Tron (TRX): Liquidity Sweep Restarted The Chart | BullishCRYPTOCAP:TRX had a quick liquidity sweep, but buyers stepped in aggressively and regained control of the zone. For now, momentum remains with the bulls, and our current target sits at $0.37. Once that level is reached, we will monitor price action closely

If resistance holds, a pullback is possible, but if buyers manage to break through, the next target will be the upper resistance zone.

Swallow Academy

Trade ideas

TRXUSDT-4h-LONGThe red cycle appears to have completed around the recent peak in July-August, indicating a potential reversal point.

The price has approached the lower boundary of the ascending Fibonacci channel, which coincides with the completion of the red cycle.

The interaction at this support could lead to a bounce if buying pressure increases, or a breakdown if selling continues, depending on subsequent candlestick patterns and volume.

This confluence marks a critical area to watch for confirmation of the next trend direction.

TRON Wave Analysis – 9 September 2025- TRON reversed from the round support level 0.3000

- Likely to rise to resistance level 0.3500

TRON cryptocurrency recently reversed up from the strong support zone between the round support level 0.3000 (which has been reversing the price from July, as can be seen below) and the 61.8% Fibonacci correction of the upward impulse from June.

The upward reversal from this support zone created the daily Japanese candlesticks reversal pattern Hammer.

Given the clear daily uptrend, TRON cryptocurrency can be expected to rise toward the next resistance level 0.3500 (former resistance from July).

TrxusdtBecause the channel has been broken, you should enter on the pullback to fall. The less risky option is to enter after the support area is broken, or enter on the pullback and reduce volume on the support area. The price targets are the green and blue lines, respectively, and finally the end of the red arrow.

TRX: Justin Sun’s Play | September 08, 2025.Sergio Richi Premium ✅

CRYPTOCAP:TRX #Crypto #Tron 🪙 — TRX: Justin Sun’s Play | September 08, 2025.

Price (Sept 8, 2025) : $0.3323

Asset Overview:

Tron (TRX) is a high-throughput blockchain platform focused on decentralizing the internet through dApps, smart contracts, and content sharing. Founded in 2017, it supports fast, low-cost transactions (up to 2,000 TPS) and powers ecosystems like DeFi, NFTs, and stablecoins (e.g., $79B USDT supply).

TRX is used for fees, staking, and governance, positioning Tron as a scalable alternative to Ethereum.

Key News (Sep 1-7, 2025):

• Treasury Boost: Tron Inc added 312.5M TRX (~$110M) to holdings, doubling to $220M for grants, liquidity, and AI/DeFi growth—echoing MicroStrategy's BTC strategy.

• Ecosystem Hype: High engagement outpaces rivals; WLFI token unlock ties to Sun spark interest.

Institutional Accumulation:

• Tron Inc leads as a "MicroStrategy of TRX," filing for $1B securities to accumulate TRX (never sell) via Nasdaq listing/reverse merger with SRM Entertainment.

• XRP whales shifting to TRX pre-ETF hype; VanEck offers TRX ETP for exposure.

Market Maker Wintermute

💡 Entry & Exit:

Entry: $0.3323 (spot long)

🎯 Take Profit: $0.6646 (+100%)

My View:

After the correction, Tron is looking solid for continuing its uptrend.

Big players holding long positions on TRX/USDT are showing strong metrics, and market maker Wintermute doubled its investment in Tron over the past week, which boosts confidence for further growth.

DeGRAM | TRXUSD fixed under the resistance line📊 Technical Analysis

● TRX/USD is moving lower inside a descending channel, with repeated rejections from the upper boundary around 0.3444 signaling persistent selling pressure.

● Price is now testing the mid-range near 0.3388; a breakdown would likely expose 0.3341 and extend the bearish momentum toward the channel base.

💡 Fundamental Analysis

● Despite TRON’s stablecoin activity growth, broader market risk-off sentiment and weaker altcoin flows are capping upside potential for TRX.

✨ Summary

Bearish below 0.3444; targets 0.3388 → 0.3341. Invalidation on a close above 0.3450.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Tron Price Holds $0.31 Support, Eyes Rally Toward $0.43Tron price action recently corrected lower but quickly found its footing at $0.31, where the 0.618 Fibonacci retracement coincided with a key weekly support. The strong bounce has reinforced confidence in the ongoing bullish trend, suggesting that the corrective move was a healthy reset rather than a reversal.

Tron Key Technical Points

- Support Confirmation: Price held above $0.31, aligning with the 0.618 Fibonacci retracement.

- Upside Targets: Key resistance sits at $0.36, with further expansion possible toward $0.43.

- Market Structure: Consecutive higher lows continue to signal bullish momentum despite recent correction.

Analysis

The recent correction on Tron allowed price to retest crucial technical levels, and the defense of $0.31 has proven significant. This level acted as both Fibonacci support and a weekly structure base, and the strong close above it confirmed demand remains present. Such confluence makes this zone a cornerstone for the current bullish setup.

