Long from accumulation range: targets 1.50 → 2.35 (Weekly FVG)Price is sitting at the upper edge of the 0.78–0.83 accumulation. Above, unfilled FVG clusters on D1/W1 act as magnets; the first target is 1.50, then 2.00–2.35 (Weekly FVG). VPVR shows the main volume base at 0.70–0.83.

Idea

Counter-trend long from range support with base R/R ≈ 3.7. Expectation: liquidity sweep to the upside and FVG fills.

Trade Plan (laddered limits)

Entries: 0.820 (40%), 0.780 (30%), 0.650 (30%)

Hard stop (invalidation): 0.611

TP1: 1.500 (take 50%)

TP2: 2.350 (leave 50%)

Risk / Reward

Max risk to stop: −23.63% from 0.800 → 0.611.

Upside: +87.5% to 1.50 and +193.8% to 2.35.

Base R/R ≈ 3.7.

Management

After 1.00–1.05, move stop to breakeven (avg entry). After TP1, trail under the latest H4/D1 HL and hold for the Weekly FVG 2.00–2.35.

Key Levels

Support: 0.83 / 0.78 / 0.72–0.70 / 0.65

Resistance: 1.00 / 1.20–1.35 / 1.50 / 1.95 / 2.35

Confirmation Triggers

H4/D1 close above 0.90–1.00 (fresh HH)

Impulsive move from 0.78–0.83 with volume and absorption of the last bearish block

Alternative (bearish)

Clean break and acceptance below 0.611 cancels the idea; wait for a new base/re-accumulation.

Risks

Meme coins are prone to sharp liquidity flushes; use strict position sizing and respect the stop.

WIFUSDT.5S trade ideas

WIF Holds Fibonacci Support as Range ConsolidatesWIF Coin is respecting the 0.618 Fibonacci retracement, which aligns with daily support and the value area low of its current range. Price action remains rotational, but a move toward range resistance is developing.

WIF Coin continues to trade within a longer-term defined range, where both support and resistance have held firm. At present, price is finding support at the 0.618 Fibonacci retracement, a key technical level in confluence with daily support and the value area low. This alignment strengthens the case for a potential rotation higher within the range, although a broader breakout has yet to occur.

Key Technical Points

- 0.618 Fibonacci Confluence: Price is currently holding above the retracement aligned with daily support and value area low.

- Rotational Range Structure: WIF Coin remains locked in a sideways trading range, awaiting breakout confirmation.

- Resistance in Focus: The next major test lies at range resistance, which price is now approaching.

The current price behavior of WIF Coin illustrates the mechanics of range-bound markets. Strong confluence between the 0.618 Fibonacci retracement, the daily support level, and the value area low has created a reliable structural base. As long as this level holds, the likelihood of continuation higher within the range remains strong.

Despite this supportive base, WIF Coin has yet to escape its longer-term trading range. Resistance overhead continues to cap upside momentum, while support has repeatedly caught downside attempts. This equilibrium creates a rotational environment where traders can anticipate cycles from the lower boundary back toward the highs.

Currently, price is leaning toward the resistance zone at the top of the range. A move toward this level would fit the rotational structure, but the key factor will be volume confirmation. Without increasing volume, any rally risks stalling before testing resistance. Conversely, a surge in bullish volume would strengthen the case for a decisive breakout attempt.

The critical catalyst lies in the eventual range resolution. A breakout above the defined resistance would open the door to significant upside expansion, while a breakdown below support would tilt the market firmly bearish. Until such a resolution occurs, price action remains rotational within the defined boundaries.

What to Expect in the Coming Price Action

If WIF Coin continues to respect the 0.618 Fibonacci support, a rotation toward range resistance remains the most probable scenario. However, only a decisive breakout will unlock explosive directional momentum. For now, the market remains balanced, with traders awaiting volume confirmation to determine the next trend-defining move.

