Oil Fails to Reach the $66 LevelAs the second week of January comes to a close, oil price action has remained contained, with fluctuations of less than 2% over recent sessions. This lack of movement highlights the market’s inability to establish a clear short-term directional bias. For now, the sense of indecision has been reinforced by recent OPEC+ announcements, following the group’s meeting on February 1, which did not signal any additional increase in production levels in the near term. At the same time, confidence in demand has yet to recover, as global risk concerns have taken center stage throughout the week. Until a clearer path emerges regarding demand or production, this neutral tone is likely to continue dominating short-term price action.

The bearish trend remains in control

For several months, a downward trendline has continued to dominate average oil price movements. So far, there has been no buying pressure strong enough to challenge this structure, keeping it as the most relevant technical formation to monitor. If indecision persists and price fails to consolidate a sustained recovery, selling pressure may remain dominant in the coming sessions—particularly if oil is unable to break convincingly above the $66 per barrel area.

Technical indicators

RSI:

Although the RSI has posted readings above the neutral 50 level, the indicator has recently begun to flatten, suggesting that bullish momentum is losing strength. If this behavior continues, it could lead to a more prolonged phase of indecision in the short term.

MACD:

Meanwhile, the MACD histogram has moved closer to the zero line, indicating that the average strength of moving averages remains in balance. As long as this condition persists, price indecision is likely to remain a key feature over the next few sessions.

Key levels to watch

$66 – Key resistance:

This level aligns with recent highs and represents the main upside barrier. A sustained move above this zone, supported by bullish momentum, could challenge the longer-term bearish structure and pave the way for a renewed dominant buying phase.

$62 – Nearby barrier:

An area aligned with the 200-period simple moving average, acting as the primary neutral reference zone. Prolonged price action around this level could reinforce the current indecisive environment and favor the formation of a short-term sideways range.

$59 – Key support:

A level aligned with the 50-period simple moving average, acting as a critical downside barrier. Sustained moves below this area could reignite selling pressure and extend the prevailing downtrend in the sessions ahead.

Written by Julian Pineda, CFA, CMT – Market Analyst

FOREX.com publications

EUR/USD Reversal Halted at Pivotal Support- Decision TimeEUR/USD is trading within the confines of an ascending pitchfork extending off the January low with the lower parallel highlighting near-term support at 1.1746/71- a region define by the objective yearly open and the 61.8% retracement of the January range. The focus is on possible inflection off this zone in the days ahead with the bears vulnerable while above.

Initial resistance is eyed at the 2025 high close and the monthly high at 1.1866/75- note that the 25% parallel converges on this zone early-next week. A topside breach / close above the 2025 high at 1.1919 is ultimately needed to mark uptrend resumption and fuel another run at the highs with key resistance steady at 1.2020/42- a region defined by the 38.2% retracement of the broader 2008 decline and the January high-day close (HDC). Look for a larger reaction here IF reached.

A break / daily close below the yearly open would be needed to suggest a more significant high is in place and a larger trend reversal is underway. Subsequent support objectives are eyed at the January low-day close (LDC) at 1.1645 backed by the 200-day moving average (currently ~1.1618), and the December low at 1.1590. Both levels of interest for possible downside exhaustion / price inflection IF reached.

Bottom line: Euro is trading just above confluent support at a multi-week uptrend- looking for a reaction off this zone early in the month. From a trading standpoint, rallies would need to be limited to 1.1919 IF price is heading lower on this stretch with a daily close below 1.1746 needed to fuel the next leg of the decline.

-MB

Silver key levels to watch as metal surges higherSilver has bounced sharply higher along with gold, and literally everything else that was sold yesterday. After that brutal sell-off, things have been quite different so far in the first half of Friday’s session. Part of this calm reflects a growing belief that the Federal Reserve is edging closer to its next easing cycle, with employment data being quite soft this week. But whether the turmoil will make an unwelcome return later on remains to be seen.

Silver is now testing its first important resistance near $77, where we also have a short-term bearish trend coming into focus. The next key level above it is at $80.

On the downside $71ish is now the most important level that needs to hold.

