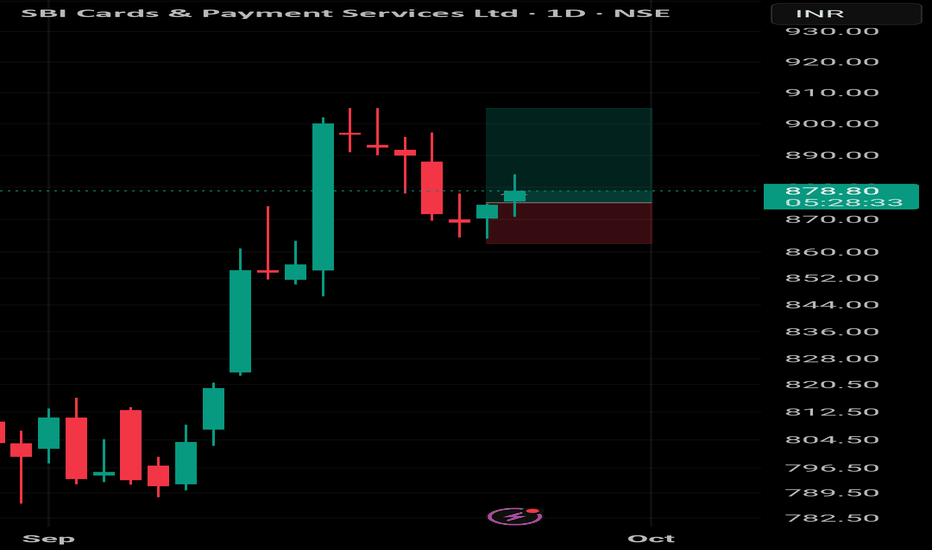

SBI CardsSBI Cards (Monthly): Structural Foundation & The Road to Ultimate Objective 🚀

Description :

"Analyzing the macro structure of SBI Cards & Payment Services Ltd on the Monthly timeframe, the stock has initiated a significant structural turnaround after a prolonged correction phase.

1. The Structu

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

22.00 INR

19.16 B INR

180.77 B INR

298.95 M

About SBI Cards & Payment Services Ltd

Sector

Industry

CEO

Salila Pande

Website

Headquarters

Gurgaon

Founded

1998

IPO date

Mar 16, 2020

Identifiers

2

ISIN INE018E01016

SBI Cards & Payment Services Ltd. engages in the business of issuing credit cards to consumers in India. It provides a co-brand credit card for doctors which offers medical professional liability insurance to cardholders. The company was founded in 1998 and is headquartered in Gurgaon, India.

Related stocks

Long SBICARD a medium term trade ideaNSE:SBICARD is showing beautiful outperformance on charts compared to indices NSE:CNXFINANCE in last few weeks, above all moving averages, long due underformer

This might go for few more rounds of support retesting but eventually poised to move near 900 and above. One can buy with time horizon o

SBICARD: Bullish Butterfly Harmonic Pattern - @Godfreystocks77Technical Analysis

The butterfly pattern is forming, with the PRZ at 882 as the 1.272 extension of the XA leg from the recent drop to 914.50 (July 2 close). With the stock at 909.30, it’s near support around 900-905. A reversal zone (e.g., 905-900) is key for entry confirmation—look for a bullish

Bull divergence at lower level , means bulls for coming back.Here we are going for long in SBICARD through its running in all time high. it's showing bullishness. So, a long trade should be initiated here by seeing RSI indicator there it's running above 50 level means bullishness can be seen in this stock.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

