Daily structure marked for weekly bearish trend trackingWe see a manipulation structure marked just like last week; in fact, it is doing the same thing where we took the same entry. We could likely have a reversal for tomorrow in buys, but today the price dictates that it wants to continue with the bearish trend, where we have a clear daily structure whe

U.S. Dollar / Mexican Peso

No trades

Related currencies

USDMXN Daily Trend Remains Under Bearish PressureUSD/MXN continues to trade within a clearly defined bearish structure on the daily timeframe, characterized by a sequence of lower highs and lower lows. Price remains firmly below both the 50-day and 200-day simple moving averages, with the 50-day SMA acting as dynamic resistance and reinforcing the

USDMXN – Sell the Pullback in a Bearish Channel (Daily & H4 FVG)USDMXN – Multi-Timeframe Technical Analysis (Daily → H4 → Intraday)

USDMXN remains in a strong bearish trend on the Daily timeframe, trading within a well-defined descending channel.

The recent impulsive move to the downside confirmed a break of structure, suggesting continuation after a corrective

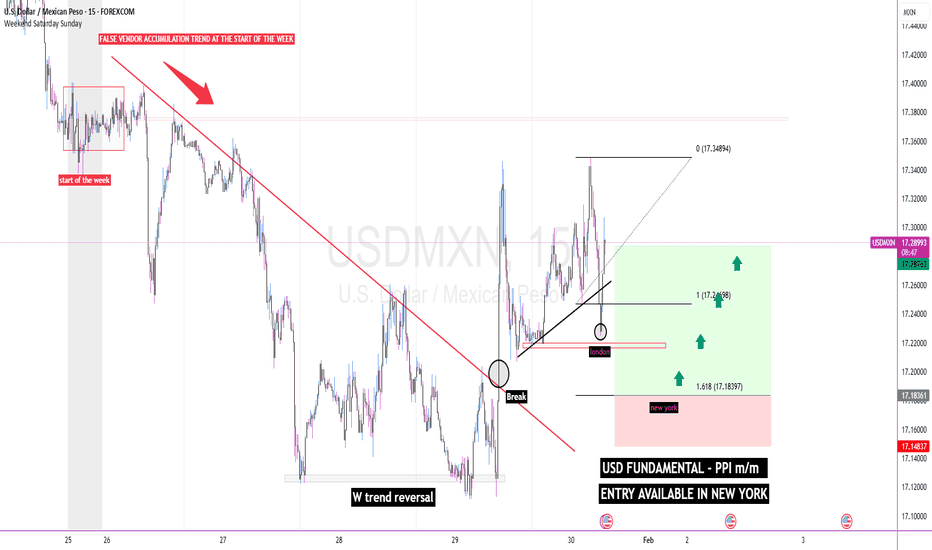

USD/MXN trend breakout monitoringWe see that the price created a false bearish accumulation trend at the start of the week to generate the midweek reversal in the corresponding liquidity zone, which produced a trend breakout telling me that the price will change direction. Therefore, along with the daily setup, it's telling me that

Marked market manipulation in USD/MXN**We can clearly see mass accumulation in Asia; the buy at 8 a.m. was used to break that accumulation and take sellers out of the market, where New York sought to improve the price by making it more expensive in order to continue selling within the trend. We expect the upcoming news in 1 hour to pus

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of USDMXN is 17.20794 MXN — it has decreased by −0.06% in the past 24 hours. See more of USDMXN rate dynamics on the detailed chart.

The value of the USDMXN pair is quoted as 1 USD per x MXN. For example, if the pair is trading at 1.50, it means it takes 1.5 MXN to buy 1 USD.

The term volatility describes the risk related to the changes in an asset's value. USDMXN has the volatility rating of 0.74%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The USDMXN showed a −1.17% fall over the past week, the month change is a −3.99% fall, and over the last year it has decreased by −15.77%. Track live rate changes on the USDMXN chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade USDMXN right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with USDMXN technical analysis. The technical rating for the pair is strong sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the USDMXN shows the sell signal, and 1 month rating is sell. See more of USDMXN technicals for a more comprehensive analysis.