By Fawad Razaqzada, market analyst with FOREX.com

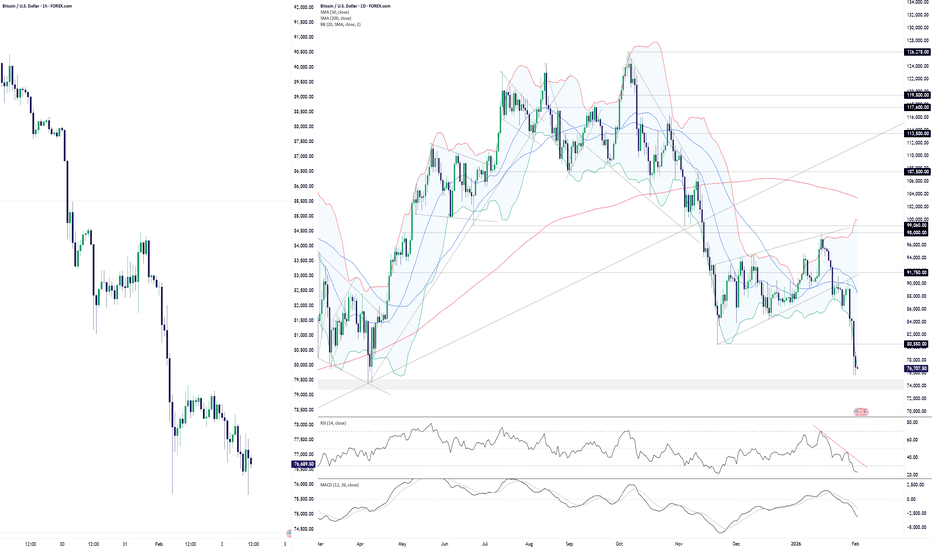

Bitcoin: Ugly but OversoldTrading through the lower Bollinger band with RSI (14) and MACD sitting at extreme levels, conditions are in place to spark some form of bounce or squeeze in BTC/USD, potentially putting upside levels in play.

$66,000 acted as both support and resistance for periods in late 2024, making it the first reference point on the topside. A sustained move above this level would allow for longs to be set with a tight stop beneath for protection, targeting a retest of the former support zone between $73,500 and $75,000.

Alternatively, if the price can’t break above $66,000, it would open the door for shorts with a tight stop above for protection, targeting $60,000 where the price bounced earlier in the session. If that level were to break, $52,650 and $49,575 come into focus, coinciding with lows set in 2024.

The message from RSI (14) and MACD remains entirely bearish, favouring selling into strength rather than setting counter-trend longs. That said, be selective on the short side given oversold conditions, paying close attention to price action around the levels outlined above.

Good luck!

DS

Breakdown risk buildingAustralian ASX 200 SPI futures are testing the key 200DMA after breaking out of the ascending channel they had been trading within since late November. With momentum beginning to swing to the downside, traders should be alert to the risk of a more prolonged unwind ahead. Price action into the close may prove instructive in gauging where near-term directional risks lie.

Should we see a close beneath the 200DMA, shorts could be established with a stop above either the moving average itself or former channel support, depending on the risk-reward profile you’re seeking from the trade. The 8652 level acted as both support and resistance around the turn of the year, putting it firmly on the radar as an initial hurdle for shorts. If price cannot break that level, it may be prudent to nix the trade. More appealing downside targets sit at the December 18 low of 8525, or 8400, where price bounced strongly in 2025.

Alternatively, if price were to recover and close back above channel support, the setup could be flipped. Longs could be established above the level with a stop beneath for protection, targeting a retest of 8925, where price struggled to break several weeks ago.

RSI (14) continues to set lower highs and lower lows and now sits beneath the neutral 50 level, indicating downside pressure is beginning to build. MACD has also crossed below the signal line from above and is trending lower, though it remains in positive territory. It’s not a definitive message from the oscillators by any means, but at the very least it suggests directional risks may be in the early stages of swinging lower.

Good luck!

