GRPN: accumulateHF fav on the short side sitting at 33% float but technicals and price have been diverging. RSI and Williams% both ticking higher and MACD crossover all signal upside. Volume shelf is cleared on a move above 23.29. Ultimate target roughly 30% higher. Will cut on a daily close below 21.23.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.140 EUR

−57.02 M EUR

475.80 M EUR

21.92 M

About Groupon, Inc.

Sector

Industry

CEO

Dusan Senkypl

Website

Headquarters

Chicago

Founded

2007

ISIN

US3994732069

FIGI

BBG00MVHJ357

Groupon, Inc. engages in the global scaled two-sided marketplace that connects consumers to merchants. It operates through the North America and International geographical segments. The company was founded by Andrew D. Mason, Eric Paul Lefkofsky, and Bradley A. Keywell in October 2008 and is headquartered in Chicago, IL.

Related stocks

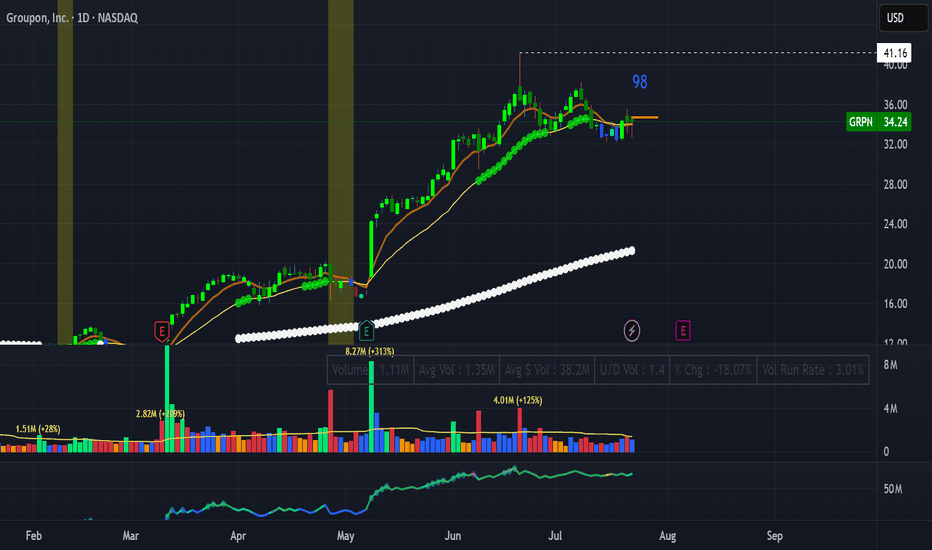

Pull back slingshot GRPNNASDAQ:GRPN

Setup : pull back slingshot

-RS 98

-uptrend

-contaction in volume

-EPS double digit up (2/3) ,Sales down( 0/3)

Play:

Entry trigger 34.69 break out with enough volume

Stop loss: under break out candle

Target: 2.5R or ride the EMA next pivot point 41,16

!!Not covered by fundamenta

GROUPON IS UP 10X - But more upside to come. #GRPN has been on fire.

It has also smashed through a major downtrend line and key horizontal level.

I expect the trend to continue.

"The company expects 2025 revenue between $493 million and $500 million and adjusted EBITDA of $70 million to $75 million, both topping Bloomberg's consensus esti

GRPN Long Setup – Flag Breakout in Progress! 🚀

📊 Trade Idea Summary:

Ticker: NASDAQ:GRPN (Groupon Inc.)

Chart: 15-minute

Trade Type: Long

Setup: Bullish pennant near breakout

Entry: $29.48 (breakout level)

Stop Loss: $28.73 (below trendline)

Target 1: $30.44 (resistance zone)

Target 2: $31.48 (measured move target)

🧠 Why This Trade

GRPN – Groupon, Inc. – 30-Min Long Trade Setup!📈 🚀

🔹 Asset: GRPN (NASDAQ)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Ascending Triangle Breakout + Resistance Flip

📊 Trade Plan (Long Position)

✅ Entry Zone: Above $18.82 (Breakout zone + confluence)

✅ Stop-Loss (SL): Below $18.36 (Trendline + recent low)

🎯 Take Profit Targets

📌 TP1: $19.31 (Key re

Stock Of The Day / 03.12.25 / GRPN03.12.2025 / NASDAQ:GRPN #GRPN

Fundamentals. The earnings report exceeded expectations.

