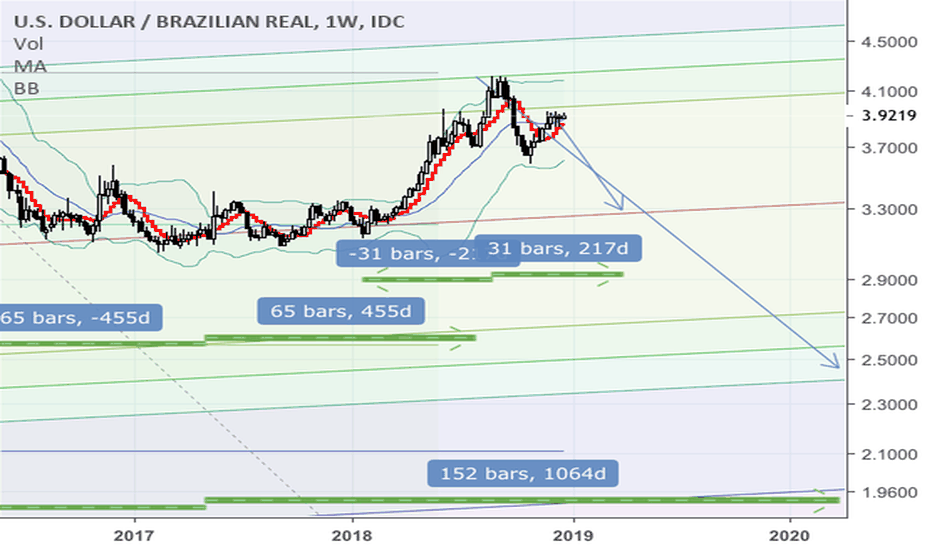

BRL struggling right now. Next weeks are critical.All necessary information is on the chart.

Following last years elections results BRL recovered against the US dollar, but despite a series of positive indicators, reports and overall better economical mood BRL failed to follow towards the target of the previous head and shoulders pattern, instead, encouraged by yet another corruption scandal, the price has been hiking strong, and has the potential to trigger a massive cup and handle pattern. Such a massive loss of value is not unheard of in South America, and has as a matter o fact befallen a neighboring country - Argentina - a few years ago.

Trade ideas

#BRICS currencies movement for the Week - 22Feb19Fairly stable week for most BRICS #currencies, thanks to some USD weakness. #SouthAfrica recovering some of last weeks losses. #BRICS currency/USD movements for this week:

Brazil -1.3%

Russia +1.4%

India +0.4%

China +0.9%

South Africa +0.5%

Euro/USD +0.4%

I must admit that the one currency that is looking mighty interesting technically this week, is the Brazilian Real. At 0.2664/USD it is not only finding itself close to the 50-day moving average at 0.2652/USD, but also at a nice little trend resistance line. A bounce off these levels could see us test the short-term highs made in both January this year and October 2018 – target 0.2744/USD . Should the current resistance break, traders should watch the 200-day moving average at 0.2608/USD as first target/stop.

USDBRL - Downtrend line resistanceIn the graph we can see the primary line (yellow 55 days) and secondary line (green 21 days) are still point down. The downs and ups of peaks and troughs are getting lower peaks and lower troughs. We can draw a downtrend line connecting the peaks, is a resistance line.

For tomorrow we can expect the downtrend line act as a resistance around 3.73 and if the price goes down we can see the next support 3.68, 3.64, 3.60.

Queda no Preço do USD ao BRLO preço do Dolar Americano no câmbio USD BRL continuará a cair amanhã conforme minha previsão, baseada em análises técnica e fundamentalista. Vista, aquela, no gráfico de 15 minutos.

E deve continiar a cair no mês de fevereiro de 2019, até a faixa entre os preços de R$3,3480 e R$3,1149, mas pode descer até R$3,0415, conforme o gráfico semanal.