VVV (VALVOLINE INC.) • RSI below 50 = in pullback mode

• RSI above 30 = not panic selling

• RSI 40-45 range = ideal "buy the dip" zone

• Room to run to RSI 75 before exit = +30 points!

Historical Pattern:

• VVV typically bounces at RSI 35-45

• RSI rarely stays below 40 for >3 days

• Last bounce from RSI 40: +8% in 5 da

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.575 EUR

179.56 M EUR

1.46 B EUR

126.92 M

About Valvoline Inc.

Sector

Industry

CEO

Lori A. Flees

Website

Headquarters

Lexington

Founded

1866

IPO date

Sep 23, 2016

Identifiers

3

ISIN US92047W1018

Valvoline, Inc. engages in the production, marketing, and supply of engine and automotive maintenance products and services. Its products include motor oil, heavy duty engine oil, antifreeze and coolants, transmission fluids, gear oils, grease, hybrid products, filters and wipers, industrial and hydraulic, small engine oils, etc. The company was founded by John Ellis in 1866 and is headquartered in Lexington, KY.

Related stocks

Valvoline Stock Chart Fibonacci Analysis 051325Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 35/61.80%

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

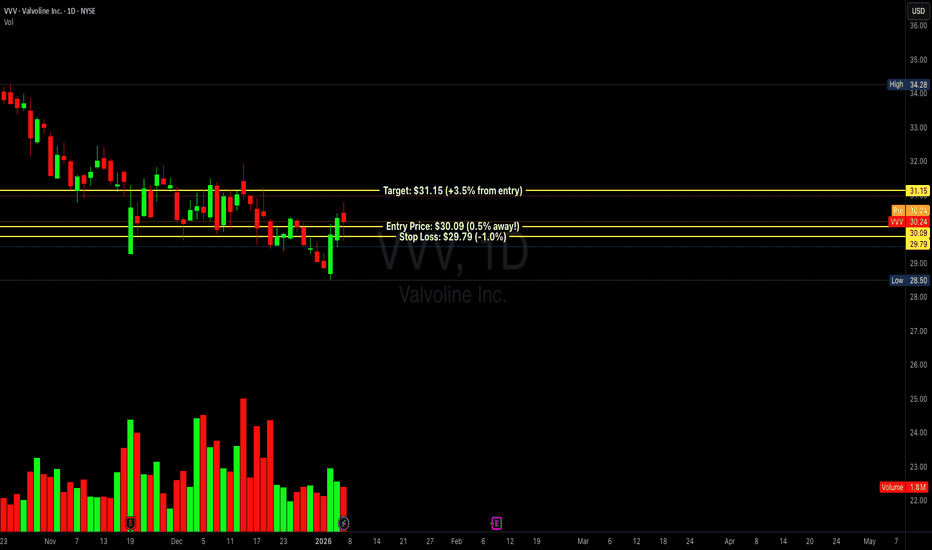

VVV | ForecastBias: Positive.

Sentiment: Optimistic.

Emoji (emotion): Confident 🏌️♂️ .

Null Hypothesis: Buy.

Alternative Hypothesis: Sell.

Signals: ..

Position: A short term swing trade.

Notes: I'm anticipating an earnings surprise.

Other: ..

Disclaimer: My journal entry is not a complete prospectus, pl

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

FCGS

Fidelity Global Small Cap Opportunities Fund ETF Series ETF Trust UnitsWeight

0.80%

Market value

26.59 M

USD

Explore more ETFs

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Valvoline, Inc. stocks are traded under the ticker 0V4.

We've gathered analysts' opinions on Valvoline, Inc. future price: according to them, 0V4 price has a max estimate of 40.44 EUR and a min estimate of 29.49 EUR. Watch 0V4 chart and read a more detailed Valvoline, Inc. stock forecast: see what analysts think of Valvoline, Inc. and suggest that you do with its stocks.

Yes, you can track Valvoline, Inc. financials in yearly and quarterly reports right on TradingView.

Valvoline, Inc. is going to release the next earnings report on May 13, 2026. Keep track of upcoming events with our Earnings Calendar.

0V4 earnings for the last quarter are 0.32 EUR per share, whereas the estimation was 0.28 EUR resulting in a 13.22% surprise. The estimated earnings for the next quarter are 0.29 EUR per share. See more details about Valvoline, Inc. earnings.

Valvoline, Inc. revenue for the last quarter amounts to 393.19 M EUR, despite the estimated figure of 393.03 M EUR. In the next quarter, revenue is expected to reach 417.27 M EUR.

0V4 net income for the last quarter is −27.93 M EUR, while the quarter before that showed 21.30 M EUR of net income which accounts for −231.08% change. Track more Valvoline, Inc. financial stats to get the full picture.

Valvoline, Inc. dividend yield was 0.00% in 2025, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 16, 2026, the company has 11.4 K employees. See our rating of the largest employees — is Valvoline, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Valvoline, Inc. EBITDA is 365.34 M EUR, and current EBITDA margin is 25.02%. See more stats in Valvoline, Inc. financial statements.

Like other stocks, 0V4 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Valvoline, Inc. stock right from TradingView charts — choose your broker and connect to your account.