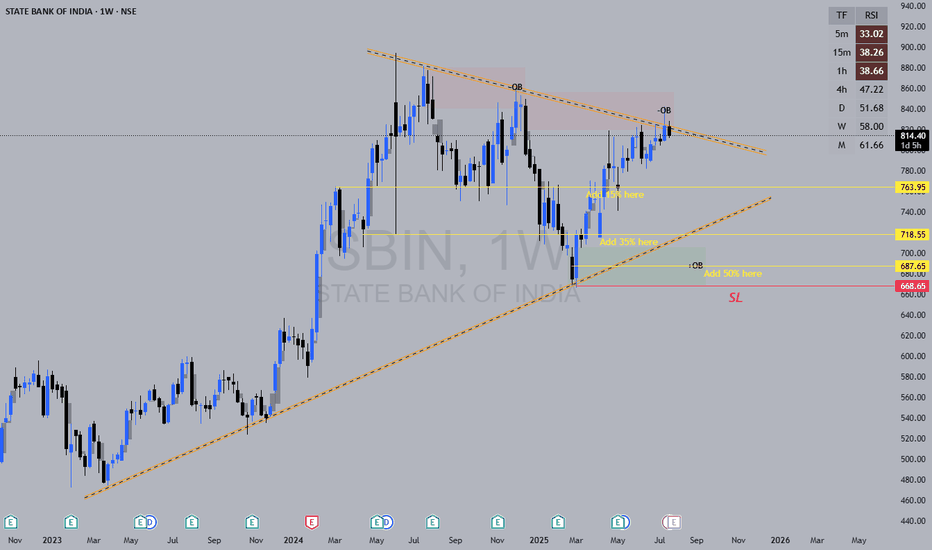

A nice 2.5:1 Risk:Reward available on a very stable security.It's State Bank of India. Can be considered relatively stable.

VSA Getting compressed. Ready to release.

Green VWAP from All time high of Jun 24.

Red VWAP from Swing low of March 25 since when the stock has stayed bullish.

With overall trend supporting, one can plan a simple 1 month position trade with 2.5:1 risk to reward ratio.

Only a study, not an advice.

Trade ideas

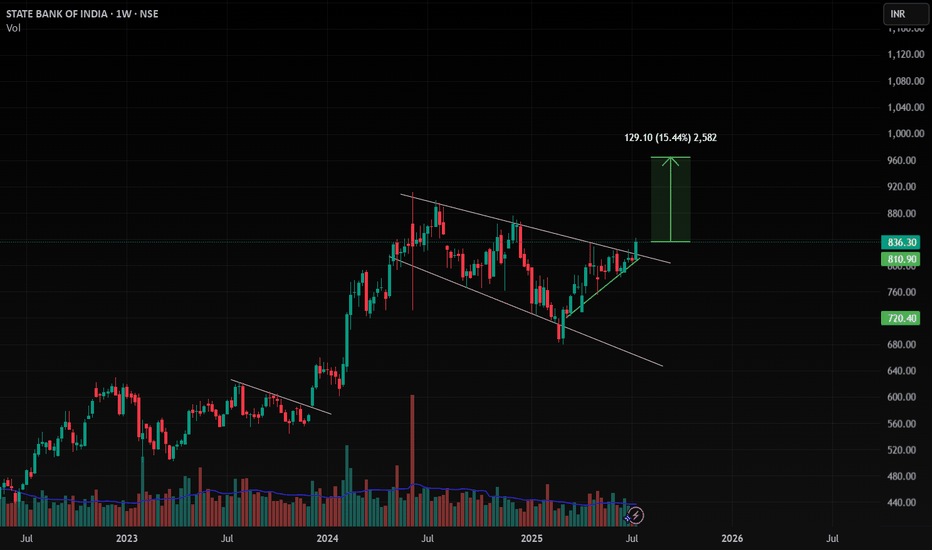

Public bank-SBINSBIN – Largest Public Sector Bank

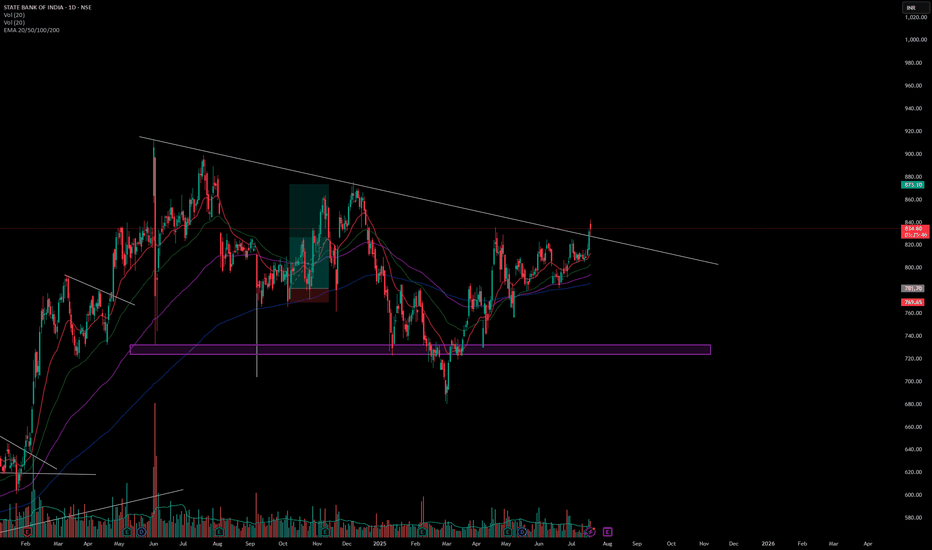

On the chart from 2022, we observed a consolidation phase, after which SBIN moved up by almost 70%. From April 2024, it declined roughly 22%.

