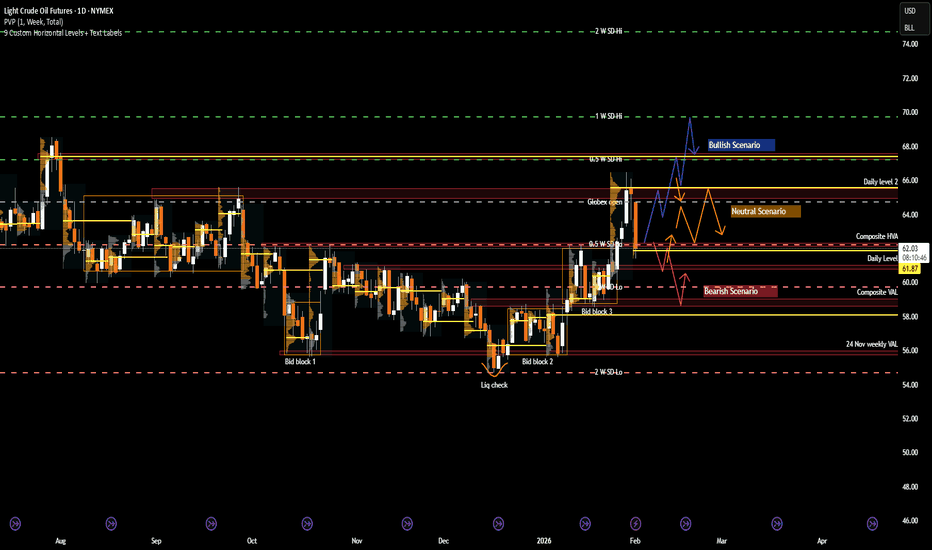

CL: Crude Oil at a Crossroads as Geopolitics Meet Key LevelsRecent Sentiment and Key Headlines Driving Crude

Crude oil sentiment over recent weeks has been shaped by a renewed mix of geopolitical risk and shifting expectations around global supply discipline. Headlines tied to Venezuela and Iran have been particularly influential, adding a layer of risk pr

Light Crude Oil Futures

No trades

About Light Crude Oil Futures

Crude Oil is a naturally occurring liquid fossil fuel resulting from plants and animals buried underground and exposed to extreme heat and pressure. Crude oil is one of the most demanded commodities and prices have significantly increased in recent times. Two major benchmarks for pricing crude oil are the United States' WTI (West Texas Intermediate) and United Kingdom's Brent. The differences between WTI and Brent include not only price but oil type as well, with WTI producing crude oil with a different density and sulfur content. The demand for crude oil is dependent on global economic conditions as well as market speculation. Crude oil prices are commonly measured in USD. Although there have been discussions of replacing the USD with another trade currency for crude oil, no definitive actions have been taken.

Related commodities

The Calendar Anomaly That Actually Works21 Bonferroni Significant Results from Turn of the Month Analysis

Preface: a study with a different outcome

Following our two RSI studies totaling 26 million tests and zero significant results, we received requests to identify a strategy that actually demonstrates statistical edge. The challenge

US OIL: Bullish! Buy The Dip!In this Weekly Market Forecast, we will analyze the US OIL for the week of Feb. 2-6th

US Crude Oil had a bullish close last week, sweeping the Sept high. I am expecting the bullish momentum to continue into this week.

Expect a pullback into discount of the range before the market pushes higher.

OIL LONG3/3 on my posted trade set ups, throwing an oil long up as well as ES short. these trades are both well off perfect entries but markup for oil and markdown for the SP500 are both in progress. Lets go 5/5. The target here is the 200EMA, with a stop at 60$. Most traders will tell you stay away from an

US OIL: Bullish Break Out Potential?In this Weekly Market Forecast, we will analyze the US OIL for the week of Jan. 19-24th.

US Crude Oil has been sideways for over 3 years. Accumulating. April '25 there was a significant

sweep of sell side liquidity, followed by an impulsive move to the high of the consolidation. Manipulation. A co

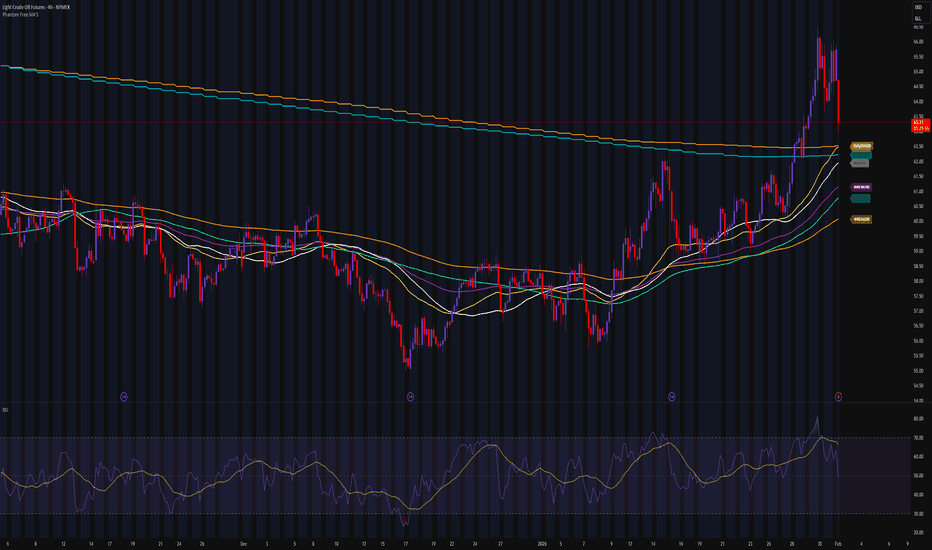

DEFEND THE IRON FLOOR ($62.50) CODENAME: THE VOLUME VACUUMINSTITUTIONAL FOOTPRINT (Volume & Flow)

The Signal: Volume on this sharp pullback to $63.30 has completely evaporated. The last 4H candle clocked in at just 7.3k volume against an average of 45k. The Diagnosis: This is a "Supply Vacuum." The sellers have left the building. When price drops but volu

Crude Oil Rally After Christmas?For quite a bit we have had Bearish momentum going on CL! This could change however due to Geopolitical risk for premium expansion, inventory tightness and seasonal demand etc. Funds are also not heavily invested in oil so far, so if we do gain headlines in the coming months we could see a spike on

Crude Oil Mini (MCX) – Back-to-Back 5 Winning Trades using EPAI 🔥 Crude Oil Mini (MCX) – Back-to-Back 5 Winning Trades using EPAI Indicator 🔥

Consistency beats prediction. 📈

EPAI Indicator delivered 5 consecutive winning trades in Crude Oil Mini, respecting trend, MA structure, and disciplined exits.

📊 Trade Highlights:

EPAI Trade-1: Sell @ 5580 → Exit at MA

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Light Crude Oil Futures is 63.55 USD / BLL — it has risen 0.41% in the past 24 hours. Watch Light Crude Oil Futures price in more detail on the chart.

The volume of Light Crude Oil Futures is 403.70 K. Track more important stats on the Light Crude Oil Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Light Crude Oil Futures this number is 316.18 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Light Crude Oil Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Light Crude Oil Futures. Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Light Crude Oil Futures technicals for a more comprehensive analysis.