EURNZD: +1920 Pips Swing Sell to compete by 2026?EURNZD has been declining since NZD became the strongest currency at the current market. Our two entries are currently performing well but there’s a strong chance the price will drop around 1920+ pips. This would be one of the biggest drops EURNZD could experience. The timeline for this trading se

Euro / New Zealand Dollar

No trades

About Euro / New Zealand Dollar

The Euro vs. the New Zealand Dollar. The New Zealand dollar had performed well against the Euro recently because it is often considered to be a proxy for the Chinese growth. Eurozone weakness may limit any significant reversal if concerns about Chinese growth occurs as the country shifts from export lead growth. The NZD has benefited from the recent Euro-zone difficulties due to idle cash efforts to find strong, secure yields.

Related currencies

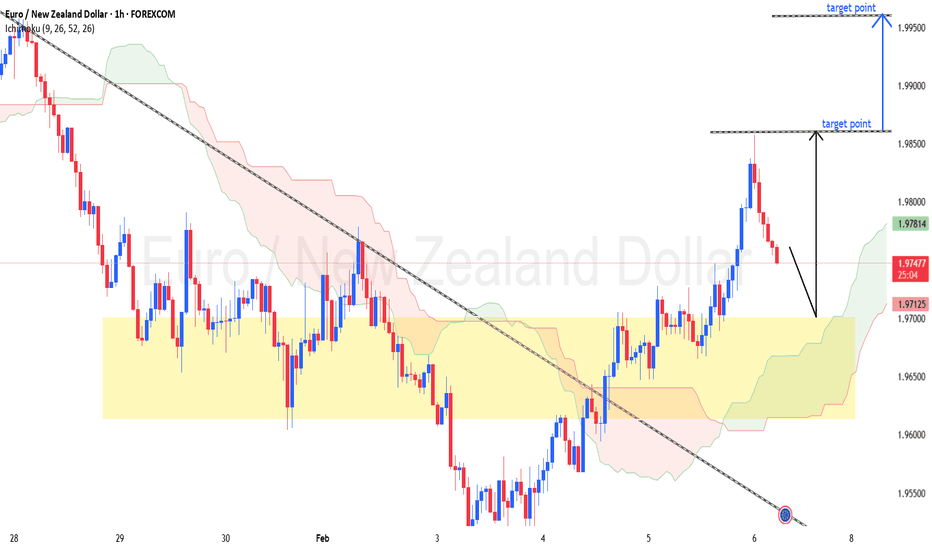

EURNZD – 1H Chart Targets...EURNZD – 1H Chart Targets 📊

Based on my chart (trendline break + strong bullish impulse + pullback zone):

🔍 Market Bias

Bullish continuation (buy on pullback)

📈 Buy Setup

Buy Zone:

1.9650 – 1.9700 (highlighted demand + cloud support)

Targets:

🎯 TP1: 1.9850

🎯 TP2: 1.9900

🎯 TP3 (Final): 1.9950 ✅ (mar

EURNZDThe first higher high after a downtrend indicates a potential trend reversal to the upside. It shows that buyers are starting to regain control, signaling the possibility of a new bullish trend.

Trendline Break: A break above a significant trendline further confirms the shift in sentiment from bear

EURNZD: Bullish Continuation Toward Key TargetsEURNZD: Bullish Continuation Toward Key Targets

EURNZD is showing early signs of bullish continuation after a strong impulsive move from the recent demand zone.

Price has successfully reacted from the highlighted support area, confirming buyer interest and structure defense.

Following the pull

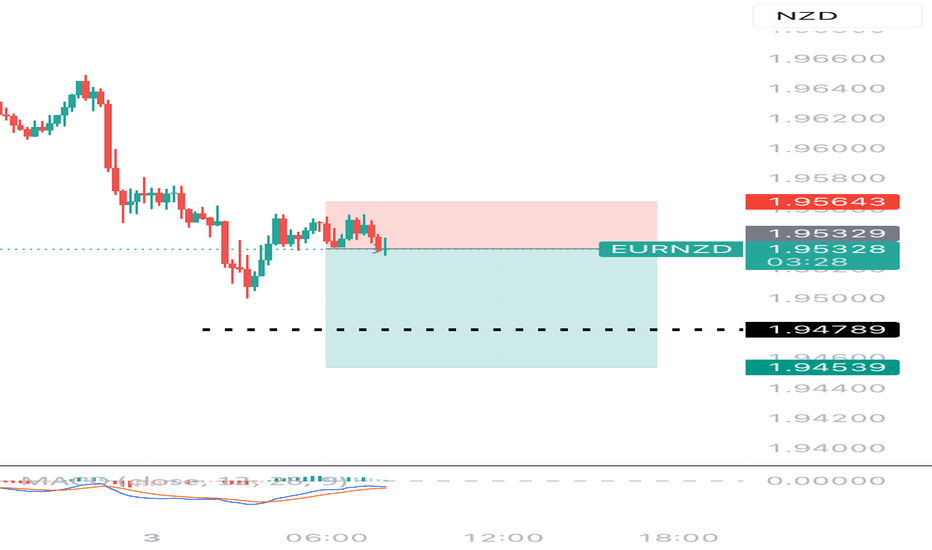

eurnzd. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it acc

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of EURNZD is 1.96924 NZD — it has increased by 0.11% in the past 24 hours. See more of EURNZD rate dynamics on the detailed chart.

The value of the EURNZD pair is quoted as 1 EUR per x NZD. For example, if the pair is trading at 1.50, it means it takes 1.5 NZD to buy 1 EUR.

The term volatility describes the risk related to the changes in an asset's value. EURNZD has the volatility rating of 0.88%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The EURNZD showed a −0.24% fall over the past week, the month change is a −2.99% fall, and over the last year it has increased by 7.63%. Track live rate changes on the EURNZD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

EURNZD is a minor currency pair, i.e. a popular pair that is not associated with USD. Such pairs are also called cross currency pairs.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade EURNZD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with EURNZD technical analysis. The technical rating for the pair is sell today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the EURNZD shows the neutral signal, and 1 month rating is buy. See more of EURNZD technicals for a more comprehensive analysis.