Uniswap Holding above $7 — Bullish Setup AheadAfter the massive 90% drop from its 2021 peak, Uniswap has been consolidating within a wide range. Each attempt to break higher has so far been followed by a return toward the lower end of the structure — a clear sign of prolonged accumulation.

What’s particularly interesting is how the $7 zone has consistently acted as a median level. Every time price dipped below it, UNI found demand and reversed back up. Recently, a solid support base has been confirmed around $5, further strengthening the bullish technical structure.

With the majority of altcoins now positioned for potential upward continuation, Uniswap could also be preparing for a significant leg higher, with a medium-term target around $14 per coin.

However, negation of this bullish setup would come with a clear breakdown below the $7 zone, which could open the way for a retest of the $5 support once again.

From a trading perspective, this setup offers an attractive 1:5 risk-to-reward ratio, making it an opportunity worth keeping on the radar — provided the $7 level holds.

UNIUSDT.P trade ideas

$UNIUSDT a good long oppotunity.The market is expected to cool down a bit after the recent CRYPTOCAP:BTC rally — that’s our chance to catch a solid long setup. Check the green box for the entry zone!

Entry in the green box as low as possible.

🎯 Target: $8.4, $9.7, $10+

If CRYPTOCAP:BTC corrects to around $120,000, it could drag altcoins lower, giving us a perfect opportunity for a juicy long position.

Always DYOR! 💪 #Crypto #Altcoins #BTC #Trading #TechnicalAnalysis #MarketUpdate #DYOR

TradeCityPro | UNI: Key Levels and Bullish Continuation Setup👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review UNI, one of the most popular DEX projects within the Ethereum ecosystem, with a market cap of $4.93 billion, ranking 28th on CoinMarketCap.

📅 Daily Timeframe

This coin has shown a strong upward move reaching 11.449 and then started a correction. After the failure at this level, a downward move began.

🧩 An important support zone around $8.5 has formed, which after breaking, is now acting as resistance.

✅ During this downward movement, the volume has been decreasing. Despite having two down legs so far, it can be said that the overall trend for this coin is still bullish.

📊 For a long position, the first trigger we have is the break of the Maker Seller level. Breaking this level will remove a lot of selling pressure, which could cause a sharp upward move in price.

🛒 The spot trigger for UNI is at 11.449. I recommend opening a long position after breaking the level, and using the profits from that position to buy this coin when the spot trigger is activated.

💥 For a short position, the trigger is 7.447. If the price ranges a bit longer in this area and then breaks the low, it would make a great position. However, if the price breaks the level right now, it would be a risky trigger.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

A $300 $UNI token?so it might sound unrealistic — until it’s not. That’s essentially a 10x from here followed by another 3x extension. With altseason approaching, DEX tokens deserve a spot in every serious portfolio. These platforms can easily spark momentum through new airdrops, fee-sharing models, or expanded token utility.

Uniswap approaches key support, potential 20% surge to 11$Hello✌️

Let’s analyze Uniswap’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

A new proposal could send 65% of Uniswap fees to UNI stakers, making the token yield-bearing.

If approved, UNI may see strong demand, but delays could slow momentum.

📊Technical analysis:

BINANCE:UNIUSDT is approaching two key support zones while testing the psychological resistance at 10. A clear breakout above this level could signal a continuation move of around 20%, with price targeting the 11 area. 📊🚀

📈Using My Analysis to Open Your Position:

You can use my fundamental and technical insights along with the chart. The red and green arrows on the left help you set entry, take-profit, and stop-loss levels, serving as clear signals for your trades.⚡️ Also, please review the TradingView disclaimer carefully.🛡

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale

UNI/USDT – Daily OutlookUNI is approaching the 7.7 – 7.8 demand zone after significant bearish pressure. This zone will act as a crucial decision point.

If demand holds, UNI may rebound and retest the 10.3 resistance, which also serves as the validation level for the Head and Shoulders pattern. A breakout above this level would invalidate the HnS scenario and open the door for further bullish continuation.

If demand breaks, the bearish structure could extend lower, potentially targeting the 6.5 – 6.7 region.

At this stage, the demand zone will be the key level to watch, as it will decide whether UNI maintains its medium-term bullish outlook or shifts into a deeper bearish trend.

Uniswap (UNI): 2 Bullish CME Gaps To Fill SoonUNI update: we’re still waiting for a clean BOS. The bullish CME gaps are yet to be filled—first around 10.2 and the bigger one near 11.3–11.5.

As long as buyers defend the EMAs and we see that breakout, we’ll look for continuation into those levels. Patience is key here; the gameplan stays the same.

Swallow Academy

UNIUSDT About to Explode or Break Traders’ Dreams?Yello Paradisers, is #UNIUSDT quietly preparing for its next major rally, or are we sitting right on the edge of a painful trap for impatient traders? Let’s break it down.

💎#UNI has been holding within its ascending channel, bouncing consistently from its demand zone around $9–$9.50. Every retest of this area has brought buyers back into the game, showing strong defense by bulls. Right below, the major demand zone at $7–$8 remains the key level where long-term buyers are waiting, meaning this area acts as a foundation for continuation.

💎On the upside, if #UNI holds current structure and builds momentum, the first challenge is the minor resistance near $14. Breaking through this opens the door toward the strong resistance zone at $18–$19, where profit-taking will likely be aggressive.

💎However, there’s no free ride. A failure to hold the current demand zone could trigger a drop into the $7–$8 major demand area. If that level also gives up, the structure is invalidated, and UNI could revisit much deeper lows around $5–$6, wiping out weak hands before any real recovery.

💎Right now, #UNI is at a pivotal point: defend support and aim for $14–$18, or lose footing and fall into heavy liquidation territory.

