NIFTY2! trade ideas

Nifty Weekly Complete Analysis (10.08.2025)the market looks bulish in the long term and short time period looks stlightly bearsh sideways for correction point of view and maybe the sideways market contineus about 18 months approx this is one of the posibility only anything can happen in the market so very cautious about the view i am very aware of market changes so done hope on anything alway flexible to change the views and in this chart note the levels as the price reaction and plan accordinly to these levels.

Intraday Plan for Monday 11 AugustTrade Plan – NIFTY FUTURE 15-Min Chart

Current Context:

Price is trading near a key demand/support zone around 24,400 -24,420. (blue zone)

There’s visible selling pressure from the recent swing high, but we’re at an important decision area where a bounce or breakdown can occur.

Volume profile shows high activity near 24,500 and 24,440 zones.

Possible Scenarios:

Bullish Scenario (Reversal / Pullback Play)

If price holds above 24,420 and shows strong bullish candles, look for a pullback entry toward 24,440.

First target: 24,480 supply zone

Second target: 24,500–24,520 high volume node / strong resistance

Watch for rejection at these levels for profit booking.

Alternate Bullish Continuation

If price quickly reclaims 24,480 supply zone with momentum, expect a rally toward 24,520–24,560.

This would require strong buying interest.

Bearish Scenario (Breakdown Play)

If price breaks below 24,400/420 with strong volume, expect a continuation toward 24,380, then 24,340–24,320.

Look for short entries on pullbacks to broken support.

Key Levels

Support: 24,420 → 24,380 → 24,340–24,320

Resistance: 24,440 → 24,480 → 24,500–24,520

Scenarios

Bullish Bounce – Hold above 24,420 → Target 24,480 / 24,520

Bearish Breakdown – Break below 24,420 → Target 24,380 / 24,340 / 24,320

Strong Bullish Continuation – Break & sustain above 24,480 → Target 24,520–24,560

Disclaimer:

This trade plan is for educational purposes only and does not constitute financial or investment advice. Trading in the stock market involves substantial risk, including the risk of loss. Always conduct your own research and consult with a qualified financial advisor before making trading decisions. You are solely responsible for your own trades and risk management.

Intraday set up for 7th August 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

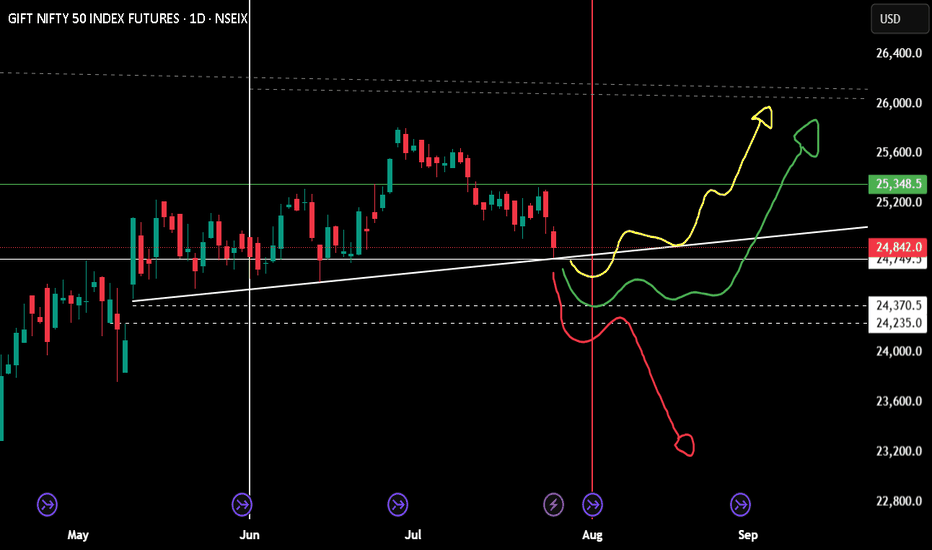

GIFT NIFTY @ 24683 ANALYSIS 04-AUG-2025: BIGGER PICTURESupports: 24577/24421/24234

Resistances: 24970/25325/24639/24800

As long as the above support levels hold, we can see big bull run towards 27500 first.

Targets: 25855, 26655, 27577

27934-28770

29234

30000-30500-31350

On the downside, if break 24421/24234, we can see 23800, 23355, 23000.

I think it's today.I admit that today's Nifty surpassed below yesterday's 24800 level, and my rash assumption that this level would act as a strong reversal support was wrong. But my overall opinion hasn't changed: there's a good chance the market will correct this whole wave 1 decline if the GIFT Nifty support level of 25620 isn't broken by tomorrow.

Monthly position for niftyExpecting a reversal, yes geo political and 1st August announcement will play a major role.

just wait for one day candle closing on your area.

If you wish to be on buying side (buy nifty future) a positive candle on top of the trend line.

Selling future for the month is only wise if 24k is crossed. Technically a bounce is expected and hopefully a green candle for August month.

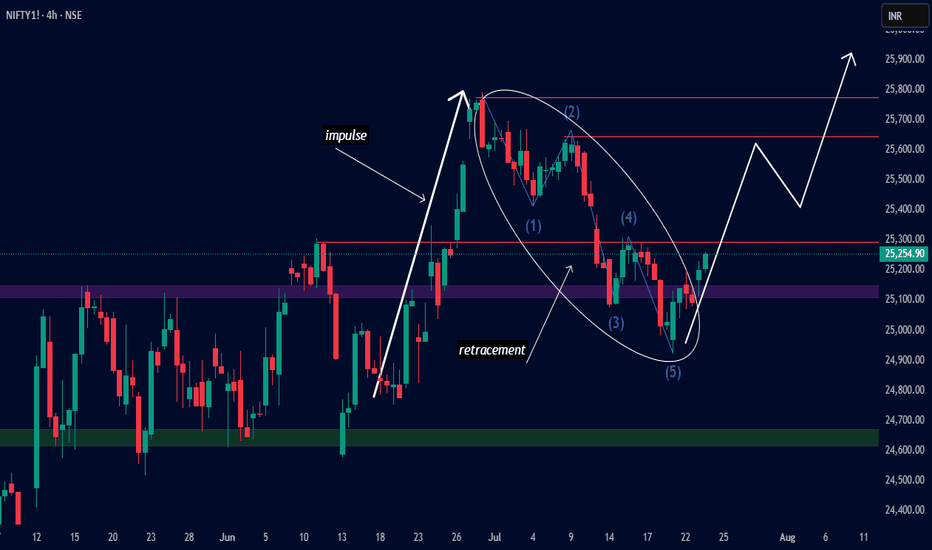

NIFTY 4H – Impulse & Retracement Complete | Bullish Move Ahead?Hello friends this is nifty futures chart

The recent 5-wave corrective structure (Elliott Wave) seems to have completed near the Flip Zone, with Wave (5) marking a potential bullish reversal point.

Key Observations:

Strong impulse move followed by a 5-wave retracement

Price reversed from previous accumulation zone

Structure suggests a potential bullish continuation

Targeting zone near 25,800–25,900

Let’s see if the bulls can take control from here! 🐂