All public sector banks behaved in a similar manner, though the percentage returns varied.

Currently, the banks are again in a consolidation phase. From here, the move could be in either direction — we just need to observe what happens next and react accordingly.

Equity Finance is business of wait and observation .This is based on the weekly chart and is purely an observation.

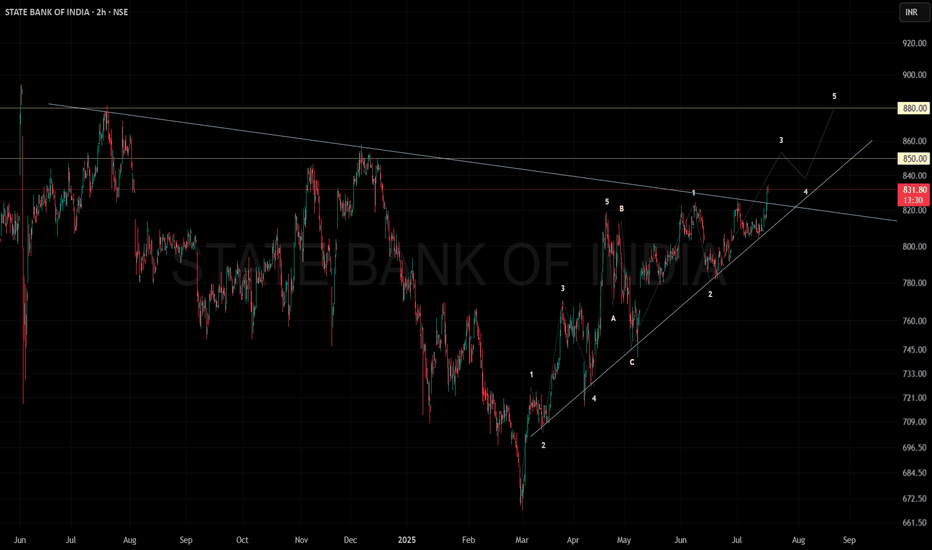

Weekly Analysis - Swing TradingHigh Beta Stocks Analysis – Coming Week

Based on Ichimoku Lag Span, RSI>60, SMA 9, and Fractals (Current Swing High and Low)

1. SBIN - Long

2. Asian Paints - Long

3. Muthoot Finance - Long

4. Tata Steel – Short Sell Futures or PE 150

5. Eternal LTD – Long

6. Kotak Mahindra Bank – Short Sell or PE 1950

7. Apollo Hospital – Long

8. Heromoto – Long after some pullback or near Fractal Support

9. Maruti Suzuki – Long

10. Mannapuram Finance

Kindly check last post to understand setup.

Importance of ATR(Average True Range)So idea here is to calculate risk.

understanding fear in the market ATR is an indication of volatility , not direction.

A smaller ATR range means low volatility.. tentatively market is consolidating.

A larger ATR range means the market is dealing with uncertainty so volatility has increased.

you can see the value of ATR on your chart.

the value of past ATR14period value is be greater than current ATR14 Period to take risk on a trades. it will help you reduce risk.

SBI - My Pick - No Financial Advice - VCP PatternAfter a recent upside rally SBI has retraced approx 8.5% from the resistance zone of 825-830, theafter second compression of 5% occurred. Thus I see sucessive Volatility contraction. Recent Golden Cross over clubbed with VCP is indication of good buying opportunity. Short to mid-term momentum is bullish, underpinned by strong moving averages and recent bullish crossover. My entry depends upon good bullish close with good volumes.

SBIN Weekly Levels and reportLook at the Weekly Chart:

This will show you how SBIN’s price has moved each week.

Identify Support and Resistance:

Support is where the price usually doesn’t fall below (like a floor).

Resistance is where the price often doesn’t go higher than (like a ceiling).

Example: If SBIN’s price bounced off ₹590 a few times, that’s support. If the price keeps struggling around ₹640-650, that’s resistance.

Check for Fibonacci Levels (Optional):

You can use a tool that shows you Fibonacci retracement levels. It helps find where prices might bounce or reverse.

Key levels to watch for are 38.2%, 50%, and 61.8% retracements from a big move (up or down).

Draw Trendlines:

If SBIN has been moving up, draw a line connecting the lows to see where it might find support in the future.

If it’s in a downtrend, connect the highs to see where resistance might be.

Check the Moving Averages:

The 50-week and 200-week moving averages can show if the stock is generally moving up or down.

If SBIN is above the 50-week average, it might be in a bullish (up) trend.

If it’s below the 200-week average, it might be in a bearish (down) trend.

Look for Round Numbers:

Prices like ₹600, ₹650, ₹700 are often seen as psychological levels. Traders often watch these prices because they’re easy to remember.

Example:

If SBIN recently bounced off ₹590 or ₹600 multiple times, that’s support.

If it keeps facing resistance around ₹640 or ₹650, those are resistance levels.

Final Thoughts:

If SBIN’s price breaks above resistance (say ₹650), it might go higher.

If it falls below support (say ₹590), it might drop further.

State Bank of India view for Intraday 20th May #SBIN State Bank of India view for Intraday 20th May #SBIN

Resistance 810 Watching above 811 for upside momentum.

Support area 780 Below 800 ignoring upside momentum for intraday

Watching below 778 for downside movement...

Above 800 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

State Bank of India view for Intraday 15th May #SBIN State Bank of India view for Intraday 15th May #SBIN

Resistance 810 Watching above 811 for upside momentum.

Support area 780 Below 800 ignoring upside momentum for intraday

Watching below 778 for downside movement...

Above 790 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point