PRESTIGE ESTATESPrestige Estates Projects Ltd., incorporated in the year 1997, is a Mid Cap company (having a market cap of Rs 71,208.32 Crore) operating in Real Estate sector.

Prestige Estates Projects Ltd. key Products/Revenue Segments include Income from Sale of Commercial Flats, Shops & Plots, Property Developm

Prestige Estates Projects Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

22.55 INR

4.67 B INR

76.91 B INR

168.23 M

About Prestige Estates Projects Limited

Sector

Industry

Website

Headquarters

Bangalore

Founded

1997

IPO date

Oct 27, 2010

Identifiers

2

ISIN INE811K01011

Prestige Estates Projects Ltd. engages in the development, construction and leasing of properties. It operates through the following segments: Residential, Retail, Commercial/Office, Property Management and hospitality. The company was founded by Irfan Razack and Rezwan Razack on June 4, 1997 and is headquartered in Bangalore, India.

Related stocks

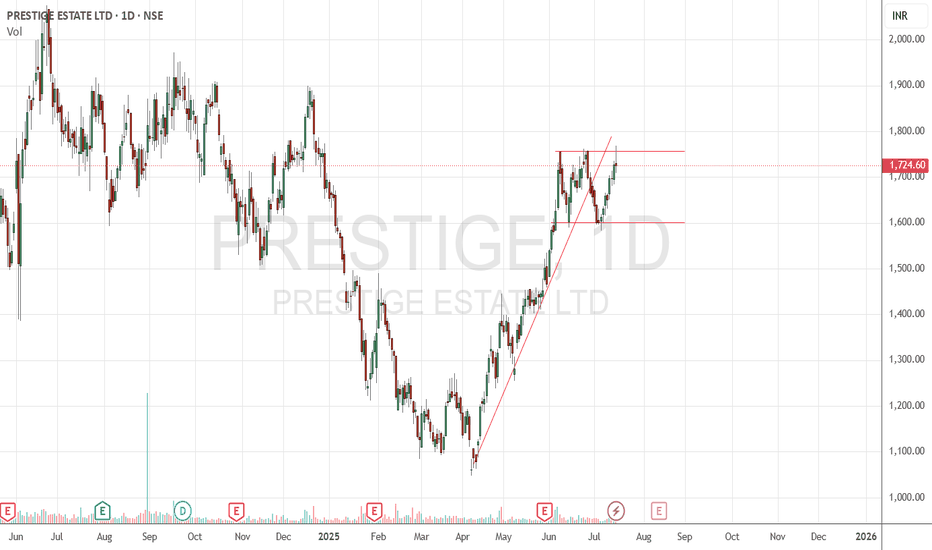

PRESTIGE | Buy @LTP | SL below 1550 | 1st Target 1920**************************************************************************

Disclaimer (Please Read Carefully):

This is not investment advice. The stocks shared here are purely for educational and informational purposes. Please do your own research or consult with a financial advisor before making

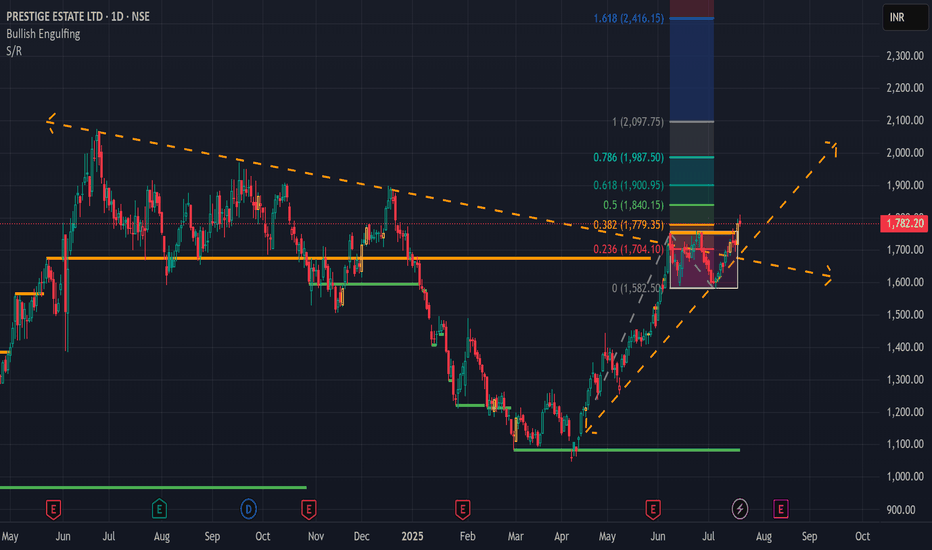

Prestige Estates: Weekly Trendline Breakout | Buy Setup 1,745BUY Setup 🏢

Entry: ₹1,737-1,745 (Current Level)

