MARKETS week ahead: September 15 – 21Markets are gearing up for the forthcoming FOMC meeting and surging expectations over a 25 basis points rate cut. These expectations have been priced during the week, where the S&P 500 reached a fresh, new all time highest level, ending the week at 6.584. On the same expectations the price of gold surged to another all time highest level, closing the week at $3.643. The 10Y US Treasury benchmark dropped below the 4,0% at one moment, however, returned a bit back as of the end of the week at 4,068%. This time the crypto market was also in the eye of the investors, where BTC managed to break the $115K resistance, ending the week modestly below the $116K.

The previous week started with the annual revision of non-farm payrolls, revealing a decline of 911,000 jobs, adding to concerns about a cooling U.S. labour market. In August, the Producer Price Index (PPI) fell by 0.1% month-over-month, bringing the annual rate to 2.6%, while core PPI also dropped 0.1%. Both figures came in below market expectations of a 0.3% increase. Meanwhile, inflation rose 0.4% for the month and 2.9% year-over-year, with core inflation slightly elevated at 0.3% monthly and 3.1% annually. Preliminary data from the University of Michigan showed September’s consumer sentiment at 51.8, slightly below the forecast of 54.9, while inflation expectations held steady at 4.8%. Declining jobs market increased market expectations to almost certain that the Fed will cut interest rates by 25 basis points on September 17th.

Nvidia and OpenAI are reportedly in talks to fund a multibillion dollar AI infrastructure project in the U.K., centred on building new data centres, in partnership with cloud firm Nscale. The agreement is expected to be unveiled during President Trump’s state visit to Britain next week. Governments globally are increasingly trying to attract the tech giants to bolster their domestic “sovereign AI” capabilities.

Gemini Space Station shares surged over 40% on Friday during their debut on the Nasdaq, opening at $37.01 under the ticker GEMI after being priced at $28, and reaching a high of $40.71. Founded by Tyler and Cameron Winklevoss, the company was valued at $4.4 billion and joins a growing wave of crypto firms going public amid a loosening regulatory environment under current US Administration.

News are reporting that investors have poured over $7 trillion into cash-like assets such as money market funds and high-yield savings, benefiting from recent Fed rate hikes. However, with the Federal Reserve expected to cut interest rates soon, these safe assets may lose appeal, prompting a shift toward riskier investments like stocks and bonds. Experts warn that a massive market rally fuelled by this "wall of cash" is unlikely unless rates drop close to zero. Historical data shows significant outflows from money funds only occur during major economic crises when rates are very low.

CRYPTO MARKET

A green week on the crypto market, supported by investors' expectation that the Fed will cut interest rates at their FOMC meeting, on September 17th. Almost all coins gained on this expectation surging the value of crypto coins mostly between 10% to 20%. At the same time total crypto capitalization passed the $4B mark, which represents another significant milestone for the crypto market. On a weekly level, total crypto market capitalization was increased by 8%, adding total $290B to its market cap. Daily trading volumes remained at higher levels, with turnovers of around $298B on a daily level. Total crypto market capitalization increase from the beginning of this year currently stands at +25%, with a total funds inflow of $803B.

BTC was the coin to lead the market, however, other altcoins also performed well during the week. BTC gained $115B of funds, increasing its value by 5,2% for the week. ETH had a good week with a gain of 10,3%, adding $53B to its market cap. XRP gained almost 13% w/w, adding $21,5B to its value. Solana and Polkadot are worth mentioning, as both coins gained above 20% for the week. Certainly, the star of the week was DOGE, with an incredible weekly gain of 41%. Ospreys Dogecoin ETF started trading during the previous week, attracting investors' funds and letting the coin surge by 41%.

Increased activity was also reflected in circulating coins. During the previous week, EOS increased the number of its coins on the market by 0,6%, while Algorand gained 0,5% of coins. Stellar managed to add 0,3% new coins to the market, same as Uniswap.

Crypto futures market

Investors' increased interest in ETH was recently exposed both on the spot and the crypto futures market. As per CME, the ETH futures open interest on this market has hit records of over $10B, as a reflection of institutional investors demand. ETH futures gained more than 7% during the previous week for all maturities. Futures expiring in December this year closed the week at $4.792, and those with the expiration date a year later were last traded at $5.143. This is a huge milestone as the long term futures returned once again to levels above the $5K mark.

BTC futures also gained more than 4,5% for all maturities. Futures maturing in December this year were last traded at $119.565, and those maturing a year later closed the week at $126.490.