#WIF/USDT Forming Descending Channel#WIF

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.890, representing a strong support point.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.893

First target: 0.897

Second target: 0.900

Third target: 0.905

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

WIF/USDT Technical UpdateBINANCE:WIFUSDT has successfully broken out of the falling wedge 📉➡️📈 and has already completed a clean retest of the breakout zone ✅.

Currently price action is forming a potential ABC corrective wave structure (Elliott Wave count), with:

🅰️ Wave (A) aiming toward the 0.84–0.85 resistance zone

🅱️ Wave (B) likely testing support around the breakout area (~0.80)

🅾️ Wave (C) targeting the major resistance zone at 0.93–0.94

Key confluences:

✨ Bullish market structure shift after wedge breakout

✨ Support-turned-resistance flip successfully tested

✨ Momentum favors the upside if BTC continues bullish momentum 🟢

📌 Watch out for BTC’s move — if BTC pumps, WIF has a high probability to continue rallying toward 0.93–0.94 🎯

⚠️ Invalid below 0.78 support zone

WIF/USDT (perpetual swap contract on OKX).1. Context

Pair: WIF/USDT (perpetual swap contract on OKX).

Timeframe: 30-minute chart.

Current price: around 0.8138 USDT.

Indicators: two moving averages are visible:

Orange line = shorter-period MA (likely 50 EMA).

Blue line = longer-period MA (likely 200 EMA).

2. Trade Setup

This chart shows a long (buy) position with defined entry, stop-loss, and take-profit:

Entry: Around the breakout level (≈ 0.8138), just above the moving averages.

Stop-loss (red box below entry): Around 0.7913–0.8070, protecting against downside if price fails.

Take-profit (green box above entry): Around 0.8670–0.8758, aiming for a higher move.

3. Why This Is a Win Long Setup

Trend Reversal Attempt: Price had been in a downtrend, but now it has reclaimed both the 50 EMA and 200 EMA — a bullish signal.

Golden Cross Potential: The orange MA is curling upwards toward the blue MA, hinting at a bullish cross.

Breakout Confirmation: Entry is placed after a strong bullish candle closed above resistance.

Risk-to-Reward (R:R):

Risk (stop-loss) is small relative to reward (take-profit).

Looks like about 1:2 or better R:R, meaning the potential gain is at least twice the risk.

4. Key Notes

If price stays above 0.81 and holds the EMAs as support, the trade can play out bullish.

If price dips below 0.8070 and 0.7913, the trade invalidates — hence the stop-loss.

WIFUSDT — Critical Demand Zone: Bounce or Breakdown?Currently, WIFUSDT is trading around 0.7605 and retesting the major demand zone (~0.62 – 0.78) — a level that previously acted as strong resistance before flipping into support.

The price action here will determine the medium-term direction:

Either a bullish reversal fueled by accumulation,

Or a bearish continuation if this zone fails.

---

🔎 Market Structure & Pattern

1. Macro Trend:

From late 2024 to early 2025, WIF faced a strong downtrend.

A sharp rebound in March–May 2025 pushed the market into a consolidation range.

Since then, the chart has been forming lower highs, showing persistent selling pressure.

2. Critical Flip Zone (0.62 – 0.78):

Previously acted as heavy resistance.

Flipped into support after a breakout in May.

Now being retested as a decisive level.

3. Potential Reversal Formation:

Holding this zone may form a double bottom / base pattern → bullish setup.

Losing this zone could trigger a continuation breakdown toward new lows.

---

🟢 Bullish Scenario

Confirmation: Daily close above 0.75–0.78 with a strong bullish candle.

Upside targets:

1.0251 → nearest resistance.

1.2008 → major consolidation area.

1.8468 – 2.1772 → mid-term resistance levels.

Ideal setup: Retest & bounce with rising volume, forming a higher low.

---

🔴 Bearish Scenario

Confirmation: Daily close below 0.62 with strong follow-through.

