GER 40 - Daily - CLS - Model 1- 50% TP Hi friends, new range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reaches 50%

GERMAN STOCK INDEX (DAX)

No trades

Related indices

GER40 — Global Outlook | MTF 1M → 1W → 1DGER40 — Global Outlook | MTF 1M → 1W → 1D

Higher-timeframe correction bias | Counter-trend move into resistance

Overview

GER40 currently looks like a market that failed to hold above ATH and is shifting into a higher-timeframe corrective phase .

The liquidity sweep, the strong monthly upper

Bullish on the DAX40Looking for price to continue its bullish direction today. Yesterday we were range bound at 25K. And this morning currently seeing price trade below the range. If I see bullish confluences on the LTF, could see price extend towards previous weeks high.

Keeping is nice and simple and always :)

Aman

GER40 (DAX) – Trading Plan | February 13🔥✅ GER40 (DAX) – Trading Plan | February 13

Today’s session opened with a short bias, setting a bearish tone for the day.

Yesterday we saw:

– rejection of higher prices,

– impulsive downside movement,

– no clear buyer acceptance.

This reinforces the bearish intraday context.

Cluster view:

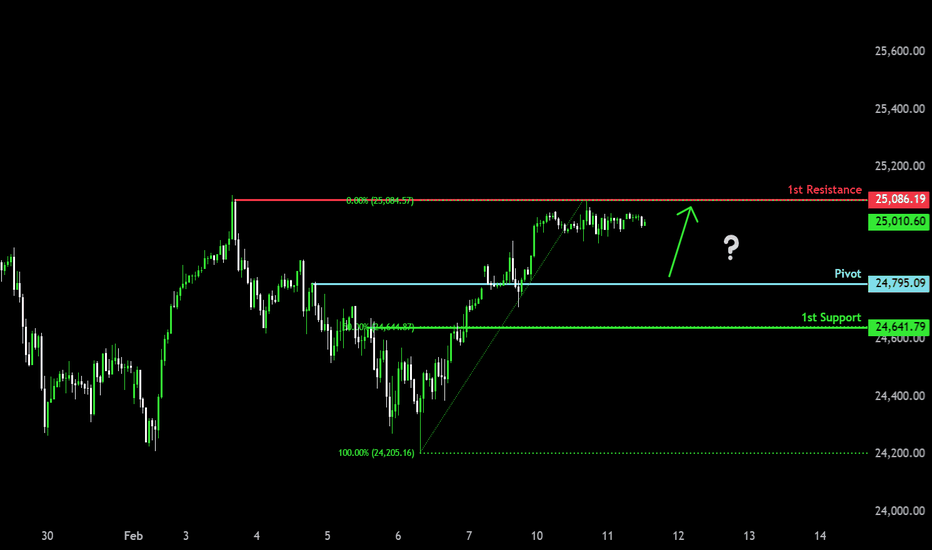

Bullish momentum to extend?DAX40 (DE40) is falling towards the pivot and could bounce to the 1st resistance, which acts as a multi-swing high resistance.

Pivot; 24,795.09

1st Support: 24,641.79

1st Resistance: 25,086.19

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opi

DAX40 CASH newyork session perspective The DAX 40 is Germany's primary stock market index. It tracks the performance of the 40 largest and most liquid blue-chip companies listed on the Frankfurt Stock Exchange.

Formerly the DAX 30, it expanded to 40 constituents in September 2021 to better represent the German economy across sectors like

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of GERMAN STOCK INDEX (DAX) is 24,914.89 EUR — it has risen by 0.25% in the past 24 hours. Track the index more closely on the GERMAN STOCK INDEX (DAX) chart.

GERMAN STOCK INDEX (DAX) reached its highest quote on Jan 13, 2026 — 25,507.79 EUR. See more data on the GERMAN STOCK INDEX (DAX) chart.

The lowest ever quote of GERMAN STOCK INDEX (DAX) is 372.30 EUR. It was reached on Nov 6, 1974. See more data on the GERMAN STOCK INDEX (DAX) chart.

GERMAN STOCK INDEX (DAX) value has increased by 1.89% in the past week, since last month it has shown a −2.02% decrease, and over the year it's increased by 11.17%. Keep track of all changes on the GERMAN STOCK INDEX (DAX) chart.

The champion of GERMAN STOCK INDEX (DAX) is XETR:ENR — it's gained 163.58% over the year.

The weakest component of GERMAN STOCK INDEX (DAX) is XETR:ZAL — it's lost −46.81% over the year.

GERMAN STOCK INDEX (DAX) is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy GERMAN STOCK INDEX (DAX) futures or funds or invest in its components.

The GERMAN STOCK INDEX (DAX) is comprised of 40 instruments including XETR:SIE, XETR:SAP, XETR:DTE and others. See the full list of GERMAN STOCK INDEX (DAX) components to find more opportunities.