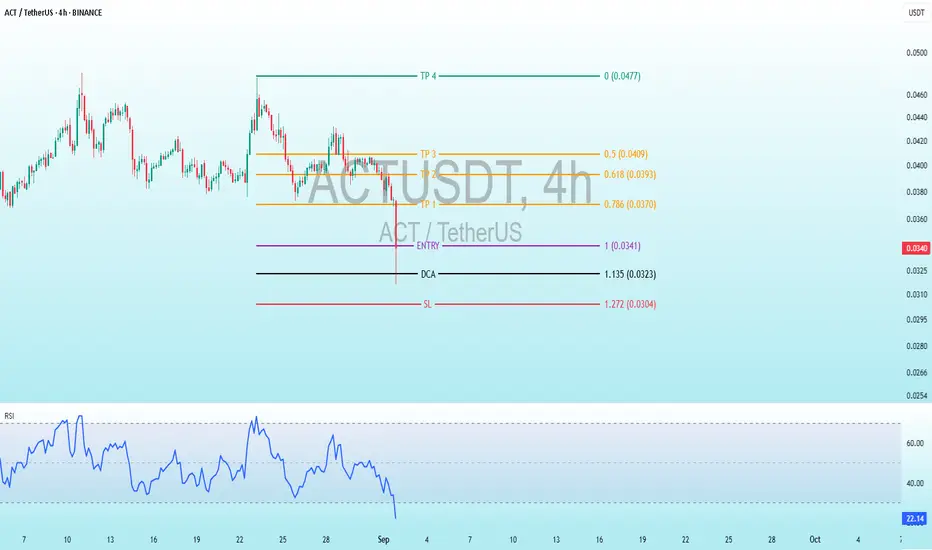

Price Action Description

Historical Trend: The price began around 0.04-0.05 USDT in mid-August, with a gradual decline punctuated by choppy movements. A sharp drop occurred in early September, pushing it toward the current level of 0.0341 USDT.

Recent Movement: A significant red candlestick around September 2 marks a drop from approximately 0.05-0.06 USDT to 0.0341 USDT (current price), suggesting strong selling pressure or a market event. The price has stabilized near this low, with smaller candles hinting at consolidation.

Current Price: Approximately 0.0341 USDT, down about 30-40% from mid-August highs, suggesting potential oversold conditions.

Volatility: High, as evident from the long wicks and large candle bodies during the recent drop, though volume data is not visible.

Key Technical Levels

Entry: Set at 0.0341 USDT, the suggested point to enter a long position, matching the current price of 0.0341 USDT, indicating an immediate buy opportunity.

TP (Take Profit): Targets are 0.0370 USDT for the first profit take, followed by 0.0393 USDT, 0.0409 USDT, and the highest goal at 0.0477 USDT, providing a range of exit points for potential gains.

DCA: Positioned at 0.0322 USDT, a level to add to the trade if the price dips slightly, helping to average down the entry cost.

SL (Stop Loss): Placed at 0.0316 USDT, the cutoff to exit the trade if the price falls, limiting losses and protecting the position.

Fibonacci Context: These levels likely derive from a Fibonacci retracement or extension tool applied to the recent drop from 0.05-0.06 USDT to 0.0341 USDT, suggesting a potential reversal zone for a long setup.

Risk-Reward: Risk from 0.0341 to 0.0316 is 0.0025 USDT, with rewards to 0.0370 (0.0029, RR 1.16:1) and up to 0.0477 (0.0136, RR ~5.44:1), indicating a favorable setup if the bounce occurs.

Indicators Analysis

RSI (Relative Strength Index): Current value is 22.36, below 30, signaling oversold conditions and a potential rebound. The line has trended downward sharply with the recent drop, showing momentum weakening, but no clear bullish divergence yet. The RSI scale (0-100) marks overbought above 70, not relevant here.

Potential Trading Implications and Risks

Bullish Case: The setup suggests a bottom-fishing opportunity post-drop, supported by oversold RSI. A rebound to take-profit levels is plausible if the broader crypto market stabilizes or if positive news emerges for Achain (e.g., network upgrades).

Bearish Case: The recent sharp decline and lack of immediate recovery indicate ongoing selling pressure. Breaking below 0.0316 (SL) could lead to further declines toward 0.03 USDT or lower.

Risks: High volatility due to ACT’s lower market cap, lack of volume data (limiting liquidity insight), and subjective Fib levels. Use risk management (e.g., 1-2% account risk).

Suggestions: Confirm with bullish patterns (e.g., hammer) at 0.0341 or RSI crossing above 30.

Trade active

ENTRY 0.0341 TARGET SCALP ✅ +9.70% PROFIT

🌍 Believe you can and you’re halfway there.

Interested for Premium 👉 t.me/Altcoin_Piooners

Follow for signals! 🔥#Crypto #Trading #CryptoSignals #ACT #Altcoins

✅MY Free Signals Telegram

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅MY Free Signals Telegram

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.