Trade ideas

MARKETS week ahead: September 8 – 14Last week in the news

The previous week was marked with surprisingly low August Non-farm payrolls of only 22K new jobs in the U.S. Figures increased market expectations that the Fed will cut rates at the FOMC meeting in September. Market reaction at Friday's trading session was strong. The S&P 500 reached another all time highest level and then tumbled back toward the 6.481, within the same day. The 10Y US Treasury benchmark dropped down from 4,2% to 4,0%. Although the US Dollar remained relatively flat during the week, the price of gold reached a new all time highest level, ending the week at $3.586. This week the crypto market was left aside, with BTC closing the week by testing the $110K.

U.S. labour market data took centre stage in the markets last week. On Wednesday, the JOLTs Job Openings report showed 7.181 million positions for July, falling short of the expected 7.3 million. Friday delivered another surprise, with August Non-Farm Payrolls revealing just 22K new jobs, which was well below the 75K anticipated by the market. Meanwhile, the unemployment rate edged up by 0.1 percentage points to 4.3%. Average hourly earnings rose by 0.3% in August, marking a 3.7% y/y increase. A significant drop in the US jobs data increased market expectations that the Fed will now certainly have a good grounds to cut interest rates by 25 basis points at September FOMC meeting.

Nobel laureate Joseph Stiglitz cautions that bond markets haven’t fully accounted for the weakening U.S. fiscal outlook, particularly the temporary boost from tariff revenues that won't last as businesses readjust supply chains. He suggests that the current projections are overly optimistic and that the true financial position of the U.S. may be significantly worse. Stiglitz’s remarks signal that investors should brace for deeper fiscal and inflationary risks than markets currently anticipate

There has been a lot of media coverage related to the announced split of shares of Kraft Hainz, aimed to unlock brand value. Shares of the company were losing value during the year, with a stock loss of around 21% over the period of the past year. Famous investor Warren Buffett commented on the split, expressing disappointment, noting that breaking up will not resolve the deeper challenges the company is facing. The proposed spin-off will create two distinct, independently traded entities, one centered on sauces and spreads, the other on grocery staples, a strategy aimed at unlocking shareholder value after years of sluggish performance.

The European Commission has levied a €2.95 B (US $3.45 B) antitrust fine against Google for abusing its dominance in the adtech market by favouring its own services, marking the company’s fourth major EU penalty. Regulators have given Google 60 days to propose remedies to end these self-preferencing practices, warning that failure to comply could lead to divestitures. Google has announced plans to appeal the decision, calling it unjustified and warning it could harm numerous European businesses. Meanwhile, the U.S. President has criticized the penalty and threatened retaliatory trade measures, escalating tensions between the U.S. and the EU.

CRYPTO MARKET

The crypto market remained relatively calm during the previous week. Investors were more concerned with surprisingly weak US jobs data, increasing expectations that the Fed might make a move in rate cuts at their September FOMC meeting. They were positioning accordingly, in which sense US equities, bond and gold markets were affected. Total crypto market capitalization was increased by modest 1% during the week, adding $28B to its total market cap. Daily trading volumes dropped to the level of $222B on a daily basis, from last week's $311B. Total crypto market capitalization increase from the beginning of this year currently stands at +16%, with a total funds inflow of $513B.

For the week, crypto coins showed mixed performance, with a blend of gains and losses across major and altcoins. BTC had steady movements, with a weekly gain of 1,4% and an inflow of $30,5B. This week, ETH was a modest losing side of -1,4% (-7,5B). Major altcoins on the market finished the week relatively flat. Market favorites Solana, ADA, XRP, BNB all finished the week almost without a change from the end of the previous week. Avalanche managed to add 3,3% to its market value. At the same time, Maker had an excellent week with a gain of 13,1%. Monero was traded higher by 4,4% and Filecoin was up by 2,7%. Another coin with a significant weekly gain was ZCash, with a surge of 11,3%.

Although the value of coins remained relatively flat, there has been increased activity with circulating coins. This week Stellar managed to add 1,1% new coins to the market. Miota`s number of coins closed the week higher by 0,8%. This week Filecoins added 0,2% to its total circulating coins. XRP should be also mentioned, as this coin continues to increase its number on the market, this week by 0,2%.

Crypto futures market

The crypto futures market showed some divergence from BTC and ETH price movements, following developments on the spot market. Bitcoin futures experienced consistent gains across all maturities, with w/w increases ranging around 2,7%. Futures with maturity in December this year closed the week at $114.205, and those maturing a year later were last traded at $121.000.