Technical analysis.

Daily chart: Wide sideways, trend break level ahead at 13.82

Premarket: Gap Up on moderate volume.

Trading session: The initial impulse from the opening was stopped at 13.15, aft

GRPN Ascending Triangle | Targeting $14.14 ."GRPN is forming an ascending triangle pattern, signaling a potential bullish breakout. Currently testing resistance at $13.12, with a target set at $14.14. Key support is holding strong at $12.00, reinforcing the setup.

Key Levels:

Support: $12.00

Resistance: $13.12

Target: $14.14

Watch for volum

GRPN Groupon Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GRPN Groupon prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2024-8-2,

for a premium of approximately $2.95.

If these options prove to be profitable prior to the earnings

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

GRPN5393523

Groupon, Inc. 1.125% 15-MAR-2026Yield to maturity

—

Maturity date

Mar 15, 2026

GRPN5939589

Groupon, Inc. 6.25% 15-MAR-2027Yield to maturity

—

Maturity date

Mar 15, 2027

GRPN6108632

Groupon, Inc. 4.875% 30-JUN-2030Yield to maturity

—

Maturity date

Jun 30, 2030

GRPN6107410

Groupon, Inc. 4.875% 30-JUN-2030Yield to maturity

—

Maturity date

Jun 30, 2030

See all GRP2 bonds

Curated watchlists where GRP2 is featured.

Frequently Asked Questions

The current price of GRP2 is 20.000 EUR — it has increased by 6.01% in the past 24 hours. Watch Groupon, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on VIE exchange Groupon, Inc. stocks are traded under the ticker GRP2.

GRP2 stock has risen by 2.73% compared to the previous week, the month change is a −10.04% fall, over the last year Groupon, Inc. has showed a 142.95% increase.

We've gathered analysts' opinions on Groupon, Inc. future price: according to them, GRP2 price has a max estimate of 40.14 EUR and a min estimate of 20.50 EUR. Watch GRP2 chart and read a more detailed Groupon, Inc. stock forecast: see what analysts think of Groupon, Inc. and suggest that you do with its stocks.

GRP2 reached its all-time high on Mar 9, 2021 with the price of 53.000 EUR, and its all-time low was 2.730 EUR and was reached on May 16, 2023. View more price dynamics on GRP2 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

GRP2 stock is 1.83% volatile and has beta coefficient of 0.88. Track Groupon, Inc. stock price on the chart and check out the list of the most volatile stocks — is Groupon, Inc. there?

Today Groupon, Inc. has the market capitalization of 790.68 M, it has increased by 3.08% over the last week.

Yes, you can track Groupon, Inc. financials in yearly and quarterly reports right on TradingView.

Groupon, Inc. is going to release the next earnings report on Nov 6, 2025. Keep track of upcoming events with our Earnings Calendar.

GRP2 earnings for the last quarter are 0.39 EUR per share, whereas the estimation was −0.01 EUR resulting in a 7.00 K% surprise. The estimated earnings for the next quarter are 0.01 EUR per share. See more details about Groupon, Inc. earnings.

Groupon, Inc. revenue for the last quarter amounts to 106.71 M EUR, despite the estimated figure of 103.96 M EUR. In the next quarter, revenue is expected to reach 103.96 M EUR.

GRP2 net income for the last quarter is 17.26 M EUR, while the quarter before that showed 6.63 M EUR of net income which accounts for 160.31% change. Track more Groupon, Inc. financial stats to get the full picture.

No, GRP2 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Oct 6, 2025, the company has 2.08 K employees. See our rating of the largest employees — is Groupon, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Groupon, Inc. EBITDA is 22.17 M EUR, and current EBITDA margin is 7.23%. See more stats in Groupon, Inc. financial statements.

Like other stocks, GRP2 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Groupon, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Groupon, Inc. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Groupon, Inc. stock shows the buy signal. See more of Groupon, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.