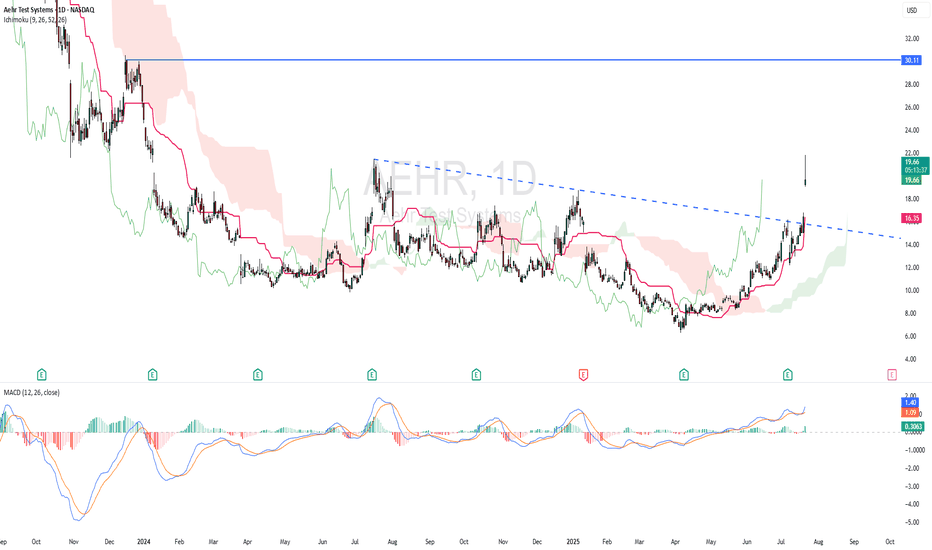

AEHR - RISING WINDOWTechnically AEHR is bullish as the stock made a strong rising window. Based on ICHIMOKU CLOUD, price is above cloud and chikou span is above candlestick - indicating bullish scenario. Kijun Sen is rising. MACD indicator showing bullish momentum.

ENTRY PRICE : 19.30 - 19.70

TARGET : 30.00 (potential

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.190 EUR

−3.45 M EUR

51.98 M EUR

27.93 M

About Aehr Test Systems

Sector

Industry

CEO

Gayn Erickson

Website

Headquarters

Fremont

Founded

1977

ISIN

US00760J1088

FIGI

BBG000C3JFX9

Aehr Test Systems engages in the design, manufacture, market, and sale of test and burn-in equipment used in the semiconductor industry. Its products include FOX-XP, FOX-NP, and FOX-CP wafer contact parallel test and burn-in systems, the WaferPak full wafer contactor, the DiePak Carrier, the WaferPak Aligner, the DiePak Autoloader, and test fixtures. The company was founded by Rhea J. Posedel on May 25, 1977 and is headquartered in Fremont, CA.

Related stocks

AEHR watch $15.99-16.27: Major Resistance may give a Dip BuyAEHR has been flying high with the general market.

Approaching a significant resistance into $16 round.

$15.99-16.27 is the exact zone of concern up here.

.

Previous analysis that caught the BreakOut:

===============================================

.

100% run up into earningsChance to get hot with semis if SPX can claim above 5950

High $8 for buying until we lose the 50MA.

Break above 12 with strength/volume will be key for continuation to 20.

Price-To-Earnings ratio (12.6x) is below the US market (17.8x) *

Revenue is forecast to grow 17.78% per year *

Earnings grew

Divergent structure, could lead to early trend reversal.This one just hit my radar, and here’s how I plan to approach it:

$9 Break = Key Alert Level

This is the trigger zone. I’ve got a volume alert set at 35K to confirm there’s real interest backing the breakout. No volume? No dice.

Downside Risk:

If this fails to hold the Low Volume Node at $7.73, it

$AEHR Set to Report Q125 Financial Results Post-Market April 8thAehr Test Systems ( IG:NASDAQ : NASDAQ:AEHR ) will report its first-quarter fiscal 2025 financial results on April 8, 2025. The announcement will follow the market close and the earnings call will begin at 5:00 p.m. Eastern Time.

The upcoming report covers the fiscal quarter ending February 28th, 2

$NASDAQ:AEHR Breaking out of a triangle patternNASDAQ:AEHR is breaking out of a triangle pattern with positive news and earning coming.

Things to consider:

Earnings - Monday 1/13, they've been posting wins quarter after quarter, and I suspect this quarter will be no different. I'd expect a positive boost for the stock price.

News - They've

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Aehr Test Systems stocks are traded under the ticker AYB.

We've gathered analysts' opinions on Aehr Test Systems future price: according to them, AYB price has a max estimate of 20.74 EUR and a min estimate of 20.74 EUR. Watch AYB chart and read a more detailed Aehr Test Systems stock forecast: see what analysts think of Aehr Test Systems and suggest that you do with its stocks.

Yes, you can track Aehr Test Systems financials in yearly and quarterly reports right on TradingView.

Aehr Test Systems is going to release the next earnings report on Jan 8, 2026. Keep track of upcoming events with our Earnings Calendar.

Aehr Test Systems revenue for the last quarter amounts to 9.42 M EUR, despite the estimated figure of 9.23 M EUR. In the next quarter, revenue is expected to reach 9.85 M EUR.

AYB net income for the last quarter is −1.78 M EUR, while the quarter before that showed −2.56 M EUR of net income which accounts for 30.19% change. Track more Aehr Test Systems financial stats to get the full picture.

No, AYB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Oct 26, 2025, the company has 136 employees. See our rating of the largest employees — is Aehr Test Systems on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Aehr Test Systems EBITDA is −4.34 M EUR, and current EBITDA margin is −1.57%. See more stats in Aehr Test Systems financial statements.

Like other stocks, AYB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Aehr Test Systems stock right from TradingView charts — choose your broker and connect to your account.