Positional setup for JSW Infrastructure (JSWINFRA)🔍 Fundamentals (from Screener & other sources)

Market Cap: ~ ₹69,000 Cr.

Revenue / Profit: Last reported revenue ~₹4,690 Cr, Profit ~₹1,614 Cr.

5-Yr Profit Growth: ~51.5% CAGR.

Valuation:

P/E is very high (in some sources ~186×) which suggests heavy premium pricing.

P/B ≈ 13.3×.

Returns:

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.65 INR

15.03 B INR

44.76 B INR

301.75 M

About JSW Infrastructure Limited

Sector

Industry

CEO

Rinkesh Roy

Website

Headquarters

Mumbai

Founded

1999

ISIN

INE880J01026

FIGI

BBG01J9XN7X8

JSW Infrastructure Ltd. engages in the provision of development, operation, and maintenance of construction and port services. It develops airports, shipyards, townships, roads and rail connectivity, inland waterways, water treatment plants, special economic zones, and other infrastructural facilities. The company was founded in 1999 and is headquartered in Mumbai, India.

Related stocks

Review and plan for 17th September 2025 Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

JSW INFRAJSW Infrastructure Ltd. (currently trading at ₹326) is India’s second-largest private port operator and a key logistics arm of the JSW Group. It operates 12 port concessions across India and a liquid storage terminal in Fujairah, UAE, with a total cargo-handling capacity of 170 MTPA. The company off

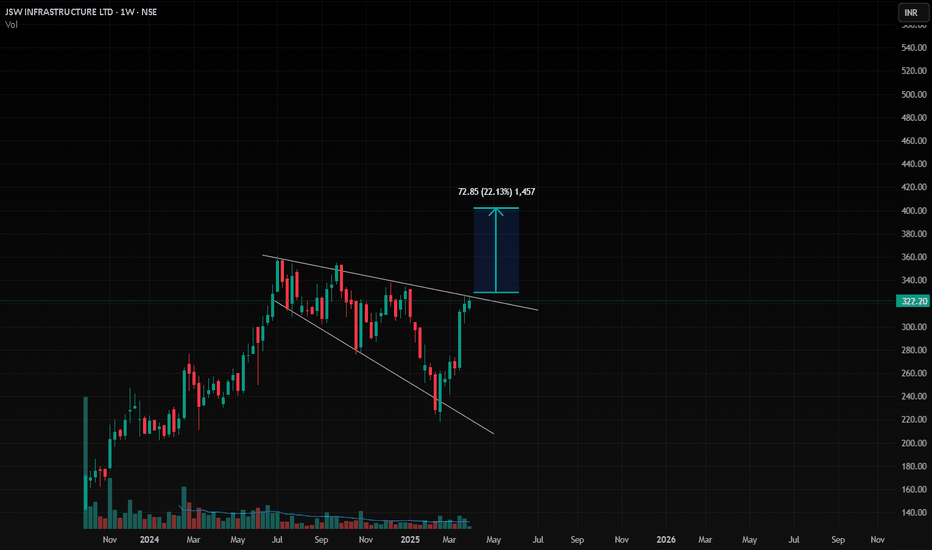

JSWINFRA - Daily time frame StudyFollowing are my Inputs for above chart reading -

1. MACD cross over

2. High volume Breakout of Symmetrical Triangle Pattern - Daily Time frame

3. It may go till weekly resistance line 330-340

This chart is only for educational purpose, Please contact your financial advisor for any trading or inves

JSW Infra Set to Rise After Strong Results and Key Support..!JSW Infrastructure has released its financial results for the December quarter, showcasing a remarkable 32.35 percent surge in consolidated net profit, reaching an impressive Rs 335.62 crore. This substantial increase marks a significant rise from Rs 253.57 crore in the same quarter last year, fuele

JSWINFRA Weekly InvestingBuy when CLOSE between 322 -334

Stoploss - 307

Target Price : 358

Reward: Risk - 2:1

% Profit : 10%

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MIDCAPETF

Mirae Asset Nifty Midcap 150 ETF Exchange Traded Fund UnitsWeight

0.28%

Market value

393.02 K

USD

FLQA.USD

Franklin FTSE Asia ex China ex Japan UCITS ETF Accum Shs USDWeight

0.01%

Market value

73.15 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of JSWINFRA is 284.55 INR — it has decreased by −1.90% in the past 24 hours. Watch JSW Infrastructure Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange JSW Infrastructure Limited stocks are traded under the ticker JSWINFRA.

JSWINFRA stock has fallen by −4.26% compared to the previous week, the month change is a −8.13% fall, over the last year JSW Infrastructure Limited has showed a −10.80% decrease.

We've gathered analysts' opinions on JSW Infrastructure Limited future price: according to them, JSWINFRA price has a max estimate of 395.00 INR and a min estimate of 172.00 INR. Watch JSWINFRA chart and read a more detailed JSW Infrastructure Limited stock forecast: see what analysts think of JSW Infrastructure Limited and suggest that you do with its stocks.

JSWINFRA reached its all-time high on Jul 4, 2024 with the price of 360.95 INR, and its all-time low was 142.20 INR and was reached on Oct 3, 2023. View more price dynamics on JSWINFRA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

JSWINFRA stock is 1.86% volatile and has beta coefficient of 1.51. Track JSW Infrastructure Limited stock price on the chart and check out the list of the most volatile stocks — is JSW Infrastructure Limited there?

Today JSW Infrastructure Limited has the market capitalization of 608.48 B, it has decreased by −3.67% over the last week.

Yes, you can track JSW Infrastructure Limited financials in yearly and quarterly reports right on TradingView.

JSW Infrastructure Limited is going to release the next earnings report on Jan 30, 2026. Keep track of upcoming events with our Earnings Calendar.

JSW Infrastructure Limited revenue for the last quarter amounts to 12.66 B INR, despite the estimated figure of 12.36 B INR. In the next quarter, revenue is expected to reach 13.60 B INR.

JSWINFRA net income for the last quarter is 3.61 B INR, while the quarter before that showed 3.85 B INR of net income which accounts for −6.09% change. Track more JSW Infrastructure Limited financial stats to get the full picture.

Yes, JSWINFRA dividends are paid annually. The last dividend per share was 0.80 INR. As of today, Dividend Yield (TTM)% is 0.28%. Tracking JSW Infrastructure Limited dividends might help you take more informed decisions.

JSW Infrastructure Limited dividend yield was 0.25% in 2024, and payout ratio reached 11.00%. The year before the numbers were 0.22% and 9.14% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 7, 2025, the company has 6.37 K employees. See our rating of the largest employees — is JSW Infrastructure Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. JSW Infrastructure Limited EBITDA is 24.18 B INR, and current EBITDA margin is 51.00%. See more stats in JSW Infrastructure Limited financial statements.

Like other stocks, JSWINFRA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade JSW Infrastructure Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So JSW Infrastructure Limited technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating JSW Infrastructure Limited stock shows the sell signal. See more of JSW Infrastructure Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.