State Bank of India SBIN– Bullish Buy on Dips StrategyTimeframe: Daily

Trend: Primary uptrend intact

SBI continues to trade within a rising trend structure, respecting the ascending trendline formed from previous higher lows. Price has retraced after a strong impulse move and is currently hovering near a confluence support zone, making this a classic

State Bank of India

No trades

Key facts today

State Bank of India (SBI) shares rose 21% in 2026, driven by strong December quarter results, with analysts keeping a 'Buy' rating and target prices up to Rs 1,300.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.53 USD

9.17 B USD

77.85 B USD

About State Bank of India

Sector

Industry

CEO

Rana Ashutosh Kumar Singh

Website

Headquarters

Mumbai

Founded

1921

IPO date

Nov 3, 1994

Identifiers

3

ISIN US8565522039

State Bank of India engages in the provision of public sector banking, and financial services statutory body. It operates through the following segments: Treasury, Corporate/Wholesale Banking, Retail Banking, and Other Banking Business. The Treasury segment includes the investment portfolio and trading in foreign exchange contracts and derivative contracts. The Corporate/Wholesale Banking segment consists of lending activities of Corporate Accounts Group, Commercial Clients Group, and Stressed Assets Resolution Group that provides loans and transaction services to corporate and institutional clients and further include non-treasury operations of foreign offices. The Retail Banking segment refers to the retail branches, which primarily includes personal banking activities including lending activities to corporate customers. The Other Banking business segment focuses on the operations of all the non-banking subsidiaries and joint ventures of the group. The company was founded on January 27, 1921 and is headquartered in Mumbai, India.

Related stocks

SBIN - STWP Equity Snapshot📊 SBIN – STWP Equity Snapshot

Ticker: NSE: SBIN

Sector: 🏦 Banking (PSU)

CMP: 1,055.00 ▲ (+2.30% | 27 Jan 2026)

Learning Rating: ⭐⭐⭐⭐☆ (Bullish with Momentum Strength)

Chart Pattern Observed: 📈 Continuation Structure with Breakout Attempt

Candlestick Pattern Observed: Strong Bullish Expansion Candle

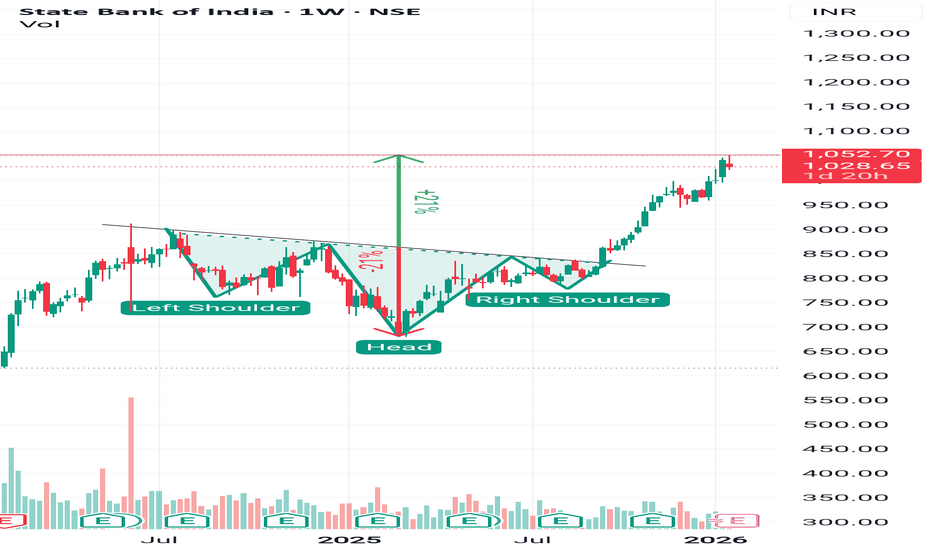

SBI - Powerful Inverse Head & Shoulders Breakout RecoveryA textbook example of an Inverse Head and Shoulders breakout on the weekly chart of SBI. The stock successfully achieved the measured move target of +21% following the neckline breach. Currently, it is showing strong momentum supported by short-term EMAs.

State Bank of India Ltd for 10th Dec #SBIN State Bank of India Ltd for 10th Dec #SBIN

Resistance 960 Watching above 961 for upside momentum.

Support area950-953 Below 950 gnoring upside momentum for intraday

Watching below 948 for downside movement...

Above 960 ignoring downside move for intraday

Charts for Educational purposes only.

Ple

SBIN Analysis for 04th Dec '25: IntraSwing & WEEKLY Levels

Published on Request of Follower.

SBIN Analysis for 04th Dec '25: IntraSwing Spot levels

WEEKLY Levels in Box Format . Can also used in Short to Medium Term Level

Weekly Level Screen Shot:

[ Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, i

State Bank of India Ltd for 6th Nov #SBIN State Bank of India Ltd for 6th Nov #SBIN

Resistance 960 Watching above 961 for upside momentum.

Support area 950-953 Below 950 gnoring upside momentum for intraday

Watching below 950 for downside movement...

Above 960 ignoring downside move for intraday

Charts for Educational purposes only.

Ple

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

770SBI38

State Bank of India 7.7% 19-JAN-2038Yield to maturity

8.34%

Maturity date

Jan 19, 2038

834SBIPERP

State Bank of India 8.34% PERPYield to maturity

7.92%

Maturity date

—

772SBIPER

State Bank of India 7.72% PERPYield to maturity

7.57%

Maturity date

—

751SBI32

State Bank of India 7.51% 06-DEC-2032Yield to maturity

7.32%

Maturity date

Dec 6, 2032

772SBI31

State Bank of India 7.72% PERPYield to maturity

7.30%

Maturity date

—

798SBIPERP

State Bank of India 7.98% PERPYield to maturity

7.26%

Maturity date

—

733SBI39

State Bank of India 7.33% 20-SEP-2039Yield to maturity

7.20%

Maturity date

Sep 20, 2039

755SBIPERP

State Bank of India 7.55% PERPYield to maturity

7.20%

Maturity date

—

775SBIPER

State Bank of India 7.75% PERPYield to maturity

7.15%

Maturity date

—

754SBI38

State Bank of India 7.54% 01-AUG-2038Yield to maturity

7.07%

Maturity date

Aug 1, 2038

680SBI35

State Bank of India 6.8% 21-AUG-2035Yield to maturity

6.07%

Maturity date

Aug 21, 2035

See all SBKFF bonds