Analysis on S50 futures: sideway 811-845Dear all

its been two very hard week for trend traders.

many false signals occur during this week.

currenctly, it is in range 811-845,

suggestion, short when close to 845, long when close 811.

from the chart it is likely to go up first, if fail to break 845,

it sohuld come back down to 818, if can hold, this level +- would be best buy,

not investment advice, take your own risk

SET50 Index Futures

No trades

Market insights

Analysis on S50: hard to predictDear all

currently, the chart did not show any bias on either long or short

day=> it is up bias

4h=> it is down

1h=> it is up

my trading plan is to take action based on which cases it is closed to happen.

4 cases in each color shown above.

not financial advices.

wish you best of luck

Analysis on S50 futures: bias downward if cannot break 842Dear all

after the previous post, i tried to guess but it went up a little too high.

but today, its about reading the price structure.

currently the price is going toward 831***

if it can hold, then cover some, if cannot hold, next target is 821***

if 821 cannot hold, 816 is the final target

that is the plan for today, good luck to you all.

dont forget money management and trade at your own risk.

trading is risky, everyone should make their own decision.

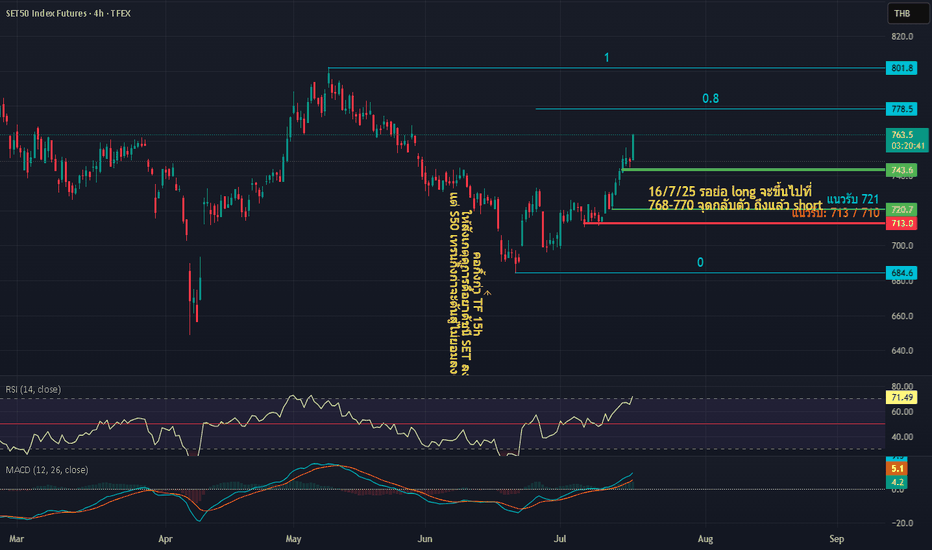

Analysis on SET50 Futures: If this level can hold, still up biasDear all

Today the chart unfold some useful information,

The old view is to wait and see how the pullback will be.

The updated view is that as long as 810 hold, it should be long bias.

But ******* Short Term ******** i expected them to come down to 819.

This will be the best entry for long if this healhty level can hold on.

Best of luck to all (including myself)

Analysis on S50 Futures: Still bullish but.. (cont.)Dear All

Now it reached 807 as the first target for fibo, you should be cautious already ,

the prob of going down increase after reaching the first target.

if i have to be biased, it is gonna keep pushing up to 840, 930 as next target.

As long as 773 holds, the long term view is upward and the targets are valid.

will keep you updated .

Trader PP

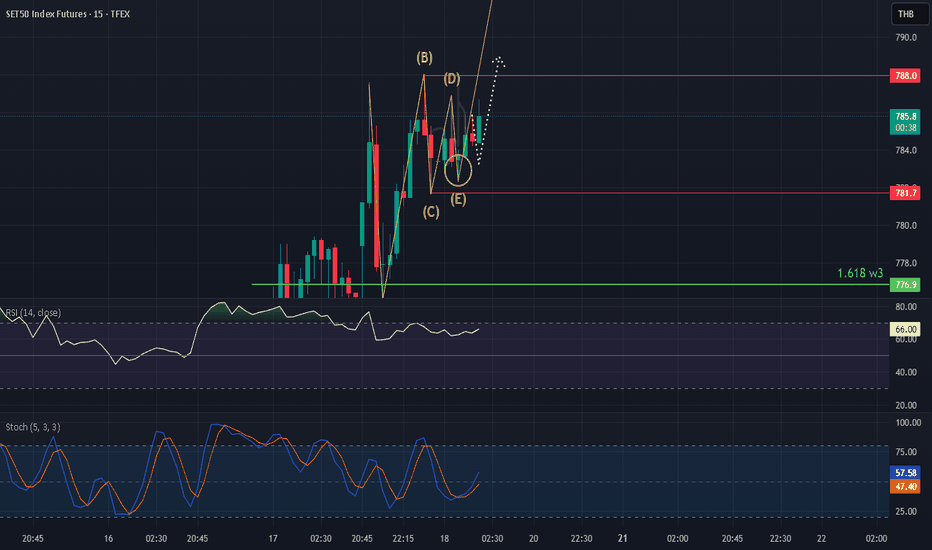

When Wave 3 Extends to 3.618×✅ What It Means

• Wave 3 has extended to 3.618× the length of Wave 1, which is a very strong impulsive wave.