Downside targets:

0.50 → psychological level & minor demand.

0.3040 → major low from the chart.

Ideal setup: Breakdown → retest of yellow zone as resistance → rejection → continuation downtrend.

---

⚖️ Key Notes

The yellow zone (0.62 – 0.78) is the decision zone for WIF.

Breakout or breakdown here will likely trigger strong momentum.

Aggressive traders: may enter inside the zone with a tight SL below 0.62.

Conservative traders: wait for a daily close confirmation with volume.

Always use risk management — WIF is highly volatile.

---

✍️ Conclusion

WIFUSDT is at a strategic turning point:

Holding above support could trigger a bullish reversal toward 1.02 → 1.20.

Losing this zone could open the door to deeper downside toward 0.40 – 0.30.

The next daily close will be crucial for validating direction.

#wifusdt #dogwifhat #cryptoanalysis #altcoins #supportresistance #demandzone #bullishscenario #bearishscenario #cryptotraders #priceaction #technicalanalysis

WIF/USDT — The Apex Point: Awaiting a Major Breakout or Breakdow🔎 Overview

The DOGWIFHAT/USDT pair is currently consolidating at a critical junction on the 3-day timeframe (3D). The chart reveals a classic Descending Triangle — a technical pattern formed by consistent lower highs (selling pressure) converging with a strong horizontal support zone.

The essence of this pattern: price is being squeezed into a tighter range (the apex). The longer the compression, the stronger the potential explosive move — either upward or downward.

---

🟢 Bullish Scenario (Breakout Potential)

Trigger: A valid breakout requires a 3D candle close above the descending trendline and ideally a reclaim of 1.1499.

Catalyst: Strong breakout volume plus successful retest of former resistance turned into support.

Upside Targets:

1. 1.1499 → Initial breakout confirmation.

2. 1.3797 → First major upside target (+50% from current price).

3. 1.8132 → Next psychological level (+98% from current price).

4. If momentum sustains, 2.7430 → 4.2894 → 4.8722 could act as medium-term magnets.

👉 Note: As long as price holds above the golden Fibonacci pocket (0.7753–0.6707), bulls maintain a strong chance of reclaiming momentum.

---

🔴 Bearish Scenario (Breakdown Risk)

Trigger: Breakdown confirmed if the 3D candle closes below 0.6707 (Fib 0.618).

Confirmation: Failed attempt to reclaim 0.77 after breakdown.

Downside Targets:

1. 0.45 → Psychological support / liquidity area.

2. 0.2840 → Historical low.

3. Measured Move: Based on the triangle’s height (approx. 0.4792), a textbook target would be ~0.19 — though this requires heavy bearish momentum.

👉 Note: Losing the golden Fibonacci pocket would hand over full control to bears.

---

📌 Pattern & Key Significance

1. Descending Triangle → Statistically leans bearish, but strong reversals are common if broader market sentiment is bullish.

2. Fibonacci Golden Pocket (0.5–0.618: 0.7753–0.6707) → Strong confluence zone; potential accumulation area for bulls.

3. Apex Point → The closer price gets to the apex, the stronger the eventual breakout/breakdown move.

---

🧭 Trading Strategies

Bullish Traders (Breakout Players):

Enter on a confirmed 3D close above 1.1499, preferably after a retest. Target 1.38 and 1.81 with stop loss below 0.95–0.85.

Bearish Traders (Breakdown Players):

Short after a 3D close below 0.6707, with confirmation from failed retest. Targets 0.45 and 0.2840. Stop loss above 0.78.

Swing Traders (Risk-Reward Optimizers):

Consider speculative longs at 0.77–0.67 with tight SL below 0.62, aiming for potential breakout to 1.15+.

---

📊 Key Levels

Critical Support Zone: 0.7753 – 0.6707 (Fibonacci confluence).

Major Resistances: 1.1499 → 1.3797 → 1.8132 → 2.7430 → 4.2894 → 4.8722.

