Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

24.75 INR

39.73 B INR

509.82 B INR

730.35 M

About Petronet Lng Limited

Sector

Industry

CEO

Akshay Kumar Singh

Website

Headquarters

New Delhi

Founded

1998

ISIN

INE347G01014

FIGI

BBG000F53ZW5

Petronet LNG Ltd. engages in the import and re-gasification of liquefied natural gas. It owns and operates liquefied natural gas regasification terminal at Dahej and also setting up another greenfield liquefied natural gas regasification terminal at Kochi. The company was founded on April 2, 1998 and is headquartered in New Delhi, India.

Related stocks

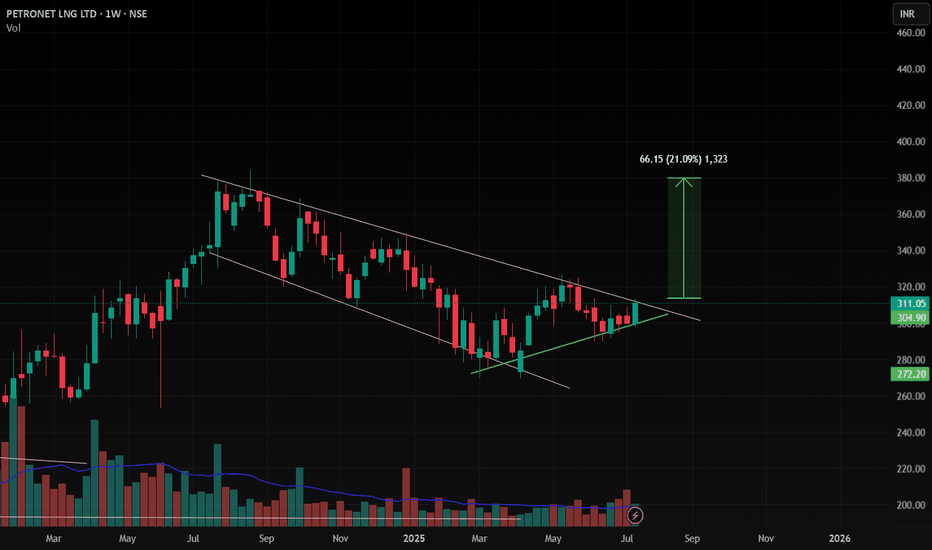

Accumulation zone spotted in Petronet LNG.Petronet LNG is currently taking support on its long-term support zone, with immediate support near ₹250.

In a worst-case scenario, the major support zone lies between ₹160–₹180.

On the weekly timeframe, the RSI is also taking support, reflecting potential strength at lower levels.

The stock cont

Pteronet Lng bullish Pole and FlagEntry- 303-304

Support- 298-300

Target- 310, 312, 315

Pattern- Bullish Pole N Flag in 1hr Time Frame and a bullish engulfing candlestick.

Disclaimer- This is just for educational purpose please take advice from you own financial advisor before making any decision.

Note- Market sentiment is bearis

Cup and Handle Breakout in PETRONETPETRONET has formed a classic Cup and Handle pattern on the hourly chart, signaling a potential bullish breakout.

Pattern Breakdown:

Cup Formation: A smooth rounding bottom from ₹310 to ₹337, indicating strong accumulation.

Handle Formation: A slight retracement near ₹330, forming a consolidation z

SWING IDEA - PETRONET LNGThis presents an attractive opportunity for swing traders to capitalize on the potential uptrend in Petronet LNG .

Reasons are listed below :

Breakout of Strong Resistance at 300 : Petronet LNG has successfully broken above a significant resistance level at 300, signaling potential bullish mom

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PETRONET is 278.95 INR — it has increased by 1.62% in the past 24 hours. Watch Petronet Lng Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Petronet Lng Limited stocks are traded under the ticker PETRONET.

PETRONET stock has risen by 3.24% compared to the previous week, the month change is a 0.07% rise, over the last year Petronet Lng Limited has showed a −17.96% decrease.

We've gathered analysts' opinions on Petronet Lng Limited future price: according to them, PETRONET price has a max estimate of 410.00 INR and a min estimate of 255.00 INR. Watch PETRONET chart and read a more detailed Petronet Lng Limited stock forecast: see what analysts think of Petronet Lng Limited and suggest that you do with its stocks.

PETRONET reached its all-time high on Aug 21, 2024 with the price of 384.20 INR, and its all-time low was 6.00 INR and was reached on Mar 26, 2004. View more price dynamics on PETRONET chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PETRONET stock is 2.26% volatile and has beta coefficient of 0.93. Track Petronet Lng Limited stock price on the chart and check out the list of the most volatile stocks — is Petronet Lng Limited there?

Today Petronet Lng Limited has the market capitalization of 418.27 B, it has increased by 2.90% over the last week.

Yes, you can track Petronet Lng Limited financials in yearly and quarterly reports right on TradingView.

Petronet Lng Limited is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

PETRONET earnings for the last quarter are 5.67 INR per share, whereas the estimation was 6.19 INR resulting in a −8.39% surprise. The estimated earnings for the next quarter are 7.49 INR per share. See more details about Petronet Lng Limited earnings.

Petronet Lng Limited revenue for the last quarter amounts to 118.80 B INR, despite the estimated figure of 117.91 B INR. In the next quarter, revenue is expected to reach 124.79 B INR.

PETRONET net income for the last quarter is 8.42 B INR, while the quarter before that showed 10.95 B INR of net income which accounts for −23.11% change. Track more Petronet Lng Limited financial stats to get the full picture.

Petronet Lng Limited dividend yield was 3.41% in 2024, and payout ratio reached 37.76%. The year before the numbers were 3.80% and 41.07% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 5, 2025, the company has 2.75 K employees. See our rating of the largest employees — is Petronet Lng Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Petronet Lng Limited EBITDA is 51.21 B INR, and current EBITDA margin is 11.13%. See more stats in Petronet Lng Limited financial statements.

Like other stocks, PETRONET shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Petronet Lng Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Petronet Lng Limited technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Petronet Lng Limited stock shows the neutral signal. See more of Petronet Lng Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.