DS

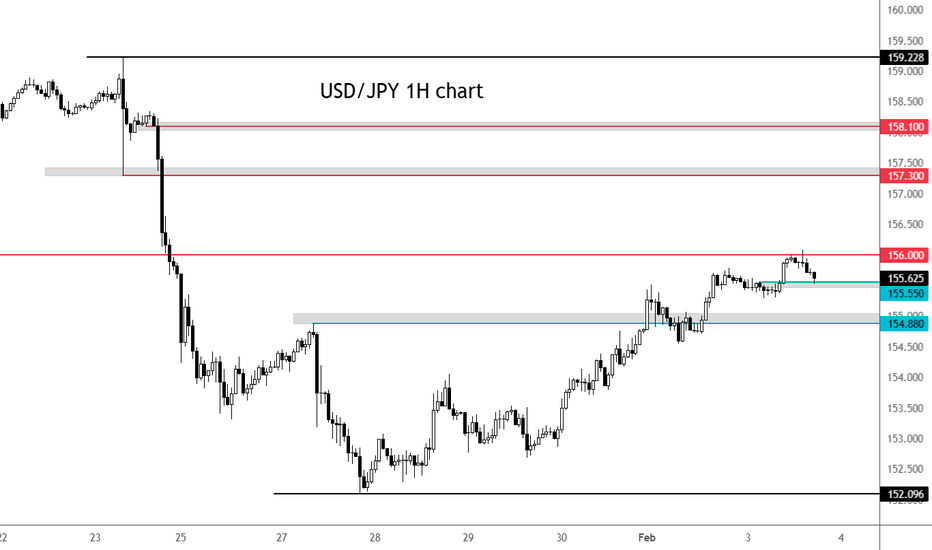

USD/JPY Bulls Charge after Sharp Selloff- Resistance in ViewThe USD/JPY selloff extending more than 4.6% off the January high with price rebounding just pips ahead of key support last week at the 2022 & 2023 swing highs and the 38.2% retracement of the April advance 151.91/98. A recovery of nearly 3.5% off the low is now within striking distance of resistance at 157.70-158.08- a region defined by the 2025 high-week close (HWC), the December high-close, and the January HWC. Look for a reaction there IF reached with a breach / close above 158.88 needed to mark resumption of the 2025 uptrend. The next major technical consideration is eyed at the 2024 HWC and the 2024 swing high at 160.74-161.95.

Monthly open support rests at 157.79 and is backed by the 61.8% retracement of the most recent advance at 154.10. Broader bullish invalidation remains at 151.91/98, and a break / weekly close below this threshold would be needed to suggest a more significant high is in place and a larger trend reversal is underway.

Bottom line: A reversal off uptrend resistance last month has rebounded just ahead of uptrend support. From a trading standpoint, losses should be limited to 154 IF price is heading higher on this stretch with a close above 158.88 still needed to fuel the next major leg of the rally.

-MB

GBP/USD drops on dovish BoEThe GBP/USD has taken a quick drop on the back of a dovish-leaning BoE. The Bank has kept rates on hold, as had been expected. BUT this turned out to be a far close decision than markets were expecting, which explains why we saw the GBP tumble in the immediate aftermath of the decision. Policymakers were far less hawkish than expected as a slim majority of only 5 MPC officials outvoted the 4 who wanted a cut, when only 2 dissenters were expected.

Additionally, the Bank has cut its GDP forecast, now sees a growth of 0.9%, while CPI has also had a large downgrade. The central bank expects unemployment rate to go up, and private sector wage growth to go down. In short, more rate cuts are on the way, and sooner. Good news for homeowners with mortgage due for renewal. Bad for savers (if there are any!).

By Fawad Razaqzada, market analyst with FOREX.com

Google Holds Below $350 Ahead of EarningsAlphabet (Google) shares have fallen more than 4.5% over the last two sessions, heading into today’s earnings release. The market is awaiting Q4 2025 results, with expectations pointing to revenue of around $111 billion, which would represent approximately 15% year-over-year growth, along with an expected EPS of $2.63 per share.

