Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

20.80 INR

7.59 B INR

464.51 B INR

564.02 M

About UPL Limited

Sector

Industry

CEO

Jaidev Rajnikant Shroff

Website

Headquarters

Mumbai

Founded

1969

IPO date

Feb 26, 1996

Identifiers

2

ISIN INE628A01036

UPL Ltd. engages in the business of manufacturing and sale of pesticides, insecticide, and micronutrients. It operates through the following segments: Crop Protection, Seeds Business, and Non-Agro. The Crop Protection segment includes the manufacture and marketing of conventional agrochemical products, and other agricultural related products. The Seeds Business segment manufactures seeds. The Non-Agro segment focuses on the manufacturing and marketing of industrial chemical and other non-agricultural related products. The company was founded by Rajnikant Devidas Shroff on May 29, 1969 and is headquartered in Mumbai, India.

Related stocks

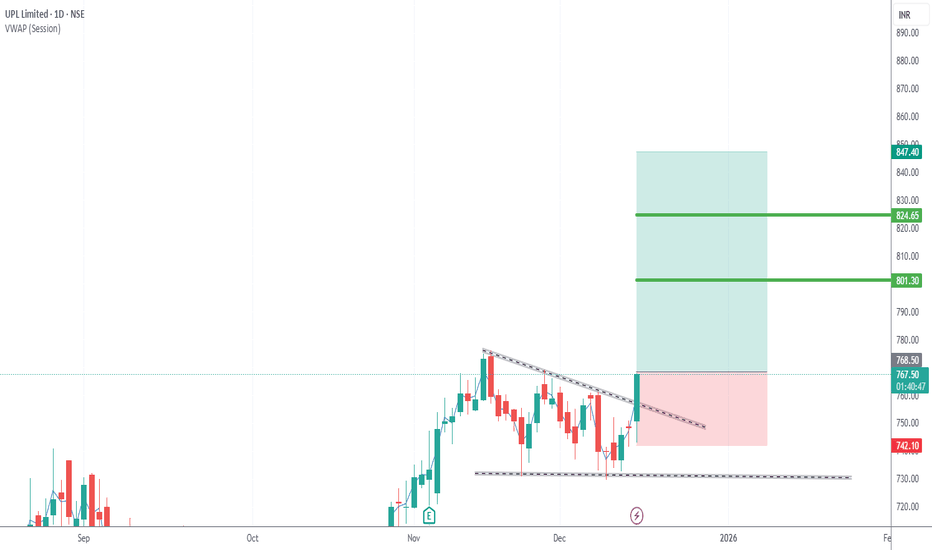

UPL – Ready for All-Time High? (Preemptive Breakout Setup)🌱 UPL – Ready for All-Time High? (Preemptive Breakout Setup)

UPL is showing signs of a rounding bottom breakout after almost 4 months of consolidation.

If this breakout sustains, the stock can head towards an all-time high (ATH) — last seen in June 2021.

Since this is a preemptive setup, follow s

UPL – On Verge of Neckline Breakout After 4.5-Year ConsolidationUPL is showing a classic rounding bottom structure formed over the last 4.5 years, signaling a potential major trend reversal on the long-term chart. The price is now hovering near the neckline resistance, and a decisive breakout above this zone could ignite strong momentum ahead.

🔹 Technical Setup

UPL LIMITED – SELL SETUP (Equity + Futures)🔻 UPL LIMITED – SELL SETUP (Equity + Futures)

Entry Zone: ₹718 – ₹717

Action: SELL

Targets:

🎯 Target 1: ₹710

🎯 Target 2: ₹700

Stop Loss: ₹725 (Closing Basis)

Analysis Insight:

UPL is showing clear weakness near its resistance zone around ₹718–₹720 levels, with consistent selling pressure and low

UPL Ltd for 27th Oct #UPL UPL Ltd for 27th Oct #UPL

Resistance 680 Watching above 682 for upside momentum.

Support area 665 Below 675 gnoring upside momentum for intraday

Watching below 665 for downside movement...

Above 675 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict st

Market Outlook and Entry Strategy for UPLBased on the daily chart structure, the current market trend is bullish, evidenced by a Break of Structure (BOS). The price has already retraced to the 70% Fibonacci level on the same timeframe, indicating a healthy pullback within the ongoing trend.

However, despite this bullish context, this is n

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

UPLC5000773

UPL Corporation Limited 4.625% 16-JUN-2030Yield to maturity

5.70%

Maturity date

Jun 16, 2030

UPLC4611648

UPL Corporation Limited 4.5% 08-MAR-2028Yield to maturity

5.65%

Maturity date

Mar 8, 2028

78KL45

Kerala Enviro Infrastructure Ltd. 7.8% 02-NOV-2045Yield to maturity

—

Maturity date

Nov 2, 2045

See all UPL bonds

GUNR

FlexShares Morningstar Global Upstream Natural Resources Index FundWeight

0.54%

Market value

36.41 M

USD

EEDM

iShares IV PLC - iShares MSCI EM CTB Enhanced ESG UCITS ETF Unhedged USDWeight

0.18%

Market value

17.96 M

USD

EDM2

iShares IV PLC - iShares MSCI EM CTB Enhanced ESG UCITS ETF Accum Shs Unhedged USDWeight

0.18%

Market value

17.96 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of UPL is 741.30 INR — it has decreased by −0.85% in the past 24 hours. Watch UPL Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange UPL Limited stocks are traded under the ticker UPL.

UPL stock has risen by 3.37% compared to the previous week, the month change is a −7.45% fall, over the last year UPL Limited has showed a 15.11% increase.

We've gathered analysts' opinions on UPL Limited future price: according to them, UPL price has a max estimate of 980.00 INR and a min estimate of 630.00 INR. Watch UPL chart and read a more detailed UPL Limited stock forecast: see what analysts think of UPL Limited and suggest that you do with its stocks.

UPL stock is 2.69% volatile and has beta coefficient of −0.17. Track UPL Limited stock price on the chart and check out the list of the most volatile stocks — is UPL Limited there?

Today UPL Limited has the market capitalization of 625.57 B, it has increased by 2.20% over the last week.

Yes, you can track UPL Limited financials in yearly and quarterly reports right on TradingView.

UPL Limited is going to release the next earnings report on May 11, 2026. Keep track of upcoming events with our Earnings Calendar.

UPL earnings for the last quarter are 5.40 INR per share, whereas the estimation was 6.46 INR resulting in a −16.41% surprise. The estimated earnings for the next quarter are 15.10 INR per share. See more details about UPL Limited earnings.

UPL Limited revenue for the last quarter amounts to 122.69 B INR, despite the estimated figure of 115.66 B INR. In the next quarter, revenue is expected to reach 169.79 B INR.

UPL net income for the last quarter is 3.96 B INR, while the quarter before that showed 5.53 B INR of net income which accounts for −28.39% change. Track more UPL Limited financial stats to get the full picture.

Yes, UPL dividends are paid annually. The last dividend per share was 6.00 INR. As of today, Dividend Yield (TTM)% is 0.81%. Tracking UPL Limited dividends might help you take more informed decisions.

As of Feb 7, 2026, the company has 12 K employees. See our rating of the largest employees — is UPL Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. UPL Limited EBITDA is 95.49 B INR, and current EBITDA margin is 17.17%. See more stats in UPL Limited financial statements.

Like other stocks, UPL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade UPL Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So UPL Limited technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating UPL Limited stock shows the buy signal. See more of UPL Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.