In contrast, ETH futures saw moderate declines across the board, with w/w changes around 0,4%. For the moment, the market is showing subdued expectations for ETH in the near to mid-term. However, ETH futures continue to hold strongly above the $4K mark. December 2025 finished the week at $4.435, while December 2026 was last traded at $4.780.

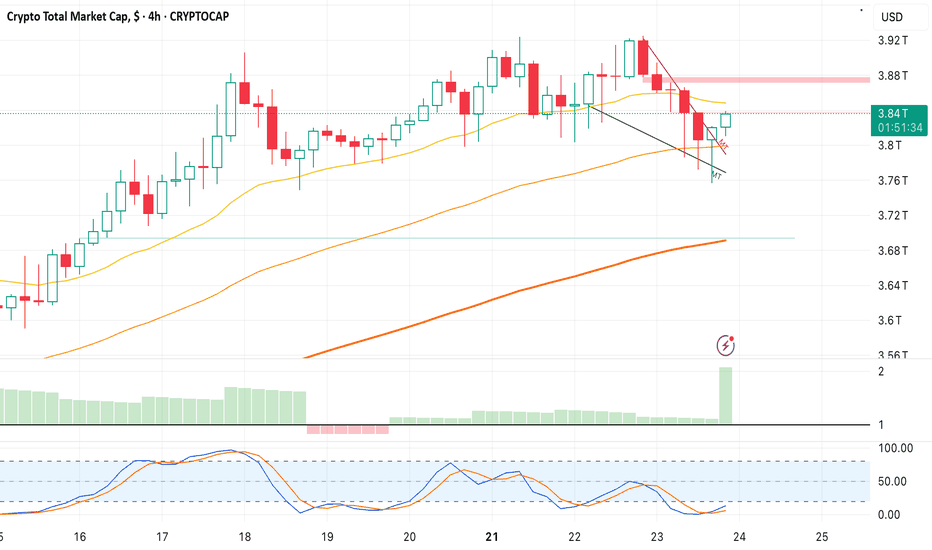

The Overlap Zone — Where Wolves Wait, Not Sheep Crypto just pulled back to the alpha trendline… a place where the weak see fear, but the wolf smells blood 🐺🩸.

The marked zone isn’t random — it’s the sweet spot where daily & weekly FVGs overlap 🎯. Add to that a clean 50% Fibonacci retrace of the last sharp rally… and suddenly this isn’t just a “support.”

It’s a hunting ground 🪓.

I expect a correction into this zone before the market reloads the chambers 🔫.

And yeah, more “data storms” 🌪️ are coming in the days/weeks, but honestly… you don’t need a news headline to recognize a kill zone.

Patience. Precision. Predation.

🐺 The wolf doesn’t chase the market — the market bends to the wolf. 🩸

#CryptoMarket #TotalMarketCap #CryptoAnalysis #MarketUpdate #WolfTrading #AlphaMindset #CryptoStrategy #SmartMoneyMoves #CryptoCorrection #CryptoGrowth #PsychoWolf #UntamedMarkets #FearGreed #TrendlineMagic #MarketHunt

Understanding How Crypto Exchanges Influence Coin PricesUnderstanding How Crypto Exchanges Influence Coin Prices

Cryptocurrency markets often appear unpredictable, with sudden price surges or drops that seem to defy logic. For example, when Bitcoin ( CRYPTOCAP:BTC ) experiences a sharp upward spike—a "green candle"—many altcoins follow almost instantly. Why does this happen so quickly? This tutorial explores the theory that centralized exchanges (e.g., Binance, Coinbase) can manipulate coin prices by adjusting internal database values rather than executing real on-chain trades, and how they may use "pegging ratios" to control price movements of specific coins or ecosystems.

The Myth of Instant Market Reactions

When CRYPTOCAP:BTC surges, altcoins often move in lockstep, seemingly without delay. A common assumption is that millions of investors or market-making bots react simultaneously, causing this synchronized movement. However, natural market reactions typically involve some lag due to order book processing, trader decisions, or bot algorithms. So why is the movement near-instantaneous?

The answer may lie in how centralized exchanges operate. Unlike decentralized exchanges (DEXs), which rely on transparent on-chain transactions, centralized exchanges manage trades internally using their own databases. This means they control virtual coin balances, not necessarily actual blockchain assets. When an exchange wants to "pump" a coin (e.g., increase its price by 10% following a CRYPTOCAP:BTC spike), it doesn't need to buy real coins on the blockchain. Instead, it can simply adjust the coin's value in its database, creating the appearance of market activity without requiring reserve assets.