Target 1: ₹1,800-1,820

Target 2: ₹1,880-1,900

Target 3: ₹1,950-2,000 (Extended)

Stop Loss: ₹1,680

Technical Rationale:

Breaking above long-term descending trendline (from 2024 highs)

Price at critical resistance zone - potential breakout imminent

We

Prestige Ready for the Next RallyPrestige Estates Projects Ltd is one of India’s most diversified real estate developers with a strong footprint across residential, commercial, retail, and hospitality segments. The company continues to benefit from robust housing demand and consistent project execution.

Reported record sales of ₹1

Amazing breakout on WEEKLY Timeframe - PRESTIGECheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the break

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PRESTIGE is 1,572.70 INR — it has decreased by −1.55% in the past 24 hours. Watch Prestige Estates Projects Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Prestige Estates Projects Limited stocks are traded under the ticker PRESTIGE.

PRESTIGE stock has risen by 3.20% compared to the previous week, the month change is a 4.85% rise, over the last year Prestige Estates Projects Limited has showed a 20.05% increase.

We've gathered analysts' opinions on Prestige Estates Projects Limited future price: according to them, PRESTIGE price has a max estimate of 2,300.00 INR and a min estimate of 1,350.00 INR. Watch PRESTIGE chart and read a more detailed Prestige Estates Projects Limited stock forecast: see what analysts think of Prestige Estates Projects Limited and suggest that you do with its stocks.

PRESTIGE reached its all-time high on Jun 24, 2024 with the price of 2,074.80 INR, and its all-time low was 57.55 INR and was reached on Dec 20, 2011. View more price dynamics on PRESTIGE chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PRESTIGE stock is 2.40% volatile and has beta coefficient of 2.24. Track Prestige Estates Projects Limited stock price on the chart and check out the list of the most volatile stocks — is Prestige Estates Projects Limited there?

Today Prestige Estates Projects Limited has the market capitalization of 687.77 B, it has increased by 3.15% over the last week.

Yes, you can track Prestige Estates Projects Limited financials in yearly and quarterly reports right on TradingView.

Prestige Estates Projects Limited is going to release the next earnings report on Jun 2, 2026. Keep track of upcoming events with our Earnings Calendar.

PRESTIGE earnings for the last quarter are 5.20 INR per share, whereas the estimation was 14.85 INR resulting in a −64.98% surprise. The estimated earnings for the next quarter are 9.76 INR per share. See more details about Prestige Estates Projects Limited earnings.

Prestige Estates Projects Limited revenue for the last quarter amounts to 38.73 B INR, despite the estimated figure of 29.49 B INR. In the next quarter, revenue is expected to reach 28.20 B INR.

PRESTIGE net income for the last quarter is 2.23 B INR, while the quarter before that showed 4.30 B INR of net income which accounts for −48.27% change. Track more Prestige Estates Projects Limited financial stats to get the full picture.

Yes, PRESTIGE dividends are paid annually. The last dividend per share was 1.80 INR. As of today, Dividend Yield (TTM)% is 0.11%. Tracking Prestige Estates Projects Limited dividends might help you take more informed decisions.

Prestige Estates Projects Limited dividend yield was 0.15% in 2024, and payout ratio reached 16.09%. The year before the numbers were 0.15% and 5.25% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 13, 2026, the company has 9.51 K employees. See our rating of the largest employees — is Prestige Estates Projects Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Prestige Estates Projects Limited EBITDA is 37.06 B INR, and current EBITDA margin is 38.95%. See more stats in Prestige Estates Projects Limited financial statements.

Like other stocks, PRESTIGE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Prestige Estates Projects Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Prestige Estates Projects Limited technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Prestige Estates Projects Limited stock shows the buy signal. See more of Prestige Estates Projects Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.