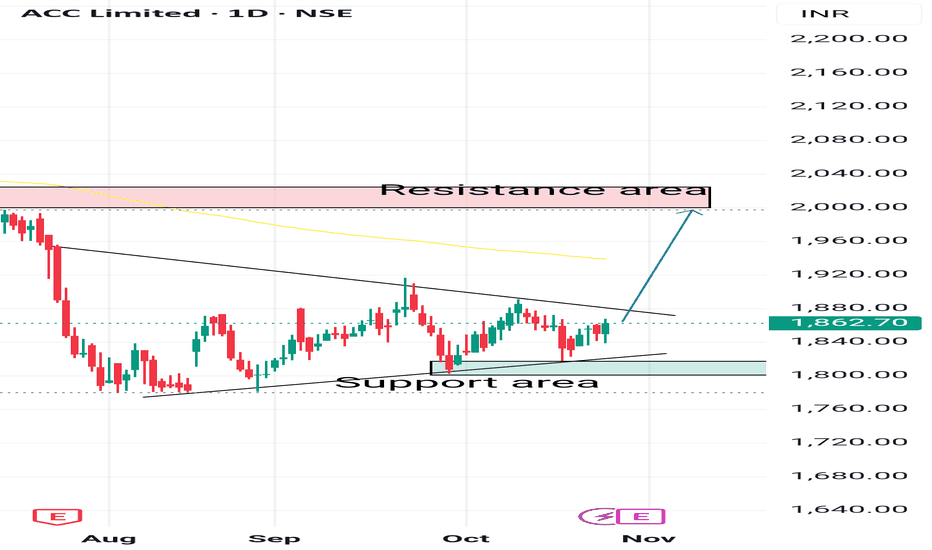

Price making triangle 📐 Pattern near support area so possiblity that it will be moves upper side.

Let's see what happens

This idea is for Educational purpose and paper trading only. Please consult your financial advisor before investing or making any position. Facts or Data given above may be slightly incorrect. We are not SEBI registered

ACC Limited

No trades

Market insights

ACCHi,

Price traded at near support area,

So possible that price will be moves upper side, Let see what happens.

This idea is for Educational purpose and paper trading only. Please consult your financial advisor before investing or making any position. Facts or Data given above may be slightly incorrect. We are not SEBI registered

ACC - RISING WEDGE [BEAR ] - Upcoming Breakout detected using AII am not a SEBI-registered investment advisor. The information provided here is for educational and informational purposes only and should not be construed as financial or investment advice. Please do your own research or consult with a SEBI-registered financial advisor before making any investment decisions. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

All the Data available in the chart itself.

ACC , 1W Breakout In this stock we clearly see the Channel or Wedge pattern is formed and Ready for Breakout , Wait for candle Close in 1D with good volume , then we can see very good move up to 45% nearly .

As now nifty is given Breakout from 1D Channel pattern and in Market Breadth 1D has given breakout and in weekly market Breadth it is near the Resistance , if we see good volume close in this week we can expect Market will be Bullish for next 2-3 Months .

Follow for more Swing Ideas Like This .

ACC - Long - Positional ACC on day timeframe shows consolidation at bottom. It has now strong base and support at 1800. All 20, 50, 100, 200 EMAs are coming together to squeeze and then breakout. Also it shows Cup formation pattern where price will follow right side of cup on uptrend. Bullish signal positional for target of 2600+

ACC Ltd. – Triple Bottom Pattern | Swing Trade Setup

ACC Ltd. is currently showing a Triple Bottom formation on the weekly chart, indicating strong support around the ₹1810 - ₹1793 level . This pattern suggests that bearish pressure is weakening and a potential reversal is on the cards.

🔍 Key Technical Highlights:

Triple Bottom: The stock has tested the same support zone three times without breaking down, which is a classic bullish reversal signal.

Price Action: Current price is near the support base, offering a favorable risk-reward entry zone.

RSI: Weekly RSI shows signs of reverse sell divergence, hinting at a potential shift in momentum.

📈 Strategy:

This is a swing trading idea based on weekly chart structure. Entry is planned near the current level with a stop-loss slightly below the support zone. I plan to use pyramiding to add positions if momentum continues after breakout above neckline resistance.

⚠️ Disclaimer:

This analysis is for educational and informational purposes only. It is not intended as investment advice or a recommendation to buy or sell any securities. I am not a SEBI-registered advisor. Please do your own research and consult with a registered financial advisor before making any investment decisions. Trading and investing involve significant risk.

ACC - ACC Ltd (Daily chart, NSE) - Long PositionACC - ACC Ltd (Daily chart, NSE) - Long Position

Risk assessment: Medium {support structure integrity risk}

Risk/Reward ratio ~ 2.75

Current Market Price (CMP) ~ 1848

Entry limit ~ 1845 to 1835 (Avg. - 1840) on July 28, 2025

Target limit ~1950 (+5.98%; +110 points)

Stop order limit ~ 1800 (-2.17%; -40 points)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

ACC Trade Setup for the Week(14–18 July 2025) – Uptrend ChannelACC Ltd. (NSE: ACC) has been trading inside a clean uptrend channel for the past few weeks, bouncing consistently between rising support and resistance. Now, it approaches a critical inflection point — the lower support of the channel.

