S&P 500 Future Outlook: Green Zone Capital Targets 8,000Summary:

The TVC:SPX remains in a structural uptrend, trading within a defined rising channel. After a strong advance into our previous target of 7,000, price has pulled back and is consolidating near ~6,800, a healthy reset that keeps structure intact and offers a potential re-entry window.

T

US SP 500 CFD

No trades

Wave B Completion at 0.786 Fib? Potential Flat Correction SetupTechnical Analysis:

Structure: Following the initial impulse (Wave A), the market executed a deep correction. By piercing the 0.618 level and rejecting the 0.786, the structure has likely shifted from a simple Zigzag to a Flat Correction.

Reaction: The 0.786 level acted as a strong resistance zone

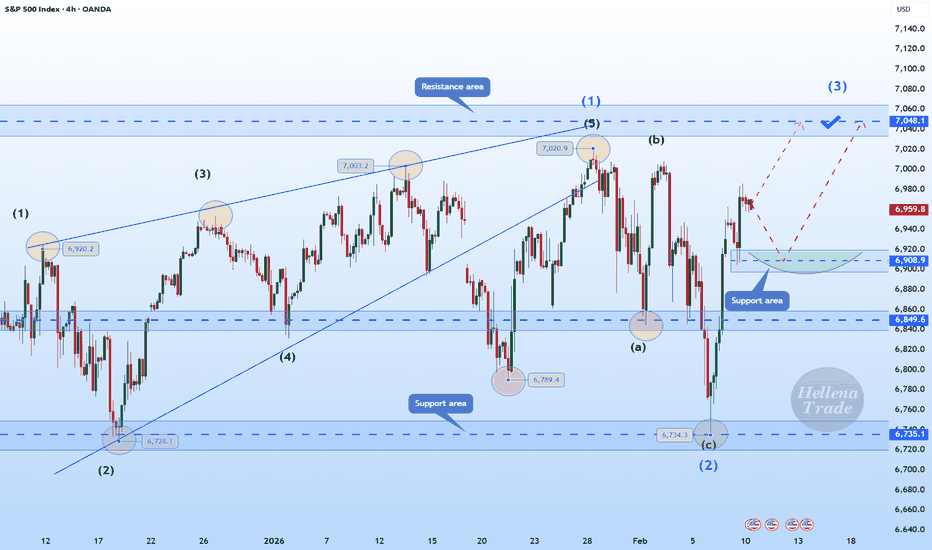

Hellena | SPX500 (4H): LONG to 7048 area (MAX of wave "1").Colleagues, the price continues to move in an upward five-wave impulse.

At the moment, I am considering a movement in wave “3” of medium order to the area of 7048 (the main thing here is the update of the maximum of wave “1”).

In principle, everything is quite simple in terms of wave construction, a

S&P500 is it about to crash due to a Global Liquidity peak??S&P500 (SPX) has been rising non-stop within its 3-year Bull Cycle following the October 2022 market bottom of the 2022 Inflation Crisis Bear Cycle. Such Bear Cycles are systemic and take place periodically on the long-term scale. Since the 2009 bottom of the U.S. Housing Crisis, those Bear Cycles h

SP500 Consolidation a bullish mid rangeSP500 Price is trading within a rising and maintaining a broader bullish structure despite recent volatility the market found strong demand near the lower boundary of the channel, followed by an impulsive bullish recovery signalling buyers stepping back in with strength.

Currently, price is consoli

Hellena | SPX500 (4H): SHORT to support area of 6849.I haven't updated my forecast for SNP in quite some time, but in reality, little has changed, and I believe that the upward movement is not yet over.

Within the higher-order upward wave “5,” I am observing the completion of the medium-order wave ‘1’ and therefore expect a correction in wave “2.”

I

WAVE 5 target 7031 plus or minus 2The sp 500 has declined today in what seems to be an ABC decline and has held support at 6833 the low is 6839 I have labeled this as wave B in wave 5 of my diagonal wave C of 5 is a target of 7031 By if we are to have anything short of this target it would be 7006 in which wave C

S&P 500 Breakdown Retest — Bears in Control, Bigger Drop Ahead?Today, I want to share a short setup on the S&P 500( SP:SPX ). Given that the crypto market—especially Bitcoin( BINANCE:BTCUSDT )—has recently regained strong correlation with the S&P, this analysis may be important for the crypto community too.

The S&P 500, over the past 20 days, has shown upward

See all ideas

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

US SP 500 CFD reached its highest quote on Jan 28, 2026 — 7,013.7 USD. See more data on the US SP 500 CFD chart.

The lowest ever quote of US SP 500 CFD is 1,264.1 USD. It was reached on Jun 3, 2012. See more data on the US SP 500 CFD chart.

US SP 500 CFD is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy US SP 500 CFD futures or funds or invest in its components.