NZDCAD trade ideas

Bullish rise?NZD/CAD has bounced off the pivot and could rise to the 1st resistance.

Pivot: 0.81602

1st Support: 0.81199

1st Resistance:0.82167

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

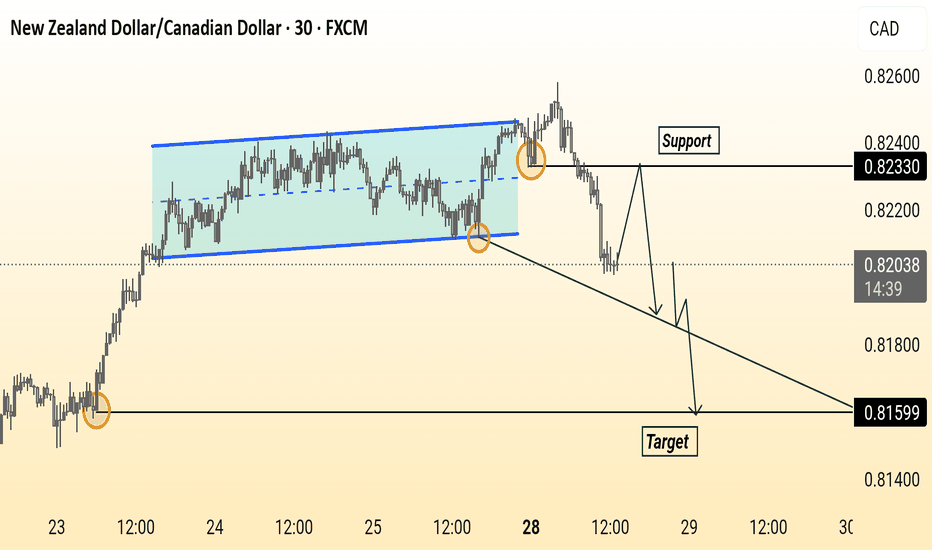

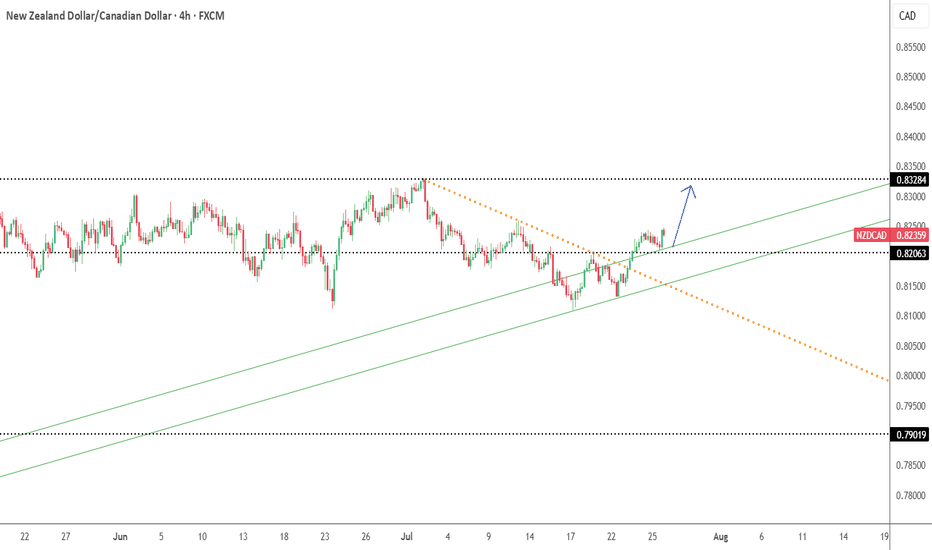

NZD-CAD Bullish Flag Breakout! Buy!

Hello,Traders!

