Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

20.40 INR

6.63 B INR

67.58 B INR

127.29 M

About Aegis Logistics Limited

Sector

Industry

CEO

Sudhir Omprakash Malhotra

Website

Headquarters

Mumbai

Founded

1956

ISIN

INE208C01025

FIGI

BBG000CMWXQ1

Aegis Logistics Ltd. engages in the provision of supply chain management services to oil, gas, and chemical industries. It operates through the Liquid Terminal Division and Gas Terminal Division segments. The Liquid Terminal Division segment undertakes storage and terminal facility of oil and chemical products. The Gas Terminal Division segment refers to the imports, storage, and distribution of petroleum products including liquid petroleum gas (LPG) and propane. The company was founded on June 30, 1956 and is headquartered in Mumbai, India.

Related stocks

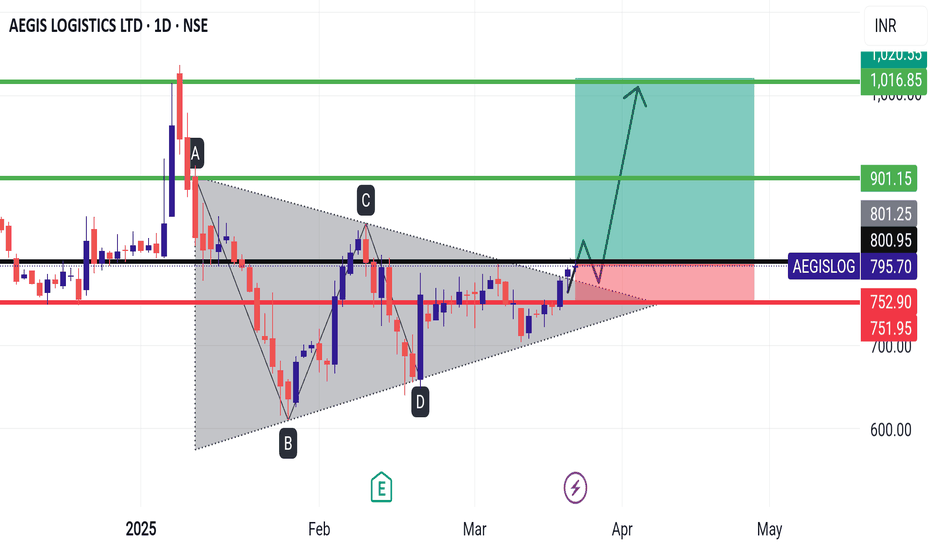

Amazing breakout on WEEKLY Timeframe - AEGISLOGCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the break

Elliott Wave Analysis of Aegis Logistics AEGISLOGThe script is doing 5th of weekly time-frame and seems to about to complete (i) of 5th with 78.6% retracement. The (i) was a diagonal impulse wave. And now in retracement, the C wave also appears to be forming an ending diagonal. After this is completed, (iii) wave should start.

AEGISLOG - Aegis Logistics Ltd. (45 minutes chart, NSE) - LongAEGISLOG - Aegis Logistics Ltd. (45 minutes chart, NSE) - Long Position; short-term swing research idea.

Risk assessment: High {volatility risk}

Risk/Reward ratio ~ 2.63

Current Market Price (CMP) ~ 880

Entry limit ~ 870 to 860 (Avg. - 865) on May 22, 2025

1. Target limit ~ 890 (+2.89%; +25

Flag & Pole breakoutThis stock exhibited highly volatile movements this week, accompanied by remarkable volumes. It attempted to break out above its previous high of ₹970 but failed.

The subsequent correction occurred on low volumes.

A POM is scheduled for January 12th, suggesting the possibility of significant new

Aegis Logistics: Prepping for a Small Rounding Bottom Breakout!🚀 Aegis Logistics: Prepping for a Small Rounding Bottom Breakout! 🚀

Current Market Price: 850

Stop Loss: 780

Targets: 925, 970, 1070

Aegis Logistics is showing signs of a potential small rounding bottom breakout. A confirmation above 925 could set the stage for further upside. Given the stock's vo

Breakout after long consolidationDouble digit ROE and ROCE

Debt to Equity ~1

PEG Ratio a little higher than 2

EPS continuously increasing

FII stake increased

DII presence

Technical: After a strong bull run the stock went into sidewise consolidation forming a triangle pattern. Currently the volumes are the highest ever clearly sho

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SMALLCAP

Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF Units Exchange Traded FundWeight

0.75%

Market value

603.86 K

USD

ASAO

abrdn Sustainable Asian Opportunities Active ETF Exchange Traded Fund UnitsWeight

0.69%

Market value

363.17 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of AEGISLOG is 761.35 INR — it has decreased by −0.61% in the past 24 hours. Watch Aegis Logistics Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Aegis Logistics Limited stocks are traded under the ticker AEGISLOG.

AEGISLOG stock has risen by 0.36% compared to the previous week, the month change is a 2.55% rise, over the last year Aegis Logistics Limited has showed a −9.47% decrease.

We've gathered analysts' opinions on Aegis Logistics Limited future price: according to them, AEGISLOG price has a max estimate of 1,020.00 INR and a min estimate of 652.00 INR. Watch AEGISLOG chart and read a more detailed Aegis Logistics Limited stock forecast: see what analysts think of Aegis Logistics Limited and suggest that you do with its stocks.

AEGISLOG reached its all-time high on Jan 8, 2025 with the price of 1,037.00 INR, and its all-time low was 0.25 INR and was reached on Aug 10, 2000. View more price dynamics on AEGISLOG chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AEGISLOG stock is 1.91% volatile and has beta coefficient of 0.87. Track Aegis Logistics Limited stock price on the chart and check out the list of the most volatile stocks — is Aegis Logistics Limited there?

Today Aegis Logistics Limited has the market capitalization of 269.87 B, it has increased by 0.32% over the last week.

Yes, you can track Aegis Logistics Limited financials in yearly and quarterly reports right on TradingView.

Aegis Logistics Limited is going to release the next earnings report on Jan 30, 2026. Keep track of upcoming events with our Earnings Calendar.

Aegis Logistics Limited revenue for the last quarter amounts to 22.94 B INR, despite the estimated figure of 18.64 B INR. In the next quarter, revenue is expected to reach 22.25 B INR.

AEGISLOG net income for the last quarter is 1.80 B INR, while the quarter before that showed 1.31 B INR of net income which accounts for 36.79% change. Track more Aegis Logistics Limited financial stats to get the full picture.

Aegis Logistics Limited dividend yield was 0.90% in 2024, and payout ratio reached 38.36%. The year before the numbers were 1.46% and 40.08% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 4, 2025, the company has 600 employees. See our rating of the largest employees — is Aegis Logistics Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Aegis Logistics Limited EBITDA is 11.72 B INR, and current EBITDA margin is 16.45%. See more stats in Aegis Logistics Limited financial statements.

Like other stocks, AEGISLOG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Aegis Logistics Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Aegis Logistics Limited technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Aegis Logistics Limited stock shows the buy signal. See more of Aegis Logistics Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.