Looking ahead, the immediate upside target is $0.36, where prior resistance could again act as a hurdle. If buyers reclaim this level decisively, it would confirm continuation of the trend and unlock the next major target at $0.43. These objectives align with the broader Fibonacci extension framework, reinforcing the technical roadmap for higher prices.

From a structural perspective, Tron’s price action remains intact within a bullish framework. The formation of consecutive higher lows, even during corrective pullbacks, highlights the underlying strength of the trend. This pattern supports the idea that corrections are providing opportunities for accumulation, rather than signaling exhaustion.

What to Expect in the Coming Price Action

As long as $0.31 holds, Tron is positioned for continuation higher, with $0.36 as the next key level. A breakout above this zone could accelerate price toward $0.43, confirming bullish momentum.

TRON is closing the end of Weekly CycleAs you see, TRX has been bullish and making higher highs with Bitcoin since November of 2022. I suspect the of this rally is very close (We might have even seen the Highest High already) and Tron can start a Weekly Correction towards towards 0.14$ - 0.09$ which is around 50 - 70% correction. So be wary if you want to invest on this one !!!

Tron (TRX): Still Strong | Do Not Miss It Tron is strong, with the 200EMA boosting the price and holding its ground as a strong support area.

We have been in a long position for over a month and we are in profits, small but still profits. We are waiting for a proper bounce and we are ready to wait!

Swallow Academy

Tron Wave Analysis – 3 September 2025

- Tron reversed from the support zone

- Likely to rise to resistance level 0.3495

Tron recently reversed from the support zone between the support level 0.3310 (low of wave b from August), lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse form July.

This support zone was further strengthened by the upper trendline of the multi-month up channel from March (acting as the support after it was broken).

Given the clear uptrend and the oversold daily Stochastic, Tron can be expected to rise to the next resistance level 0.3495, former monthly high from July.

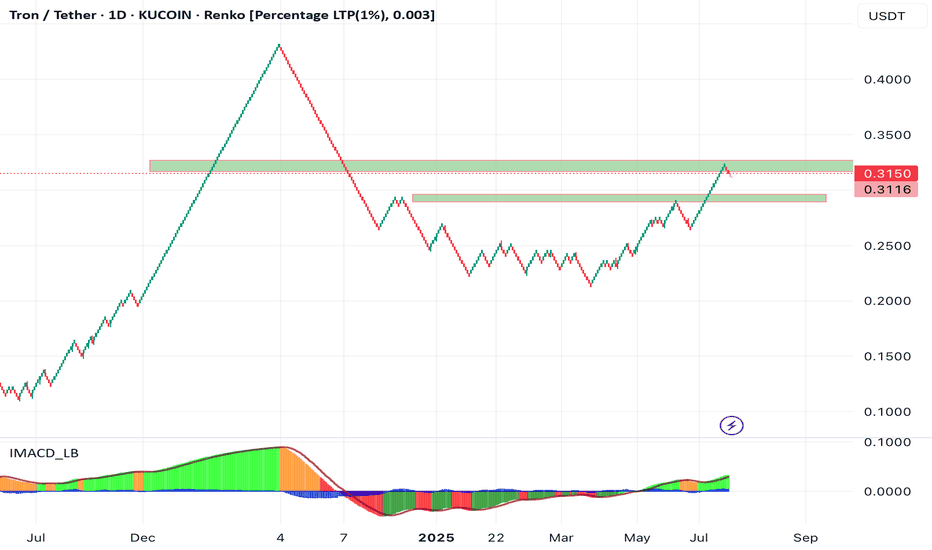

Remarkable Growth in TRON (TRX/USDT) Stability and Price – SuppoIn recent months, the TRON (TRX) network and price have witnessed remarkable stability and growth. According to a recent analysis by CryptoOnchain published on the CryptoQuant platform, one of the main indicators of this stability has been the unprecedented consistency in daily block production on the TRON network. The report highlights that the daily block count has remained nearly constant (around 28,500 blocks), mainly attributed to recent technical improvements, an increase in network energy capacity, and the implementation of a dynamic energy model.

On the provided Renko chart, TRX’s positive price momentum is also clear. Following the recovery from the 0.20–0.22 support zone and strengthening bullish momentum (as indicated by the histogram indicator), a breakout above the $0.3150 resistance could accelerate the upward trend.

Technical & Fundamental Context:

Based on the CryptoOnchain analysis on CryptoQuant: The network’s energy capacity has doubled and a dynamic energy model has been implemented, ensuring operational stability even alongside record transaction volumes.

Despite high on-chain activity, the block production rate has stayed stable, and strong fundamentals supported by security upgrades continue to strengthen both the network and price.

Technically, reclaiming key supports, holding above the Ichimoku cloud, and positive signals from the IMACD_LB indicator all confirm the strength of the trend.