Despite these expectations, the stock continues to show signs of weakness as investors focus on the growth of cloud services revenue and the pace of investment in artificial intelligence. Should these areas fail to exceed market expectations, the current selling pressure could remain relevant over the coming sessions. On the other hand, strong results, combined with stable long-term guidance, could act as a key catalyst to restore confidence that the stock has begun to lose in recent trading.

The bullish trend remains relevant

Since June 24, 2025, Google shares have followed a well-defined bullish trend, which has dominated average price action over recent months. So far, there has been no meaningful bearish correction strong enough to break this structure, keeping it as the most relevant technical reference in the short term. If buying pressure manages to recover, this bullish trendline could continue to extend in the sessions ahead. However, the volatility surrounding the earnings release could put this structure at risk in the near term.

Technical indicators

RSI:

The RSI is currently drifting toward the neutral 50 level, suggesting a balance between buying and selling momentum. This behavior reflects a short-term indecisive environment, which could lead to a lack of clear direction in upcoming sessions.

MACD:

The MACD shows a similar setup, with the histogram hovering around the zero line, indicating that short-term moving average momentum lacks clear direction. This reinforces the sense of market indecision, driven largely by earnings-related uncertainty.

Key levels to watch

$346 – Key resistance:

This level aligns with recent highs and represents the most important upside barrier. A sustained move above this zone could open the door to higher highs and allow the bullish trend to extend further.

$326 – Nearby support:

A key support area aligned with the 50-period simple moving average. Sustained price action below this level could trigger a more relevant bearish bias in the sessions ahead.

$298 – Major support:

This level corresponds to the most relevant lows on the daily chart. A break below this zone would put the current bullish structure at risk and could pave the way for the development of a short-term bearish trend.

Written by Julian Pineda, CFA, CMT – Market Analyst

AUD/USD Coils Below Resistance- Weekly Break to Decide DirectionAussie rebounded off support yesterday at the 38.2% retracement of the January range and the 2024 swing high at 6930/43 with the weekly opening-range taking shape just above. Note that momentum remains in the overbought condition on both the weekly and daily chart and the focus remains on a potential breakout with the long-bias vulnerable while below this slope.

AUD/USD is trading just below initial resistance at the January high-day close (HDC) at 7049. Ultimately, a breach / daily close above the 2023 high-day close (HDC) at 7077 would be needed to mark resumption of the broader uptrend and to fuel the next major advance. Subsequent resistance objectives are eyed at the 2023 close high at 7136 with the next major technical consideration eyed at 7208/14- a region defined by the 61.8% retracement of the 2021 decline and the 100% extension of the 2025 advance.

Initial support rests at 6930/43 and is backed by the 38.2% retracement of the November rally and the 61.8% retracement of the January range at 6828/37. Losses below this threshold would be needed to suggest a more significant high is in place and a larger trend reversal is underway. Subsequent support seen a the 6717 and is backed by 6663/78- a region defined by the January low, the 2026 yearly open and the 61.8% retracement.

Bottom line: The AUD/USD is trading just below uptrend resistance, and the immediate focus is on a breakout of the weekly opening-range here for guidance. From a trading standpoint, losses would need to be limited to 6828 IF Aussie is heading higher on this stretch with a close above 7077 needed to fuel the next major leg of the rally.