Historical Low: 0.2840.

Pattern: Descending Triangle → approaching resolution.

---

🚀 Conclusion

DOGWIFHAT is at a major crossroads. This descending triangle could serve as a springboard into the next altcoin rally or a trapdoor toward new lows.

The golden Fibonacci pocket (0.77–0.67) is the key battleground. If it holds, bulls have a real shot at reclaiming higher levels. If it breaks, bears will likely dominate the structure.

---

#DOGWIFHAT #WIFI #Crypto #Altcoin #ChartAnalysis #TechnicalAnalysis #DescendingTriangle #SupportResistance #Fibonacci #Breakout #Breakdown

WIF Breakout Watch – Testing Key Resistance! 🚨 WIF Breakout Watch – Testing Key Resistance! 🔴⏳

WIF is testing the red resistance zone right now.

📊 If a breakout confirms, the next move could target:

🎯 First Target → Green line level

A confirmed breakout here could trigger strong bullish continuation.

WIF/USDT – 15M | FVG & Breaker Block in Play Price is hovering near the P1D Low / OB zone. Two possible scenarios to watch:

📈 Bullish – Hold above P1D Low (~0.8980) → Break into FVG (~0.9250) → Push toward Breaker Block (~0.9700) for further confirmation.

📉 Bearish – Fail to hold P1D Low → Break below OB (~0.8800) → Continue toward deeper downside liquidity.

Key Levels:

Breaker Block: ~0.9700

FVG: ~0.9250

P1D Low: ~0.8980

OB Support: ~0.8800

⚠️ Monitor price action at the P1D Low for directional confirmation.

WIF/USDT – 1H | Key Levels & Breaker Block in FocusPrice is holding near the P1D Low / Swing Low zone. We’re watching two scenarios:

📈 Bullish – Hold above P1D Low → Break Swing High (~0.9400) → Push toward Breaker Block (~0.9750) and potentially higher.

📉 Bearish – Fail to hold P1D Low → Break lower → Continuation toward FVG (~0.8100) for potential reaction.

Key Levels:

Breaker Block / Strong High: ~0.9750

Swing High: ~0.9400

P1D Low / Swing Low: ~0.8980

FVG from left side: ~0.8100

⚠️ Reaction at P1D Low will be critical in determining the next move.

CryptoWolfy - Buy NOW, The Pre-Moon Buy Zone🚀 WIF at $0.92 — The Pre-Moon Buy Zone

Massive Bullish Setup: Inverse Head & Shoulders + Bullish Engulfing on weekly — textbook breakout pattern.

Volume Surge + CMF Positive: Smart money is flowing in. Momentum is building.

Resistance at $1.20 is weak — once cracked, $4 is the next magnet.

Social Hype Reigniting: Meme coin cycles are fast and furious — WIF is next in line.

💥 WIF at $0.92 is not a dip — it’s a launchpad.

$4 isn’t a dream. It’s a destination.