NZD-CAD made a bullish

Breakout from the bullish

Flag pattern and the breakout

Is confirmed so we are

Bullish biased and we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

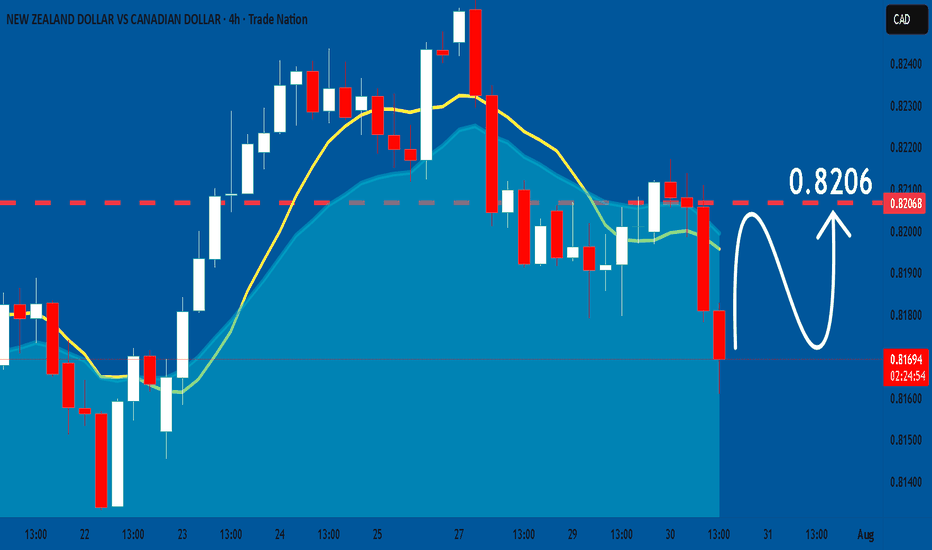

NZDCAD SHORT Market structure bearish on HTFs DW

Entry at both weekly and daily

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Daily EMA retest

Previous Structure point Daily

Around Psychological Level 0.82000

H4 Candlestick rejection

Levels 3.23

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

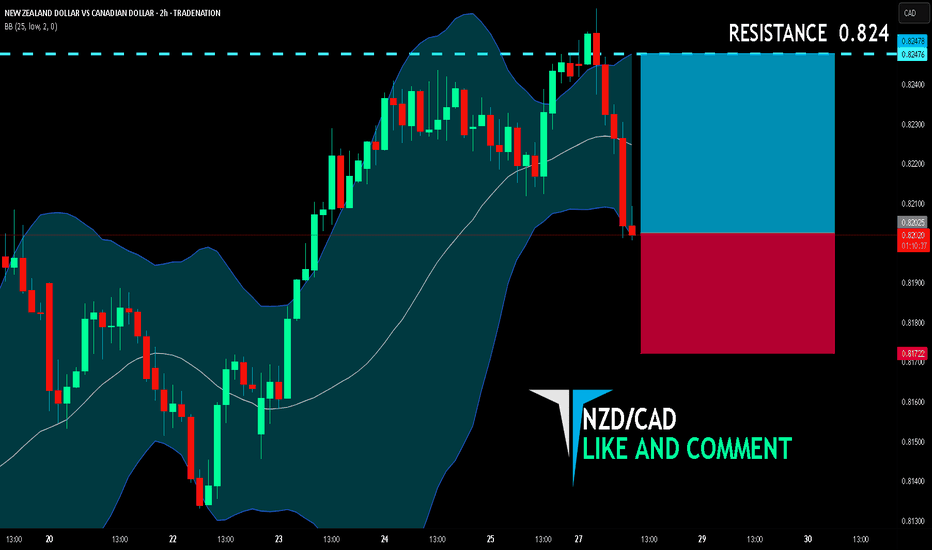

NZD/CAD SENDS CLEAR BEARISH SIGNALS|SHORT

NZD/CAD SIGNAL

Trade Direction: short

Entry Level: 0.815

Target Level: 0.811

Stop Loss: 0.819

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 4h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZDCAD – Range Play with a Bullish Twist NZDCAD – Range Play with a Bullish Twist 🎯

Some trades aren't about chasing breakouts — they’re about precision timing. NZDCAD is stuck in a clear range, but the opportunity is at the bottom. Price is sitting right at demand, momentum is starting to turn up, and fundamentals give the bulls a reason to step in. This could be a quiet accumulation before the move.

📈 I’m bullish on NZDCAD — looking to buy at the bottom of the range.

Here’s why this setup has potential:

Strong demand zone holding price 📍

Range structure gives defined risk/reward 🎯

Bullish momentum building from oversold levels 🔄

CAD sentiment is soft amid trade concerns 📉

NZ fundamentals improving despite mixed sentiment ✅

New Zealand’s economy is slowly rebuilding momentum. Business confidence just hit an 11-year high, inflation is crawling back into target, and while the RBNZ has paused, the outlook isn’t overly dovish. Yes, further cuts are possible, but the currency has shown resilience — holding above 0.60 even in choppy conditions.