This internal manipulation allows exchanges to influence prices rapidly, explaining the lack of lag in altcoin movements.

------------------

How Exchanges Peg Coins to Major Assets

Exchanges often peg the price movements of altcoins to major cryptocurrencies like CRYPTOCAP:BTC , CRYPTOCAP:ETH , or CRYPTOCAP:SOL , using a weighted ratio that determines how closely a coin follows these leaders. This pegging isn't a fixed value but a dynamic relationship that can vary by coin or ecosystem. For instance:

Typical Pegging Structure:

50% tied to CRYPTOCAP:BTC (the dominant market driver).

50% tied to other ecosystems (e.g., CRYPTOCAP:ETH for Ethereum-based tokens, CRYPTOCAP:SOL for Solana-based tokens).

Example: A meme coin on the Ethereum blockchain might be pegged 50% to CRYPTOCAP:BTC , 25% to CRYPTOCAP:ETH , and 25% to a general "meme coin" index.

This pegging explains why some coins pump or dump more aggressively than others during market trends. Each coin's price movement is a weighted response to the assets it's tied to.

The Role of Pegging Ratios: Pumps vs. Dumps

Exchanges don't apply uniform ratios for upward and downward price movements. Instead, they may assign positive or negative ratios to influence a coin's trajectory:

Positive Ratio: A coin rises faster than its pegged assets during pumps (upward movements) and falls slower during dumps (downward movements). This increases the coin's value over time, often because the exchange holds a large position and plans to sell later for profit.

Example: CRYPTOCAP:SOL might have a 2:1 positive ratio, rising twice as fast as CRYPTOCAP:BTC during a pump and falling half as fast during a dump.

Other Examples: CRYPTOCAP:BNB (Binance's token) and GETTEX:HYPE often show positive ratios, benefiting from exchange favoritism.

Negative Ratio: A coin rises slower than its pegged assets during pumps and falls faster during dumps. This can gradually erode a coin's value, often used by exchanges to liquidate or delist coins they no longer favor.

Example: SEED_DONKEYDAN_MARKET_CAP:ORDI , pegged to CRYPTOCAP:BTC , may fall faster than CRYPTOCAP:BTC during dumps and rise slower during pumps, leading to a net decline.

Other Examples: CRYPTOCAP:INJ , NYSE:SEI , LSE:TIA often exhibit negative ratios.

Meme coins are a special case, typically pegged to both CRYPTOCAP:BTC and their native blockchain:

CRYPTOCAP:PEPE (Ethereum-based) may have a neutral ratio, moving evenly with CRYPTOCAP:BTC and $ETH.

SEED_DONKEYDAN_MARKET_CAP:BONK (Solana-based) might have a negative ratio, falling faster than CRYPTOCAP:BTC and $SOL.

------------------

Exchange Strategies: Controlling Ecosystems and Liquidation

Exchanges can manipulate entire ecosystems by adjusting ratios for categories of coins. For example:

Setting a 2:1 ratio on all meme coins could make them rise twice as fast as CRYPTOCAP:BTC during a pump, creating hype and attracting retail investors.

Conversely, assigning a negative ratio to an ecosystem (e.g., certain layer-2 tokens) can suppress their value, allowing the exchange to accumulate or liquidate positions.

A notable strategy is slow liquidation:

Exchanges may apply a negative ratio to a coin they wish to delist (e.g., SEED_DONKEYDAN_MARKET_CAP:ORDI ). Over time, the coin's value erodes until it reaches a level where the exchange can justify delisting it, citing "low trading volume" or "lack of interest."

This process creates space for new coins the exchange favors, often ones they hold or have partnerships with.

------------------

Why This Matters for Traders?

The idea that coin prices are driven purely by investor sentiment and organic price action is overly simplistic. Centralized exchanges, with their control over internal databases, can heavily influence price trends. Understanding this can help traders:

Identify Positive-Ratio Coins: These are likely to increase in value over the mid-to-long term. Accumulating coins like CRYPTOCAP:SOL or CRYPTOCAP:BNB during dips could yield profits if their positive ratios persist.

Avoid Negative-Ratio Coins: Coins like SEED_DONKEYDAN_MARKET_CAP:ORDI or CRYPTOCAP:INJ may bleed value over time, draining portfolios unless traded carefully.

Monitor Ecosystem Shifts: Watch for exchange announcements (e.g., new listings, delistings) or unusual price movements that deviate from $BTC/ CRYPTOCAP:ETH trends, as these may signal ratio changes.