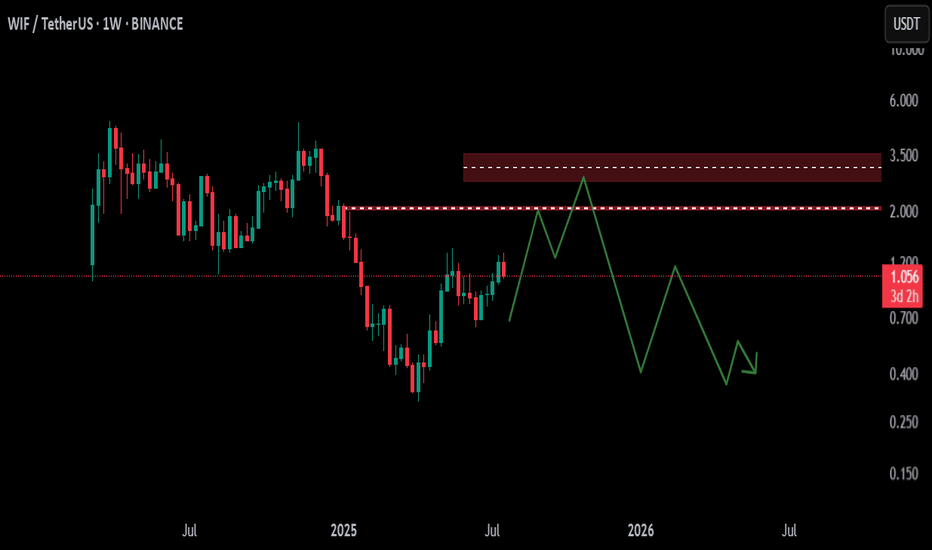

WIFUSDT to bounce from weekly support around 0.60#WIF #WIFUSD #WIFUSDT SEED_WANDERIN_JIMZIP900:WIF

On WIFUSDT, I see two possibilities for the upcoming price action.

The price has tapped into daily support DS1 and it is currently bouncing from there.

The first path suggests that this is the start of the reversal and upward journey continuation. But I am not very inclined to that possibility.

The second path suggests that the price will go down further to weekly support zone WS1 after the current bounce from DS1 is exhausted.

I am more inclined on the second path. This will allow a bounce with enough strength to make the price move beyond the current highs. And that bounce from weekly support WS1 will be a real breakout and allowing the price to move beyond 1.5 and so on.

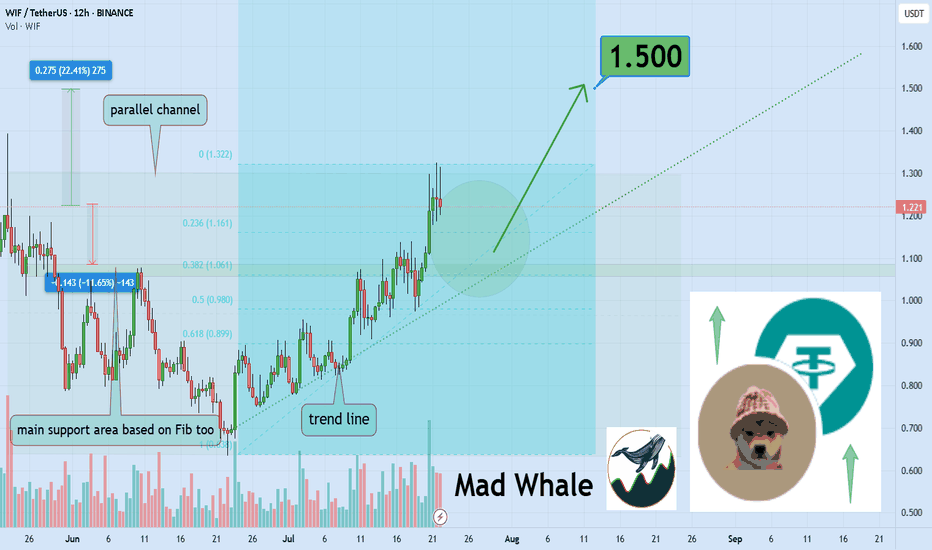

Dogwifhat Poised For 22% Growth Toward $1.50Hello✌

Let’s analyze Dogwifhat’s upcoming price potential 📈.

📈 BINANCE:WIFUSDT is currently sitting near a strong daily support and trendline. At the same time, the Fibonacci Level support lines up closely with this key level. This convergence suggests a potential upside of about 22%, aiming for a target price of $1.50. 🔥

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks , Mad Whale

Memecoin with potential for purchase.Hello friends🙌

Considering the decline we had in the weekly timeframe, you can now see that with the good growth we had, it gives us a good signal to buy, of course in a stepwise manner and with capital and risk management.