On the other side, CAD is vulnerable. Canada's GDP dipped in April and May, and while jobs data was solid in June, oil prices and trade tariffs continue to cloud the outlook. Speculators have ramped up short bets on the CAD, and that bearish tone might keep a lid on any strength — especially if US tariffs remain in play.

This is a classic buy-low setup. We’re at support, structure is intact, and both technical and macro factors are aligned.

Would you take this range buy — or wait for a breakout? Let’s compare notes.

NZD/CAD - Triangle Breakout (05.08.2025)The NZD/CAD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 0.8096

2nd Support – 0.8087

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

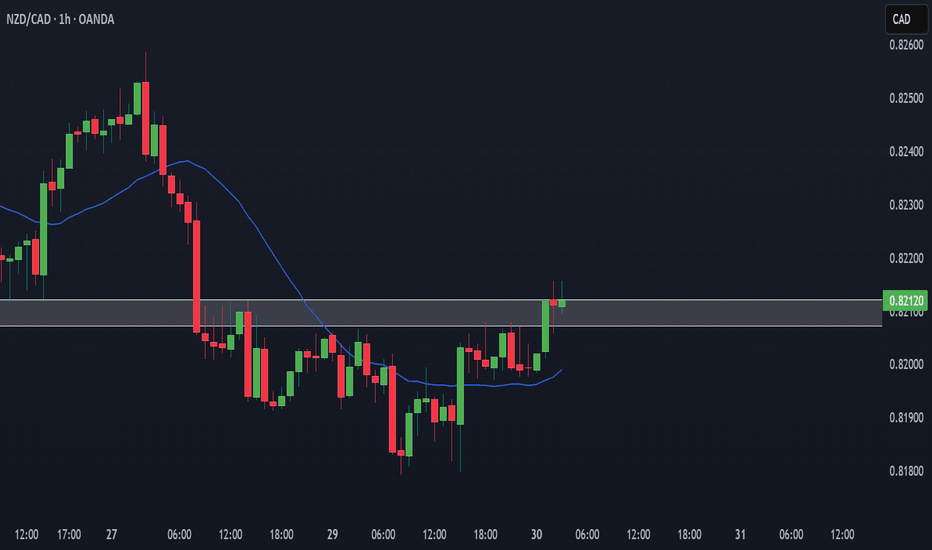

NZD-CAD Will Go UP! Buy!

Hello,Traders!

NZD-CAD made a retest

Of the horizontal support level

Of 0.8125 from where we

Are already seeing a nice

Bullish rebound so we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

(art📊 Smart Money Concept Trade Setup (NZD/CAD – 30-Min Chart)

🧠 Market Structure Overview:

Price initially formed a Lower Low (left side of the chart).

Then, price made a clear Break of Structure (BOS) to the upside, creating a Higher High.

An IDM indicates price manipulation and confirms liquidity resting above the recent high (target).

🔍 Entry Plan:

📉 Price is currently dropping towards a marked 30-minute POI (Point of Interest) — a Demand Zone.

⏳ Once price enters this 30M POI zone, switch to the 5-minute or 1-minute timeframe for confirmation.

🔁 Look for a CHoCH (Change of Character) within the POI on the lower timeframe — this shows bullish intent and potential reversal.

📥 Enter a Buy trade right after CHoCH confirmation:

Stop Loss (SL): Just below the POI/Demand zone.

Take Profit (TP): At the Targeted High marked above (where external liquidity sits).

📐 Risk:Reward Details:

This setup offers a minimum 1:5 RR (Risk to Reward).

SL: Below the 30M POI.

TP: Just above the previous high (liquidity grab zone).

✅ Entry Checklist (English)

