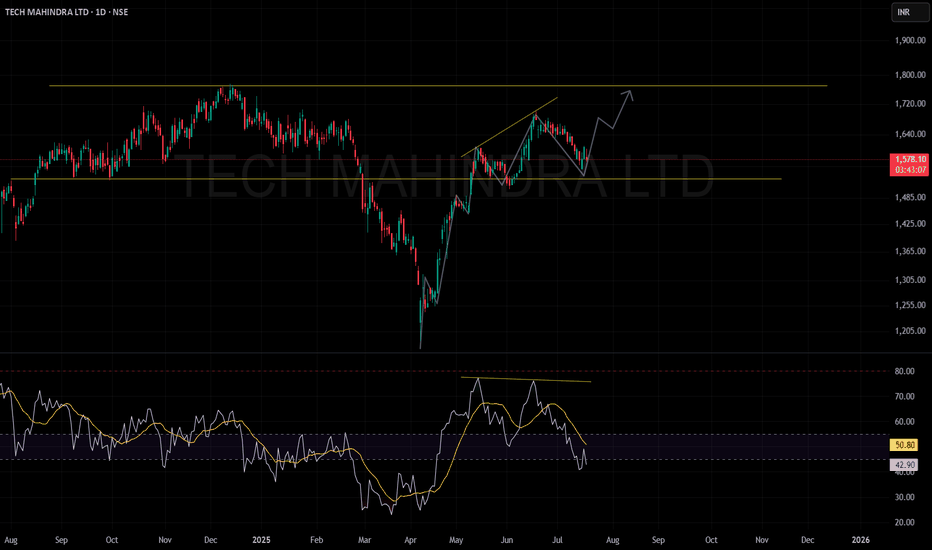

TECHM bullish breakout above. Resistance Buliish breakout above, resistance, Price has confirmed a bullish breakout above a key resistance zone, indicating a potential shift in short-term trend. The breakout is supported by a strong reversal from the Fibonacci 0.5 retracement level, which previously acted as a demand area.

This confluence

Tech Mahindra Limited

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

52.25 INR

42.52 B INR

529.88 B INR

635.42 M

About Tech Mahindra Limited

Sector

Industry

CEO

Mohit Joshi

Website

Headquarters

Pune

Founded

2010

IPO date

Aug 1, 2006

Identifiers

2

ISIN INE669C01036

Tech Mahindra Ltd. operates as an holding company. It engages in the provision of information technology solutions. The operates through Information Technology Business, and Business Process Services segments. It provides computers, networking technology solutions, and business support services to the global telecommunications industries. The company was founded on October 24, 1986 and is headquartered in Pune, India.

Related stocks

TECH MAHINDRA monthly range breakout PREMPTINGtech mahindra range breakout preempting

it index is strong and most negative news are priced in

on monthly basis its forming a marubozu candle

my sl is 940weekly closing basis

target 1277 1484

after falling forming range

on weekly basis range breakout has occur and this week i will be consider fo

TECH MAHINDRA (TECHM) – Weekly Structure Turning Positive🟦 TECH MAHINDRA (TECHM) – Weekly Structure Turning Positive

Tech Mahindra is showing positive price action on the weekly chart, especially after Infosys results, indicating improving sentiment in the IT space.

📊 Technical View

• Weekly structure improving

• Strength visible post-earnings reaction

TECHM – Daily Chart | Symmetrical Triangle observationPrice is forming a clear symmetrical triangle after the recent up move.

Structure:

• Lower highs – supply line drifting down from ₹1685 → ₹1678 → ₹1672

• Higher lows – demand rising from ₹1580 → ₹1605 → ₹1625

• Range tightening toward the apex

This shows a balance between buyers and sellers.

Direc

Tech Mahindra on the Move-Bullish Momentum vs Costly Valuation –Tech Mahindra on the Move 🚀 Bullish Momentum vs Costly Valuation – Opportunity or Trap?

Overview

Tech Mahindra’s technical trend has shifted from “mildly bullish” to a “confident bullish” phase. With a Mojo Score of 72 (Buy), the stock is showing strong short-term momentum, supported by improving p