955SCPSL29

SBI Cards and Payment Services Limited 9.55% 29-JAN-2029Yield to maturity

5.90%

Maturity date

Jan 29, 2029

829SBICP34

SBI Cards and Payment Services Limited 8.29% 28-FEB-2034Yield to maturity

—

Maturity date

Feb 28, 2034

705SCPSL28

SBI Cards and Payment Services Limited 7.05% 28-JUL-2028Yield to maturity

—

Maturity date

Jul 28, 2028

785SCPSL28

SBI Cards and Payment Services Limited 7.85% 17-MAY-2028Yield to maturity

—

Maturity date

May 17, 2028

899SCPSL29

SBI Cards and Payment Services Limited 8.99% 12-JUN-2029Yield to maturity

—

Maturity date

Jun 12, 2029

825SCPSL32

SBI Cards and Payment Services Limited 8.25% 30-JUN-2032Yield to maturity

—

Maturity date

Jun 30, 2032

825SCPSL34

SBI Cards and Payment Services Limited 8.25% 08-AUG-2034Yield to maturity

—

Maturity date

Aug 8, 2034

833SBICS34

SBI Cards and Payment Services Limited 8.33% 24-JAN-2034Yield to maturity

—

Maturity date

Jan 24, 2034

See all SBICARD bonds

Frequently Asked Questions

The current price of SBICARD is 760.70 INR — it has decreased by −1.57% in the past 24 hours. Watch SBI Cards & Payment Services Ltd stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange SBI Cards & Payment Services Ltd stocks are traded under the ticker SBICARD.

SBICARD stock has risen by 1.56% compared to the previous week, the month change is a −10.77% fall, over the last year SBI Cards & Payment Services Ltd has showed a −7.79% decrease.

We've gathered analysts' opinions on SBI Cards & Payment Services Ltd future price: according to them, SBICARD price has a max estimate of 1,026.00 INR and a min estimate of 650.00 INR. Watch SBICARD chart and read a more detailed SBI Cards & Payment Services Ltd stock forecast: see what analysts think of SBI Cards & Payment Services Ltd and suggest that you do with its stocks.

SBICARD reached its all-time high on Sep 1, 2021 with the price of 1,165.00 INR, and its all-time low was 495.00 INR and was reached on May 22, 2020. View more price dynamics on SBICARD chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SBICARD stock is 2.28% volatile and has beta coefficient of 0.99. Track SBI Cards & Payment Services Ltd stock price on the chart and check out the list of the most volatile stocks — is SBI Cards & Payment Services Ltd there?

Today SBI Cards & Payment Services Ltd has the market capitalization of 723.68 B, it has increased by 1.11% over the last week.

Yes, you can track SBI Cards & Payment Services Ltd financials in yearly and quarterly reports right on TradingView.

SBI Cards & Payment Services Ltd is going to release the next earnings report on Apr 24, 2026. Keep track of upcoming events with our Earnings Calendar.

SBICARD earnings for the last quarter are 5.85 INR per share, whereas the estimation was 6.26 INR resulting in a −6.62% surprise. The estimated earnings for the next quarter are 6.79 INR per share. See more details about SBI Cards & Payment Services Ltd earnings.

SBI Cards & Payment Services Ltd revenue for the last quarter amounts to 51.27 B INR, despite the estimated figure of 46.59 B INR. In the next quarter, revenue is expected to reach 45.84 B INR.

SBICARD net income for the last quarter is 5.57 B INR, while the quarter before that showed 4.45 B INR of net income which accounts for 25.15% change. Track more SBI Cards & Payment Services Ltd financial stats to get the full picture.

SBI Cards & Payment Services Ltd dividend yield was 0.28% in 2024, and payout ratio reached 12.41%. The year before the numbers were 0.37% and 9.84% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 15, 2026, the company has 35.68 K employees. See our rating of the largest employees — is SBI Cards & Payment Services Ltd on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SBI Cards & Payment Services Ltd EBITDA is 80.30 B INR, and current EBITDA margin is 33.73%. See more stats in SBI Cards & Payment Services Ltd financial statements.

Like other stocks, SBICARD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SBI Cards & Payment Services Ltd stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SBI Cards & Payment Services Ltd technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SBI Cards & Payment Services Ltd stock shows the sell signal. See more of SBI Cards & Payment Services Ltd technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.