------------------

Important Notes

Dynamic Ratios: Pegging ratios are not fixed and can change daily based on exchange strategies, market conditions, or liquidity needs. Always verify current trends with real-time data.

Data Sources: Use tools like CoinGecko, CoinMarketCap, or on-chain analytics (e.g., tradingview) to track correlations between coins and their pegged assets.

Risks of Centralized Exchanges: This tutorial focuses on centralized platforms, not DEXs, where on-chain transparency limits such manipulation. Consider diversifying to DEXs for more predictable trading.

Speculative Nature: While this theory is based on observed market patterns, it remains speculative. Exchanges rarely disclose internal mechanisms, so traders should combine this knowledge with technical analysis and risk management.

------------------

Conclusion

Crypto exchanges wield significant power over coin prices by adjusting virtual balances in their databases and using dynamic pegging ratios. By understanding positive and negative ratios, traders can make informed decisions about which coins to hold or avoid. Always conduct your own research, monitor market trends, and use secure platforms to protect your investments. The crypto market may be rigged in some ways, but knowledge of these mechanics can give you an edge.

CRYPTO MARKET IN COMING DUMPThe crypto market is setting up for a dump before the next big upside move — and before Alt Season truly begins.

In this video, I break down the TOTAL Market Cap and Bitcoin charts to show exactly where I’m looking to buy, and the psychology behind why the market moves this way.

📊 What you’ll learn in this video:

Why I expect a dump before the next big crypto move

How TOTAL Market Cap + BTC are setting up Alt Season

The key buy levels I’m targeting

The psychology that drives these setups (liquidity, fear, and greed)

This could be one of the most important setups of the year — make sure you’re ready.

💬 Do you agree that we need a dump before Alt Season? Comment below 👇

Disclaimer: This video is for educational purposes only and does not constitute financial advice. Always do your own research before trading or investing in cryptocurrency.

Crypto Market Approaching Support, While Finishing A CorrectionGood morning Crypto traders! Crypto market continues to slow down due to consolidation in stocks, but notice that the US dollar remains bearish, while gold is experiencing a strong bullish breakout. This suggests that we are still in a risk-on environment, meaning stocks could continue higher, while cryptocurrencies may soon stabilize. Crypto TOTAL market cap chart now appears to be approaching the key 3.6 - 3.5T support area within a three-wave ABC correction for wave 4, from where bulls for wave 5 may show up again, especially considering that the NASDAQ could be completing a bullish running triangle, while the US dollar index (DXY) is forming a bearish one.

MARKETS week ahead: August 31 – September 4Last week in the news

The market sentiment during the previous week was driven by PCE data. As the inflation was in line with expectations, the sentiment about Fed rate cut was further supported. The US equity markets continued to surge, with the S&P 500 reaching the new all-time highest level at 6.500 and closing the week at 6.460. In expectation of rate cuts, the price of gold surged, closing the week at $3.446. The US 10Y continued to test the 4,2% supporting level, ending the week at 4,23. The sentiment around the BTC and the crypto market was not in a positive territory, where BTC slipped down to the levels below the $109K.

July’s PCE inflation report came in right on target to market forecast, with headline PCE up 0.2% month-over-month and core PCE up 0.3%, reinforcing expectations for a Federal Reserve rate cut in September. The revised second estimate for Q2 U.S. GDP showed stronger-than-expected growth at 3.3% annualized, up from the initial 3.0%, fuelled largely by increased consumer spending and business investment. According to the CME Group’s FedWatch tool, there's now an approximately 87% chance of a 25-basis-point cut at next month’s FOMC meeting, all of which supports market optimism ahead of upcoming labour data. The week ahead is bringing the release of non-farm payrolls and JOLTs.

The Federal Reserve’s ongoing quantitative tightening has entered a more uncertain phase as usage of its overnight reverse repo facility, once a $2.6 trillion liquidity buffer,has plunged to just $32 billion, signaling that this tool is nearly exhausted. With the reverse repo effectively drained, further balance sheet reductions will increasingly come directly from bank reserves, currently around $3.3 trillion, raising the risk of strains in short-term funding markets. To mitigate this risk and maintain control over interest rate policy, the Fed is relying on its Standing Repo Facility (SRF) as a contingency for future liquidity support. However, analysts remain cautious, warning that the Fed must tread carefully to avoid a repeat of the 2019 episodic funding stress.