• This often indicates high momentum and strong underlying trend (usually confirmed with high volume).

• It’s a classic sign of an extended wave structure — common in high-volatility, trend-driven markets.

⸻

🔄 Wave 4 Retracement Behavior

In such cases, Wave 4 tends to be shallow, both in price and time. Here’s what we know:

🔍 Typical Wave 4 Retracement When Wave 3 = 3.618 × Wave 1:

Type

Typical Behavior

Depth (Fibonacci)

0.236 to 0.382 of Wave 3

Time

Often longer than Wave 2

Form

Often sideways: triangle, flat

Probability of Deep Retrace

Low (< 25%)

So when Wave 3 is extended, Wave 4 usually does not retrace deeply.

📊 Historical/Educated Probability Estimate

Event

Probability

Wave 3 extends to 3.618× Wave 1

~10–15% of impulsive wave cases

Wave 4 retraces shallowly (0.236–0.382)

~70–80% in extended Wave 3

Wave 4 retraces deeply (>0.5)

~10–15% (rare, usually corrective failure)

So:

🧠 If Wave 3 is extended (3.618×), there is ~70–80% chance that Wave 4 will be shallow and not violate Wave 1 top.

📌 Summary

• ✅ Wave 3 extended to 3.618× implies strong trend

• ✅ Wave 4 likely shallow (0.236–0.382 retrace)

• ❌ Deep retrace into Wave 1 territory is unlikely unless structure is failing

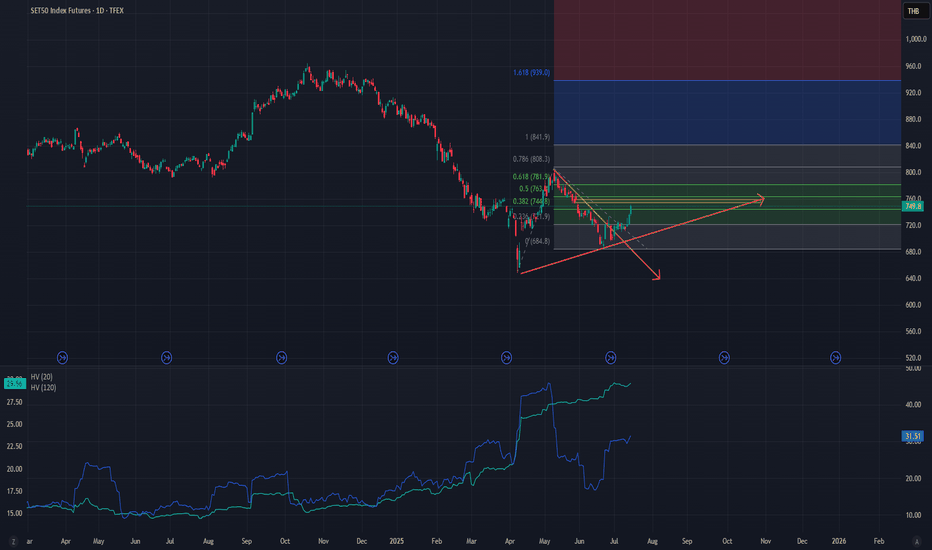

Analysis on S50 Futures: Most likely to go down tmrHI All

With the today's red candle, the trend is down, momentum is down as well.

The Index now will go back to test 694, if brown down 650.

The way to make money from this market is to not over trade, simple as that.

It does not matter what method you use, once overtrade, it is bound to lose

Best of luck

Analysis on S50 Futures: Last line of DefenseDear ALL

it is now close to the 735.

if this level do not hold, you would most likely to see 635.

lets just hope that this level hold.

on trading plan, morning if not going down, it may went up to 755

but in the end, it would go and challenge 735.

short bias should prevail

Best of luck

Trader PP

Analysis on SET50 Futures: sideway phrase endedDear All

After shooting up for quite some time.

It consolidate in the high zone and now the uptrend line is broken down.

Most likely that, from now on, it would go down but trend and momentum.

The target obviously 890 and 850.

After that it should start to go side way and continue upward again

TraderPP

Analysis on SET50 Futures: Short term bearishDear all

in timeframe 15, it is not downtrend with the downward momentum.

But keep in your heart that, in big picture, it is most likely the beginning of the up trend already.

You should thus be cautious when to buy cover and when to buy stocks.

This would be the best opportunity if it really came down to 3 zones that i draw.

Good luck trading and investing.

TraderPP

2 Sep 2024

TFEX S50 Swing ShortTFEX S50 Swing Short

Still keeping perspective in all my Trend

Primary, Secondary, Minor : Down Trend

This swing cycle saw another short position order at the Island Gap Reversals and Follow Sell when the price jumped down the next day.

Short only strategy with a price target of 770 along the Standard Deviation of the Volume Profile that forms a Normal Distribution shape.

TFEX S50 FuturesTFEX S50 Futures

All Trend is Down in Primary, Secondary and Minor

Strategy 1: Wait for the price to rise to the resistance level (Supply Zone, POC of Volume and Regression Trend) then open Short Position.

Strategy 2: Divide Open Short Position and cut the losses short with Minor Trend

Target at Range Volatile 1 Month and 3 Month Low around 800 -790 point as last opinion.