🔥Follow us for more signals🔥

*Trade safely with us*

Surprisingly, WIF looks good!I wanted to write a scathing review about what a terrible meme coin it is and how it should slide to zero.

➡️ But after looking at the chart in detail, I was surprised to see that technically, the token looks incredibly good! Let me explain why:

🔹 $1-1.08 are key levels for the token, with a large number of support levels that are actively holding the price so far. Since the token has undergone a powerful correction, it is not now falling down with every sneeze of Bitcoin.

🔹 Volume - purchase volumes are indeed diverging from the price, which means that buyers are not interested at current prices. However, this is currently observed across the entire market due to a decline in activity in the summer and after a powerful rebound.

🔹 Money Flow - the liquidity inflow indicator shows surprising harmony with the price! Moreover, WIF is one of the only tokens that has been actively receiving new liquidity since February 2025! This means that whales have long noticed this underprice and started to take positions. Even now, when the market is in a range, the indicator is in the positive zone.

🔹 Dynamic Support/Resistance - the token continues to be in a bullish structure (higher highs, higher lows) and has been rejected twice from key resistance at $1.359. This is currently the biggest resistance for the price, and once it is overcome, the movement will become much easier, especially given the huge number of short stops above, because everyone loves to short meme coins so much that their funding becomes negative within minutes of any correction.

But, as you can see from the chart, a huge and uniform layer of interest has formed from $0.85 down to $0.31. This shows that there are a lot of people willing to buy the token at low prices.

📌 Conclusion:

I am one of the main haters of WIF. It always looked like crap, I shorted it a lot at any hint of a correction and made good profits.

But now the token looks really good and is in the process of forming its low. So, if the structure remains the same, I will definitely consider buying it on the spot.

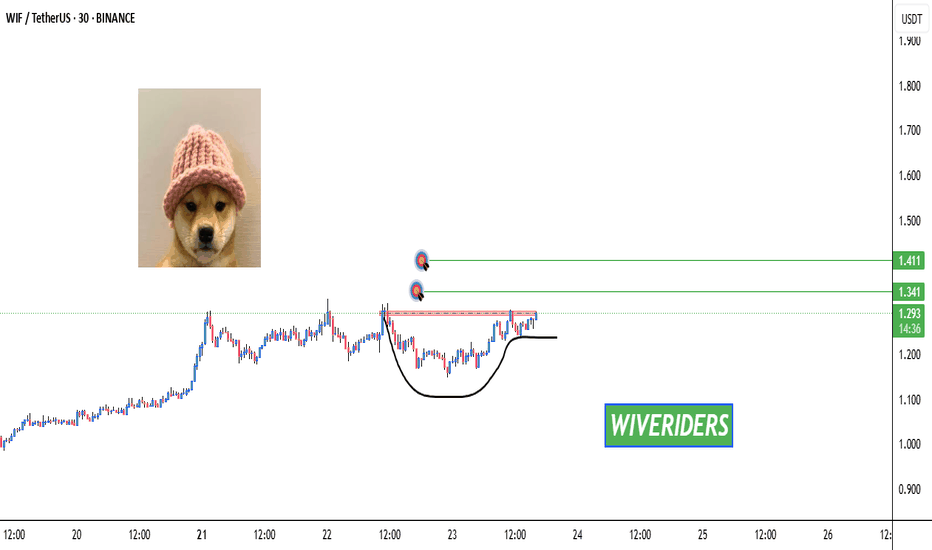

Bullish Cup & Handle Pattern Formed 🚨 SEED_WANDERIN_JIMZIP900:WIF Testing Red Resistance – Bullish Cup & Handle Pattern Formed 📈

SEED_WANDERIN_JIMZIP900:WIF is currently testing the red resistance zone and has formed a bullish cup and handle pattern on the chart.

If a breakout occurs, potential upside toward:

✅ First Target: Green line level

✅ Second Target: Green line level

Wait for breakout confirmation before entering long. 📊

Patience is key—watch this closely! 💼💸