-MB

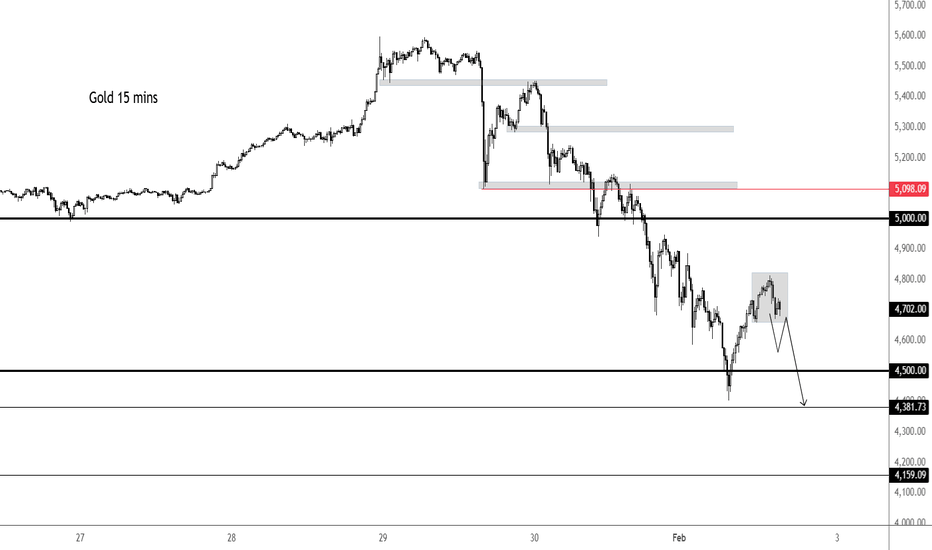

Gold inside key technical areaIf the sellers are still in control, then THIS is where they need to step right back in, after a corrective bounce in the last two days. Price is testing the major inflection point between 5,000 and 5,100 area where we have seen some wild swings in recent days. Meanwhile, there is also a rising wedge pattern where gold was trying to break from on the downside at the time of writing. Things could get spicy again if we break 5,000 level.

Fawad Razaqzada, market analyst at FOREX.com

Dow Jones: Something’s Got to Give as Triangle TightensSomething’s got to give in our Dow Jones contract, with the price continuing to coil within an ascending triangle. Bulls are lurking beneath trendline support established in early December, while bears are parked above 49580. It’s a real stalemate, and the longer price continues to coil, the more it feels like we could see an explosive breakout once the structure breaks.

Convention suggests we’re more likely to see a bullish breakout, putting fresh record highs on the table, with a move above 51000 possible given where the triangle formed. If we were to see a break and close above 49580, longs could be set above the level with a stop beneath for protection. 50000 will naturally be eyed closely given its significance, but I’d be more inclined to wait for a notable topping pattern before considering whether to cut, reduce or hold.

Of course, convention doesn’t always work, especially in an era where there are ample concerns about lofty valuations, so traders should also be alert to the risk of a bearish break from the triangle.

As things stand, the December uptrend is running near parallel with the 50-day moving average, providing a zone to establish both longs and shorts around, depending on the price action should we see another unwind.

If we see a test and bounce, longs could be established seeking a retest of 49580 resistance. But if we see a break and close beneath the zone, that setup could be flipped, allowing for shorts to be set with a stop above the trendline for protection. 47840 looms as an initial target, coinciding with where price bounced on numerous occasions in December. Beyond that, 47200 was where the uptrend started, putting it on the radar, along with 46875 which saw plenty of two-way price action in the final quarter of 2025.

Possibly improving the prospects for a bullish breakout, RSI (14) has broken its downtrend and remains above 50, suggesting waning upside momentum has stalled for the moment. MACD is sending a similar signal, curling back towards the signal line from below while holding in positive territory. It’s more a neutral message on directional bias than anything, although bulls remain marginally in the ascendency.

Gold Daily Trend Shows Strong Momentum With Volatility RisingDespite the recent selloff, Gold continues to trade within a well-established bullish trend on the daily timeframe, highlighted by a strong series of higher highs and higher lows. Price remains decisively above both the 50-day and 200-day SMAs, with the 50-day SMA trending sharply higher and acting as dynamic support throughout the advance. The wide separation between price and the long-term 200-day SMA underscores the strength of the broader uptrend.

Recent price action reflects a sharp impulsive rally followed by increased volatility and a brief corrective pullback. Former resistance levels in the mid-range of the structure have transitioned into support, suggesting that the market is consolidating gains rather than reversing trend. Despite the pullback from recent highs, price continues to hold above key structural levels, keeping the bullish framework intact.

Momentum indicators align with this view. RSI pushed into overbought territory during the rally and has since cooled back toward the mid-50s, indicating a reset in momentum without a loss of trend strength. MACD remains firmly positive, with the histogram elevated, reflecting sustained bullish momentum even as short-term momentum moderates.