A federal appeals court ruled 7–4 that most of former President Trump’s sweeping global tariffs, imposed under the International Emergency Economic Powers Act (IEEPA), are unlawful, finding that the law does not explicitly authorize tariffs, a power reserved for Congress. Nonetheless, the court has allowed the tariffs to remain in effect until mid-October to permit time for appeal, likely setting the stage for a potential U.S. Supreme Court review. The US President responded by denouncing the court’s decision and signalling his intent to pursue the case further.

El Salvador will redistribute its entire national Bitcoin reserve—valued at approximately $682 million from a single address into multiple new wallet addresses to enhance security and reduce exposure. Each address will hold no more than 500 BTC (around $54 million), a strategic limit designed to minimize risk in the event of a security breach. To maintain transparency, the country’s National Bitcoin Office will launch a public dashboard displaying the total holdings across all addresses.

CRYPTO MARKET

Bitcoin dropped to around $108K last week due to a combination of technical sell signals, large “whale” liquidations, and ETF outflows, which also triggered margin call liquidations. This decline reflected a broader pullback across the cryptocurrency market, despite ongoing institutional interest. Notably, a major investor reportedly sold about 24,000 BTC, sparking forced liquidations that accelerated the price drop. Due to general crypto market correction, the total crypto market capitalization dropped by 6% for the week, with an outflow of $217B. Daily trading volumes were modestly decreased to the level of $311B on a daily basis, from $468B traded the week before. Total crypto market capitalization increase from the beginning of this year currently stands at +15%, with a total funds inflow of $485B.

Over the past week, major crypto coins experienced mostly negative performance. Bitcoin fell sharply to the levels below $109K, with total value decrease of 5,5% and funds outflow of $127,5B. ETH continues to trade above the $4K, still, with a weekly decrease in value of 8,5% and funds outflow of $48B. Other prominent coins such as XRP (-7,1%), Litecoin (-8,2%) and BNB (-2,6%) also posted losses. Market favorite Solana managed to sustain the $200 level, with a relatively small weekly loss of 1,5%. The majority of altcoins finished the week with a single-digit loss. Among rare coins which finished the week in positive territory were POL (previous Matic) with a weekly gain of 2%, and DASH with a plus of 1%.

With respect to coins in circulation, the week was surprisingly calm, with only a few changes. BNB decreased the number of its coins on the market by -0,1%. On the other side were coins like Stellar, DASH, Solana or Filecoin which increased their circulating coins by 0,1%.

Crypto futures market

Crypto futures expressed broader weakness, similar to the spot market. BTC futures experienced a week-on-week decline of around 7,5% for all maturities. Futures maturing in December this year ended the week at $110.985, and those maturing a year later were last traded at $117.505. Despite the price drop, the BTC futures curve remains upward sloping, suggesting that while near-term sentiment is bearish, traders still expect higher prices in the long term.

A similar situation is with ETH futures, which were traded lower by more than 10% on a weekly basis. The steepest drop occurred for maturities in August 2025 which were traded down by 11,3%. December 2025 closed the week at $4.458, and December 2026 was last traded at $4.800. The structure of the futures curve indicates that there is still long-term bullish positioning priced into the market.

TOTAL - total cap crypto "this looks bad," Not saying I've done trivial work in effort to determine the end of an Elliott wave phase peak; so, the chart looks like an Elliott wave does it not? The previously major halving did not have a similar chart where an Elliott wave 1,2,3,4,5 happened. This time it does look like that. Is it possible to have 6,7 phase inclusive to the chart albeit from the idea that Elliott wave means nothing to the new community of virtual currency digital money defi tropes meme derivative foreplay variable online meta landscape of the future? If I was betting on history repeating itself and the looks of the chart here for all cryptocurrency I would say this is not good looking for me, a guy who has made literally no money on cryptocurrency since the last halving despite trying so many times. The world is against me, the trends are fake, the people in society are all brainwashed by propaganda war machine rhetoric political asylums and the minority reports of mainstream majority peoples. Why now? Why not? I'm not looking forward to losing more money then I already have. I haven't made money. Online news doesn't help. Content creators don't help. My family does not help. These indicators which I feel I have a strong understanding of, do not help. Cryptocurrency is too volatile and unpredictable in ways that prevents mathematical decision making becoming profitable. The major players that control the phases of time are established based on the backs of working class people, and savings. We created a monster(s). Now those monsters are eating cryptocurrency for lunch. Cryptocurrency ≠ main course.

Is the Crypto Winter here?Ethereum is seeing a very large decline today.

Hitting massive long term technical resistance in an overbought and hyped up treasury bull run.