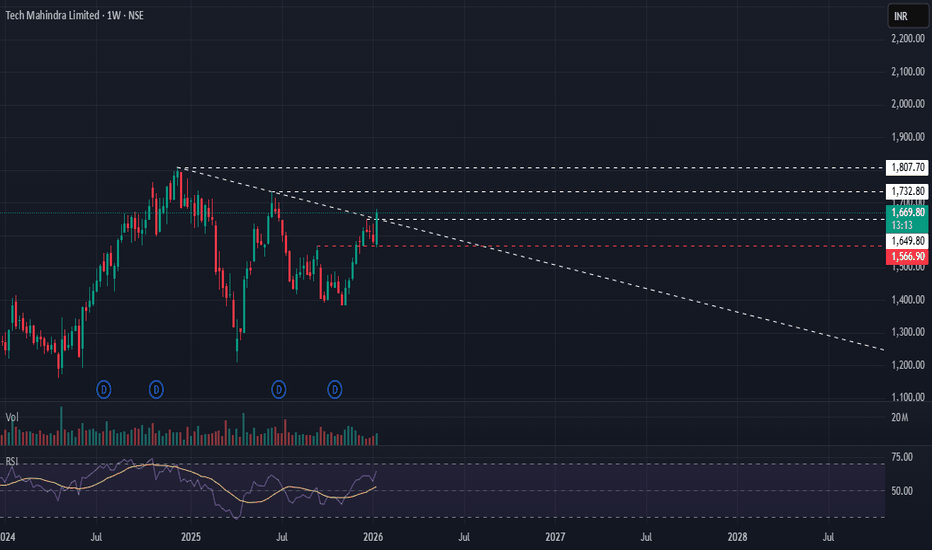

TECHM Weekly Trendline Retest and Compression StudyTech Mahindra is trading inside a tightening weekly structure formed by a descending trendline from the previous highs and a rising support line from the recent lows. This price action indicates compression, suggesting that the stock is building energy for a directional move.

The stock previously fa

At Support - Weekly Chart - TECHM📊 Script: TECHM

📊 Industry: IT - Software (Computers - Software & Consulting)

Key highlights: 💡⚡

📈On Weekly Chart Script is forming symmetrical triangle and trading near support line.

📈 Script is trading at upper band of BB.

📈 MACD and Double Moving Averages are giving Crossover

📈 Right now RSI is

Tech Mahindra Ltd for 17th Sept #TECHM Tech Mahindra Ltd for 17th Sept #TECHM

Resistance 1540 Watching above 1542 for upside momentum.

Support area 1520 Below 1520 gnoring upside momentum for intraday

Watching below 1517 for downside movement...

Above 1540 ignoring downside move for intraday

Charts for Educational purposes only.

Plea

TECH MAHINDRA POISED FOR AN UPMOVE#TECHMAHINDRA

Support and Resistance:

A support zone is identified near ₹1,500 (lower yellow horizontal line).

The resistance zone is marked around ₹1,800 (indicated by the upper yellow horizontal line).

Trend Analysis:

Following a significant decline, the stock has shown a sharp recovery and is n

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of TECHM is 1,534.40 INR — it has decreased by −0.14% in the past 24 hours. Watch Tech Mahindra Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Tech Mahindra Limited stocks are traded under the ticker TECHM.

TECHM stock has fallen by −6.72% compared to the previous week, the month change is a −4.87% fall, over the last year Tech Mahindra Limited has showed a −8.39% decrease.

We've gathered analysts' opinions on Tech Mahindra Limited future price: according to them, TECHM price has a max estimate of 2,350.00 INR and a min estimate of 1,220.00 INR. Watch TECHM chart and read a more detailed Tech Mahindra Limited stock forecast: see what analysts think of Tech Mahindra Limited and suggest that you do with its stocks.

TECHM reached its all-time high on Feb 3, 2026 with the price of 1,854.00 INR, and its all-time low was 51.25 INR and was reached on Jan 23, 2009. View more price dynamics on TECHM chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TECHM stock is 5.71% volatile and has beta coefficient of 1.08. Track Tech Mahindra Limited stock price on the chart and check out the list of the most volatile stocks — is Tech Mahindra Limited there?

Today Tech Mahindra Limited has the market capitalization of 1.50 T, it has decreased by −5.52% over the last week.

Yes, you can track Tech Mahindra Limited financials in yearly and quarterly reports right on TradingView.

Tech Mahindra Limited is going to release the next earnings report on Apr 23, 2026. Keep track of upcoming events with our Earnings Calendar.

TECHM earnings for the last quarter are 12.64 INR per share, whereas the estimation was 15.55 INR resulting in a −18.69% surprise. The estimated earnings for the next quarter are 17.59 INR per share. See more details about Tech Mahindra Limited earnings.

Tech Mahindra Limited revenue for the last quarter amounts to 143.93 B INR, despite the estimated figure of 141.88 B INR. In the next quarter, revenue is expected to reach 146.64 B INR.

TECHM net income for the last quarter is 11.22 B INR, while the quarter before that showed 11.95 B INR of net income which accounts for −6.07% change. Track more Tech Mahindra Limited financial stats to get the full picture.

Tech Mahindra Limited dividend yield was 3.17% in 2024, and payout ratio reached 93.74%. The year before the numbers were 3.20% and 150.02% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 15, 2026, the company has 119.34 K employees. See our rating of the largest employees — is Tech Mahindra Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Tech Mahindra Limited EBITDA is 83.36 B INR, and current EBITDA margin is 13.48%. See more stats in Tech Mahindra Limited financial statements.

Like other stocks, TECHM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Tech Mahindra Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Tech Mahindra Limited technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Tech Mahindra Limited stock shows the neutral signal. See more of Tech Mahindra Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.