Overall, gold is displaying strong trend continuation characteristics with signs of digestion after an extended rally. As long as price remains supported above rising moving averages and prior breakout zones, the technical picture continues to favor a bullish bias within a volatile but constructive market environment.

-MW

USDMXN Daily Trend Remains Under Bearish PressureUSD/MXN continues to trade within a clearly defined bearish structure on the daily timeframe, characterized by a sequence of lower highs and lower lows. Price remains firmly below both the 50-day and 200-day simple moving averages, with the 50-day SMA acting as dynamic resistance and reinforcing the prevailing downtrend. The long-term 200-day SMA is also sloping lower, highlighting sustained downside pressure rather than a short-term correction.

From a structure standpoint, recent price action shows a sharp impulsive move lower followed by a modest rebound. This bounce has so far lacked follow-through and appears corrective, with price still holding beneath prior support zones that have now transitioned into resistance. The inability to reclaim these levels keeps the broader bearish bias intact.

Momentum indicators support this view. RSI recently dipped toward oversold territory and is now attempting to recover, but remains below the neutral 50 level, suggesting that bearish momentum has eased slightly without signaling a trend reversal. MACD remains in negative territory, with the signal and histogram reflecting ongoing downside momentum, even as selling pressure shows signs of slowing.

Overall, USDMXN is displaying a bearish trend with short-term stabilization after an extended decline. Unless price can meaningfully recover above key moving averages and former support levels, the technical picture continues to favor a cautious, downside-leaning bias within the broader trend.

-MW

USD/JPY Daily Structure Holding Within Rising ChannelUSDJPY continues to trade within a well-defined ascending channel on the daily timeframe, highlighting a broader bullish market structure that has been in place for several months. Price action remains above the 200-day SMA, which is gradually turning higher and reinforcing the longer-term trend bias. The recent pullback appears corrective rather than impulsive, with price stabilizing near the midline of the channel.

From a moving average perspective, the 50-day SMA is acting as a dynamic reference point. After a sharp downside spike, price has rebounded back toward this average, suggesting dip-buying behavior within the prevailing uptrend. As long as daily closes remain above the lower boundary of the channel and the 200-day SMA, the broader structure remains intact.

Momentum indicators show mixed but stabilizing signals. RSI has recovered from near the lower end of its recent range and is moving back toward the neutral 50 level, indicating easing downside momentum rather than strong bearish pressure. MACD remains slightly negative but appears to be flattening, which can be consistent with consolidation within an established trend rather than trend reversal.

Overall, USDJPY is displaying signs of short-term consolidation within a larger bullish channel. The technical picture suggests the market is digesting recent volatility while respecting key trend-defining levels, keeping the medium-term bias constructive unless the channel structure is decisively broken.

-MW

USD/JPY testing support - can it bounce here?The USD/JPY has drifted lower in the last few hours, but that's mainly due to the gov shutdown delaying data release this week. Otherwise, the backdrop is a positive one for the greenback. Thus I would be watching for support here at 155.55 to hold and potentially trigger a fresh wave of buying. Key levels on the chart.

By Fawad Razaqzada, market analyst with FOREX.com

USDCAD Prints a Bullish Wick off the January 2026 LowsFrom a technical perspective, extended lower shadows reflect rejected downside levels — in other words, bullish dominance over bearish pressure. The weekly timeframe adds further weight to this signal, especially when aligned with the recent surge in US ISM Manufacturing PMI.

For DXY, my framework maintains:

A bearish bias following a confirmed weekly close below the 96 level

A bullish bias only if price holds cleanly above 98, 99.50, and the key 100.40 level

Against this backdrop, the following scenarios emerge for USDCAD.

USDCAD briefly dropped toward levels last seen in 2024 near 1.3480 before recovering above the 1.36 mark. Applying Fibonacci extensions from the September 2024 low, February 2025 high, and January 2026 low, key upside levels emerge at 1.3860, 1.40, and 1.4150 — zones that would help confirm the sustainability of the rebound before another potential acceleration higher.

On the downside, the 1.3580–1.3420 support zone remains critical. A failure to hold this area could expose the pair to a deeper structural breakdown toward the 1.33 and 1.30 levels.