It looks like Ethereum has done a prefect bull trap of the all time high price.

Our members received the short alert on Friday and its been a very profitable trade thus far.

A failed breakout of all time highs can lead to catastrophic falls.

The total crypto market caps need to be monitored for a head & shoulders topping formation.

Alt-Season or Alt-Control-Delete.?🤖💣 Alt-Season or Alt-Control-Delete.? 🧠📉

The market looks like it's a bout to rug someone... and it might just be Trump.

While President Trump narrows down his Fed Chair shortlist, the real driver — Powell — is still at the wheel. But the car? It's swerving dangerously near the edge. BTC has lost a key S/R level, the S&P 500 is at major resistance, and Total Crypto Market Cap is stalling at a crucial decision point.

Despite the hype around altcoins and "recovery rallies," I’m deeply cautious. JP Morgan and Bank of America stocks might dip after Trump’s public accusations — signaling that institutions might already be repositioning. Capital tends to exit before the narrative shifts... and that shift could be incoming.

The chart says it best:

👀 BTC beneath S/R

🎲 S&P 500 gamblers partying at resistance

🧠 Meme coin mania while total crypto hits S/R

🧨 Trump’s signaling right, but Powell might yank the wheel left...

This could all be the calm before a liquidity flush.

Stay sharp, don’t follow the crowd — follow the capital.

That said , Bitcoin remains my favorite asset — especially in times of systemic risk. Remember what history shows us: when banks stumble or go bust, Bitcoin tends to rise. If there's one asset in the world I want to carry through a storm, it's Bitcoin. The decentralized antidote to centralized chaos.

One Love,

The FX PROFESSOR 💙

ps. we might see a breakout and Fomo for good reasons...why not? but for now my charts are screaming: CAREFUL!

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

TOTAL ANALYSIS (4H)After the speech of the currently most hated man in finance, the entire market experienced a strong pump. With this upward move, TOTAL market cap is now signaling a potential trend shift.

The corrective A-B-C wave has already concluded following the formation of a double bottom.

A new impulsive upward wave now appears to be on the horizon.

Key Levels:

The current retracement for Wave 3 should find support around $3.83T.

The main target for Wave 3 is projected near $4.4T.

Cycle HeatmapGm, the cycle heatmap says we are still early.

This idea is purely based on the 4 year boom and bust cycle theory.

We expect btc to bottom about 1 year before the halving and top at least 6 months but probably 9-18 months after the halving. So I adapt this theory to the total market cap and estimate a conservative 50% btc dominance to get an idea of the total crypto market cap targets of this new cycle.

We can also combine different cycle based models to create a heatmap.

- 140k BTC target as minimum conservative target

- 10x total target

- 1M BTC target

- trololol log regression aasasoft.org

- log log price chart price.bublina.eu.org

- stock to flow www.lookintobitcoin.com

- halving en.bitcoin.it

This allows us to track where we are in the big picture and identify mean reversion risks.

#dubious #speculation

MARKETS week ahead: August 24 – 29Last week in the news

Fed Chair Powell's speech at Jackson Hole Symposium brought a significant shift in market sentiment on Friday. Markets welcomed the information regarding a potential rate cut in the coming period. The US equity markets were the major weekly gainers, where S&P 500 added 1,52% on Friday, closing the week in a plus of 0,3% at the level of 6.466. The US Dollar lost in value on the news, pushing the price of gold 0,98% higher, and close $3.371. The 10Y US benchmark yields also strongly reacted, easing to the level of 4,25%. Among weekly gainers was also BTC, which tested the resistance at $117K.

In his speech at the Jackson Hole Symposium on Friday, Fed Chair Jerome Powell took a balanced tone, acknowledging progress in bringing inflation down while emphasizing the need for continued vigilance. He noted that inflation has eased from its peak but remains above the Fed's 2% target. Powell indicated that the Fed is prepared to adjust monetary policy as needed, suggesting that if inflation continues to decline sustainably, a rate cut could be considered in the near future. However, he also stressed that the Fed will act cautiously, monitoring economic data closely to avoid reigniting inflation. Overall, his remarks signaled a potential shift toward monetary easing, but with a clear message that the path forward depends on continued improvement in inflation dynamics.

The U.S. government will acquire a 9.9% equity stake in Intel for $8.9 billion by converting previously awarded CHIPS Act grants and Secure Enclave program funds into non-voting common stock. This passive investment does not grant the government any board or governance rights, though it includes a five-year warrant to potentially purchase an additional 5% if Intel’s foundry ownership drops below 51%. The agreement follows tensions between President Trump and Intel CEO Lip-Bu Tan, but industry observers suggest this move aims to bolster U.S. semiconductor manufacturing and national technological leadership.

