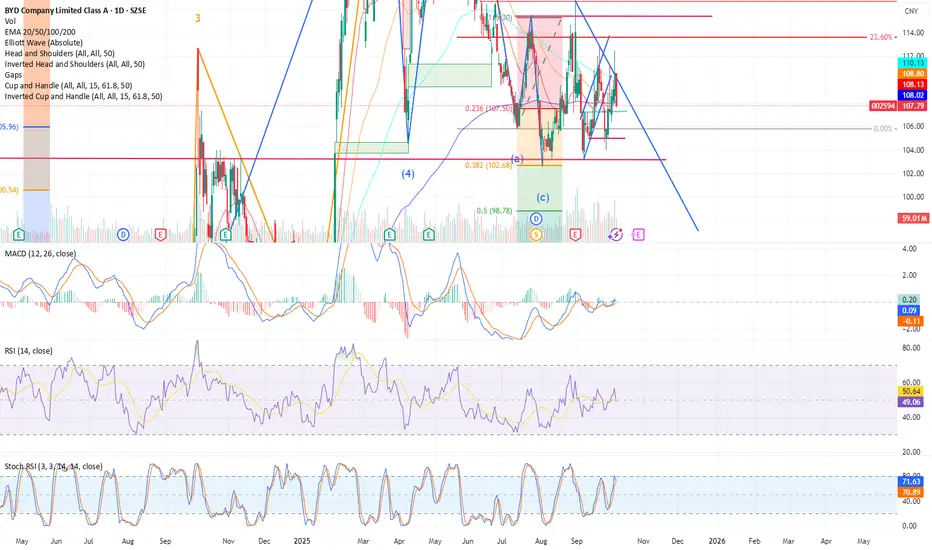

Once the 100-103 CNY level breaks, I expect BYD to drop to approximately 85 CNY. This decline could be sparked by several catalysts, such as the potential elimination of EV tax credits in the USA or a broader Chinese economic slowdown.

However, I believe that in the long run, this stock represents a great value play. The Chinese government has clearly demonstrated its commitment to aggressively pushing the electric vehicle market. Combined with the apparent end of the brutal EV price wars in China—as I believe we have already seen the worst of them—this industry has significant upside potential for patient investors.

Trade active

Key notes:- BYD could fall even more sharply to near 60-65 CNY

- This investment is recommended to be entered at the right price for it to be a recovering opportunity due to Chinese Macroeconomic data being very weak (however will recovery inevitably)

- The EV market sales are stagnating, but when President Trump stops pressuring against EV's the project of a greener future will resume

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.