Entry Condition Status

Price entered 30M POI? ✅

CHoCH confirmed on 5M/1M? ✅

Bullish BOS or structure break visible? ✅

Risk:Reward at least 1:5? ✅

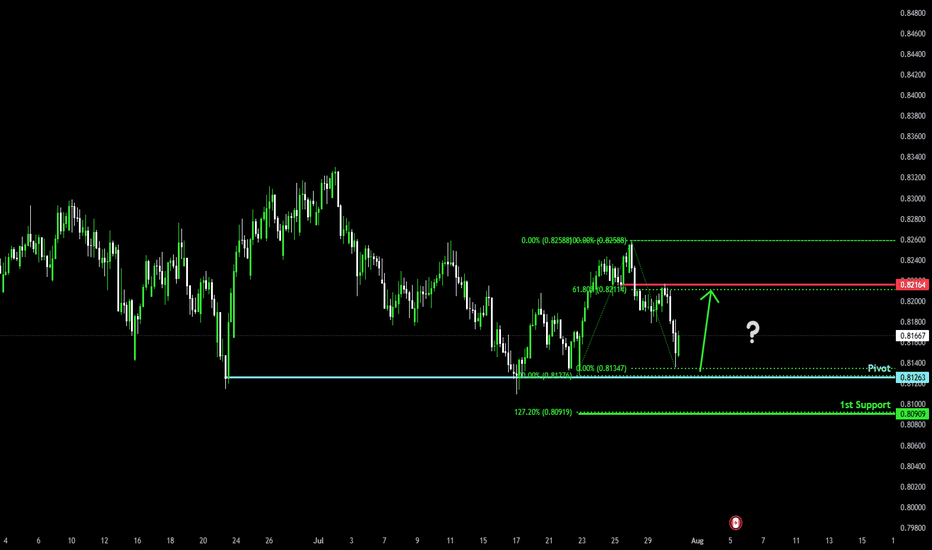

Bullish reversal?NZD/CAD is falling towards the pivot an could bounce to the 1st resistance.

Pivot: 0.81263

1st Support: 0.80909

1st Resistance: 0.82164

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDCAD; Heikin Ashi Trade IdeaIn this video, I’ll be sharing my analysis of NZDCAD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

NZDCAD: Bullish Continuation is Expected! Here is Why:

The analysis of the NZDCAD chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

A Top Down Approach will help you spot quality tradesAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

NZD/CAD BULLS ARE GAINING STRENGTH|LONG

NZD/CAD SIGNAL

Trade Direction: long

Entry Level: 0.820

Target Level: 0.824

Stop Loss: 0.817

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

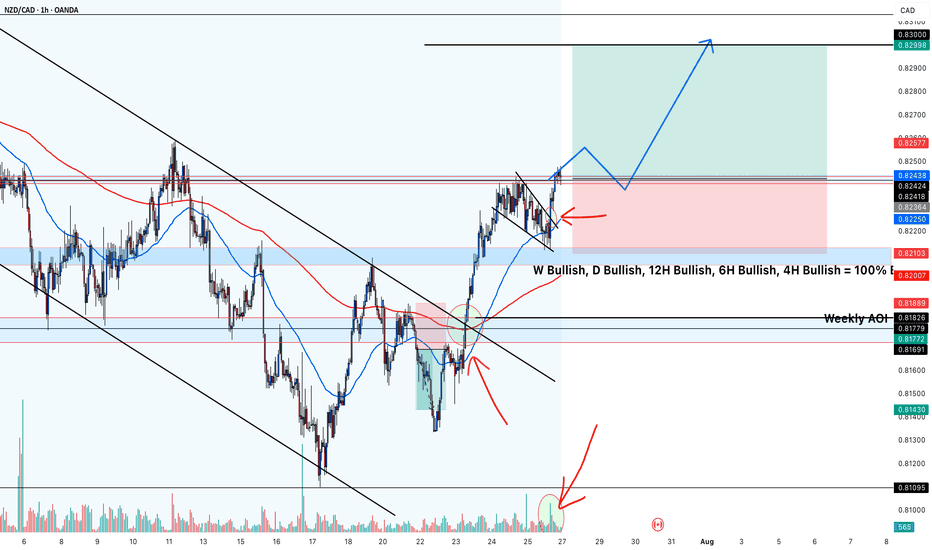

NZDCAD Long Now!📌 Instrument & Timeframe

NZD/CAD – 4H timeframe

Overall trend across multiple timeframes is noted as bullish (W, D, 12H, 6H, 4H all bullish).

📈 Market Structure

Price previously moved within a descending channel (drawn by two black trendlines) but has broken out to the upside.

After the breakout, price retraced back near a key area (just above the 200 EMA / red line) and is forming a smaller bull flag or descending wedge, indicating a potential continuation.

🔥 Area of Interest

Weekly AOI (Area of Interest) marked around 0.8180 – 0.8200 zone has acted as strong support.

Price reacted bullishly from that AOI, confirming buyers stepped in.

✅ Trade Bias

All higher timeframes (W, D, 12H, 6H, 4H) are bullish, so the bias is long.