Strive for consistency, wait for clear confirmations, and remember that discipline always beats chasing quick profits.

MyCryptoParadise

iFeel the success🌴

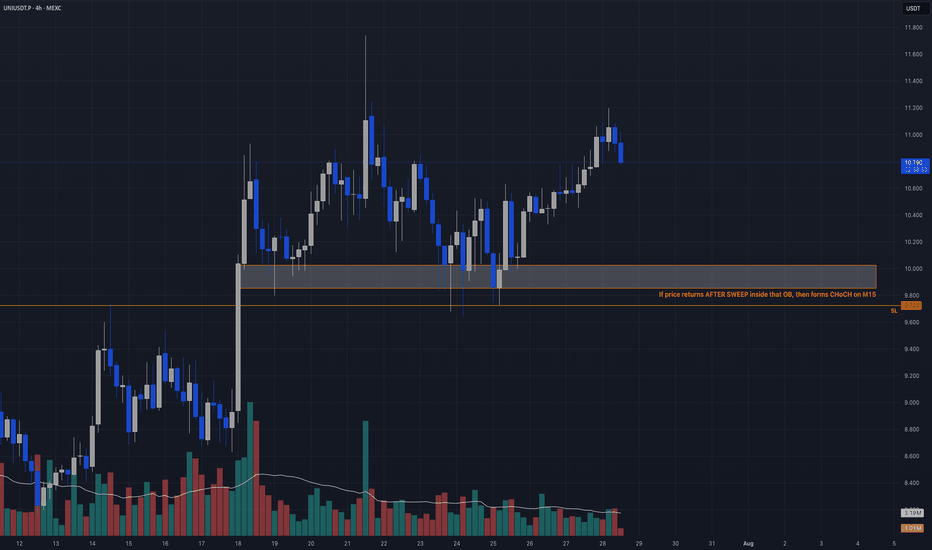

Liquidity Sweep + OB Retest → CHoCH TriggerCandle Craft fam — we’ve got a clean and calculated setup unfolding on UNIUSDT.P (4H). This one fits our criteria perfectly: structure, sweep, and planned trigger. No rush. We wait for the market to show its hand.

⸻

📈 Bias: Long

🧠 Strategy: Liquidity Sweep + OB Retest → CHoCH Trigger

📍 Entry Plan:

▫️ Entry Zone: 9.80 – 10.00 (after sweep)

🛡️ Stop Loss: 9.724

🎯 Take Profits:

• TP1: 10.85

• TP2: 11.20

• TP3: 12.00+

⸻

🧠 Why This Trade?

– Price approaching 4H OB with prior impulse support

– Eyes on liquidity sweep under $10.00

– Looking for M15 CHoCH after sweep for confirmation

– HTF bias remains bullish → continuation expected on reclaim

⚠️ This is a reactive setup — no blind entries. Let the trap trigger the trade.

⸻

Trade clean. Execute with intent.

We don’t guess. We wait, we strike.

—

Candle Craft | Signal. Structure. Execution.

UNIUSDT — Value Slips Under 9.35, Who Holds the Floor?UNI’s auction looks like a bar with a strict bouncer: every rally into 9.7 gets thrown out, while the crowd drifts back toward 9.2. Let’s map the value bands.

High Timeframes (Weekly → 2D → 12H)

– Weekly: Rejecting 10–11 supply. Demand 8.6–9.0, deeper 7.6–8.0.

– 2D: LH sequence into 9.0–9.3 floor. Resistance = 9.8–10.1. Residual FVGs: 9.55–9.70, 9.85–10.0.

– 12H: Range 9.0–9.8. Acceptance >9.70 = breaks LH drift toward 10+. Acceptance <9.00 = sweep down 8.6–8.8.

Orderflow / Profile

– POC 9.54–9.56.

– VAL 9.34–9.36, VAH 9.70–9.72.

– Current 9.28 trades under VAL; sustained build migrates value lower.

Derivatives

– OI steady/slightly down.

– Funding ~0 with flips.

– CVD distributive.

– Liquidations modest.

Inter-Market

– BTC mid-range, BTC.D <60% keeps alts supported, but UNI remains seller-weighted until reclaim ≥9.35.

Conclusion

UNI sits balanced-to-heavy. Below VAL → 9.0 → 8.6–8.8 demand. Above VAL → 9.55–9.65 rotation.

Candle Craft | Signal. Structure. Execution.

uniswap trade 2 month time frame1st.on the 22 hr time frame, there is triple bull div. on this time frame about to move. above the 200 ma

2nd. from the fib exstention i dont see it going past $35.78 still i nice move

3rd august was a slight bearish month trying to shake us out

4th. the total market cap of all the cryptos closed above its pattern that its been in for almost 5 years. which is a good sign.

in the short term i see uniswap going to 21 dollars and consolidating

is is my thesis for this project. let me know what you think. thanks!!!

UNI UPDATE (4H)After completing a five-wave impulsive move to the upside, UNI now appears to have entered a corrective A–B–C pattern.

Additionally, a head and shoulders formation has already broken down and been retested, further confirming bearish momentum. All signals currently point toward a downward continuation.

On the 15-minute timeframe, a mini bear flag has also formed, which strengthens this bearish outlook.

Good Luck.

UNIUSDT.P LONGIf price shows bullish pattern at any of our levels dont hesitate to jump in the trade.

The 50% area has been marked dont forget to take 50% of the profit and S.L to entry price.

Those who follows me must be in profit.

Please keep following me it will encourage me to post more and more analysis for you guys.

Uniswap (UNI): Good Buying OpportunityUNI has recently formed a decent BOS, where price is currently retesting that broken zone. As soon as we see that buyers have taken control over that retest area, we are going to look for a buy entry right there—seems like a pretty solid setup for us so let's try!

Swallow Academy