Overall, bullish and bearish scenarios for USDJPY and USDCAD are expected to move in tandem with DXY, as the index continues to test its long-term 2008–2026 trend support.

- Razan Hilal

USDJPY Climbs Back Above 155, Signaling a Bullish BiasFrom a technical perspective, extended lower shadows reflect rejected downside levels — in other words, bullish dominance over bearish pressure. The weekly timeframe adds further weight to this signal, especially when aligned with the recent surge in US ISM Manufacturing PMI to 3 year highs. That said, volatility risks remain elevated amid geopolitical developments and upcoming economic data uncertainties.

Following January’s sharp downside wick toward the 152 support zone, USDJPY has rebounded into bullish-bias territory above 154.80 (rounded to 155). Upside resistance levels are located at 158.80, 161, and 164.

These elevated levels warrant caution, given historical intervention risks that previously triggered sharp drawdowns near the 160 area. The broader uptrend from the April 2025 lows remains intact, with key downside levels at 154, 151.80, and 149.80 — aligning with the lower bound of the trend unless a clear structural breakdown materializes.

- Razan Hilal

GBP/USD for USD-WeaknessAs looked at in the post on USD the Dollar basket has bounced pretty aggressively over the past few days following a deep oversold reading. The USD/JPY recovery has certainly played a big role in that, but so too has the EUR/USD pullback that sees the pair push towards the Fibonacci levels at 1.1748/1.1686.

If looking to fade the USD rally, however, GBP/USD seems to be in a more attractive spot as the pullback from fresh multi-year highs retains a bullish posture, and there's even support potential from a prior point of resistance as derived from the trendline connecting June and September highs. - js

USD Bounce from OversoldLast week saw the US Dollar go more oversold on the daily chart than at any point in the past five years. The Trump comment on Tuesday when asked what he thought about US Dollar weakness to which he replied with 'it's great,' helped USD to sell off even more. But, the latter half of last week saw those comments get walked aback, first by US Treasury Secretary Scott Bessent and then by Director of the National Economic Council Kevin Hassett. Hassett in particular is a noted Trump ally so it seems unlikely that he refuted his boss in public on his own, and it does seem as though the admin wanted to walk those comments back a bit after the aggressive push from bears last Tuesday.

While RSI isn't a great timing indicator it can be phenomenal for context, and when a market is as oversold as the USD was last week, it's a tough argument to chase it lower.

But now that it's bounce, bears have a chance to make a push as there's some resistance that can be coming into play soon, such as the 97.94 Fibonacci level, or the 98.98 level that sits above that.

It's on pullbacks that we can see what a trend is made of, whether it gets defended and holds as a higher-low or a lower-high. - js

Aussie Bulls Relent Ahead of RBAAUD/USD exhausted into the 2023 high-day close last week at 7077 with price unable to mark a daily close above uptrend resistance. A decline of more than 2.6% is now testing initial support at the 2024 high which converges on the 75% parallel near 6943. A break below this slope would threaten a larger pullback within the broader uptrend with subsequent support seen at the 6817/37- a region defined by the 2023 yearly open and the 38.2% retracement of the November advance. Look for a bigger reaction there IF reached.

Initial resistance is eyed at the 100% extension of the November rally at 7009 with a breach / close above the 7077 ultimately needed to fuel the next major leg of the advance.

Bottom line: Aussie has responded to uptrend resistance with the pullback now testing initial support ahead of tonight’s RBA rate decision. The central bank is widely expected to hike rates by 25bps, and the focus will be on the accompanying commentary. From a trading standpoint, rallies should be limited to 7009 IF price is heading for a deeper setback on this stretch with a close below 6943 needed to keep the bears in control near-term.

-MB

Disney Weakens Following Earnings ReleaseThe week has started with Disney shares falling more than 7%, and for now, selling pressure has remained in place following the company’s quarterly earnings report. Revenue came in at $26 billion, above the $25.7 billion forecast, while net income totaled $2.4 billion. However, selling pressure has intensified due to a sustained increase in costs observed over recent quarters, which is increasingly weighing on the company’s profitability. This dynamic has contributed to a more cautious market sentiment, which could continue to pressure the stock in the coming sessions.