The U.S. and EU have introduced more specifics on their updated trade framework, with clear 15 percent tariffs set for pharmaceuticals, semiconductors, lumber, and automobiles, offering some clarity to already imposed tariffs. However, many businesses remain wary—uncertainties around customs rules, enforcement, and the deal’s long-term reliability continue to create unease.

Apple is reportedly in early talks with Google to use Google's Gemini AI model to power a revamped version of Siri, sparking investor optimism. Following the news, Alphabet’s stock climbed approximately 4%, while Apple’s stock also gained around 2%.

According to UBS Weekly Intelligence, the biggest tech spenders (based on combined capex and R&D intensity relative to sales) are Meta, Intel, and Oracle, while the lightest spenders include Mastercard, Uber, and Accenture. Other notable names include Microsoft (36 %), Amazon (31 %), Alphabet (35 %), and Apple (11 %) — a useful gauge of how tech firms are prioritizing investment amid the AI-driven market environment.

CRYPTO MARKET

Crypto assets surged after Fed Chair Powell's Jackson Hole remarks hinted at an interest rate cut as soon as next month, fuelling renewed risk-on sentiment. Bitcoin rallied back above $117K from below $112K, while crypto-linked stocks like MicroStrategy and Coinbase gained around 5–7%. Altcoins such as Ether and Solana also climbed sharply. Ether gained 15% on Friday, surpassing the $4,8K level. Regardless of Friday's higher push toward the higher grounds, the total crypto market capitalization remained relatively flat on a weekly level. By managing to cover weekly losses, the crypto market cap gained quite modest $9B in total cap during the week. At the same time, daily trading volumes were significantly increased to the level of $468B on a daily basis, from $312B traded the week before. Total crypto market capitalization increase from the beginning of this year currently stands at +22%, with a total funds inflow of $702B.

The previous week was significant for ETH, since this coin attracted the majority of investors attention and also funds. ETH ended the week by 7% higher from the week before, adding more than $37B to its market cap. ETH also managed to reach ATH at the level of $4.877. BTC is closing this week by 2,13% lower from the week before, after dropping during Saturday trading to the level of $115K. Other altcoins were traded in a mixed manner, with either small gains, or small weekly losses. Among higher gainers were LINK, with an increase in market cap of 14.5%, ZCash had a very good week, with a gain of 16%, while market favorite Solana was last traded higher by 7,5% w/w. This week Maker closed with a higher drop in value of 7,3%.

Regarding circulating coins, the situation was also a bit mixed. On one side was Polkadot, with a weekly increase of circulating coins by 0,6%. On the opposite side was Filecoin, with a decrease in the number of coins on the market by 0,6%. This sort of action is indeed rarely seen, when Filecoins is in question. ADA was another coin with an increase in circulating coins by 0,3%. BTC should be especially mentioned, as its circulating supply was increased by 0,1% w/w.

Crypto futures market

While BTC futures saw a week of softening prices, ETH futures rallied significantly, reflecting diverging market sentiment between the two leading crypto currencies. BTC futures experienced moderate decline across all maturities, with the largest weekly drop in March 2026 of -2,08% and June 2026 of 1,93%. The weekly price changes indicate a slightly firmer long-term sentiment, as December 2026 closed the week at $126.795 and December this year dropped by 0,9% at the level of $119.845.

In contrast, ETH futures showed strong bullish momentum, with weekly gains of around 10% across all maturities. The highest rise was in October 2025 of 10,3%, suggesting a robust market outlook for ETH in both the short and long term. At the same time ETH futures maturing in December 2026 reached their all time highest level at $5.347, while December 2025 was closed at $4.994.

Bitcoins Cycles - Looks like it's the sameAccording to the 4-year cycle concept, Bitcoin’s peak should land around October –November 2025. That's 1 year of a bear market and 3 years of a bull market.

The only way we’ll know the cycles have broken is if Bitcoin keeps climbing past that window, even if there is a correction.

That would really confirm a new paradigm in this asset class for the cycles.

Crypto Total Market Cap: Major Daily Trendline RetestThe entire crypto market is pulling back to its key daily trendline, a level that has provided strong support since April. This retest will determine whether the uptrend remains intact or if we risk a deeper correction. Watching this closely for confirmation.

Educational content - not financial advice.