Summary:

The synergy between strong fundamentals (as highlighted in the CryptoOnchain/CryptoQuant analysis) and the chart’s technical structure creates a positive outlook for TRX. If the price holds above the 0.22–0.25 support and overcomes the $0.3150 resistance, higher targets become more likely.

Tron is set up for a mega pump, just like Bitcoin in 2017!I believe a massive pump is coming for Tron. The chart is showing a pattern very similar to Bitcoin in 2017. Markets are fractal in nature, and these patterns tend to repeat over and over. Tron could be an excellent hold during the mass adoption phase we’re heading into.

As always, stay profitable.

- Dalin Anderson

DeGRAM | TRXUSD will retest the support level📊 Technical Analysis

● TRX remains inside a broad descending channel, with price recently rebounding from the $0.336–0.338 support zone and forming a higher low structure.

● Short-term momentum suggests a corrective bounce toward $0.3459 and potentially $0.3515, provided buyers hold above $0.3394.

💡 Fundamental Analysis

● TRON’s network continues to expand its dominance in stablecoin transfers, with USDT transaction volumes hitting new highs, reinforcing TRX’s role in DeFi and boosting underlying demand.

✨ Summary

Bullish above $0.3394; targets $0.3459 → $0.3515. Invalidation on a close below $0.336.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Tron (TRX): Moving like SP500 | $0.40 is HappeningTRX is still a good investment in our opinion;ever since the end of May, we have been aiming for the $0.40 zone to be reached.

The 100 and 200 EMAs are both bullish and the price keeps that buyside momentum pretty well so we will keep on riding that trend as long as we are above the EMAs! ($0.40 is the target but it might not be the final stop.)

Swallow Academy

DeGRAM | TRXUSD is preparing for a rebound📊 Technical Analysis

● TRX is consolidating inside a rising channel, bouncing strongly from the $0.3500 support area while eyeing resistance near $0.3627.

● Price action suggests a potential retest of lower channel support before resuming upward momentum toward $0.3688, confirming bullish continuation.

💡 Fundamental Analysis

● Recent news highlights TRON’s network leading in stablecoin transfers, with USDT activity surpassing Ethereum, boosting demand for TRX and reinforcing its utility.

✨ Summary

Long above $0.3500; breakout toward $0.3627 and $0.3688 expected. Invalidation below $0.3500.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

TRXUSDT 1H Chart Analysis | Eyeing the Breakout for MomentumTRXUSDT 1H Chart Analysis | Eyeing the Breakout for Momentum

🔍 Let’s break down TRX/USDT price action and identify setups that could unlock the next move, with a spotlight on RSI dynamics and key breakout levels.

⏳ 1-Hour Overview

The chart is currently forming a tightening symmetrical triangle, signaling a squeeze ahead of an expected breakout. Price action is consolidating between the local support at $0.3457 and resistance near $0.3520–$0.3547.

📈 RSI Insights

- The RSI sits around 48, reflecting short-term indecision and neutral momentum.

- There’s a clear RSI trendline forming higher lows, indicating underlying strength building up.

- Watch closely: An RSI breakout above 59 is flagged as a momentum trigger, historically driving stronger moves.

📊 Key Highlights:

- Chart pattern: Tightening triangle points to an imminent volatility expansion.

- Price structure: Breakout (BO) above $0.3520 or, more convincingly, $0.3547 opens up higher targets.

- Bullish targets: $0.3615 and $0.3680—these mark the next resistance zones if upside momentum takes over.

- RSI dynamics: Trendline support on RSI signals hidden demand; BO above 59 on RSI can fuel upside moves.

🚨 Conclusion:

TRX is at a make-or-break juncture. A decisive breakout above $0.3520 or, even better, $0.3547 could unlock a rally to $0.3615 and $0.3680. Keep a close eye on the RSI—trendline holds and a thrust above 59 can serve as early confirmation of buyer strength.

TRX Bearish📊 TRXUSDT (8H) – Technical Analysis

TRX has been moving within an ascending channel (blue lines) over the past weeks, repeatedly testing both the upper and lower boundaries. After the recent peak, a stronger correction started and is still in progress.

🔻 Based on the chart, there is a potential -13.7% pullback, pointing to the following key support levels:

• 0.3347 USDT – first support (previous local low, yellow line).

• 0.3185 USDT – stronger support zone that has been tested multiple times.

• 0.3006 USDT – major support level, aligned with the projected target area.

📌 Scenarios:

• As long as TRX stays within the ascending channel, the trend remains bullish.

• Losing the 0.3347 and 0.3185 supports could open the way down to 0.3006.

• On the upside, resistance is seen near 0.36.

Tron long to $0.35520 then 0.37sl: 0.34811

tp: 0.35520

Roughly 5RR

By end of weekly tron is likely to return to $0.37 target area and possibly higher. 4hr is bearish right now but will need to shift back bullish to facilitate this move. Target is 4hr lower high. Afterwards another correction is likely which can provide another entry for long up to $0.37