The bearish trend regains relevance

Since July 2025, Disney shares have displayed a consistent pattern of lower highs, forming a well-defined bearish trendline that remains the most relevant technical structure at this stage. The latest downside move has reinvigorated selling pressure, and as long as new meaningful lows continue to form, this downtrend is likely to remain dominant in the short term.

Technical indicators

RSI:

The RSI has shifted below the neutral 50 level, suggesting that bearish momentum remains dominant when considering the average price action over the last 14 sessions. If this behavior persists, it could reinforce continued downside pressure in the short term.

MACD:

A similar picture is emerging in the MACD, with the histogram holding below the zero line, indicating that short-term moving average momentum has turned bearish. As long as this condition remains in place, it may continue to reinforce a prevailing bearish bias in the stock.

Key levels to watch

$116 – Key resistance:

This level aligns with recent highs and represents the main upside barrier. A move back toward this area could challenge the current bearish trendline and open the door to a more sustained bullish bias.

$110 – Current barrier:

A key level marked by the convergence of the 50- and 200-period moving averages. Prolonged price action around this zone could lead to a neutral phase, favoring a short-term sideways range.

$101 – Key support:

The most important downside level, corresponding to the lows of recent months. A move back toward this area would reinforce bearish momentum and could enable a further extension of the existing downtrend.

Written by Julian Pineda, CFA, CMT – Market Analyst

Gold's intraday bounce already over?Short-term price action on gold looking a bit bearish. The bias on the daily turned bearish after Friday's big slide, so a lot of people would be looking to sell into rallies now, I'd imagine. On this 15m char you can see that the kick back rally has lost some momentum. A breaking below 4680ish could trigger the next liquidation phase, taking prices back to 4500 potentially, or even lower.

By Fawad Razaqzada, market analyst with Forex.com

Bitcoin Slide Deepens as BTC/USD Squeeze Risk BuildsBuying bitcoin right now looks a low probability play given the price action, resembling something closer to catching a falling knife, but it is extremely stretched. That creates the type of condition that could easily spark a countertrend squeeze given the speed and scale of the recent falls.

Looking at the daily timeframe on the right, RSI (14) continues to trend deeper into oversold territory, sitting at 22.03, similar to levels seen in November 2025 just ahead of a bounce. As was the case then, price is also trading below the lower Bollinger Band, again reinforcing how stretched bitcoin looks after falling more than 20% since mid January.

Of course, stretched short-term positioning and oversold conditions are not a reason to buy in isolation, particularly at a time when downside momentum is strengthening rather than slowing. However, with bitcoin now approaching a zone between $75,000 and $73,500 that has previously acted as both support and resistance, near-term price action above and within this area could prove instructive in assessing whether the risk of a countertrend squeeze is increasing.

Should a notable bottoming pattern emerge on a shorter timeframe such as the hourlies on the left, whether a hammer, bullish pin or a multi-candle formation like a morning star, the option would be there to buy with a stop below the recent lows. Initial upside targets would include the November 21 low at $80,550, with $85,000 another area of interest given price bounced there on multiple occasions prior to the latest breakdown.

Given the bearish message from both price action and oscillators, there is no need to move pre-emptively to set longs. For now, the idea remains firmly in watch-and-wait mode until a clear signal emerges.

Gold stays under pressure, testing 5K supportHere's a 15 min chart of gold, which highlights today's bearish price action - former support levels turning into resistance. But now we have arrived at the big one: $5K - will we see a break below here, too? Or will gold gold this level ahead of the weekend, where there is a possibility that we could see strikes on Iran by the US. Hopefully not, but judging by oil price action, which is testing session highs, one has to be mindful of the risks. Gold needs to break short-term bear trend shown on chart to trigger technical buying, but at the time of writing, the pressure was growing for a possible breakdown. Earlier, it did dip below $5K but managed to bounce back above it. So far, too early to say LT bull trend is over.

By Fawad Razaqzada, market analyst with FOREX.com