While no breakdown has occurred yet, the structure is weakening, and a bearish opportunity may soon present itself. Let’s explore how to trade this if the setup confirms.

1. What’s Happening on the Chart?

ACC is trading close to the channel support zone (~₹1975).

The resistance zone near ₹2000–₹2020 has held strong.

A potential breakdown below the rising green support trendline could trigger a bearish move toward the ₹1910–₹1920 demand zone.

But nothing is confirmed yet — this is a watchlist setup.

2. Trade Setup – Conditional Bearish Opportunity

✅ Trade Plan:

Wait for breakdown of the rising support line.

After breakdown, wait for a re-test of the broken support zone (~₹1975–₹1980).

Look for bearish confirmation via a candlestick pattern (engulfing or strong rejection) on the 15-min or 1-hour timeframe.

🚨 Entry Trigger:

Only enter short if re-test holds and price starts reversing.

📉 Stop Loss:

SL should be above the re-test high (around ₹1990–₹1995).

🎯 Target:

Profit booking zone: ₹1910–₹1920.

Potential R:R: 1:2, 1:3, or even 1:4 depending on entry.

3. Why This Setup Matters

Trend exhaustion is visible near the upper resistance of the channel.

A clean breakdown + re-test gives a low-risk entry.

The 200 EMA lies near the target zone, providing confluence for mean reversion.

4. What If There’s No Breakdown?

If price respects the support and bounces again, no trade should be taken on the short side.

In that case, look for possible bullish reversal signals back toward channel resistance — or stay neutral.

5. Final Thoughts

This is a highly conditional setup — and patience is the key. Don’t jump the gun. The best trades happen after confirmation.

🔔 What to watch this week:

Breakdown below ₹1975 support

Re-test and rejection from ₹1975–₹1985

Confirmation candle (bearish engulfing)

Only then consider a short trade toward ₹1910 with a well-placed SL.

Plan your trade. Wait for structure. Trade only when the market shows its hand.

ACC BULL waves started BIG Giant Ready to Roll !!!ACC daily counts suggested DUAL match for Eillot waves + Harmonics bullish Wave structure

both looks bullish implus started for this stock

LONG TERM investors get ready for good returns in future for 2 to 5 yrs

all charts shown to understand elliot waves theory + harmonics waves + gann theory + time theory

all charts are education purpose!!!!!

we don't any responsibilities for profit /loss

ACCNSE:ACC

One Can Enter Now !

Or Wait for Retest of the Trendline (BO) !

Or wait For better R:R ratio !

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low.

2. R:R ratio should be 1 :2 minimum

3. Plan as per your RISK appetite and Money Management.

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

ACC Ltd (NSE: ACC) Weekly Chart Analysis🔹 Channel Support and Resistance

The stock has been moving within an ascending channel since early 2022, creating a structured uptrend. Currently, it’s trading near the channel’s lower boundary, around ₹2,357. This zone has historically acted as a key support level, making it an area to watch closely for potential buying interest.

🔹 Descending Wedge Breakout

Recently, ACC broke out of a descending wedge pattern, a generally bullish formation, which suggests the potential for an upward move. The breakout is still in its early stages, so continued momentum will be critical in confirming the trend reversal.

🔹 Price Targets

First Resistance: ₹2,592.75 – If momentum sustains, this level aligns with a prior high and could act as a short-term target.

Channel Resistance: If the stock gains further strength, the upper boundary of the channel could offer the next significant resistance level.

🔹 Cement Industry Tailwinds

According to brokerages, Indian cement firms, including ACC, have seen successful price hikes in September, and there are plans for further hikes in October. This is generally positive for margins, adding fundamental support to the current technical picture.

🔹 RSI

The Relative Strength Index (RSI) shows an oversold condition that’s starting to turn upwards, suggesting possible accumulation at these levels.

📈 Conclusion: Watch for sustained support around ₹2,357 and an upward move towards ₹2,592. A close above ₹2,592 could indicate renewed bullish strength, especially with ongoing industry tailwinds from price hikes.

Analysis for ACC LTD

We have a fresh Monthly Supply formed which is a Source Supply and we have a Monthly fresh Destination Demand.

We have further divided the Supply Demand Equilibrium into 5 parts giving us an understanding for which specific area should we Buy or Sell into.

Now the most important part the trade analysis.

We have a short position for a reward of 2.4 at the risk of 1.

Analysis on Indian Stock ACC Ltd. 15min chart timeframeHey there tradingview community, Its another analysis on the indian market,specifically ACC Ltd.

So the market opened at 9:45 and opened gap down and immediatedly pumped up and then showed a sideways movement. Also the it showed a minor uptrend.

After that its clear that the operator like banks and mutual funds entered into the market for a bearish momentum. But just before that the market engulfed retail investor's "Stop Loss" at exactly 2515 points.Then we can see a swing and there comes the analysis on the classical method fibonacci retracement. by using the fib tool on the swing i found out the down level that the market could potentially reach. I just drew a zone between 2428 to 2436 as a major support zone. The market reversed from this zone and trying to go for a up direction. Also i think the market could open gap up tomorrow. If the market opens gap up tomorrow then it can take support at the last swing (used fib tool there).

Asif Hassan Risan

3 October,2024